Home > Health insurance Marketplace > Rhode Island

Rhode Island Marketplace health insurance in 2025

Compare ACA plans and check subsidy savings from a third-party insurance agency.

Rhode Island health insurance Marketplace guide

This guide, including the FAQs below, is designed to help you understand your Rhode Island health insurance options and the financial assistance that might be available to you and your family in Rhode Island.

Rhode Island has an individual health insurance mandate, which means residents who do not have health insurance in Rhode Island may be subject to a state tax penalty. Rhode Island also created a reinsurance program that took effect in 2020, helping to keep pre-subsidy health insurance premiums lower than they would otherwise be.3

Rhode Island created its own state-based health insurance exchange – HealthSource RI. Rhode Island residents can use this platform to shop for individual and family health insurance offered by two private health insurance carriers.

HealthSource RI is also among the state-based exchanges that offer small group health insurance for small businesses, and Rhode Island’s exchange also allows eligible applicants to enroll in Rhode Island Medicaid.

Frequently asked questions about health insurance in Rhode Island

Who can buy Marketplace health insurance in Rhode Island?

To sign up for health insurance through the Rhode Island Health Insurance Marketplace (HealthSource RI), you must:4

- Be lawfully present in the United States and live in Rhode Island

- Not be incarcerated

- Not be enrolled in Medicare

So most Rhode Island residents can enroll in coverage through the exchange. But eligibility for financial assistance is a bigger question for most people, and there are a few additional eligibility rules for HealthSource RI subsidies. To qualify for income-based Advance Premium Tax Credits (APTC) or cost-sharing reductions (CSR), you must:

- Not be eligible to enroll in an affordable employer-sponsored health plan. If you can enroll in an employer’s health plan and aren’t sure if it’s considered affordable, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies to offset the cost of a plan obtained through HealthSource RI.

- Not be eligible for Rhode Island Medicaid or CHIP, or for premium-free Medicare Part A.5

- File a joint tax return if you’re married.6 (with very limited exceptions)7

- Not be able to be claimed by someone else as a tax dependent.6

Beyond those basic parameters, qualifying for subsidies through HealthSource RI will depend on your household’s income compared with the cost of the second-lowest-cost Silver plan in your area – which will depend on your age. (In most states it also depends on location, but Rhode Island is all one rating area, so premiums do not vary by zip code).8

When can I enroll in an ACA-compliant plan in Rhode Island?

The open enrollment period for health insurance in Rhode Island runs from November 1 through January 31. Enrollments need to be completed by December 31 in order to have coverage effective January 1.9 (Note that the enrollment dates are potentially subject to change in future years.)

Outside of the open enrollment window, you may still be eligible to enroll or make a plan change if you experience a qualifying life event, such as giving birth or losing other health coverage. And some people can enroll year-round even without a specific qualifying life event.

Rhode Island is one of several states where pregnancy counts as a qualifying life event, allowing an uninsured person to enroll in health coverage as soon as they find out they’re pregnant (in most states, the birth of a baby is a qualifying event, but pregnancy is not). This took effect in Rhode Island in 2023, due to legislation the state enacted the year before10

Enrollment in Rhode Island Medicaid and CHIP is available year-round for eligible residents.

How do I enroll in a Rhode Island Marketplace plan?

To enroll in ACA Marketplace/exchange health insurance in Rhode Island, you can:

- Visit HealthSource RI, which is the state’s health insurance exchange (Marketplace). It will allow you to compare available health plans, determine whether you’re eligible for financial assistance, and enroll in a health plan.

- Enroll in a health insurance plan through HealthSource RI with the help of an insurance broker, Navigator, or certified application counselor. There is no charge to have assistance with the plan selection and enrollment process.

How can I find affordable health insurance in Rhode Island?

When you enroll in a Rhode Island health insurance plan through HealthSource RI, you may be eligible for financial assistance that reduces the monthly cost of your coverage (premium subsidies), and possibly also your out-of-pocket expenses (cost-sharing reductions, or CSR). These federal subsidy programs were created by the Affordable Care Act, and eligibility depends on your income and circumstances.

