Medicaid eligibility and enrollment in New Hampshire

New Hampshire Medicaid enrollment has grown by 96% since 2013, but is expected to decline somewhat in 2023 and 2024

Who is eligible for Medicaid in New Hampshire?

Each state sets eligibility criteria for the covered populations, which must meet minimum standards set by the federal government. For the populations whose Medicaid eligibility is based on income alone (ie, children, pregnant women, and adults under age 65), these are the income limits that are used in New Hampshire:

- 318% of federal poverty level (FPL) for children ages 0-18

- 196% of FPL for pregnant women (Coverage for the mother ends 60 days after the birth. Legislation (H.B.2 and S.B.175) is under consideration in 2023 that would extend this to 12 months)

- 138% of FPL for adults under age 65 (Medicaid expansion group)

Apply for Medicaid in New Hampshire

You can apply through HealthCare.gov or directly through the New Hampshire Department of Health and Human Services. You can also use a paper application or you can call 1-800-852-3345, extension 9700 and apply by phone.

Eligibility: Adults with household incomes up to 133% of poverty, and pregnant women with incomes up to 196% of poverty. Children are eligible for CHIP with household incomes up to 323% of poverty.

Medicaid expansion in New Hampshire

Although low-income residents in New Hampshire did not have access to expanded Medicaid in the first half of 2014, the state did expand coverage mid-year, and applications for the newly expanded Medicaid program were available as of July 1, 2014, for coverage effective August 15. Expanded Medicaid in New Hampshire is called Granite Advantage, and it covers more than 96,000 people as of early 2023 (out of a total of more than 250,000 enrolled in New Hampshire Medicaid/CHIP).

Learn how states that expanded Medicaid might reduce spending on Medicaid.

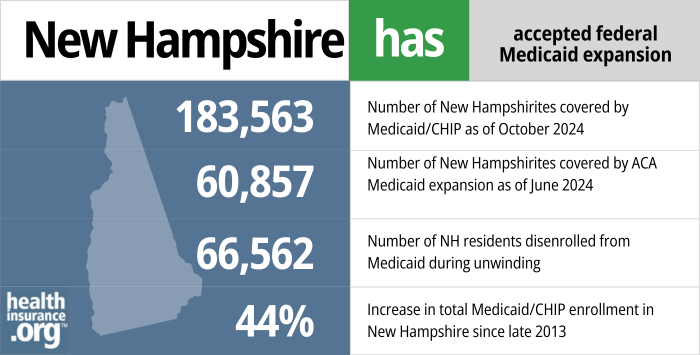

- 183,563 – Number of New Hampshirites covered by Medicaid/CHIP as of October 20241

- 60,857– Number of New Hampshirites covered by ACA Medicaid expansion as of June 20242

- 66,562 – Number of NH residents disenrolled from Medicaid during unwinding3

- 44% – Increase in total Medicaid/CHIP enrollment in New Hampshire since late 20134

Explore our other comprehensive guides to coverage in New Hampshire

We’ve created this guide to help you understand the New Hampshire health insurance options available to you and your family, and to help you select the coverage that will best fit your needs and budget.

Learn about health insurance coverage options in New Hampshire.

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in New Hampshire.

Use our guide to learn about Medicare, Medicare Advantage, and Medigap coverage available in New Hampshire as well as the state’s Medicare supplement (Medigap) regulations.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage.

Learn about short-term insurance regulations in New Hampshire.

Frequently asked questions about New Hampshire Medicaid

How can I enroll in New Hampshire Medicaid?

- You can apply through HealthCare.gov or apply directly through the New Hampshire Department of Health and Human Services (use this option if you are 65 or older or have Medicare)

- You can download a paper application. (The state website also has versions available in Spanish and Nepali.) Complete it, and either fax it to (603) 271-8604 or mail it to the district office that serves your area.

- You can also call 1-800-852-3345, extension 9700 and apply for Medicaid by phone.

