Home > States > Health insurance in Idaho

See your Idaho health insurance coverage options.

Find individual and family plans, small-group, short-term or Medicare plans through licensed agency partners.

Idaho Health Insurance Consumer Guide

This Idaho health insurance guide is designed to help you understand the health coverage options and possible financial assistance available to you and your family in Idaho.

Idaho created its own state-run health insurance exchange (Marketplace), which is called Your Health Idaho. This is Idaho’s platform where residents can shop for individual and family health plans offered by eight private health insurance carriers1 (coverage areas vary from one insurer to another).

When you enroll in a plan through Your Health Idaho, you may find that you’re eligible for financial assistance that reduces the monthly cost of your coverage (premium subsidies), and possibly also your out-of-pocket expenses (cost-sharing reductions, or CSR). These are federal subsidy programs created by the Affordable Care Act, and eligibility depends on your income and circumstances.

Your Health Idaho applicants who appear to be eligible for Medicaid will be referred to Idaho Medicaid where they can complete an application for coverage.

Explore our other comprehensive guides to coverage in Idaho

Dental coverage in Idaho

Want to improve your smile and save some money when you go to the dentist? Dental insurance might be a good idea, in addition to your medical coverage. Our guide explains dental coverage options in Idaho.

Idaho’s Medicaid program

Voters in Idaho approved a Medicaid expansion ballot measure in 2018, which resulted in Medicaid expansion taking effect in the state in 2020. More than 430,000 Idaho residents were covered by Medicaid and CHIP as of early 2023.2

Medicare coverage and enrollment in Idaho

As of 2023, more than 377,000 Idaho residents were enrolled in Medicare.3 Our guide to Medicare in Idaho explains the various parts of Medicare, Medicare Advantage and Part D options in Idaho, and Idaho regulations regarding Medigap (Medicare Supplement) availability.

Short-term health coverage in Idaho

There are two types of short-term plans in Idaho – enhanced and traditional.4 They each have different rules and regulations they must follow. There are two insurers that offer enhanced short-term plans in Idaho, and at least four that offer traditional plans.5

Frequently asked questions about health insurance in Idaho

Who can buy Marketplace health insurance in Idaho?

In order to sign up for private health coverage through Your Health Idaho, you must:6

- Be an Idaho resident and lawfully present in the United States

- Not be incarcerated

- Not be enrolled in Medicare7

So most Idaho residents are eligible to enroll in coverage through the exchange. But eligibility for financial assistance is a bigger question for most people, and there are a few additional eligibility rules to qualify for subsidies through Your Health Idaho.

To qualify for income-based Advance Premium Tax Credits (APTC) or cost-sharing reductions (CSR), you must:

- Not be eligible to enroll in an affordable employer-sponsored health plan. If you have access to an employer’s health plan and aren’t sure if it’s considered affordable, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies to offset the cost of a Your Health Idaho plan.

- Not be eligible for Idaho Medicaid or CHIP.

- Not be eligible for premium-free Medicare Part A.8

Beyond those basic parameters, qualifying for Your Health Idaho’s subsidies will depend on your household’s income. Here’s how that’s calculated under the ACA.

When can I enroll in an ACA-compliant plan in Idaho?

Your Health Idaho’s open enrollment period is shorter than any other state’s enrollment window, and both its start and end dates are unique.

In Idaho, open enrollment begins October 15 and ends December 15.9 So enrollment starts about two weeks earlier than it does in other states, but ends a month earlier. Idaho is the only state where open enrollment ends in December.

All enrollments submitted during open enrollment in Idaho will have January 1 coverage effective dates.

(CMS has proposed a rule change that would require all state-run exchanges to have open enrollment periods that extend until at least January 15, for 2025 and future years. Idaho is the only state this would affect if the rule is finalized, as all of the other state-run exchanges already have enrollment deadlines of January 15 or later.)10

After open enrollment ends, you may still be eligible to enroll or make a plan change, but only if you qualify for a special enrollment period. After December 15, 2023, a special enrollment period is necessary in order to enroll or make a plan change for 2024.

Most special enrollment periods are triggered by qualifying life events, such as giving birth or losing other health coverage. However, some people can qualify for a special enrollment period without a specific qualifying life event.11

Enrollment in Idaho Medicaid and CHIP is available year-round for eligible residents.

How do I enroll in an Idaho Marketplace plan?

To enroll in an ACA Marketplace/exchange plan in Idaho, you can:

- Visit Your Health Idaho, which is Idaho’s health insurance exchange (Marketplace). The Your Health Idaho website will allow you to compare available health plans, determine whether you’re eligible for financial assistance, and enroll in a health plan.

- Enroll in a Your Health Idaho plan with the help of an insurance broker or certified enrollment counselor.

You can reach Your Health Idaho’s call center at 855-944-3246.

How can I find affordable health insurance in Idaho?

