Home > States > Health insurance in Illinois

See your Illinois health insurance coverage options now.

Find affordable individual and family plans, small-group, short-term, or dental plans through licensed agency partners.

Illinois Health Insurance Consumer Guide

Illinois runs a partnership exchange with the federal government. The state operates Get Covered Illinois, which has a website, in-person help, and a help desk,1 but Illinois residents use the federally-run HealthCare.gov platform to enroll in Affordable Care Act (ACA) Marketplace health plans.

But starting in the fall of 2025, for coverage effective in 2026, Illinois will have its own state-run enrollment platform.

Use this guide to help you understand the Illinois Marketplace and choose the right health plan for you and your family. ACA Marketplace plans – or Obamacare or exchange – are affordable choices for many people. Enrolling on the exchange may make you eligible for financial assistance through an advance premium tax credit.

Explore our other comprehensive guides to coverage in Alaska

Dental coverage in Illinois

In 2023, ten insurers offer stand-alone individual/family dental coverage through the health insurance marketplace in Illinois.2 Learn about other dental coverage options in the state.

Medicaid in Illinois

Illinois expanded Medicaid eligibility under the ACA in 2014.3 By April 2023, the number of people enrolled in Medicaid and CHIP in Illinois was over 3.8 million.4

Medicare coverage options and enrollment in Illinois

As of April 2023, over 2.3 million people in Illinois have Medicare coverage.5 If you’re curious about signing up for Medicare in Illinois or want to know about the state’s Medigap rules, our guide has you covered.

Short-term coverage in Illinois

In 2018, Illinois passed a law that restricts short-term health plans to six months and bans any renewals. As of 2023, there were at least nine insurers offering short-term health insurance policies in the state:6

Frequently asked questions about health insurance in Illinois

Who can buy Marketplace health insurance?

You can buy a health plan through the exchange if:7

- You reside in the United States.

- You are a U.S. citizen or national.

- You are not incarcerated.

- You are not already covered Medicare.

Qualification for financial assistance, including premium subsidies and cost-sharing reductions (CSR), depends on your income and how it compares with the cost of the second-lowest-cost Silver plan in your area. This can vary based on where you live and your age. Moreover, to be eligible for financial aid for your Marketplace plan, you must:

- Not have affordable health coverage available through your job or your spouse’s job. If you have access to employer-sponsored insurance, but it seems too expensive, you can use our Employer Health Plan Affordability Calculator to see if you might be eligible for premium subsidies on the Marketplace.

- Not qualify for Medicaid or CHIP.

- Not be eligible for premium-free Medicare Part A.8

When can I enroll in an ACA-compliant plan in Illinois?

In Illinois, open enrollment for ACA Marketplace individual and family health coverage is from November 1 through January 15.9

You can sign up for an exchange plan — or make changes to your coverage — outside of open enrollment if you meet special enrollment period (SEP) requirements.10 This generally means you must have a qualifying life event, such as losing your health insurance, getting married, or having a baby.

But some special enrollment periods don’t require a specific qualifying event. So if the open enrollment deadline has passed and you haven’t experienced a qualifying event, you may still be able to sign up for an ACA plan. For example:

- If you’re eligible for premium tax credits and your income is not more than 150% of the poverty level, you can enroll anytime until at least the end of 2025.11

- If you’re a Native American, you can enroll whenever necessary.12

For those who lose Medicaid or CHIP coverage between March 31, 2023 and July 31, 2024, an extended SEP allows you to enroll anytime during that window.13

Illinois legislation (HB5142) was enacted in 2022 that created an easy enrollment program, which became available as of early 2023, when 2022 tax returns were being filed.

For the time being, Illinois cannot offer a special enrollment period for marketplace plans in conjunction with the easy enrollment program, because using the federally-run exchange means there cannot be state-specific SEP opportunities. That will change as of 2026, when Illinois is running its own exchange platform.

For now, Illinois residents can indicate on their state tax return whether they’d like their information to be shared with applicable state agencies (This is Step 12 on the 2022 Illinois state tax return).