How does Medicaid provide financial assistance to Medicare beneficiaries in New Hampshire?

Many Medicare beneficiaries receive Medicaid financial assistance that can help them with Medicare premiums, lower prescription drug costs, and pay for expenses not covered by Medicare – such as long-term care.

Our guide to financial assistance for Medicare enrollees in New Hampshire includes overviews of these programs, including Medicare Savings Programs, Medicaid long-term care benefits, and eligibility guidelines for assistance.

How is New Hampshire handling Medicaid renewals after the pandemic?

During the COVID pandemic, from March 2020 through March 2023, states were not allowed to disenroll anyone from Medicaid, even if the person no longer met the eligibility guidelines. That rule ended March 31, 2023, and states are now required to redetermine eligibility for everyone enrolled in Medicaid over the course of a 12-month “unwinding” period.

New Hampshire returned to regular Medicaid eligibility operations as of April 1, 2023. And the state started the process of conducting those eligibility redeterminations in February 2023, so that disenrollments could begin in April.

New Hampshire’s Medicaid program continued to renew benefits throughout the pandemic when they had enough information to do so, but people were not disenrolled during that three-year period even if they were no longer eligible or failed to respond to a renewal notice. There are 102,000 Medicaid enrollees in the state (out of a total of about 250,000) whose eligibility was pended during the pandemic. These individuals were sent yellow notices from the state, informing them that the pandemic-era continuous coverage rules were ending, and that they need to watch out for a renewal notification and respond to any information requests, if applicable.

New Hampshire was already conducting outreach in 2022, warning people to renew their Medicaid coverage before the end of the public health emergency, which kept getting extended in 90-day intervals. So some enrollees stayed on top of their eligibility redeterminations, and their coverage is current. Eligibility will need to be redetermined for all Medicaid enrollees during the unwinding period. But since this continues for a year, some people will not get their renewal notice until late 2023 or early 2024. For now, Medicaid enrollees need to make sure that their contact information is up-to-date and watch out for renewal notices.

The state is prioritizing eligibility redeterminations for people who have not used their Medicaid benefits in the past year, along with people for whom the state has information indicating that they are no longer eligible for Medicaid. As a result, the bulk of New Hampshire’s expected Medicaid terminations are projected to come in the first seven months of the unwinding period.

For people who lose Medicaid, there’s a 16-month special enrollment period via HealthCare.gov, and a six-month special enrollment period when those who are eligible for Medicare can transition to that program. There’s also a 60-day special enrollment window when a person can transition to employer-sponsored health coverage due to loss of Medicaid.

Legislation impacting New Hampshire Medicaid

Does New Hampshire use a privatized version of Medicaid expansion?

No, although New Hampshire did purchase private health plans for Medicaid expansion enrollees from 2016 through 2018. But starting in 2019, New Hampshire switched back to regular Medicaid managed care for the expansion population.

New Hampshire obtained a waiver from CMS that allowed the New Hampshire Health Protection Program to be slightly different from straight Medicaid expansion as called for in the ACA. The waiver that was approved by the Obama administration allowed for a privatized solution to Medicaid expansion, and most members were transitioned to subsidized private coverage (QHPs in the exchange) as of 2016, under a system called the Premium Assistance Program, or PAP (in 2014 and 2015, prior to the transition to PAP, Medicaid expansion in New Hampshire had functioned in much the same way it did in other states).

PAP utilized Medicaid funds to pay QHP premiums for Medicaid-eligible enrollees (other than the medically frail and Medicaid-eligible enrollees who were enrolled in an employer-sponsored plan and received help from New Hampshire Medicaid in paying the premiums). PAP also covered the QHP cost-sharing that exceeded Medicaid levels. So PAP enrollees didn’t pay any more than they would have if New Hampshire had continued to use traditional Medicaid coverage, but they were enrolled in the same QHPs as other residents with higher incomes who either received ACA premium subsidies or paid full price for their coverage.

