What is an individual coverage health reimbursement arrangement (ICHRA)?

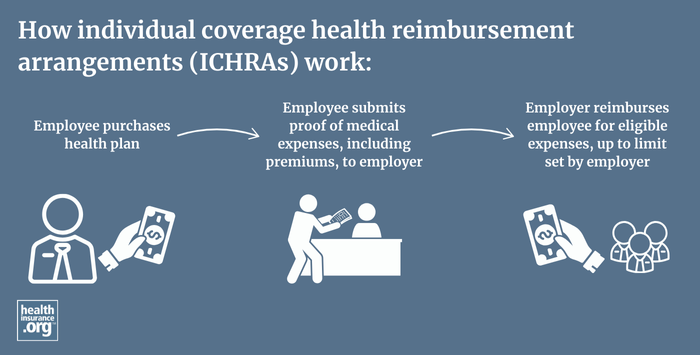

An individual coverage health reimbursement arrangement (ICHRA) is a fairly new type of health reimbursement arrangement in which employers of any size can reimburse employees for some or all of the premiums the employees pay for health insurance they purchase on their own.

ICHRAs were created under regulations issued by the Trump administration in 2019, and became available as of 2020. ICHRA adoption has grown significantly since then, increasing each year. And more than 83% of the employers providing ICHRA benefits in 2025 didn't previously provide health coverage to their workers.1

From 2024 to 2025, according to the HRA Council's annual report, the number of large employers offering ICHRAs grew by 34%, and the number of small employers offering ICHRAs grew by 18%. But the HRA Council notes that these numbers might under-represent the true size of the ICHRA market.1

As more employers offer ICHRAs, it’s important to understand the pros and cons of ICHRAs.

ICHRAs represent a departure from previous ACA implementation rules that forbid employers from reimbursing employees for individual market premiums. QSEHRAs, which became available in 2017, allow small employers to reimburse employees for individual market premiums. ICHRAs allow this for employers of any size, and they offer more flexibility in terms of how much an employer is allowed to reimburse an employee.

- Large employers can use an ICHRA to satisfy the employer mandate as long as the ICHRA benefit is substantial enough to make an individual health insurance plan affordable. (Note that the affordability determination under ICHRAs uses the same percentage of income that applies to employer group plans, but is calculated based on the price of the lowest-cost Silver plan in the marketplace, after the ICHRA benefit is subtracted from the total cost. This is different from the benchmark plan in the marketplace, which is the second-lowest-cost Silver plan. The interaction between ICHRAs and premium subsidies in the marketplace is discussed below).

- There are no limits on how much an employer can reimburse under an ICHRA (unlike a QSEHRA, which does have limits), nor are there minimum contribution requirements.

- An employer cannot offer an employee a choice between a group health plan and an ICHRA; it has to be one or the other. An employer can offer both a group health plan and an ICHRA, but they have to be offered to different classes of employees so that no employee has an option to choose between the group plan and the ICHRA.

- Employees who become eligible for reimbursement of premiums under an ICHRA (or QSEHRA) are eligible for a special enrollment period during which they can enroll in an individual market health plan.

- Employees must be enrolled in an individual market health plan (or Medicare) to receive the ICHRA benefit. In most cases, this will mean fully ACA-compliant coverage, but the rules do allow people with grandmothered and grandfathered plans to utilize an ICHRA benefit if it's available to them. For a Medicare beneficiary to use an ICHRA, they must be enrolled in Medicare Part A and B, or in Medicare Part C. The ICHRA benefit can be used to reimburse premiums for Medicare Parts A, B, C, D, and Medigap (Medicare Supplement).2

- ICHRAs can be used to reimburse qualified medical expenses in addition to individual market health insurance premiums if the employer opts to allow this. However, if ICHRA reimbursement is available for pre-deductible expenses, the employee would not be eligible to contribute to an HSA, even if they enroll in an individual market HSA-qualified health plan.

- Employees can select any individual market plan available in their zip code. In some areas this means employees can choose from among dozens of plans. If the ICHRA benefit doesn't cover the full price of the plan, the employee must pay the remaining premium.

- If the ICHRA benefit covers some, but not all, of the employee's premium in the individual market, the employer can allow the employee to use a pre-tax salary reduction (via a cafeteria plan) to pay the employee's share of the premium, but only if the plan is purchased outside the exchange. If the employee purchases on-exchange coverage with the ICHRA funds, the employee cannot use a pre-tax salary reduction to fund the remainder of the premium (assuming the ICHRA benefit doesn't cover the full premium).

- If, after applying the ICHRA benefit, the employee would have to pay more than 9.02%3 of their 2025 household income (the threshold is adjusted annually) for self-only coverage (ie, not counting family members) under the lowest-cost silver plan in the exchange, the ICHRA does not constitute affordable employer-sponsored insurance. In that case, the employee can reject the ICHRA and claim a premium subsidy in the exchange instead, assuming they're eligible for one. But if the employee accepts the ICHRA benefits and/or if the ICHRA benefit results in the lowest-cost self-only plan in the exchange having an after-ICHRA premium that doesn't exceed 9.02% of the employee's 2025 household income, the employee is not eligible for premium subsidies in the exchange. In this regard, an ICHRA is treated in the same manner as employer-sponsored health insurance.

- But it's important to note that while the rules for determining the affordability of employer-sponsored health coverage changed as of 2023 to eliminate the "family glitch," the rule change does not apply to how ICHRA affordability is determined. In other words, there continues to be a "family glitch," so to speak, for ICHRA coverage. In the rule that fixed the family glitch, the IRS noted that they plan to "consider whether future guidance should be issued to provide an ICHRA affordability rule for related individuals that is separate from the affordability rule for employees." But as of 2025, no additional rule changes have been proposed.

- ICHRAs can be used to provide health benefits to household employees, such as nannies. All of the above rules must be followed, meaning that the person's coverage must be obtained in the individual market and Marketplace subsidies are not available if the ICHRA is used. The household employer will need to draft the correct plan documents to offer the ICHRA benefit, so it's advised that they seek expert assistance with that process to make sure that all of the paperwork is in order.

How many people are utilizing ICHRA benefits?

ICHRA utilization has been steadily growing since 2020. As of 2025, the HRA Council estimated that almost 450,000 people had ICHRA benefits, including employees and their dependents (but as noted above, the HRA Council believes that the true scope of ICHRA adoption is likely larger than the numbers indicated in their report).1

The state of Indiana is encouraging the use of ICHRAs by offering small businesses a tax credit of $400 per employee in 2024, and $200 per employee in 2025, if the business sets up an ICHRA and contributes at least as much as they were paying for employees' health care or coverage the year before.4

Learn how ICHRA rules would be changed by the budget reconciliation bill passed by the U.S. House of Representatives in May 2025 (these provisions were not included in the Senate's initial version of the budget bill, so their future is unclear).5

Footnotes

- "Growth Trends for ICHRA and QSEHRA" HRA Council. Volume 4, 2024-2025. Accessed June 20, 2025 ⤶ ⤶ ⤶

- "Health Reimbursement Arrangements and Other Account-Based Group Health Plans" Federal Register: Internal Revenue Service, Employee Benefits Security Administration, and the Health and Human Services Department. June 20, 2019 ⤶

- "Revenue Procedure 2024-35” Internal Revenue Service. Accessed Apr. 14, 2025 ⤶

- "Indiana’s ICHRA Incentive and What it Means for Your Business" LifeRaft Blog. March 7, 2024 ⤶

- "Budget Reconciliation Bill" Senate Finance Committee. Draft published June 16, 2025 ⤶