Income-based subsidies (APTC, created by the Affordable Care Act) are available to lower the amount you pay for your health coverage each month. These subsidies are available to enrollees who meet the eligibility requirements and select a metal-level health plan through Your Health Idaho.

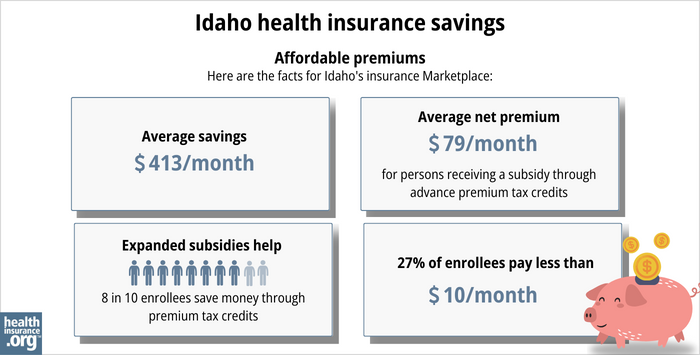

Eighty-five percent of the people who selected a plan through Your Health Idaho during the 2023 open enrollment were eligible for premium subsidies. These subsidies paid an average of $487/month, reducing the average enrollee’s premium to about $96/month.12

Although most Your Health Idaho enrollees qualify for premium subsidies, the state’s reinsurance program helps to keep full-price premiums lower than they would otherwise be, making coverage more affordable for people who have to pay full price.13

If your household doesn’t earn more than 250% of the federal poverty level, you’ll also be eligible for federal cost-sharing reductions (CSR) as long as you select a Silver-level plan through Your Health Idaho. These subsidies will reduce your deductible and other out-of-pocket expenses, making health care more affordable. Twenty-seven percent of Your Health Idaho enrollees were receiving CSR benefits as of early 2023.14

If you’re eligible for APTC and CSR, you can use them both if you enroll in a Silver-level plan through Your Health Idaho (APTC can be used with any metal-level plan, but you can only get CSR benefits if you enroll in a Silver plan).

Depending on your income and circumstances, you may be able to enroll in free or low cost health coverage through Idaho Medicaid or CHIP. Learn more about whether you might be eligible for these programs in Idaho.

Idaho also has some unique “enhanced” short-term health plans available, which follow various state rules and provide more substantial coverage than traditional short-term health plans.15 These can potentially be a good option for a person who isn’t eligible for Marketplace subsidies, depending on the circumstances (subsidies cannot be used with any type of short-term plan).

Source: CMS.gov16

How many insurers offer Marketplace coverage in Idaho?

For 2024 coverage, eight insurers offer exchange plans in Idaho, with varying coverage areas.17

The same eight insurers offered coverage for 2023, but there have been some additions in recent years: Molina joined the Idaho marketplace in 2022. And for 2023, St. Luke’s Health Plan and Moda Health joined.18 19

Are Marketplace health insurance premiums increasing in Idaho?

For 2024, overall average pre-subsidy premiums decreased by about 1% in Idaho’s individual/family market20 (the third consecutive year of decreasing premiums in Idaho). Nationwide, most states saw overall premiums rise for 2024, but Idaho’s reinsurance program, which took effect in 2023,21 is keeping premiums lower than they would otherwise be.

The following average rate changes were approved for 2024:1

Idaho’s ACA Marketplace Plan 2024 Approved Rate Changes by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Blue Cross of Idaho Health Service, Inc. | 0% |

| Molina Healthcare of Utah | 0% |

| Mountain Health CO-OP (an ACA-created CO-OP): | -2% |

| PacificSource Health Plans | -13% |

| Regence Blue Shield of Idaho | -3% |

| SelectHealth | 0% |

| St. Luke’s Health Plan | -3% |

| Moda Health | 1% |

Source: Idaho Department of Insurance1

Average rate changes apply to full-price rates, and most enrollees do not pay full price: Eighty-six percent of Your Health Idaho enrollees were receiving premium subsidies in 2023, offsetting some or all of their monthly premium cost.14

Subsidy amounts vary from one enrollee to another and change annually depending on the cost of the second-lowest-cost Silver plan relative to the enrollee’s household income. The American Rescue Plan and the Inflation Reduction Act have resulted in larger, more widely available subsidies, and will continue to be true at least through 2025.

Here’s an overview of how average pre-subsidy premiums have changed over the years in Idaho’s individual/family market:

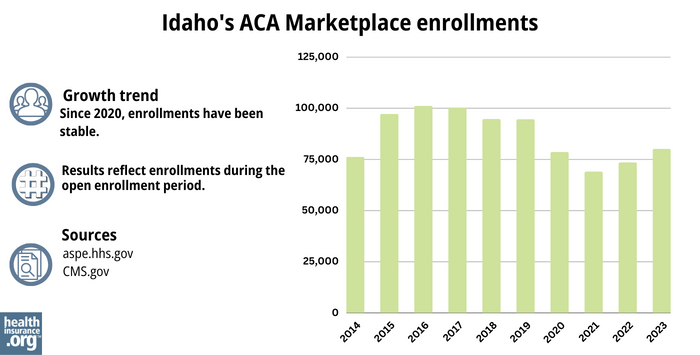

How many people are insured through Idaho’s Marketplace?