However, New Hampshire enacted legislation in 2018 that called for the state to submit a new waiver proposal to CMS (submitted in July 2018, along with a proposal to extend the state’s Medicaid expansion waiver for five more years), requesting permission to abandon the PAP system and switch to a Medicaid managed care system instead, as well as eliminate the 90-day retroactive eligibility for Medicaid.

The proposal was approved by CMS in November 2018, but the state had already communicated to enrollees, in September 2018, that their coverage would switch to Medicaid managed care as of January 2019. And the rate filings that QHP insurers submitted in the summer of 2018 included the assumption that PAP would no longer be operational after the end of 2018. So the state’s PAP experiment only lasted three years (2016-2018), with New Hampshire transitioning to a regular Medicaid managed care model as of 2019.

Does New Hampshire Medicaid have a work requirement?

No, New Hampshire does not currently have a Medicaid work requirement. The state did briefly implement one, in 2019. But it was soon suspended and then overturned by a judge. And federal approval for it was eventually revoked by the Biden administration.

New Hampshire’s proposal to implement a Medicaid work requirement had been approved by the Trump administration in May 2018. Under the terms of the approved waiver renewal (more details below), New Hampshire Granite Advantage Program (formerly the Health Protection Program) enrollees aged 19 to 64 were required to participate in “community engagement” (work, school, job training, community service, etc.) at least 100 hours per month in order to maintain eligibility for Medicaid.

The Granite Advantage program‘s work requirement took effect in 2019, and residents were to begin reporting their community engagement hours by June, with coverage terminations for non-compliance slated to begin on August 1. But the work requirement was soon challenged in court, and the state opted to delay implementation until September (with coverage losses beginning December 1) when it became clear that compliance was low in June, with many enrollees potentially unaware of the new rules.

New Hampshire also enacted legislation to modify the work requirement and end it altogether if the state determines that more than 500 people will lose their coverage as a result of non-compliance with the work requirement (for perspective, more than 18,000 people lost coverage in Arkansas under the terms of a work requirement that took effect in mid-2018, but more than 250,000 people had gained Medicaid coverage in Arkansas as a result of Medicaid expansion, whereas fewer than 50,000 did so in New Hampshire). But in July 2019, US District Court Judge James A. Boasberg overturned New Hampshire’s new Medicaid work requirement. And in March 2021, the Biden administration notified New Hampshire that they were officially withdrawing approval for the work requirement.

Obama administration rejected proposed work requirement in 2016, but Medicaid expansion continued

After New Hampshire enacted HB1696 in 2016, the state then had to request a waiver modification from CMS in order to implement the new requirements called for in the legislation, which were generally stricter than the Obama Administration had allowed in any other states. They included:

- A work requirement. HB1696 called for able-bodied, childless adults to participate in at least 30 hours per week of work, job training, education towards obtaining a job, or other related activities. But work requirements were a non-starter for CMS under the Obama Administration. An amendment was eventually added to HB1696 — after much debate — that allowed expansion to continue even if CMS wouldn’t approve the work requirement.

- A premium requirement of $25/month (up to 2% of household income) for able-bodied adults with income between 101% and 138% of the poverty level, and $10/month for those with income up to 100% of the poverty level. There would be a 60-day grace period for non-payment of premiums, after which coverage would be terminated and the person wouldn’t be eligible to re-enroll for six months.

- Copays for non-emergency use of an emergency room.

New Hampshire’s Medicaid expansion already utilized a CMS waiver, as the state was at that point using Medicaid funds to purchase private coverage in the exchange for Medicaid-eligible residents. The changes called for in HB1696 required an additional waiver, which was submitted to CMS in August 2016.

On November 1, 2016, CMS replied to New Hampshire’s waiver amendment proposal, rejecting most of it, including the work requirement. CMS agreed to allow copays for non-emergency use of emergency rooms, but “only if the request satisfies the requirements of sections 1916(f) and 1115 of the Social Security Act, including the requirement that the waiver promote the objectives of the Medicaid program.”

