Home > States > Health insurance in District of Columbia

See your Washington, DC health insurance coverage options.

Find individual and family plans, small-group, short-term or Medicare plans through licensed agency partners.

Washington, DC Health Insurance Consumer Guide

This guide to health insurance in Washington, DC, including the FAQs below, will help you understand the coverage options available to you and your family, and whether you might be eligible for financial assistance with your health coverage. Having health coverage is especially important in DC, as the District requires residents to maintain health coverage (unless they qualify for an exemption) or pay a penalty on their tax return.1

(Revenue from the penalty is used to fund DC’s Individual Insurance Market Affordability and Stability Fund, used for outreach and education related to health coverage.2)

The District of Columbia runs its own health insurance exchange – DC Health Link. DC residents and business owners can use DC Health Link to shop for individual/family and small-group health plans offered by various private health insurance carriers.

DC Health Link’s individual and family plans are used by people who aren’t eligible for Medicare, Medicaid, or an affordable employer-sponsored health plan. The small-group health plans are used by businesses with up to 50 employees, as well as by members of Congress and their staff.3

Individual/family and small-group health insurance can only be obtained via the exchange (DC Health Link) in Washington, DC.4 In the rest of the country, off-exchange policies are available – albeit without any subsidies. But that’s not the case in DC.

Washington, DC’s exchange is also unique in terms of having more small-group enrollees than individual enrollees.5 In the rest of the country, small-group plans are either not available through the exchange, or account for a minority of total exchange enrollment.

Explore our comprehensive guides to coverage in Washington, DC

Dental coverage in Washington, DC

Want to improve your smile and save money when you visit the dentist? Dental insurance might be a good addition to your medical coverage. Our guide will help you understand your dental coverage options in the District of Columbia.

DC’s Medicaid program

DC Medicaid is the District’s Medicaid program, which provides health coverage for low-income residents. Compared with the rest of the country, DC Medicaid has more generous eligibility rules for Medicaid expansion, allowing adults under 65 to enroll in Medicaid with income up to 215% of the poverty level, as opposed to 138% in other states.6 This results in fewer people being enrolled in individual market plans through DC Health Link, as they’re eligible for Medicaid instead.

Medicare enrollment in Washington, DC

Nearly 95,000 DC residents had Medicare coverage as of 2023.7 Our Washington, DC Medicare guide explains the various parts of Medicare, coverage options for Medicare Advantage and Part D, and the District’s rules regarding Medigap (Medicare Supplement) availability.

Short-term health insurance coverage in Washington, DC

There are no insurers that offer short-term health insurance in Washington, DC. The District enacted legislation that limits short-term plans to three months, prohibits renewals, and prevents short-term health insurance from excluding pre-existing conditions or basing eligibility on medical history. This essentially made short-term health insurance a non-starter in DC, and the plans are no longer available for purchase.

Frequently asked questions about health insurance in Washington, DC

Who can buy Marketplace health insurance in Washington, DC?

To be eligible to enroll in private individual/family health coverage through DC Health Link, you must:8

- Be lawfully present in the United States, and reside in Washington, DC

- Not be incarcerated

- Not be enrolled in Medicare9

So most DC residents can enroll in a health plan through the exchange. But eligibility for financial assistance involves some additional parameters. To qualify for income-based federal Advance Premium Tax Credits (APTC) or cost-sharing reductions (CSR), you must:

- Not be eligible to enroll in an affordable plan offered by an employer. If you have access to an employer’s plan and are wondering whether it’s considered affordable, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies via DC Health Link.

- Not be eligible for DC Medicaid.

- Not be eligible for premium-free Medicare Part A.9

- If married, file a joint tax return with your spouse.10 (with very limited exceptions)11

- Not be able to be claimed by someone else as a tax dependent.10

In addition to those basic parameters, DC Health Link premium subsidy eligibility will depend on your household’s income.

When can I enroll in an ACA-compliant plan in Washington, DC?

In Washington, DC, the open enrollment period begins November 1 and continues through January 31,12 which is a couple weeks longer than the enrollment window in most states.