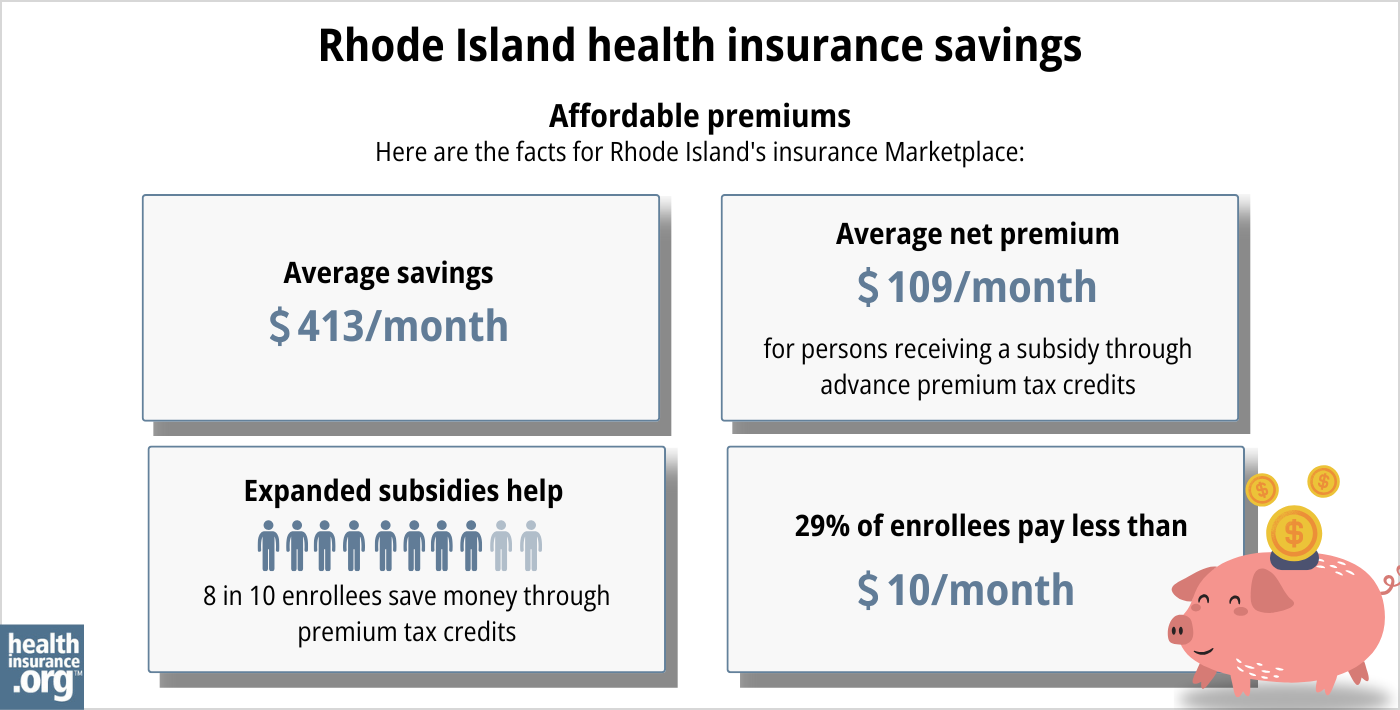

Income-based subsidies (APTC) are available to lower the amount you pay for your HealthSource RI coverage each month. Eighty-six percent of HealthSource RI enrollees were receiving premium subsidies as of early 2024. The subsidies covered an average of $454/month, and reduced the average enrollee’s premium (including those who pay full price) to about $153/month.11

Source: CMS.gov12

If your household doesn’t earn more than 250% of the federal poverty level, you’ll also be eligible for federal cost-sharing reductions (CSR) as long as you enroll in a Silver-level plan through HealthSource RI. CSR subsidies will reduce your deductible and other out-of-pocket expenses, making it more affordable for you to receive health care. More than a third of HealthSource RI enrollees were receiving CSR benefits as of early 2024.11

Rhode Island lawmakers introduced legislation in 2024 that would have created additional state-funded premium subsidies and cost-sharing reductions, but the legislation did not advance.13 Several other states already offer state-funded subsidies in addition to the federal subsidies that are available nationwide.

