Q. What’s the difference between prescription discount plans and prescription drug insurance?

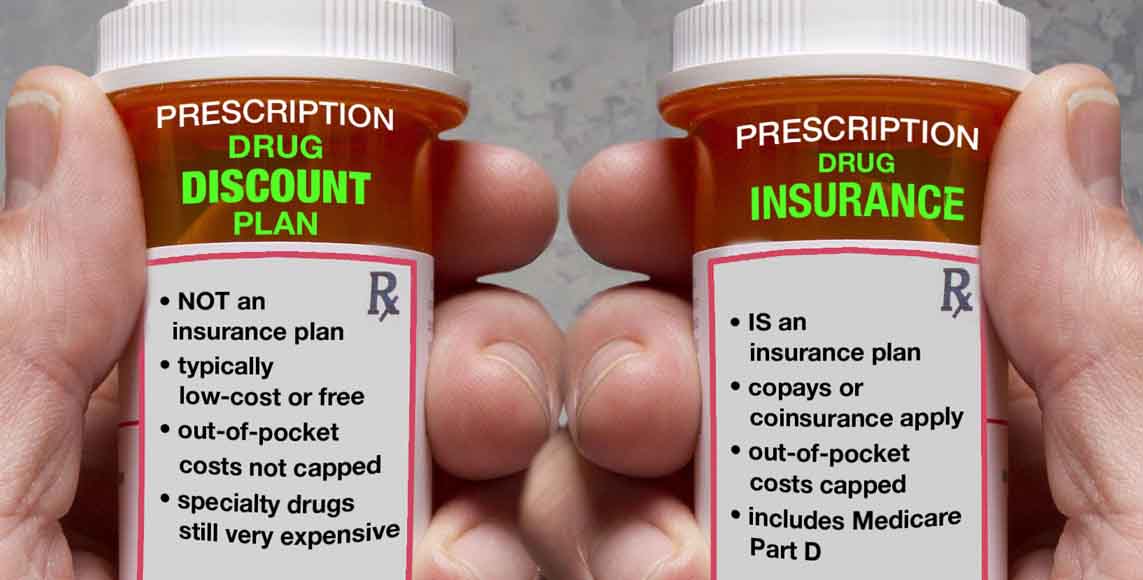

A. There are two basic and very different types of drug plans: prescription discount plans and prescription drug insurance.

In a discount plan, you typically pay a monthly or annual fee, although some discount plans are available free of charge. You present your card when you fill a prescription, and the pharmacy gives you a certain percentage discount on the cost of the drug. The discount may vary drug by drug or by brands versus generics. Discount plans are offered by drug manufacturers, drug stores, and membership organizations like AARP. Discount plans are NOT insurance plans. They are not required to cap your out-of-pocket costs, and your mileage will vary in terms of how much you save by using a discount plan.

Prescription drug insurance is similar to medical insurance. You (or your employer) pay a premium, and then you pay a copay (or a deductible or coinsurance) when you fill a prescription. If you are insured through a large employer group plan, prescription drug coverage may be a separately-administered plan or integrated with your medical insurance.

Large group plans and self-insured plans are not required to include coverage for the ACA’s essential health benefits, which means it’s possible (although very rare) to have large group or self-insured coverage that doesn’t include prescription drug coverage.

Original Medicare does not cover outpatient prescription drugs. Medicare beneficiaries have two choices for drug coverage (unless they have drug coverage through an employer or retiree health plan): they can enroll in a Medicare Advantage plan that includes Part D prescription coverage (MA-PD), or they can purchase a stand-alone Medicare Part D prescription drug plan (PDP).

Medicare Part D coverage is insurance, and as of 2025 it has an out-of-pocket cap of $2,000 for covered drugs. This is true regardless of whether the coverage is obtained under an MA-PD or a PDP. The out-of-pocket cap is due to the Inflation Reduction Act.

Learn more about how the Inflation Reduction Act has improved Medicare drug coverage.

Medicare beneficiaries can choose to enroll instead in a prescription discount plan instead of getting Part D coverage, but that would result in a late enrollment penalty if they were to decide later on that they want to join a Part D plan after their initial enrollment window had passed. And discount plans are not an adequate substitute for prescription drug insurance; they may provide significant discounts on lower-cost medications, but will generally leave the member will substantial out-of-pocket costs for higher-priced drugs.

For people who get their health insurance through Medicaid, a small-group plan, or the individual market (on or off-exchange), prescription drug insurance is now required to be included in all new health plans with effective dates of January 2014 or later, as prescription coverage is one of the ten essential health benefits under the ACA. The prescription coverage under the ACA is insurance — not a discount plan. But depending on the plan design, you may have to meet your deductible before the plan starts to pay for your prescriptions. Either way, the maximum out-of-pocket limit on your plan includes spending on prescription drugs.

So if you have an ACA-compliant health plan, you shouldn’t need to purchase any additional stand-alone drug coverage. But if you have a grandmothered or grandfathered health plan or a large group or self-insured plan that has skimpy or non-existent drug coverage, or if you’re covered under Original Medicare, or if you’re uninsured, you may want to consider a stand-alone prescription plan.

Medicare Part D plans, along with major medical plans that include drug coverage, are regulated by the federal and/or state government. But discount drug plans are not regulated unless states choose to regulate them.

Get your free quote now through licensed agency partners!