Home > Health insurance Marketplace > Indiana

Indiana Marketplace health insurance in 2025

Compare ACA plans and check subsidy savings from a third-party insurance agency.

Indiana health insurance Marketplace guide

Indiana uses the federally-facilitated health insurance exchange/Marketplace, HealthCare.gov, where six private insurance companies offer individual/family coverage for 2024.3 There will continue to be six carriers offering Indiana Marketplace plans in 2025, but with some changes (discussed in more detail below). And unlike most states, the overall weighted average premium change (before subsidies) amounts to a slight decrease in Indiana for 2025.4

Marketplace plans are designed to serve those without access to employer-sponsored coverage or government-run coverage like Medicare or Medicaid. This includes self-employed individuals, people who work for small businesses that don’t offer health benefits, and early retirees who aren’t yet eligible for Medicare.

Many people find Affordable Care Act (ACA) Marketplace plans to be budget-friendly, and nearly 296,000 people enrolled in private health plans through the Indiana Health Insurance Marketplace during the open enrollment period for 2024 coverage.5

If you buy a plan through the Indiana Health Insurance Marketplace, you may qualify for financial assistance through an advance premium tax credit (premium subsidy) and also possibly a subsidy that reduces your out-of-pocket costs when you get medical care.6

As of 2024, small businesses (fewer than 50 employees) in Indiana can qualify for a state tax credit if they offer an ICHRA benefit to their employees, as long as certain parameters are met.7

Frequently asked questions about health insurance in Indiana

Who can buy Marketplace health insurance?

You can buy individual/family health insurance from Indiana’s Marketplace if:8

- You live in Indiana.

- You are lawfully present in the U.S.

- You don’t have Medicare.

- You are not incarcerated.

Marketplace financial assistance, such as premium subsidies and cost-sharing reductions, depends on your household income. In addition, to qualify for financial assistance, you must:

- Not have access to affordable coverage via an employer. Our Employer Health Plan Affordability Calculator can help you check if you might qualify for premium subsidies in the Marketplace.

- Not be eligible for Medicaid or CHIP/Hoosier Healthwise.

- Not be eligible for premium-free Medicare Part A. 9

- File a joint tax return with your spouse, if you’re married.10 (with very limited exceptions)11

- Not be able to be claimed by someone else as a tax dependent.10

When can I enroll in an ACA-compliant plan in Indiana?

In Indiana, you can sign up for ACA-compliant individual and family health plans during the annual open enrollment period, which runs from November 1 through January 15.12

If you sign up by December 15, your coverage starts on January 1. If you enroll between December 16 and January 15, your coverage begins on February 1.

If the open enrollment deadline passes, you may still be able to sign up for or make changes to an ACA Marketplace health plan through a special enrollment period (SEP). To qualify for a SEP, you’ll generally need a qualifying life event.

However, you can apply in some situations even if you don’t have a qualifying life event. These include:

- If you’re eligible for premium tax credits and your income is no more than 150% of the poverty level, you can enroll at any time.13 (The federal government has proposed making this a permanent SEP opportunity.)14

- If you’re a Native American, you can enroll anytime.15

- If you lose Medicaid or CHIP between March 31, 2023 and November 30, 2024, you can use the extended SEP to enroll at any time during that window.16

How do I enroll in a Marketplace plan in Indiana?

There are a few ways to enroll in an exchange health plan in Indiana:

- You can sign up on HealthCare.gov – the ACA exchange website.

- Alternatively, you can call them at (800) 318-2596 (TTY: 1-855-889-4325). The call center is available 24 hours a day, seven days a week, but it’s closed on holidays.

- You can get help — in person, online, or over the phone, from agents, navigators, or certified application counselors.

- You can enroll via an approved enhanced direct enrollment entity.17

How can I find affordable health insurance in Indiana?

In Indiana, you can find affordable health plans through the ACA Marketplace’s website: HeathCare.gov.

Thanks to the ACA, you may be eligible for income-based premium subsidies called Advance Premium Tax Credits (APTC), which help reduce your monthly premiums.

