What is a cost-sharing reduction?

A cost-sharing reduction (CSR) is a provision of the Affordable Care Act that reduces out-of-pocket costs for eligible enrollees who select Silver health insurance plans in the marketplace. CSRs – sometimes referred to as cost-sharing subsidies – reduce enrollees' cost-sharing by lowering a health plan's out-of-pocket maximum, and increasing the actuarial value (AV) of the plan.

Who's eligible for cost-sharing reductions?

Cost-sharing reductions are available to eligible enrollees who select Silver plans in the marketplace and have household incomes up to 250% of the federal poverty level (FPL).

The lower income threshold for CSR is 100% of the poverty level in states that have not expanded Medicaid, and above 138% of FPL in states that have expanded Medicaid. (If you’re eligible for Medicaid, you’re not eligible for any sort of subsidies in the exchange; note that the lower income limits do not apply to recent immigrants, as they are generally not eligible for Medicaid until they've been in the U.S. for at least five years.)

Here are the 2024 poverty level numbers, which are compared with projected 2025 income to determine subsidy eligibility for 2025 coverage (note that the poverty level is higher in Alaska and Hawaii).

How many Marketplace enrollees have cost-sharing reductions?

As of early 2024, there were nearly 10.4 million people enrolled in plans with CSR benefits. This accounted for half of all Marketplace enrollees.1

How do applicants receive cost-sharing subsidies?

When an enrollee who is eligible for CSR selects a Silver plan, they are enrolled into a Silver plan that has cost-sharing reductions automatically built into the plan design. So the lower out-of-pocket cap and higher AV are automatic, as long as the person picks a Silver plan.

Silver plans with built-in CSR will only appear on Marketplace/exchange websites for applicants whose income makes them eligible for CSR benefits. People who enter a higher income will only see regular Silver plans, without CSR benefits included.

Note that CSRs work differently for American Indians and Alaskan Natives, who can receive CSRs with Bronze, Silver, Gold or Platinum plans. For Native Americans, these CSR benefits extend to households earning up to 300% of the poverty level, and they eliminate cost-sharing, as opposed to just reducing it.

How much do cost-sharing reductions reduce out-of-pocket maximums in Silver plans?

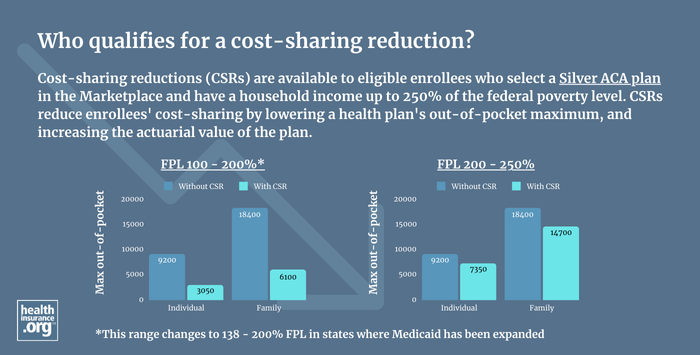

CSR reduces the maximum out-of-pocket exposure on a Silver plan for households with eligible incomes.

For 2025 coverage, the unsubsidized maximum allowable out-of-pocket limit for an individual is $9,200, or $18,400 for a family2 (this will increase to $10,150 and $20,300, respectively, in 2026).3

But as long as they select Silver plans, enrollees who are eligible for cost-sharing subsidies are automatically given lower out-of-pocket limits.

2025 CSR maximum out-of-pocket limits

For people who are eligible for CSR, Silver plans have maximum out-of-pocket limits no higher than the following amounts in 2025:2

- For applicants with MAGI between 100% and 200% of FPL, the 2025 maximum out-of-pocket on a Silver plan is $3,050 for a single individual and $6,100 for a family. (This amounts to a two-thirds reduction from the regular out-of-pocket maximum.)

- For applicants with MAGI between 200% and 250% of the poverty level, the 2025 maximum out-of-pocket for Silver plans is $7,350 for a single individual and $14,700 for a family. (This amounts to a 20% reduction from the regular out-of-pocket cap.)

