Expert analysis of health reform issues

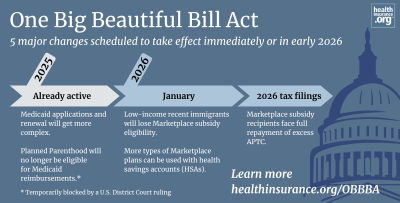

One Big Beautiful Bill Act brings sweeping changes to health coverage

July 18, 2025 – Five provisions of the One Big Beautiful Bill (OBBBA) Act take effect in 2025 and early 2026 and will significantly impact Medicaid…

New federal rule brings immediate changes to Marketplace enrollment

July 10, 2025 – A new federal rule will bring significant changes to Marketplace enrollment, with some of regulations becoming effective in August 2025.…

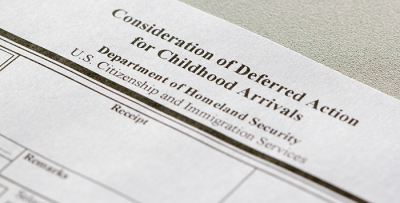

DACA news: 100,000 Dreamers become eligible for Marketplace health insurance

June 30, 2025 – Starting in November, DACA health insurance options will include exchange enrollment and eligibility for income-based premium subsidies.…

Budget bill provisions could make ICHRAs more appealing to businesses

May 30, 2025 – The budget reconciliation bill that passed in the House of Representatives includes provisions intended to make ICHRAs – or CHOICE…

ICHRA vs QSEHRA: Which is right for your small business?

May 28, 2025 – Compare ICHRA and QSEHRA to find out which health reimbursement arrangement best fits your business. Learn about eligibility, contribution…

9 mental health insurance questions consumers should ask

May 16, 2025 – The answers to nine mental health insurance questions consumers ask about coverage of mental health treatment, substance abuse disorder…

The most likely targets for Medicaid cuts

May 6, 2025 – We look at likely ways the government might make cuts to federal Medicaid spending – and look at the populations that the cuts would…

Medicaid for children: 6 facts every parent should know

April 23, 2025 – Medicaid for children plays a vital role in covering kids in the U.S., but many families may not be aware of the state and federal…

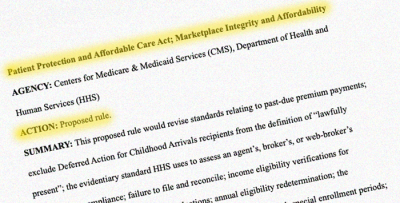

Proposed rule would bring sweeping changes to Marketplace enrollment, eligibility

March 13, 2025 – A proposed federal rule issued this week would, if finalized, bring wide-ranging changes for the Affordable Care Act’s health insurance…

HMO vs PPO vs POS vs EPO: What’s the difference?

February 17, 2025 – The type of managed care your health plan falls under affects your healthcare costs and plan benefits – including access to medical…

Can a new President make health policy changes on ‘Day One?’

January 17, 2025 – When a new Commander in Chief takes office and their party also controls both chambers of Congress, how quickly can they make changes to…

Four reasons to not wait until January to enroll in an ACA health plan

January 16, 2025 – Obamacare's 2023 open enrollment runs until January 15 in most states. Here's why you might want to enroll by December 15…