Home > States > Health insurance in West Virginia

See your West Virginia health insurance coverage options.

Find individual and family plans, small-group, short-term or Medicare plans through licensed agency partners.

West Virginia Health Insurance Consumer Guide

West Virginia has a partnership exchange for its health insurance Marketplace. This means you enroll through HealthCare.gov, which is the Marketplace platform run by the federal government. However, West Virginia oversees the plan certification process for plans sold in the state.

You can use the West Virginia Health Insurance Marketplace to enroll in health coverage for yourself or your family; two private insurance companies offer Marketplace plans throughout West Virginia.1 The Marketplace also allows you to see if you qualify for premium subsidies or cost-sharing reductions (CSR) to lower your premiums and out-of-pocket costs.

The Marketplace is a good option for:

- Self-employed individuals

- Early retirees not yet on Medicare

- People whose employers don’t provide health insurance coverage

This guide explains the West Virginia ACA Marketplace and helps you understand your options.

Explore our other comprehensive guides to coverage in West Virginia

Dental coverage in West Virginia

In 2023, there is only one insurer offering stand-alone individual/family dental coverage through the health insurance Marketplace in West Virginia.

West Virginia’s Medicaid program

West Virginia implemented the ACA Medicaid expansion in 2014. This led to over 655,000 people enrolling in Medicaid as of April 2023.2

Medicare coverage options and enrollment in West Virginia

In 2023, there were 445,699 Medicare beneficiaries in West Virginia.3 Our guide explains Medicare, Medicare Advantage, and the Medigap plans available in West Virginia.

Short-term coverage in West Virginia

You can buy short-term health insurance in West Virginia for an initial duration of up to 364 days. These plans can be renewed for up to 36 months.

Frequently asked questions about health insurance in West Virginia

Who can buy Marketplace health insurance?

Anyone who meets the following criteria can buy Marketplace health coverage in West Virginia:

- You live in West Virginia

- You’re a U.S. citizen, national, or lawfully present

- You’re not incarcerated

- You don’t already have Medicare

Your eligibility for financial assistance, like premium subsidies and cost-sharing reductions, depends on your income. In addition, to qualify for financial help on the Marketplace, you must:

- Not have access to affordable health coverage through your employer. If you think your employer’s health coverage is too expensive, use our Employer Health Plan Affordability Calculator to see if Marketplace premium subsidies are available to you.

- Not be eligible for West Virginia Medicaid or CHIP.

- Not be eligible for premium-free Medicare Part A.4

When can I enroll in an ACA-compliant plan in West Virginia?

You can sign up for an ACA-compliant individual or family health insurance in West Virginia between November 1 and January 15 during open enrollment.5

Sign up by December 15 for your coverage to start on January 1. If you enroll between December 16 and January 15, your coverage will begin on February 1.

Outside of open enrollment, you can only sign up for coverage or switch plans if you qualify for a special enrollment period (SEP). In most cases, SEPs are time-limited and triggered by a qualifying life event. But there are some circumstances in which a SEP is available without a specific qualifying event. For example:

- Your income isn’t more than 150% of the poverty level, and you’re eligible for premium tax credits. In this scenario, you can enroll anytime until at least 2025.

- Native Americans can enroll whenever necessary.

For people who lose Medicaid or CHIP coverage between March 31, 2023, and July 31, 2024, there’s an extended SEP available for enrollment.6

How do I enroll in a Marketplace plan in West Virginia?

Use one of the following options to enroll in a Marketplace plan in West Virginia:

- Visit HealthCare.gov

- Call 1-800-318-2596 (TTY: 1-855-889-4325). The call center is available 24 hours a day, seven days a week, except for holidays.

You can find local help from local insurance agents, brokers, or certified application counselors. They help you review Marketplace plan options and choose a plan to fit your needs. Find help at localhelp.HealthCare.gov.7

You can also enroll in a West Virginia Marketplace plan via an approved enhanced direct enrollment entity.8

How can I find affordable health insurance in West Virginia?

You can find affordable health plans in West Virginia on the ACA Marketplace (HealthCare.gov).