2026 CSR maximum out-of-pocket limits

For people who are eligible for CSR, Silver plans have maximum out-of-pocket limits no higher than the following amounts in 2026:4

- For applicants with MAGI between 100% and 200% of FPL, the 2026 maximum out-of-pocket on a Silver plan is $3,350 for a single individual and $6,700 for a family.(A two-thirds reduction from the regular out-of-pocket maximum.)

- For applicants with MAGI between 200% and 250% of the poverty level, the 2026 maximum out-of-pocket for Silver plans is $8,100 for a single individual and $16,200 for a family. (A 20% reduction from the regular out-of-pocket cap.)

- These limits will increase if the Trump administration finalizes its proposed rule changes for 2026. One of those proposals is to increase overall maximum out-of-pocket costs, which would also increase out-of-pocket costs for CSR plans.

How much do CSRs increase the benefits offered by a Silver plan?

CSR also increases the actuarial value (AV) of the plan. Actuarial value is used to measure the percentage of total medical costs that a plan will cover for an average population; the percentage that it covers for a specific individual will vary tremendously depending on how much health care the person needs during the year.

The unsubsidized AV of a Silver plan is roughly 70% (there’s a de minimus range that allows actual AV to vary a bit above that level, with a range of 70% to 72%; the range used to also extend below 70%, but that ended as of 2023 for individual/family plans).5

This means that across a standard population, the insureds pay roughly 30% of total medical bills, and the insurance company pays roughly 70% (again, this will vary significantly from one person to another, depending on the person's specific claims during the year).

For eligible enrollees, cost-sharing subsidies increase the AV of a Silver plan to between 73% and 94%, depending on the enrollee’s income. For enrollees with household income from:

- 100% to 150% of FPL, AV is increased to 94% (better than a Platinum plan)

- 150% to 200% of FPL, AV is increased to 87% (nearly as good as a Platinum plan)

- 200% to 250% of FPL, AV is increased to 73% (better than the normal 70% for a regular Silver plan)

In addition, as noted above, Native Americans with income under 300% of FPL are eligible for plans with zero cost-sharing.

How do cost-sharing reductions work?

As an example, an enrollee with an income of 146% of FPL (about $22,000 for a single person in the continental U.S. in 2025) would be eligible to enroll in a Silver plan that’s more robust than a Platinum plan.

For this person, CSR benefits would reduce the maximum allowable out-of-pocket exposure in 2025 by about 67% (from the regular 2025 maximum out-of-pocket of $9,200 to the adjusted maximum out-of-pocket of $3,050 – keeping in mind that plans can offer out-of-pocket limits that are lower than those amounts).

The increase in AV – from about 70% to 94% – is achieved by reducing the copays, deductible, and coinsurance that the enrollee has to pay, so that the insurance company covers more of the claims.

But again, this does not mean that the insurance company will cover 94% of a specific enrollee’s medical costs. The actual percentage they cover will vary significantly for each policyholder, since a person with substantial medical bills will end up having the vast majority of her bills covered by the insurance plan (it will pay 100% of covered costs once she reaches her out-of-pocket maximum), whereas a person who needs very little care during the year would end up paying a larger percentage of her costs, since she wouldn’t have met her out-of-pocket maximum.

What is 'Silver loading?'

The federal government used to directly reimburse health insurance companies for the cost of cost-sharing reductions. That ended in the fall of 2017, but cost-sharing subsidies have continued to be available to eligible enrollees.

To cover the cost, most insurers simply add the cost of CSR to on-exchange Silver plan premiums. This approach, known as “Silver loading,” results in larger premium subsidies for everyone in the area, as premium subsidy amounts are based on the cost of the second-lowest-priced Silver plan in each area. But it can also mean that for a person who isn't eligible for CSR, a non-Silver plan might present a better overall value, since the cost of CSR isn't added to non-Silver plan premiums in most areas.

If I'm eligible for CSR, is a Silver plan always the best choice?