After the open enrollment period ends, you may still be able to enroll or make a plan change if you experience a qualifying life event, such as giving birth or losing other health coverage.

DC Health Link is one of just seven state-run exchanges where pregnancy is considered a qualifying life event, making it easier for someone who is pregnant to obtain health coverage.

Some people can enroll year-round even without a specific qualifying life event. And enrollment in DC Medicaid is available year-round. (You can enroll at districtdirect.dc.gov.)

How do I enroll in a Marketplace plan in Washington, DC?

To enroll in an ACA Marketplace/exchange plan in the District of Columbia, you can:

- Visit DC Health Link – the District’s exchange – to compare the health plans that are available in your area, determine whether you’re eligible for financial assistance, and enroll in coverage during open enrollment or during a special enrollment period.

- Enroll in a DC Health Link plan with the help of an insurance agent or broker, Navigator, or a certified enrollment assister.

How can I find affordable health insurance in Washington, DC?

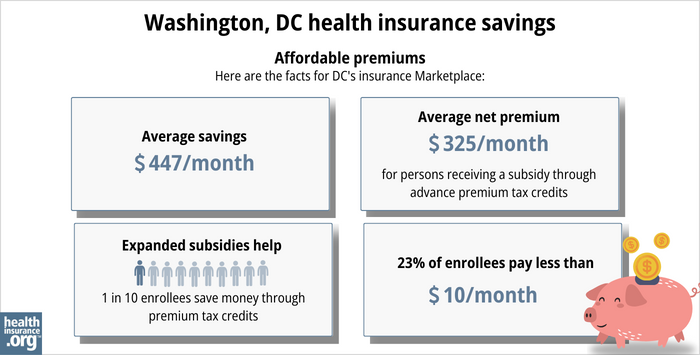

When you enroll in coverage through DC Health Link, you may find that you’re eligible for subsidies that can cover some of your monthly premiums and possibly also reduce your out-of-pocket costs for medical care.

These subsidies are not as common in DC as they are in other states, simply because Medicaid eligibility extends to higher income levels in DC, meaning that many people qualify for Medicaid instead of premium subsidies for private plans. (For adults under age 65, the eligibility limit for Medicaid in DC is 215% of the poverty level, as opposed to 138% in most states.13)

In addition, the fact that there is no “off-exchange” enrollment option in DC also helps to reduce the percentage of subsidy-eligible exchange enrollees. (In other states, people who know they aren’t eligible for subsidies might opt for off-exchange coverage, whereas that’s not possible in DC.)

So only 19% of DC Health Link enrollees were receiving federal premium subsidies as of 2023, versus 91% of Marketplace enrollees nationwide.14

Premium subsidy eligibility will depend on how your household income compares with the cost of the second-lowest-cost Silver plan in your area, which will depend on your age. (In most states, it also depends on your location, but DC is one rating area so there are not location-specific rate differences within the District.15)

Applicants with household income up to 250% of the federal poverty level are also eligible for federal cost-sharing reductions (CSR), which will reduce the deductible and other out-of-pocket expenses for Silver-level plans. But only 3% of DC Health Link enrollees were receiving these subsidies as of 2023, versus 48% of Marketplace enrollees nationwide.14 Again, this is due in large part to the fact that people with income between 139% and 215% of the poverty level are eligible for Medicaid in DC, whereas they’re eligible for premium subsidies and CSR in other states.

The plans available through DC Health Link include both standardized and non-standardized plans. All of the plans are compliant with the ACA, but standardized plans also conform to additional District-specific rules that include pre-deductible coverage for a variety of services.16 Starting in 2024, outpatient mental health visits for children with standardized DC Health Link plans will have just a $5 copay, with no deductible.17

Learn more about whether you might be eligible for Medicaid in Washington DC.

How many insurers offer Marketplace coverage in Washington, DC?

