What is small-group health insurance?

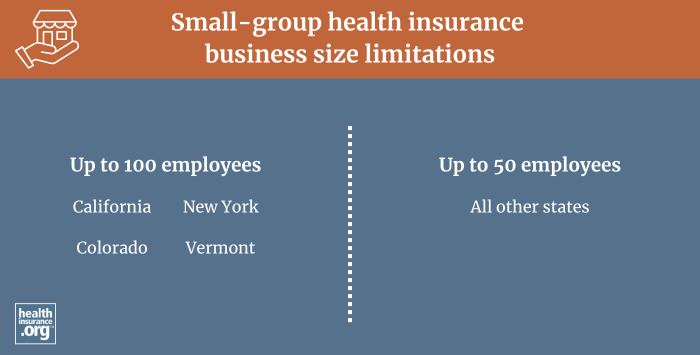

In most states, small-group health insurance is medical insurance purchased by businesses with 50 or fewer full-time equivalent employees, to provide health coverage for the employees and their families. In four states, small group plans are sold to businesses with up to 100 employees, although this will drop to three states when Colorado changes its definition of small group starting in 20261 (in most states, businesses with 51+ employees obtain coverage in the large group market, but in those four states — three states as of 2026 — the large group market starts with businesses that have at least 101 employees).

How are small group health plans regulated?

Small-group plans effective since January 2014 are required to fully comply with Affordable Care Act (ACA) rules that apply to individual and small-group health plans.

Insurers can't use a group’s medical history to set premiums for ACA-compliant small-group plans, and premiums for older employees cannot be more than three times those for younger employees. ACA-compliant small-group plans also have to fit into one of the four metal levels and cover the ACA’s essential health benefits with no dollar limits on how much the health plan will pay for a member's treatment.

How can a business obtain small-group health insurance?

Businesses can buy small-group plans at any time of the year, directly from an insurance company, via a broker or private exchange, or from a state's SHOP exchange (most states no longer have SHOP exchange plans available, but some do; in the District of Columbia, small group plans can only be obtained in the SHOP exchange).

In most states, insurers can impose participation requirements (in terms of the percentage of employees who sign up for the coverage) as well as employer contribution requirements (in terms of the amount of the premiums covered by the employer, as opposed to being payroll deducted). But there's a one-month window each year, from November 15 to December 15, when small group coverage is guaranteed-issue even to small groups that don't meet the normal participation or contribution requirements.

Purchase of a SHOP plan may qualify the buyer for the Small Business Health Care Tax Credit. In states that use Healthcare.gov, SHOP plans are now purchased directly through the insurance companies, or with the help of a SHOP-certified broker, although there are no SHOP-certified plans available anymore in most states that use HealthCare.gov (meaning the Small Business Health Care Tax Credit isn't available to employers).

Find out whether your business would benefit by providing small-group coverage for employees.

How can employees enroll in small-group health insurance?

When an employer purchases a small-group health plan, eligible employees are enrolled if they choose to accept the coverage. After that initial enrollment window, employees can sign up during an annual open enrollment period (set by the employer and the insurer), or during a special enrollment period triggered by a qualifying life event. Newly eligible employees can enroll as soon as they become eligible, which can be at any time of the year (for example, a new hire, or a person who transitions from part-time to full-time).

Are there any other alternatives for small groups to obtain health insurance?

Yes. Small groups can choose to self-insure rather than purchase ACA-compliant health insurance from an insurance company. Self-insurance is the primary type of coverage used by large employers.2 And although it's not as common among small employers, it is possible, especially in conjunction with a stop-loss policy.3

Another option is to use a QSEHRA or ICHRA, both of which involve the employer reimbursing employees for the cost of self-purchased health coverage.

Are small employers required to offer health coverage?

No, unless they have 50 full-time equivalent employees. As noted above, groups with up to 50 employees are considered small groups in most states. The ACA's employer mandate requires employers with 50 or more employees to offer health coverage to full-time employees.

So there is that slight overlap: A business with exactly 50 full-time equivalent employees does have to offer coverage, and would be purchasing coverage in the small group market if they choose to purchase group coverage from an insurer. But as noted above, they could also choose to self-insure or use a reimbursement arrangement that lets the employees purchase their own coverage in the individual market (the reimbursement must be substantial enough that the self-purchased coverage would be considered affordable).

Businesses with 49 or fewer full-time equivalent employees are not required to offer health coverage. Many do as a way to attract and retain employees, but there is no government requirement that they provide health benefits to their workers. People who work for a small employer that doesn't offer health benefits can purchase their own coverage in the health insurance Marketplace. Depending on their household income, they may qualify for premium subsidies that offset some or all of the cost of the coverage.

Footnotes

- "Colorado Senate Bill 73" BillTrack50. Enacted May 1, 2024 ⤶

- "2024 Employer Health Benefits Survey" KFF.org. Oct. 9, 2024 ⤶

- "Understanding Stop-Loss Insurance" Roundstone. Nov. 20, 2023 ⤶