If the person is found to be eligible for Medicaid or CHIP, the state can notify them and help them enroll, since those programs have year-round enrollment.14

How do I enroll in a Marketplace plan in Illinois?

Here are the main ways to enroll in a Marketplace health plan in Illinois:

- Online: You can sign up directly through HealthCare.gov, federal Marketplace website.

- By Phone: Dial 1-800-318-2596 (TTY: 1-855-889-4325) to enroll over the phone with a Marketplace representative. The call center is available 24 hours a day, seven days a week, but it’s closed on holidays.

- In-person: Enrollment assistance is also available from trained Navigators and assisters who can answer your questions. Go to localhelp.HealthCare.gov or getcovered.illinois.gov to find in-person assistance in your area.

- With the help of a broker or via an approved enhanced direct enrollment entity.15 (Note that EDEs can also offer off-exchange plans and non-ACA-compliant plans. If you’re working with an EDE, be clear in specifying what type of coverage you want. Keep in mind that you can only get subsidies if you choose a Marketplace plan.)

How can I find affordable health insurance in Illinois?

Individuals and families who enroll in Marketplace coverage in Illinois can take advantage of two different types of income-based financial assistance:

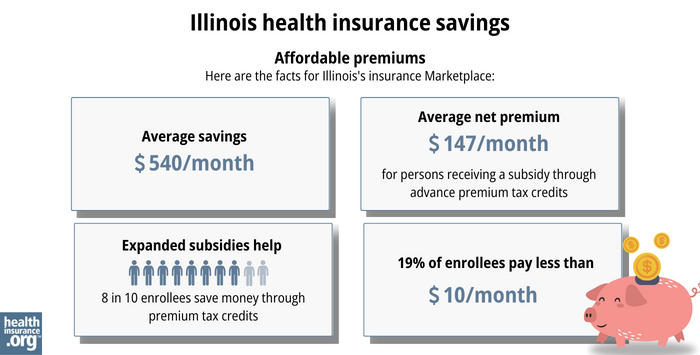

- Premium subsidies: The ACA Marketplace is the only place where you can qualify for income-based subsidies known as Advance Premium Tax Credits (APTC) that help lower your monthly premiums. Nearly nine out of 10 Illinois exchange enrollees were eligible for subsidies on 2023 plans, saving $540 monthly with premium tax credits in Illinois. As a result, the average after-subsidy monthly premium was $147.16

- Cost-Sharing Reductions: You may qualify for cost-sharing reductions (CSR) if your income is no more than 250% of the federal poverty level.17 CSRs help reduce your out-of-pocket costs, making coverage more affordable. Forty-three percent of Illinois Marketplace enrollees were receiving CSR benefits as of early 2023.18

Medicaid: Illinois residents may qualify for affordable Medicaid coverage if eligible.

Short-Term Health Insurance: For people who are not eligible for subsidies, Medicare, or Medicaid, short-term health insurance may offer a more budget-friendly option.

How many insurers offer Marketplace coverage in Illinois?

Twelve insurers are offering exchange plans in Illinois for 2024, up from 11 in 2023.19

Aetna Life Insurance is the new insurer that joined the exchange in Illinois for 2024 (Aetna Health already offered plans; there are now two Aetna entities). The Illinois Department of Insurance also noted that as of 2024, SSM Health Plan changed its name to Medica Central Health Plan.20

Are Marketplace health insurance premiums increasing in Illinois?

