What is a private exchange?

A private exchange is simply an online resource set up by brokers, insurance carriers, or benefit consultants, where individuals and employers can shop for health insurance, enroll in a plan, and receive customer support as needed. When you visit a health insurance comparison site (that isn't the ACA-created Marketplace in your state) and submit an application, you’re using a private exchange. These are not new, and they’re not part of the Affordable Care Act.

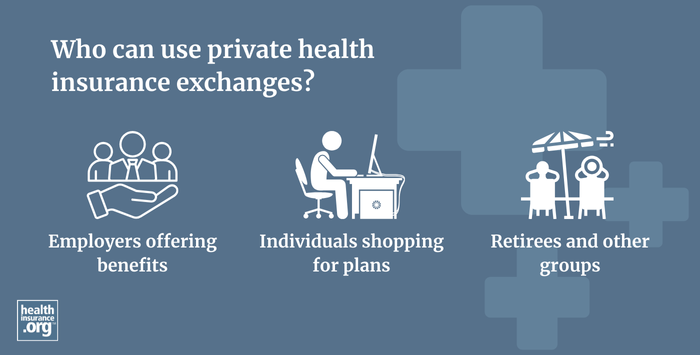

Private exchanges can be used in the individual or group markets. The public exchanges/Marketplaces established by the ACA provide options for individuals — and in some states, small groups. In addition, various Enhanced Direct Enrollment (EDE) entities operate private exchanges that can be used to enroll directly in Marketplace (public exchange) coverage. In addition, brokers and web brokers who operate their own private plan comparison site (ie, a private exchange) can assist consumers who are enrolling in coverage through the Marketplace — either directly or via an EDE.

There is no public exchange for large groups, but private exchanges can be used by brokers and insurance carriers to help large employers find plans that best meet their needs and also conform to ACA regulations.