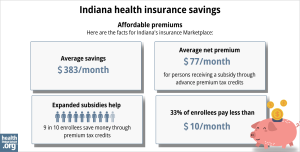

Nearly nine out of 10 Indiana exchange enrollees were eligible for premium subsidies on 2024 plans, with an average monthly savings of about $452. People who receive these subsidies pay an average monthly premium of only $82, after the subsidies are applied.18

Source: CMS.gov19

Cost-sharing reductions (CSR) also reduce costs by helping lower your deductibles and out-of-pocket costs. CSR benefits are automatically built into all of the available Silver-level plans as long as your income isn’t more than 250% of the federal poverty level.6

The federal government used to reimburse insurers for the cost of providing CSR benefits, but that ended in 2017. Since then, insurers have been adding the cost of CSR to the premiums they charge. In most states, this cost is only added to Silver-plan rates, since CSR benefits are only available on Silver plans. But Indiana is one of only two states where insurers are required to spread the cost of CSR across premiums for plans at all metal levels (broad loading, as opposed to the silver loading approach taken in most states).20

Medicaid offers very affordable access to coverage and care for those who meet the eligibility criteria. Check out our guide on Medicaid in Indiana for more information.

Short-term plans are also available as a cost-effective option if you don’t qualify for employer plans, Medicaid, Medicare, or subsidies from the exchange. Learn more about short-term health insurance in Indiana.

How many insurers offer Marketplace coverage in Indiana?

Six insurance companies provide individual and family plans for 2024 through the exchange in Indiana,21 including Aetna Health, which is new to Indiana’s Health Insurance Marketplace.22

For 2025, there will continue to be six insurers, but with some changes:4

- UnitedHealthcare Insurance Company is joining the market in Indiana, and will offer plans plans through the Marketplace.

- Celtic will no longer offer on-exchange plans, and will instead only offer plans outside the exchange. Everyone with an on-exchange Celtic plan in 2024 will be mapped to a Coordinated Care plan (Coordinated Care and Celtic are both owned by the same parent company, Centene23)

- U.S. Health & Life is exiting the individual market in Indiana at the end of 2024.

Are Marketplace health insurance premiums increasing in Indiana?

For 2025, Indiana’s Marketplace insurers will implement the following average rate changes, which amount to a weighted average rate decrease of 1.3%.4

Indiana’s ACA Marketplace Plan 2025 APPROVED Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Anthem (Anthem BCBS) | -3.1% |

| Caresource | 2.3% |

| Coordinated Care (2024 Celtic plans map to Coordinated Care for 2025) | -4.3% |

| Cigna | 4.4% |

| Aetna Health | 10.8% |

| UnitedHealthcare Insurance Company | New to market |

| US Health and Life Insurance Company | exiting market |

Source: Indiana Department of Insurance4

The average rate changes apply to the full-price premiums. But most Indiana residents who use the exchange receive financial assistance in the form of premium tax credits (premium subsidies), and thus do not pay full price.24

If you qualify for subsidies, the actual change in what you pay depends on how much your plan’s cost changes and how much financial assistance you receive from the government.

For perspective, here’s an overview of how full-price premiums have changed over the years in Indiana’s individual/family health insurance market:

- 2015: Average increase of 5%.25

- 2016: Average increase of 0.7%.26

- 2017: Average increase of 18.9%.27

- 2018: Average increase of 24%.28

- 2019: Average increase of 2.6%.29

- 2020: Average increase of 13.5%.30

- 2021: Average increase of 10.5%.31

- 2022: Average decrease of 1.7%.32

- 2023: Average increase of 5.7%.33

- 2024: Average increase of 2.1%.34

How many people are insured through Indiana’s Marketplace?