Depending on your income and circumstances, you may be able to enroll in free or low-cost health coverage through Rhode Island Medicaid or CHIP. Learn more about whether you might be eligible for these programs.

On the other hand, if you’ve being disenrolled from Rhode Island Medicaid during the “unwinding” of the pandemic-era continuous coverage rule, you may find that you’re eligible to receive at least two months of premium-free coverage through HealthSource RI. For people in this situation with household income up to 250% of the poverty level, Rhode Island is covering the after-APTC portion of premiums for the first two months. And if your income doesn’t exceed 200% of the poverty level, HealthSource RI will automatically enroll you in a health plan when your Medicaid ends14 (you’ll still have the option to select a different plan).

As of April 2024, CMS reported that 4,515 people in Rhode Island had transitioned from Medicaid to a Marketplace plan during the unwinding period. Nearly 2,000 of those people had been automatically enrolled.15

How many insurers offer Marketplace coverage in Rhode Island?

Are Marketplace health insurance premiums increasing in Rhode Island?

For 2025, the following average rate changes have been approved for the insurers that offer individual/family coverage through HealthSource RI, amounting to an overall average increase of 7.8%.17

Rhode Island’s ACA Marketplace Plan 2025 APPROVED Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Blue Cross Blue Shield of Rhode Island (BCBSRI) | 11% |

| Neighborhood Health Plan of Rhode Island (NHPRI) | 5.9% |

Source: Rhode Island Office of the Health Insurance Commissioner17

Average rate changes apply to full-price rates, and most enrollees do not pay full price: Eighty-six percent of the people enrolled in private plans through HealthSource RI were receiving premium subsidies in 2024.11

If the cost of your coverage is increasing for the coming year, you may want to consider some of the other plans that are available through HealthSource RI. You may find an alternative that better fits your budget and still meets your coverage needs.

For perspective, here’s how average full-price Rhode Island health insurance premiums have changed over the years:

- 2015: Increase of about 4%18

- 2016: Average increase of 6.5%19

- 2017: Average increase of 1.3%20

- 2018: Average increase of 21.7%21

- 2019: Average increase of 8.1%22

- 2020: Average decrease of 0.5%23 (reinsurance and individual mandate took effect)

- 2021: Average increase of 4.2%24

- 2022: Average increase of 2.1%25

- 2023: Average increase of 6.1%26

- 2024: Average increase of 5.9%27

How many people are insured through Rhode Island’s Marketplace?