During the open enrollment period for 2023 coverage, nearly 80,000 people selected private plans through Your Health Idaho.30

As of early 2023, effectuated enrollment (always a little lower than the number of plan selections) stood at nearly 69,000 people.14

Source: 2014,31 2015,32 2016,33 2017,34 2018,35 2019,36 2020,37 2021,38 2022,39 202330

What health insurance resources are available to Idaho residents?

Your Health Idaho – This is the state-run exchange/Marketplace in Idaho, where you can compare plans, determine financial assistance eligibility, and select a health plan. You can reach Your Health Idaho at 855-YHIdaho (855-944-3246)

State Exchange Profile: Idaho – The Henry J. Kaiser Family Foundation overview of Idaho’s progress toward creating a state health insurance exchange.

Idaho Department of Insurance – Regulates the insurance industry in Idaho, and addresses consumers’ questions and complaints related to insurance.

(208) 334-4250 / toll-free (800) 721-3272.

Idaho Senior Health Insurance Benefits Advisors – A service for Idaho Medicare beneficiaries and their caregivers, providing information and assistance with questions related to Medicare eligibility, enrollment, and claims.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- Idaho Rate Review Individual, Summary for 2024 Coverage. Idaho Department of Insurance. Accessed December 2023. ⤶ ⤶ ⤶

- “May 2023 Medicaid & CHIP Enrollment Data Highlights” Medicaid.gov, Accessed August 2023 ⤶

- “Medicare Monthly Enrollment”b CMS.gov, April 2023 ⤶

- “Short-term Health Plan: Enhanced vs Traditional” Idaho.gov, Accessed August 2023 ⤶

- “Availability of short-term health insurance in Idaho” healthinsurance.org, Aug. 2, 2023 ⤶

- Frequently Asked Questions About Your Health Idaho. Your Health Idaho. Accessed December 2023. ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- “Your Health Idaho Policy Manual” yourhealthidaho.org, June 21, 2023 ⤶

- Patient Protection and Affordable Care Act, HHS Notice of Benefit and Payment Parameters for 2025; Updating Section 1332 Waiver Public Notice Procedures; Medicaid; Consumer Operated and Oriented Plan (CO-OP) Program; and Basic Health Program. Treasury Department and the Centers for Medicare and Medicaid Services. November 2023. ⤶

- “Who doesn’t need a special enrollment period?“ healthinsurance.org, Accessed August 2023 ⤶

- “2023 OEP State-Level Public Use File” CMS.gov, March 23, 2023 ⤶

- Reinsurance Innovation Waiver under Section 1332 of ACA. Idaho Department of Insurance. Accessed December 2023. ⤶

- “Effectuated Enrollment: Early 2023 Snapshot and Full Year 2022 Average”CMS.gov, March 15, 2023 ⤶ ⤶ ⤶

- Short-Term Health Plan. Idaho Department of Insurance. Accessed December 2023. ⤶

- “2023 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2023 ⤶

- Open Enrollment for 2024 health insurance is open through December 15, 2023. Idaho Department of Insurance. November 2023. ⤶

- “Part II Rate Increase Justification“ Idaho.gov, May 29, 2022 ⤶

- “Preliminary Rate Increase Justification for 2023“ Idaho.gov, Accessed August 2023 ⤶

- Idaho’s individual health insurance rates decrease for 2024. Idaho Department of Insurance. September 2023. ⤶

- “Idahoans to see 12-percent lower health insurance costs with approval of key “Leading Idaho” waiver” Idaho.gov, Aug. 17, 2022 ⤶

- FINAL PROJECTION: 2016 Weighted Avg. Rate Increases: 12-13% Nationally* ACA Signups. October 2015. ⤶

- Avg. UNSUBSIDIZED Indy Mkt Rate Hikes: 25% (49 States + DC). ACA Signups. October 2016. ⤶

- 2018 Rate Hikes. ACA Signups. October 2017. ⤶

- 2019 Rate Hikes. ACA Signups. October 2018. ⤶

- 2020 Rate Changes. ACA Signups. October 2019. ⤶

- Idaho Rate Review Individual, Summary for 2021 Coverage. Idaho Department of Insurance. Accessed December 2023. ⤶

- Idaho Rate Review Individual, Summary for 2022 Coverage. Idaho Department of Insurance. Accessed December 2023. ⤶

- “Idaho: Final Avg. Unsubsidized 2023 #ACA Rate Changes: -3.6% (Was -2.5%)” ACASignups.net, Oct. 12, 2022 ⤶

- “Health Insurance Marketplaces 2023 Open Enrollment Report” CMS.gov, 2023 ⤶ ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