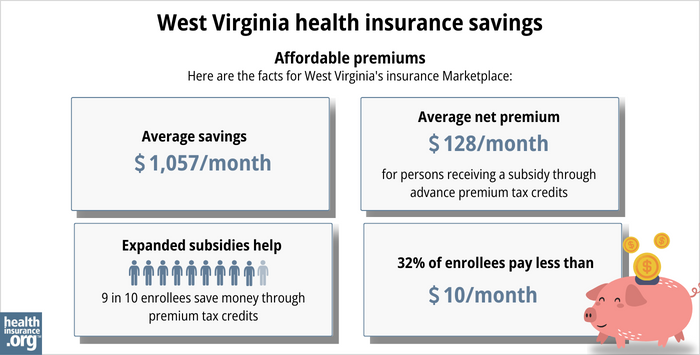

For the 2023 open enrollment period on the exchange:

- 95% of eligible enrollees qualified for premium subsidies.9

- Subsidies (called Advance Premium Tax Credits or APTC) save West Virginians about $1,057 monthly in 2023 (this is the largest average premium subsidy in the nation, because West Virginia has the nation’s highest full-price premiums). Those with subsidies pay an average premium of $128 per month.9

Apart from APTC, if your household income falls below 250% of the federal poverty level, you may also qualify for cost-sharing reductions (CSR).10 CSRs help reduce deductibles and out-of-pocket expenses.

Medicaid is another affordable health insurance option if you’re eligible.

Short-term plans are low-cost alternatives for people not eligible for Medicaid, Medicare, or subsidies.

Source: CMS.gov9

How many insurers offer Marketplace coverage in West Virginia?

Two companies provide 2023 individual and family plans through West Virginia’s exchange:11

- CareSource West Virginia Co.

- Highmark Blue Cross Blue Shield West Virginia

Are Marketplace health insurance premiums increasing in West Virginia?

West Virginia’s individual market insurers have proposed the following average rate increases for 2024:12

West Virginia’s ACA Marketplace Plan 2024 Approved Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| CareSource West Virginia Co. | 1.13% |

| Highmark Blue Cross Blue Shield West Virginia | 2.10% |

Source: HealthCare.gov12

West Virginia’s average pre-subsidy premiums are the highest in the nation. But most enrollees (96% in 2023) get premium subsidies which are also the largest in the nation — more than $1,000 per month, on average, in 2023.13

If you qualify for subsidies, your actual rate change will depend on your plan and the subsidy amounts. Your age can affect your premium too.

If the cost of your current plan increases, you can explore other health plans in the exchange that may be more affordable and offer similar benefits.

For perspective, here’s an overview of how average full-price (unsubsidized) premiums have changed in West Virginia’s individual market over time:

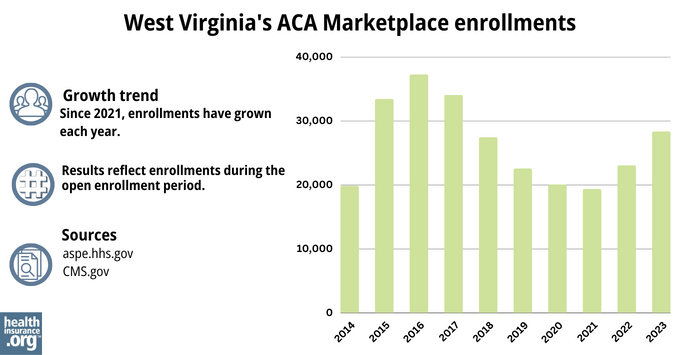

How many people are insured through West Virginia’s Marketplace?

West Virginia’s 2024 Marketplace enrollment far exceeded any previous year even before the end of the open enrollment period. By December 23, 2023 (with three weeks remaining before the enrollment deadline), 46,289 people had signed up for Marketplace plans in West Virginia.22

That was an increase of nearly 79% from the same time a year before, which was the largest year-over-year growth in the nation.23

The previous record high enrollment in West Virginia’s Marketplace came in 2017, when a total of 34,045 people signed up for coverage.24 The 2024 enrollment had far surpassed that level, with more than three weeks to go.