DC Health Link offers individual/family health insurance from two insurers, although one of them (CareFirst) has both HMO and PPO entities offering plans, while the other (Kaiser) only offers HMO plans.18

Are Marketplace health insurance premiums increasing in Washington, DC?

The following average rate changes were approved for 2024 for the carriers that offer individual/family coverage through DC Health Link, amounting to an overall average rate increase of 7.8%:19

Washington, DC’s ACA Marketplace Plan 2024 Approved Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Group Hospitalization and Medical Services (CareFirst PPO) | 5.4% |

| CareFirst Blue Choice (CareFirst HMO) | 10% |

| Kaiser of the Mid-Atlantic States | 12% |

Source: DC Department of Insurance, Securities, and Banking19

Average rate changes apply to full-price premiums, and most DC Health Link enrollees do pay full price (as opposed to most other states, where the large majority of Marketplace enrollees receive subsidies and thus do not pay full price).20

But for those who qualify for premium subsidies, the net rate change from one year to the next will depend on how much the subsidy amount changes, as well as how much their own plan’s rate changes.

For perspective, here’s a summary of how average full-price premiums have changed in DC’s individual/family health insurance market over the years:

- 2015: Average increase of 11%.21

- 2016: Average increase of 4.3%.22

- 2017: Average increase of 7.3%.23

- 2018: Average increase of 15.6%.24 (negligible CSR cost; not added to rates)

- 2019: Average increase of 13%.25

- 2020: Average increase of 7.6%.26

- 2021: Average increase of 0.2%.27

- 2022: Average increase of 5%.28

- 2023: Average increase of 13.6%.29

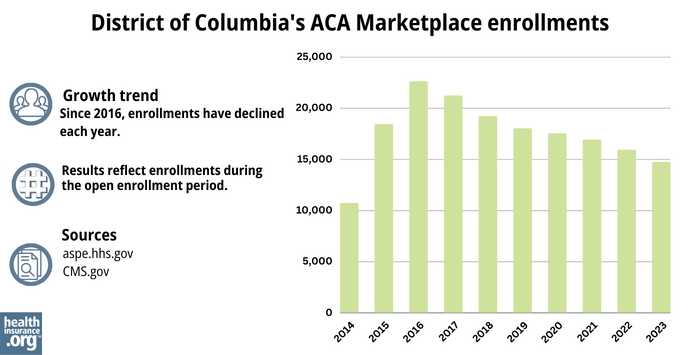

How many people are insured through DC’s Marketplace?

For 2024 coverage, 14,301 people had enrolled in individual/family health plans through DC Health Link by January 13, 2024.30 There were still more than two weeks remaining in the open enrollment period at that point.

During the open enrollment period for 2023 coverage, 14,768 people enrolled in private individual/family plans through DC Health Link.31

Source: 2014,32 2015,33 2016,34 2017,35 2018,36 2019,37 2020,38 2021,39 2022,40 202314

The chart above shows historical enrollment in individual/family coverage through DC Health Link. Nationwide, enrollment in individual/family Marketplace plans has been steadily increasing since 2021,41 but that has not been the case in DC.

In contrast to the rest of the U.S., the majority of DC Health Link’s enrollees have small group coverage. As of January 2024, DC Health Link’s enrollment included more than 14,000 people with individual/family coverage, and nearly 87,000 people with small-group coverage.42

What health insurance resources are available to DC residents?

DC Health Link

The District’s health insurance exchange (Marketplace) for small businesses, individuals, and families.

DC Department of Health Care Finance

Administers DC’s Medicaid program and various other social services programs in the state.

District of Columbia Department of Insurance, Securities & Banking

Licenses and regulates health insurance companies, brokers, and agents in the District. Provides assistance and information to consumers who have questions or complaints about regulated entities.