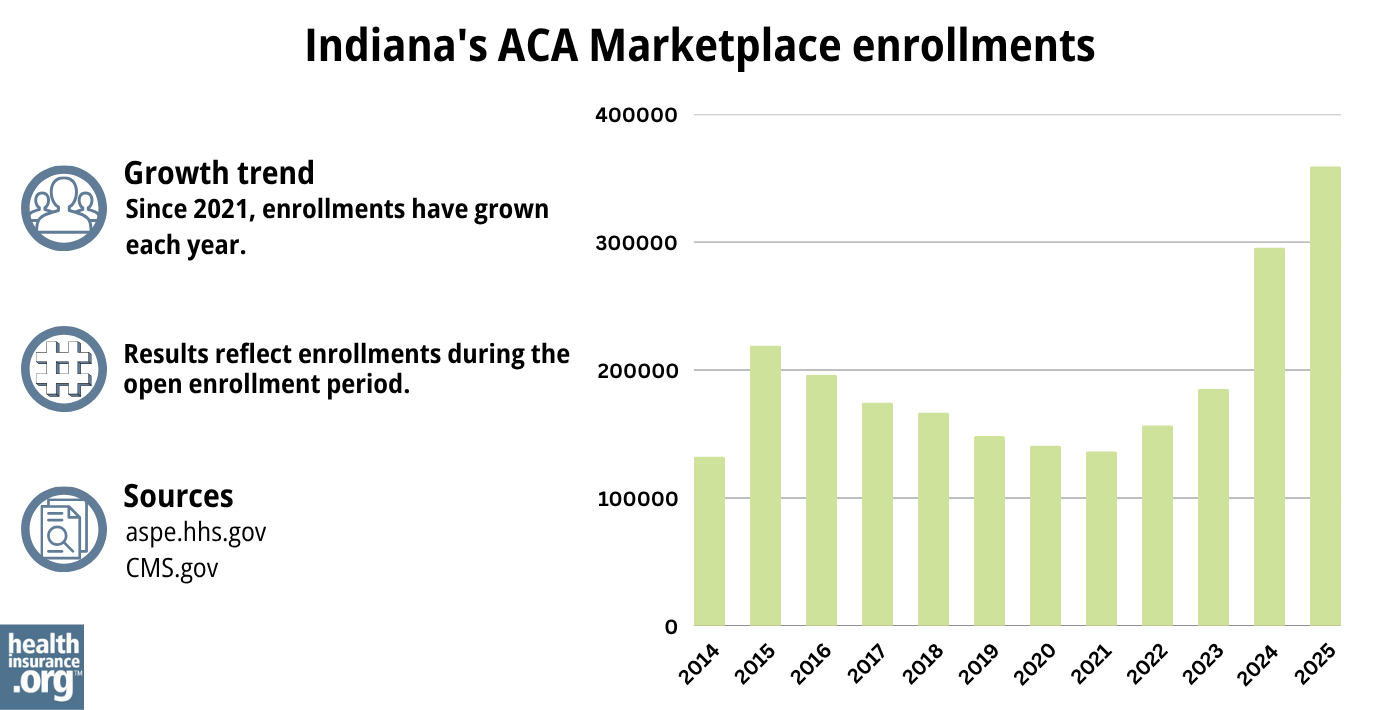

During the open enrollment period for 2024 coverage, 295,772 people enrolled in private individual market health plans through the Indiana Marketplace.35

The 2024 enrollment number was a record high (see chart below for historical enrollment numbers).

Enrollment has been growing since 2021, partly due to the subsidy enhancements created by the American Rescue Plan and Inflation Reduction Act.

The enrollment growth in 2024 was also due to the “unwinding” of the pandemic-era Medicaid continuous coverage. As of June 2024, more than 479,000 Indiana residents had been disenrolled from Medicaid.36 And CMS reported that by April 2024, more than 125,000 of those people had transitioned to a Marketplace plan.37

Source: 2014,38 2015,39 2016,40 2017,41 2018,42 2019,43 2020,44 2021,45 2022,46 2023,47 2024,48 202549

What health insurance resources are available to Indiana residents?

HealthCare.gov

800-318-2596

Indiana Department of Insurance

Oversees and licenses health insurance companies, brokers, and agents who sell insurance plans. It can be a valuable source for Indiana residents with questions or complaints about their health coverage.

Affiliated Service Providers of Indiana, Inc. (ASPIN)

A Navigator organization funded by the federal government, serving Indiana. They can assist with questions and help people enroll in Medicaid or a private insurance plan through the exchange.

Indiana State Health Insurance Assistance Information Program (SHIP)

This local service offers guidance and information to Medicare beneficiaries and their caregivers.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Indiana?