Previously, West Virginia’s 2023 open enrollment period had marked the highest enrollment since 2017, with 28,325 individuals signing up for private plans.9

As illustrated below, West Virginia’s Marketplace enrollment has been climbing since 2022, largely due to the American Rescue Plan’s enhancements of the ACA’s premium subsidy rules. The Inflation Reduction Act has extended the ARP’s subsidy enhancements through 2025.

Source: 2014,25 2015,26 2016,27 2017,24 2018,28 2019,29 2020,30 2021,31 2022,32 20239

What health insurance resources are available to West Virginia residents?

HealthCare.gov

This is the ACA Marketplace, where you can enroll in a health insurance plan online. You may also get help by calling (800) 318-2596.

West Virginia Offices of the Insurance Commissioner

Oversees and regulates insurance companies, brokers, and agents in the state while assisting consumers with insurance-related inquiries and concerns.

West Virginia Navigator

A free, non-profit program accessible to all residents within the state, providing free enrollment assistance.

West Virginia Senior Health Insurance Assistance Program (SHIP)

Helps answer questions and help Medicare beneficiaries.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- Plan Year 2024 Qualified Health Plan Choice and Premiums in HealthCare.gov Marketplaces. Centers for Medicare and Medicaid Services. October 25, 2023. ⤶

- “April 2023 Medicaid & CHIP Enrollment Data Highlights” Medicaid.gov ⤶

- “Medicare Monthly Enrollment” CMS.gov, April 2023 ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- “When can you get health insurance?” HealthCare.gov, 2023 ⤶

- “Temporary Special Enrollment Period (SEP) for Consumers Losing Medicaid or the Children’s Health Insurance Program (CHIP) Coverage Due to Unwinding of the Medicaid Continuous Enrollment Condition– Frequently Asked Questions (FAQ)” CMS.gov, Jan. 27, 2023 ⤶

- “Find Local Help” localhelp.HealthCare.gov, Accessed September 2023 ⤶

- Entities Approved to Use Enhanced Direct Enrollment. CMS.gov, Accessed November 2023 ⤶

- “2023 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 2023 ⤶ ⤶ ⤶ ⤶ ⤶

- “Federal Poverty Level (FPL)” HealthCare.gov, 2023 ⤶

- ”Consumer Insurance Information” West Virginia Offices of the Insurance Commissioner, 2023 ⤶

- ”West Virginia Rate Review Submissions” HealthCare.gov, 2023 ⤶ ⤶

- Effectuated Enrollment: Early 2023 Snapshot and Full Year 2022 Average. Centers for Medicare and Medicaid Services. Published 2023. ⤶

- Analysis Finds No Nationwide Increase in Health Insurance Marketplace Premiums. The Commonwealth Fund. December 2014. ⤶

- Highmark Blue Cross Blue Shield considered pulling out of Obamacare exchange. Metro News. November 2015. ⤶

- Avg. UNSUBSIDIZED Indy Mkt Rate Hikes: 25% (49 States + DC). ACA Signups. October 2016. ⤶

- West Virginia: 24.8% Rate Hikes; 10.9 Points Due To CSR Sabotage. ACA Signups. October 2017. ⤶

- 2019 Rate Hike Project Wrap-Up: FINAL/APPROVED Rate Changes For West Virginia. ACA Signups. November 2018. ⤶

- 2020 Rate Changes. ACA Signups. October 2019. ⤶

- 2021 Rate Changes. ACA Signups. October 2020. ⤶

- 2022 Rate Changes. ACA Signups. October 2021.[/efn-note]

- 2023: Average increase of 5%.[efn_note]West Virginia: Final Avg. 2023 #ACA Rate Changes: +5.0%. ACA Signups. October 2022. ⤶

- Under the Biden-Harris Administration, Over 20 Million Selected Affordable Health Coverage in ACA Marketplace Since Start of Open Enrollment Period, a Record High. Centers for Medicare and Medicaid Services. January 2024. ⤶

- State By State Breakout: Florida Breaks 4.0M, Texas Adds 1.0M, WV Up 79% & Much More! ACA Signups. January 2024. ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶ ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