DC Department of Aging and Community Living

A resource for DC Medicare beneficiaries and their caregivers.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- Do You Know Your Health Insurance Rights? DC Department of Insurance Securities and Banking. Accessed December 2023. ⤶

- ”Fiscal Year 2019 Budget” Council of the District of Columbia. Accessed February 2024. ⤶

- “What are SHOP and DC Health Link?” Health Questions and Answers, U.S. Office of Personnel Management ⤶

- “Frequently Asked Questions” DC Health Benefit Exchange Authority ⤶

- “DC Health Benefit Exchange Authority Enrollment Summary” DC.gov, January 4, 2024. ⤶

- “Medicaid, Children's Health Insurance Program, & Basic Health Program Eligibility Levels” Medicaid.gov, 2022 ⤶

- "Medicare Monthly Enrollment" CMS.gov, April 2023 ⤶

- ”A quick guide to the Health Insurance Marketplace” HealthCare.gov ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶ ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed MONTH. ⤶ ⤶

- Updates to frequently asked questions about the Premium Tax Credit. Internal Revenue Service. February 2024. ⤶

- “Health Benefit Exchange Authority Executive Board Meeting Minutes” DC Health Benefit Exchange Authority, May 2019 ⤶

- “Uninsured DC Residents Can Apply for Free Health Insurance” DC.gov, Accessed September 2023 ⤶

- “2023 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 2023 ⤶ ⤶ ⤶

- “Market Rating Reforms State Specific Geographic Rating Areas” CMS.gov, Accessed September 2023 ⤶

- DC HBS Standard Plans 2024. DC Health Benefit Exchange Authority. April 2023. ⤶

- DC Health Benefit Exchange Authority Makes it Easier for Children to Access Mental and Behavioral Health Services. DC Health Benefit Exchange Authority. November 2022. ⤶

- DC Announces 2024 Health Insurance Rates; District Review Nets Almost $3 Million in Savings as 50% of Insurers Decreased Rates. DC Department of Insurance Securities and Banking. October 2023 ⤶

- DC Announces 2024 Health Insurance Rates; District Review Nets Almost $3 Million in Savings as 50% of Insurers Decreased Rates. DC Department of Insurance Securities and Banking. October 2023 ⤶ ⤶

- “Effectuated enrollment: Early 2023 snapshot and full-year 2022 average.” CMS.gov, March 31, 2023 ⤶

- Analysis Finds No Nationwide Increase in Health Insurance Marketplace Premiums. The Commonwealth Fund. December 2014. ⤶

- FINAL PROJECTION: 2016 Weighted Avg. Rate Increases: 12-13% Nationally* ACA Signups. October 2015. ⤶

- Avg. UNSUBSIDIZED Indy Mkt Rate Hikes: 25% (49 States + DC). ACA Signups. October 2016. ⤶

- DISB Approves Rates for 2018 Health Plan Offerings on DC Health Link. Capitol Hill Chamber of Commerce. Accessed December 2023. ⤶

- Information About Approved Rates for January 2019 Health Plan Offerings on DC Health Link. DC Department of Insurance Securities and Banking. Accessed December 2023. ⤶

- Information About Approved Rates for January 2020 Health Plan Offerings on DC Health Link. DC Department of Insurance Securities and Banking. Accessed December 2023. ⤶

- Information About Approved Rates for January 2021 Health Plan Offerings on DC Health Link. DC Department of Insurance Securities and Banking. Accessed December 2023. ⤶

- Information About Approved Rates for January 2022 Health Plan Offerings on DC Health Link. DC Department of Insurance Securities and Banking. Accessed December 2023. ⤶

- Information About Approved Rates for January 2023 Health Plan Offerings on DC Health Link. DC Department of Insurance Securities and Banking. Accessed December 2023. ⤶

- ”Marketplace 2024 Open Enrollment Period Report: Final National Snapshot” Centers for Medicare & Medicaid Services. January 2024. ⤶

- ”2023 Marketplace Open Enrollment Period Public Use Files” Centers for Medicare & Medicaid Services. March 2023. ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- ”Record ACA Marketplace Signups for 2024 Are Driven in Part by Medicaid Unwinding and More Affordable Coverage” KFF. January 11, 2024. ⤶

- “DC Health Benefit Exchange Authority Enrollment Summary” DC.gov, January 4, 2024. ⤶