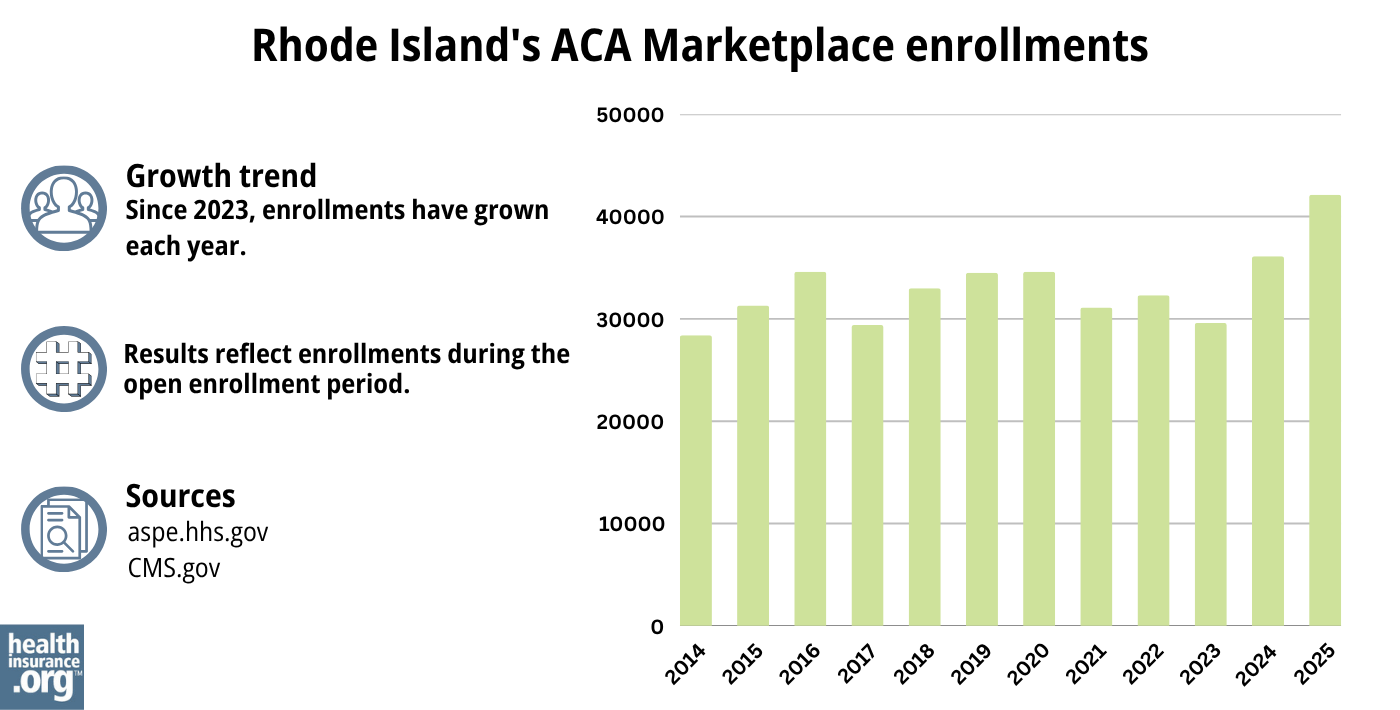

36,121 people enrolled in 2024 coverage through HealthSource RI during the open enrollment period.28 This was a new record high for HealthSource RI (note that the state’s report showed a slightly lower total enrollment, but still a record high).29

The chart below shows historical enrollment through HealthSource RI, which has previously hovered between about 28,000 and 35,000 people. Although nationwide Marketplace enrollment has increased sharply since 2021,30 that has not been the case in Rhode Island. But 2024 enrollment did reach a new record high in the state.

Source: 2014,31 2015,32 2016,33 2017,34 2018,35 2019,36 2020,37 2021,38 2022,39 2023,40 2024,41 202542

What health insurance resources are available to Rhode Island residents?

HealthSource RI

The state-based Marketplace/exchange in Rhode Island. Provides health insurance options for individuals, families, and small businesses, as well as financial assistance for individuals and families based on household income.

Rhode Island Insurance Division

Regulates the insurance industry in Rhode Island, and addresses consumers’ questions and complaints related to insurance.

Rhode Island Health Center Association

Navigator and Certified Application Counselor services to help people enroll in coverage through HealthSourceRI. Can provide assistance with private plan enrollment and Medicaid/CHIP enrollment, as well as information on applicable financial assistance available to offset costs in private plans.

Rhode Island Office of Healthy Aging, Medicare Counseling

The state health insurance assistance program for Medicare beneficiaries; can provide information, assistance, and counseling related to enrollment, eligibility, and claims.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Rhode Island?