There's no right or wrong answer here. CSR benefits vary depending on income — a person earning 240% of the poverty level and a person earning 140% of the poverty level are both CSR-eligible, but they'll receive very different benefits. If your income is in the range where the plan's AV will only be increased to 73%, it might end up being prudent to enroll in a lower-cost Bronze plan, saving money on premiums (possibly getting a plan for free) in trade for somewhat higher out-of-pocket costs.

Depending on income and location, it's also possible that you might be eligible for a Gold plan that has a very low premium or even no premium at all. That's something you'd have to closely compare with the available Silver plans and their built-in CSR benefits, making sure to account for the difference in premiums when you do your comparison.

But if your income is on the lower end and you're eligible for strong CSR benefits (meaning your income is under 200% of the poverty level), you'll want to strongly consider the Silver plans that are available to you, even if there are free Bronze plans available too.

And note that if your income is under 150% of the poverty level, you'll also be eligible for premium-free Silver plans in most states, with built-in CSR benefits. This will continue at least through the end of 2025,6 and possibly indefinitely, depending on whether Congress chooses to further extend the subsidy enhancements that have been in place since 2021.

Pay attention to the amount you'll have to pay in out-of-pocket costs if you end up needing medical care during the year: It's going to be a lot higher on the Bronze plan, which could quickly obliterate any savings you had from the lower monthly premiums.

Did the American Rescue Plan or Inflation Reduction Act change anything about cost-sharing reductions?

Cost-sharing reductions themselves were not changed by the American Rescue Plan (ARP) or the Inflation Reduction Act. However, the ARP did boost premium subsidies, thus making it easier for people to afford Silver-level plans. The Inflation Reduction Act extended those premium subsidy enhancements through 2025, ensuring that more people continue to be able to afford Silver-level plans.

For 2021 through 2025 (and possibly future years, if Congress extends the ARP's subsidy enhancements again), premium subsidies have been increased to ensure that a household earning up to 150% of the poverty level can enroll in either of the two lowest-cost Silver plans with no premium at all. This ensures that people with the lowest incomes can afford Silver plans, rather than having to settle for a Bronze plan (which doesn't have CSR benefits).

Also through the end of 2025, households earning up to 200% of the poverty level pay no more than 2% of income for the benchmark plan, and households earning up to 250% of the poverty level pay no more than 4% of income for the benchmark plan. These percentages are lower than they were pre-ARP, making it easier for anyone eligible for CSR to afford a Silver plan.

Footnotes

- "Effectuated Enrollment: Early 2024 Snapshot and Full Year 2023 Average" CMS.gov, July 2, 2024 ⤶

- Premium Adjustment Percentage, Maximum Annual Limitation on Cost Sharing, Reduced Maximum Annual Limitation on Cost Sharing, and Required Contribution Percentage for the 2025 Benefit Year. Centers for Medicare and Medicaid Services. Nov. 15, 2023 ⤶ ⤶

- Premium Adjustment Percentage, Maximum Annual Limitation on Cost Sharing, Reduced Maximum Annual Limitation on Cost Sharing, and Required Contribution Percentage for the 2026 Benefit Year. Centers for Medicare and Medicaid Services. Oct. 8, 2024 ⤶

- Premium Adjustment Percentage, Maximum Annual Limitation on Cost Sharing, Reduced Maximum Annual Limitation on Cost Sharing, and Required Contribution Percentage for the 2026 Benefit Year. Centers for Medicare and Medicaid Services. Oct. 8, 2024 ⤶

- Patient Protection and Affordable Care Act; HHS Notice of Benefit and Payment Parameters for 2023. U.S. Department of Health and Human Services. May 2022. ⤶

- Patient Protection and Affordable Care Act, HHS Notice of Benefit and Payment Parameters for 2025; Updating Section 1332 Waiver Public Notice Procedures; Medicaid; Consumer Operated and Oriented Plan (CO-OP) Program; and Basic Health Program. U.S. Treasury Department and U.S. Centers for Medicare and Medicaid Services. November 2023. ⤶