Illinois has historically had very little transparency in terms of rate filing details for health plans, and state regulators have not had the authority to modify or reject rate changes proposed by insurers. But that will change as of the 2025 plan year (for rates filed in 2024), due to a new law that was enacted in 2023 (some provisions of the law will be phased in the following year).21

Illinois’ individual/family market insurers implemented the following average rate increases for 2024,22 amounting to a weighted average rate increase of 5.7% before any subsidies are applied:23

Illinois’ ACA Marketplace Plan 2024 Approved Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Aetna Health | -3.2% |

| Aetna Life Insurance | New for 2024 |

| Celtic Insurance Co. (Ambetter) | 6.87% |

| Cigna HealthCare of Illinois, Inc. | 5.91% |

| Health Alliance Medical Plans, Inc. (HAMP) | 10.68% |

| Health Care Service Corporation (Blue Cross Blue Shield of Illinois) | 4.79% |

| Quartz Health Benefit Plans Corporation | 14.41% |

| MercyCare HMO | 12.15% |

| Molina Healthcare of Illinois, Inc. | 7.75% |

| Oscar Health Plan, Inc. | 6.77% |

| SSM Health Plan (WellFirst Health) | 22.21% |

| UnitedHealthcare | 3.02% |

Source: HealthCare.gov24

For perspective, here’s how average individual/family health insurance premiums have changed in Illinois over the years (note that in Illinois, average rate changes have often been published based on rate changes for the lowest-cost plan at each metal level, rather than overall rate changes, which differs from how this information has typically been presented in other states. And weighted averages have not typically been available in Illinois, due to the lack of transparency in the rate filing process. This should change in future years, under the terms of the state’s new law.)

- 2015: Average increases ranged from 2.6% to 11%.25

- 2016: Average increases ranged from 5.3% to 11.3%.26

- 2017: Overall average increase of 45.1%.27

- 2018: Overall average increase of 30%.28

- 2019: Average rate changes generally ranged from -4% to +6%.29

- 2020: Average rate decrease of 0.3%.30

- 2021: Relatively flat rates for most insurers31

- 2022: Average increase of roughly 5%.32

- 2023: Average increase of roughly 7%33

How many people are insured through Illinois’ Marketplace?

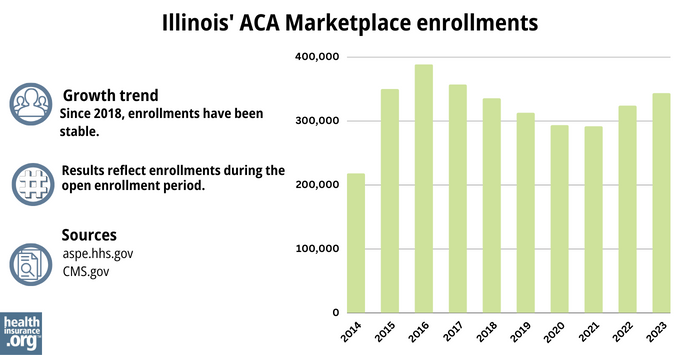

398,814 people signed up for private health coverage through the Illinois exchange during the open enrollment period for 2024 coverage, up from about 342,000 the year before.34 This marked the highest enrollment Illinois has ever had; the previous record high came in 2016, when about 388,000 people enrolled.35

Enrollment over time in the Illinois Marketplace is illustrated in the chart below. The increase in recent years is due in large part to the subsidy enhancements provided by the American Rescue Plan and Inflation Reduction Act. The increase for 2024 is also partially driven by the return to normal disenrollments for the Medicaid program, which was paused for three years during the pandemic.

Source: 2014,36 2015,37 2016,35 2017,38 2018,39 2019,40 2020,41 2021,42 2022,43 202344

What health insurance resources are available to Illinois residents?

HealthCare.gov

Premium tax credits are available only through the ACA Marketplace.

Illinois Department of Insurance

The Illinois Department of Insurance regulates individual, small-group, and large-group health plans in the state (excluding self-insured ones). They also regulate brokers and agents selling private health insurance.

Illinois Senior Health Insurance Program (SHIP)

Contact them for assistance with Medicare questions.