Explore more resources for options in Rhode Island including short-term health insurance, dental insurance, Medicaid and Medicare.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- ”2025 OEP State-Level Public Use File (ZIP)” Centers for Medicare & Medicaid Services, Accessed May 13, 2025 ⤶ ⤶

- ”2025 Commercial Health Insurance Rates Have Been Approved with Modifications” Rhode Island Office of the Health Insurance Commissioner. Sep. 3, 2024 ⤶

- ”Rhode Island: State Innovation Waiver under section 1332 of the PPACA” Centers for Medicare and Medicaid Services. August 2019 ⤶

- “Eligibility Appeals System for ACA Programs” Rhode Island Health Benefits Exchange ⤶

- ”Medicare and the Marketplace, Master FAQ” Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed MONTH. ⤶ ⤶

- Updates to frequently asked questions about the Premium Tax Credit. Internal Revenue Service. February 2024. ⤶

- “Market Rating Reforms State Specific Geographic Rating Areas” CMS.gov, Accessed September 2023 ⤶

- “Open Enrollment” HealthSource RI ⤶

- ”Rhode Island House Bill 7454 and Rhode Island Senate Bill 2548” BillTrack50. Enacted 2022 And “Governor signs bill allowing special insurance enrollment period during pregnancy” State of Rhode Island General Assembly. June 30, 2022 ⤶

- ”Effectuated Enrollment: Early 2024 Snapshot and Full Year 2023 Average” CMS.gov, July 2, 2024 ⤶ ⤶ ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶

- ”Rhode Island S2345” BillTrack50. Introduced February 12, 2024. ⤶

- “Transitioning from Medicaid to a Qualified Health Plan” HealthSource RI ⤶

- ”State-based Marketplace (SBM) Medicaid Unwinding Report” Centers for Medicare & Medicaid Services. Data through April 2024; Accessed July 29, 2024. ⤶

- ”2024 Individual Market Plans & Benefits” HealthSource RI. Accessed December 1, 2023. ⤶

- ”2025 Commercial Health Insurance Rates Have Been Approved with Modifications” Rhode Island Office of the Health Insurance Commissioner. Sep. 3, 2024 ⤶ ⤶ ⤶

- ”OHIC Approves Commercial Health Insurance Rates for 2015” Rhode Island Office of the Health Insurance Commissioner. July 2014 ⤶

- ”Rhode Island: Approved 2016 Rate Increase: 6.5% Weighted Avg” ACA Signups. August 2015 ⤶

- ”Rhode Island: Insurance Commissioner *Approves* Avg. Indy Market Rate Hike Of 1.3%” ACA Signups. August 2016 ⤶

- ”Rhode Island: 21.7% Avg Rate Hikes; Over Half Caused By CSR Sabotage” ACA Signups. October 2017 ⤶

- ”Rhode Island: APPROVED 2019 #ACA Rate Hikes: 8.1% (Only Minor #ACASabotage Impact This Time)” ACA Signups. September 2018 ⤶

- ”Rhode Island: *Approved* Unsubsidized 2020 ACA Premiums: 0.5% *Lower* Thanks To Reinsurance/Mandate Penalty” ACA Signups. September 2019 ⤶

- ”2021 Rate Changes” ACA Signups. October 2020 ⤶

- ”2022 Rate Changes” ACA Signups. October 2021 ⤶

- ”Rhode Island: Final Avg. 2023 Unsubsidized #ACA Rate Changes: +6.1% (Down From +8.0%)” ACA Signups. October 2022 ⤶

- “2024 Commercial Health Insurance Rates Have Been Approved with Modifications” Rhode Island Office of the Health Insurance Commissioner. Accessed December 1, 2023 ⤶

- ”Health Insurance Marketplaces 2024 Open Enrollment Period Report” CMS.gov. March 22, 2024 ⤶

- ”HealthSource RI Open Enrollment closes with record enrollment of 34,456” HealthSource RI. April 16, 2024 ⤶

- ”Another Year of Record ACA Marketplace Signups, Driven in Part by Medicaid Unwinding and Enhanced Subsidies” KFF. January 24, 2024. ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- “Health Insurance Marketplaces 2023 Open Enrollment Report” CMS.gov, 2023 ⤶

- ”HEALTH INSURANCE MARKETPLACES 2024 OPEN ENROLLMENT REPORT” CMS.gov, 2024 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