However, Medicaid expansion continued in New Hampshire in 2017 and 2018, despite the Obama Administration’s refusal to allow the state to impose a work requirement.

Trump administration approved work requirement, but a judge overturned it

But with the Trump Administration assuming office in early 2017, GOP lawmakers in New Hampshire passed a budget measure requiring the state to seek a work requirement for Medicaid by April 2018, or else Medicaid expansion would expire at the end of 2018. The state submitted a work requirement waiver amendment to CMS in October 2017, which was approved by CMS in May 2018.

Later in 2018, CMS revised the work requirement approval, making them tougher on enrollees. Under the new rules, extra hours could not be carried forward to meet a future month’s work requirement. However, an enrollee whose prior month’s hours were deficient could make those hours up during the current month. CMS clarified, however, that an enrollee could not be perpetually behind and making up hours during each month of the year.

The work requirement applied to Medicaid expansion enrollees aged 19-64, unless they were otherwise exempt. The work requirement was implemented in March 2019, and enrollees were to begin reporting their community engagement hours to the state by June 1, 2019. In February, the state began sending letters to enrollees to notify them of the mandatory work requirements, and there is a page on the NH DHHS website that includes information on how the reporting worked. But the state found that compliance with the reporting requirement was exceedingly low in June, and expressed concerns about how challenging it was to adequately communicate the new requirements to Medicaid enrollees. To address the issue, New Hampshire opted to delay the work requirement, with reporting slated to begin September 1 and coverage terminations delayed until December 1.

But then in July 2019, Federal Judge James A. Boasberg (the same judge who struck down the Medicaid work requirements in Kentucky and Arkansas) overturned New Hampshire’s Medicaid work requirement. The state appealed the ruling, and in December 0f 2020, the Supreme Court agreed to take up the appeal from New Hampshire to reverse the end of the work requirements. However, in March of 2021 the Supreme Court announced it will no longer hear arguments from the appeal.

Extending Medicaid expansion through 2023, with a switch from PAP to managed care

In 2018, Republican Senators in New Hampshire introduced S.B.313, which called for a work requirement (although CMS has already approved a work requirement as part of the waiver approval that was granted in May 2018), along with a new Medicaid expansion program that will use Medicaid managed care — as most of the country does — instead of the Premium Assistance Program (as of 2018, only New Hampshire and Arkansas purchased private plans in the exchange for Medicaid expansion enrollees). The new program, dubbed the New Hampshire Granite Advantage Health Care Program, replaced the New Hampshire Health Protection Program in January 2019.

The Senate passed S.B.313 in March 2018, with an 18-7 vote. In the House, an amendment was approved, and the House voted 222-125 that the bill ought to pass. The bill ultimately did pass, and was signed into law in July 2018. Within two weeks, the state submitted a proposal to CMS, seeking approval to implement the changes called for in S.B.313. Those include:

- Switching from PAP to Medicaid managed care (as of September 2018, the state had already communicated the switch to managed care on their website, although the waiver proposal didn’t receive CMS approval until late November; the change was implemented in January 2019)

- Implementing a work requirement (the waiver proposal for this has already been approved)

- Changing the way the state’s share of Medicaid expansion funding is generated

- Eliminating retroactive coverage for Medicaid

Work requirement — and a subsidy for employers who hire Medicaid enrollees

The work requirement in S.B.313 aligned with the work requirement that CMS had already approved. The legislation called for non-exempt enrollees to work at least 600 hours every six months, which was similar to the 100 hours per week requirement in the waiver that CMS had already approved. By measuring total work over a six-month period, enrollees would have been protected from losing Medicaid due to temporary drops in employment, as long as they can make up the lost hours within the six-month window. The legislation calling for 600 hours of work every six months is more flexible than the initial Senate bill (and the state’s approved waiver proposal) which requires 100 hours per month. However, the terms of the already-approved work requirement were not adjusted to reflect the 600 hours every six months requirement.