Illinois Department of Healthcare and Family Services

Assistance with Medicaid eligibility or enrollment in Illinois and with All Kids, the state’s Children’s Health Insurance Program, and Family Care, the state’s Medicaid coverage for parents with minor children.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- ”Get Covered Illinois” getcovered.illinois.gov ⤶

- “Illinois dental insurance guide 2023” healthinsurance.org, Accessed September 2023 ⤶

- “Affordable Care Act | HFS” Illinois.gov, Accessed September 2023 ⤶

- "Total Monthly Medicaid & CHIP Enrollment and Pre-ACA Enrollment" KFF.org, April 2023 ⤶

- “Medicare Monthly Enrollment” CMS.gov, April 2023 ⤶

- “Availability of short-term health insurance in Illinois” healthinsurance.org, Feb. 23, 2023 ⤶

- “Are you eligible to use the Marketplace?” HealthCare.gov, 2023 ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- “Get Covered Illinois FAQs” getcovered.illinois.gov, Accessed September 2023 ⤶

- “Enroll in or change 2023 plans – only with a Special Enrollment Period” HealthCare.gov, 2023 ⤶

- “An SEP if your income doesn’t exceed 150% of the federal poverty level” healthinsurance.org, Feb. 1, 2023 ⤶

- “Who doesn’t need a special enrollment period?“ healthinsurance.org, Accessed August 2023 ⤶

- “Temporary Special Enrollment Period (SEP) for Consumers Losing Medicaid or the Children’s Health Insurance Program (CHIP) Coverage Due to Unwinding of the Medicaid Continuous Enrollment Condition– Frequently Asked Questions (FAQ)” CMS.gov, Jan. 27, 2023 ⤶

- “House Bill 5142” Illinois General Assembly, enacted 2022 ⤶

- “Entities Approved to Use Enhanced Direct Enrollment” CMS.gov, April 28, 2023 ⤶

- “2023 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 2023 ⤶

- “Federal Poverty Level (FPL)” HealthCare.gov, 2023 ⤶

- Effectuated Enrollment: Early 2023 Snapshot and Full Year 2022 Average. Centers for Medicare and Medicaid Services. Published 2023. ⤶

- 2024 Analysis of Illinois On-Exchange Plans. Illinois.gov, 2023 ⤶

- 2024 Analysis of Illinois On-Exchange Plans. Illinois.gov, 2023 ⤶

- ”Illinois House Bill 2296” BillTrack50. Enacted 2023 2023 ⤶

- Illinois Rate Review Submissions” HealthCare.gov. Accessed November 2023. ⤶

- So How’d I Do On My 2024 Avg. Rate Change Project? Not Bad At All! ACA Signups. December 2023. ⤶

- Illinois Rate Review Submissions. HealthCare.gov. Accessed November 2023. ⤶

- ”Obamacare rates in Illinois: Higher premiums, more options in 2015” Venteicher, Wes, et al. Chicago Tribune. November 7, 2014 ⤶

- ”UnitedHealthcare of Illinois, Inc. History” Zippia.com ⤶

- ”Avg. UNSUBSIDIZED Indy Mkt Rate Hikes: 25% (49 States + DC)” ACA Signups ⤶

- ”Illinois: RATE-HIKE-A-PALOOZA! Six More States Added At Once!” ACA Signups ⤶

- ”Illinois Department of Insurance releases ACA Exchange health care insurance rates for 2019” Illinois.gov. October 10, 2018. ⤶

- ”Illinois: *Final* Avg. 2020 #ACA Premiums: 0.3% Decrease” ACA Signups. October 30, 2019. ⤶

- ”Illinois: Preliminary Avg. 2021 #ACA Premiums: -1.8% Indy; +5.2% Sm. Group (Unweighted)” ACA Signups. October 15, 2020. ⤶

- ”*APPROVED* Avg. 2022 #ACA Rate Changeapalooza! AK, CA, GA, HI, IL, KS, LA, MA, MS, MO, NE, NH, TX, WY” ACA Signups. November 2, 2021. ⤶

- ”Illinois: Final Avg. Unsubsidized 2023 #ACA Rate Changes: +7.1% (Updated)” ACA Signups. August 5, 2022. ⤶

- “2023 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 2023 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶ ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- “Health Insurance Marketplaces 2023 Open Enrollment Report” CMS.gov, 2023 ⤶