With the U.S. Supreme Court decision in June that legalized same-sex marriage nationwide, the LGBTQ community has plenty to celebrate. Marriage equality is a major victory in itself, but it’s also another step in the ongoing pursuit of equal access to health insurance for the LGBTQ community.

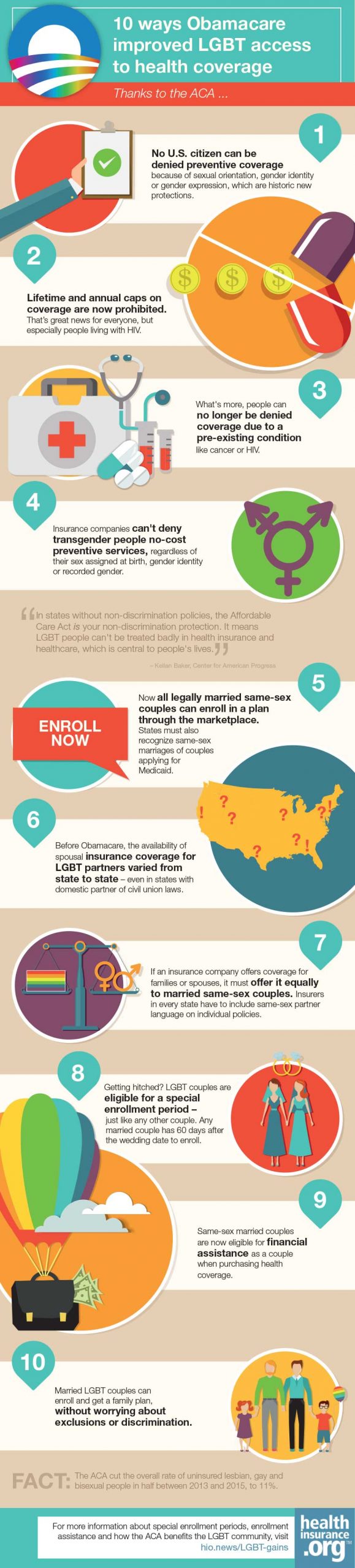

Before the Affordable Care Act (ACA), the availability of insurance coverage for LGBTQ people was a state-by-state patchwork, says Katie Keith, a steering committee member at Out2Enroll, a national initiative to connect LGBTQ people with health insurance options under the ACA.

“Even in states with domestic partner or civil union laws, not every insurer was offering that coverage — although some employers were willing to accommodate requests for coverage for a same-sex partner,” she explains. “It was definitely not the norm on the individual and small-group market unless people asked for it, especially in states without marriage equality.”

Recognition, even before marriage equality

Another major step toward health insurance equality came with the U.S. Supreme Court ruling in 2013 that struck down the Defense of Marriage Act (DOMA). At that point, all federal agencies took steps to implement marriage equality when it came to benefits at the federal level.

“The ‘place of celebration’ standard stated that if you got married in a state that recognized your marriage, you were married for the purposes of federal law,” Keith says. “So from the beginning, we said ‘Obamacare recognizes your relationship.’”

“The ‘place of celebration’ standard stated that if you got married in a state that recognized your marriage, you were married for the purposes of federal law,” Keith says. “So from the beginning, we said ‘Obamacare recognizes your relationship.’”

In other words, if a couple files their federal income taxes jointly, they could apply for individual insurance coverage and any tax credits they may be eligible for as a couple, too. That was true even before marriage equality became the law of the land in June (married spouses can enroll in separate health insurance, but must file a joint tax return in order to qualify for premium tax credits; this is true for both same-sex and opposite-sex couples).

Initial hurdles from carriers

There were still some hurdles, given that applications through HealthCare.gov and state marketplaces recognized same-sex couples, but not all insurance companies would. Again, this was especially common in states without non-discrimination policies.

But at the urging of a variety of advocates, in March 2014 the U.S. Department of Health and Human Services (HHS) issued guidance saying that denying same-sex couples insurance coverage violated the guaranteed issue provision.

“What that means is that if an insurance company offers coverage for families or spouses, they must offer it equally to same-sex couples,” Keith says. She points out that if insurers don’t offer family or spousal benefits, they don’t have to offer it to same-sex couples, either.

Effective January 2015, all states were required to enforce the HHS guidance requiring plans offered on the individual market to cover same-sex couples if they also cover heterosexual couples.

Get hitched, get covered without a hitch

Following the marriage equality ruling in June, there was even greater clarity in the individual market. Although insurers already had to offer the same coverage options to all married couples, states could still approve paperwork and forms that didn’t include same-sex partners. That’s no longer the case.

What’s more, for couples applying for Medicaid, every state must recognize their marriage regardless of where they got married. Some states don’t consider marriage status when it comes to Medicaid eligibility anyway, but those that do must now recognize same-sex couples, even if they had carved out exclusions in the past.

And LGBTQ couples who get married are eligible for the same special enrollment period any other couple is under the ACA. That means there’s no need to wait until the next open enrollment period begins in November to get covered as a couple.

Getting married is considered a “qualifying life event” under the ACA. So newly married couples qualify for a special enrollment period that lets them sign up for a new health plan or make changes to the plan they enrolled in during the last open enrollment period. Any married couple has 60 days after the wedding date to enroll (EDIT: As of 2017, this special enrollment period is available only as long as at least one spouse already had minimum essential coverage within the 60 days prior to the wedding; this requirement applies to both same-sex and opposite-sex couples).

Same-sex couples are also eligible for the same financial assistance as anyone else, thanks yet again to the U.S. Supreme Court, which upheld (in a 2015 ruling) the tax subsidies available under the ACA to help make insurance more affordable.

Best of all, no one can be denied insurance or preventive coverage because of sexual orientation, gender identity or gender expression. Although there’s still some work to do to prevent discrimination against transgender people, the gains made in providing equal coverage to LGBT people in recent years are well worth celebrating.

“We’ve made great progress in non-discrimination protections in healthcare,” Keith says. “And now married LGBT couples can enroll and get a family plan, without worrying about exclusions or discrimination.”

For more information about special enrollment periods, enrollment assistance and how the ACA benefits the LGBT community, visit Out2Enroll.