In addition, S.B.313 also calls for the state to use up to $3 million in TANF (Temporary Assistance for Needy Families) funding, through June 30, 2019, to provide subsidies to employers who hire people who are eligible for Medicaid expansion in New Hampshire. The employer would get $2,000 at the time of the hire, and another $2,000 after the enrollee has been working for three months.

The legislation also had an asset test (with a $25,000 maximum asset limit, after accounting for excludable assets, such as a primary residence, household furnishings, and one vehicle), which would only be implemented if future changes in federal law allow it. As a result of the ACA, Medicaid currently only allows asset tests for Medicaid that covers the aged, blind, and disabled populations (but not Medicaid expansion, pregnant women, or children), but that could change if federal rules change.

Transition to managed care

Another provision of S.B.313 was to transition Medicaid expansion in New Hampshire away from the Premium Assistance Program (PAP) and utilize Medicaid managed care instead, as most states do. PAP enrollees were able to select whichever managed care plan they preferred, and were transitioned to the new plans as of January 2019.

The state has contracted with three Medicaid managed care health plans: AmeriHealth Caritas, New Hampshire Healthy Families, and Well Sense Health Plan.

Gubernatorial leadership on Medicaid

Former Governor Maggie Hassan was instrumental in expanding Medicaid in New Hampshire, and worked to ensure continued funding. But Hassan did not seek re-election to the governor’s office — she ran instead for the U.S. Senate in 2016, challenging incumbent Kelly Ayotte, who opposed the ACA and Medicaid expansion. The Hassan-Ayotte race was tight, but Hassan won, assuming office in the Senate in January 2017.

Republican Chris Sununu won the gubernatorial election in New Hampshire in 2016. Sununu had previously been uncommitted in terms of his views on Medicaid expansion, but after his win, Sununu said that he did not plan to eliminate Medicaid expansion in New Hampshire, but wanted to ensure that the program is a temporary solution while people work to obtain their own health insurance (either in the individual market or from an employer), rather than a permanent solution. And in early 2017, Sununu said that New Hampshire had seen “great results” from expanding Medicaid. Governor Sununu has since remained committed to keeping Medicaid expansion intact, but supported GOP lawmakers’ efforts to impose the work requirement that briefly took effect in 2019.

New Hampshire Medicaid enrollment numbers

As of early 2023, there are more than 250,000 people enrolled in Medicaid and CHIP in New Hampshire. As of 2013, enrollment had stood at just over 127,000 people.

New Hampshire officials estimated that about 50,000 people would be newly eligible for Medicaid coverage once expansion took effect in mid-2014. From the fall of 2013 to December 2018, total enrollment in Medicaid/CHIP in New Hampshire increased by 53,242 people —a 42% increase. Not all of the new enrollees were newly eligible, but there’s no doubt that Medicaid expansion significantly increased the Medicaid-covered population in the state.

But enrollment grew substantially during the COVID pandemic, due in large part to the federal rules that prevented states from disenrolling anyone between March 2020 and March 2023. Enrollment is expected to decline starting in the spring of 2023, when that rule ends.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in New Hampshire?

Explore more resources for options in New Hampshire including ACA coverage, short-term health insurance, dental insurance and Medicare.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- “October 2024 Medicaid & CHIP Enrollment Data Highlights”, Medicaid.gov, Accessed January 2025 ⤶

- “Medicaid Enrollment – New Adult Group”, Medicaid.gov, Accessed February 2025 ⤶

- ”Medicaid Enrollment and Unwinding Tracker“, KFF.org, January 2025 ⤶

- “Total Monthly Medicaid & CHIP Enrollment and Pre-ACA Enrollment”, KFF.org, Accessed February 2025 ⤶