Explore more resources for options in Indiana including short-term health insurance, dental insurance, Medicaid and Medicare.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- ”2025 OEP State-Level Public Use File (ZIP)” Centers for Medicare & Medicaid Services, Accessed May 13, 2025 ⤶ ⤶

- ”Rate Review Submissions” RateReview.HealthCare.gov. Accessed Jan. 7, 2025 ⤶

- Indiana 2024 ACA Filings. Indiana Department of Insurance. Accessed December 7, 2023. ⤶

- ”Indiana 2025 ACA Filings” Indiana Department of Insurance. Accessed Sep. 13, 2024 ⤶ ⤶ ⤶ ⤶

- ”Marketplace 2024 Open Enrollment Period Report: Final National Snapshot” Centers for Medicare & Medicaid Services. January 2024. ⤶

- APTC and CSR Basics. Centers for Medicare and Medicaid Services. June 2023. ⤶ ⤶

- New tax credit a boon for Indiana Small Business Health Insurance. Take Command Health. September 2023. ⤶

- “Are you eligible to use the Marketplace?” HealthCare.gov, 2023 ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed MONTH. ⤶ ⤶

- Updates to frequently asked questions about the Premium Tax Credit. Internal Revenue Service. February 2024. ⤶

- “When can you get health insurance?” HealthCare.gov, 2023 ⤶

- “An SEP if your income doesn’t exceed 150% of the federal poverty level” healthinsurance.org, Feb. 1, 2023 ⤶

- HHS Notice of Benefit and Payment Parameters for 2025 Proposed Rule. Centers for Medicare and Medicaid Services. November 2023. ⤶

- “Who doesn’t need a special enrollment period?“ healthinsurance.org, Accessed August 2023 ⤶

- ”Temporary Special Enrollment Period (SEP) for Consumers Losing Medicaid or Children’s Health Insurance Program (CHIP) Coverage Due to Unwinding of the Medicaid Continuous Enrollment Condition Operations for Plan Year 2024” CMS.gov, Mar. 28, 2024 ⤶

- “Entities Approved to Use Enhanced Direct Enrollment” CMS.gov, April 28, 2023 ⤶

- “2024 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 22, 2024 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶

- ”SERFF Plan Management Instructions for Plan Year 2025” Indiana Department of Insurance. May 10, 2024 ⤶

- Indiana 2024 ACA Filings. Indiana Department of Insurance. Accessed December 2023. ⤶

- Aetna CVS Health to enter the Affordable Care Act (ACA) individual insurance exchange marketplace in Indiana for January 1, 2024. PR Newswire. October 2023. ⤶

- ”Report of Examination of Coordinate Care Corporation” Indiana Department of Insurance. May 13, 2020 ⤶

- “2024 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 2024 ⤶

- Analysis Finds No Nationwide Increase in Health Insurance Marketplace Premiums. The Commonwealth Fund. December 2014. ⤶

- Indiana: Approved 2016 Weighted Avg. Rates Confirmed As Only 0.7%. ACA Signups. September 2015. ⤶

- Avg. UNSUBSIDIZED Indy Mkt Rate Hikes: 25% (49 States + DC). ACA Signups. October 2016. ⤶

- UPDATE: Indiana Chooses The Worst Possible Way Of Spreading Their CSR Load. ACA Signups. October 2017. ⤶

- 2019 Rate Hikes. ACA Signups. October 2018. ⤶

- Indiana: *Final* Avg. 2020 #ACA Premium Rate Hikes: IN DOI Says 9.7%. The Math Says 13.5%. ACA Signups. October 2019. ⤶

- 2021 Rate Changes. ACA Signups. October 2020. ⤶

- Indiana 2022 ACA Filings. Indiana Department of Insurance. Accessed December 2023. ⤶

- Indiana: Final Avg. Unsubsidized 2023 #ACA Rate Changes: +5.7%. ACA Signups. October 2022. ⤶

- Indiana: *Final* Avg. Unsubsidized 2024 #ACA Rate Changes: +2.1%. ACA Signups. August 2023. ⤶

- ”Marketplace 2024 Open Enrollment Period Report: Final National Snapshot” Centers for Medicare & Medicaid Services. January 24, 2024. ⤶

- ”Medicaid Enrollment and Unwinding Tracker” KFF. June 14, 2024. ⤶

- ”HealthCare.gov Marketplace Medicaid Unwinding Report” Centers for Medicare & Medicaid Services. Data through April 2024. ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- “Health Insurance Marketplaces 2023 Open Enrollment Report” CMS.gov, 2023 ⤶

- ”HEALTH INSURANCE MARKETPLACES 2024 OPEN ENROLLMENT REPORT” CMS.gov, 2024 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