Home > States > Health insurance in Utah

See your Utah health insurance coverage options.

Find individual and family plans, small-group, short-term or Medicare plans through licensed agency partners.

Utah Health Insurance Consumer Guide

If you need health insurance in Utah, this guide, including the FAQs below, is for you. You may find that an Affordable Care Act (ACA) Marketplace plan – commonly referred to as an Obamacare plan or exchange – may be an affordable choice.

In Utah, the exchange or Marketplace is operated at the federal level, meaning individuals and families enroll in health plans through HealthCare.gov or authorized enhanced direct enrollment entities.1

The Marketplace serves individuals and families who are looking to purchase their own health insurance. This includes people who have retired early and are not yet eligible for Medicare, self-employed individuals, and employees of small businesses that do not provide health benefits. Enrolling in a plan on the exchange is the only way Utah residents can access financial assistance for their individual market plan coverage.

For the 2024 plan year, two new insurers joined Utah’s marketplace: Imperial Health Plan of the Southwest, Inc. and Aetna Health of Utah, Inc. And enrollment reached a significant new record high, with nearly 367,000 people selecting 2024 Marketplace plans during the open enrollment period.2

Explore our other comprehensive guides to coverage in Utah

Dental coverage in Utah

In 2023, eight insurers offer stand-alone individual/family dental coverage through the health insurance Marketplace in Utah.

Utah’s Medicaid program

In 2019, Utah extended Medicaid eligibility under the Affordable Care Act (ACA), allowing Utah residents with incomes up to the federal poverty level to qualify for Medicaid.3

Medicare coverage options and enrollment in Utah

In Utah, 444,583 people have Medicare as of 2023.4 Our guide details Medicare enrollment in Utah. It also explains how the state handles Medigap plans for enrollees under 65.

Short-term coverage in Utah

Utah residents can buy short-term health insurance plans that span up to 36 months. This includes renewals and extensions.

Frequently asked questions about health insurance in Utah

Who can buy Marketplace health insurance?

Most people in Utah can buy health insurance through the exchange. Marketplace health coverage is available if you meet the following criteria:5

- You must be a resident of Utah.

- You must be lawfully present in the U.S.

- You can’t be incarcerated.

- You must not be enrolled in Medicare.

Whether or not you qualify for financial assistance with your premium, deductible, or out-of-pocket costs depends on your income and how it compares with the cost of the second-lowest-cost Silver plan in your area.

Additionally, to qualify for financial assistance, you must:

- Not have access to affordable health coverage through an employer. If you think your employer-sponsored health plan is too expensive, use our Employer Health Plan Affordability Calculator to check if you qualify for premium subsidies in the Marketplace.

- Not be eligible for Medicaid or CHIP in Utah, or for premium-free Medicare Part A.6

When can I enroll in an ACA-compliant plan in Utah?

In Utah, the open enrollment window to sign up for ACA Marketplace individual and family health plans runs from November 1 to January 15.7

For coverage to start on January 1, enroll by December 15. Enrolling between December 16 and January 15 will push your coverage start date to February 1.

Outside of open enrollment, you can only sign up for coverage (through the exchange or directly through an insurance company) if you have a special enrollment period (SEP). In most cases, this means you need to have a qualifying life event, but there are some SEPs that don’t require specific qualifying events, such as:

- Your income is more than 138% of the poverty level but no more than 150% of the poverty level, and you’re eligible for premium tax credits. In this scenario, you can enroll until at least 2025 (note that if your income isn’t more than 138% of the poverty level you’ll likely qualify for Utah Medicaid, which accepts enrollments year-round).

- American Indians and Alaska Natives can enroll whenever necessary.

- For people who lose Medicaid or CHIP coverage between March 31, 2023, and July 31, 2024, there’s an extended SEP available for enrollment.8

How do I enroll in a Marketplace plan in Utah?

You have a few ways to enroll in a Marketplace health plan in Utah:

- Online: Go to HealthCare.gov. This is the federal Marketplace website that also lets you shop around for plans.

- By Phone: Call 1-800-318-2596 (TTY: 1-855-889-4325) to talk to a representative over the phone. The call center is available 24 hours a day, seven days a week, except holidays.

- In-person: Get help from a licensed insurance agent, navigator, or certified application counselor in your area. Look for assistance at localhelp.HealthCare.gov. Call 2-1-1 or visit takecareutah.org.9

No matter which of the above methods you use, you’ll still purchase your health plan through HealthCare.gov since Utah uses the federally-facilitated Marketplace. The website will walk you through the application process and determine your eligibility for financial assistance.

How can I find affordable health insurance in Utah?

People in Utah who enroll in a Marketplace plan (accessed at HealthCare.gov) can be eligible for two different types of financial assistance, depending on their household income:

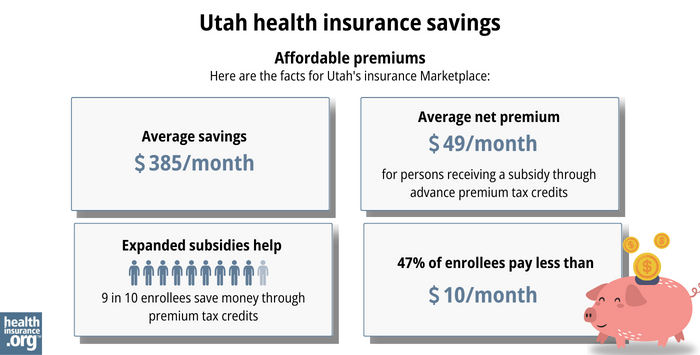

- Premium tax credits (premium subsidies): If you sign up on HealthCare.gov, you may qualify for financial assistance called Advance Premium Tax Credits (APTC) to lower your monthly premiums. More than nine out of ten Utahns who signed up in the 2023 enrollment period received APTC averaging $385 per month. These subsidies reduced their average premium to $49 per month.10

- Cost-sharing reductions (CSR): If your household income is no more than 250% of the federal poverty level, you can also receive cost-sharing reductions (CSR) assistance, as long as you select a Silver-level plan. CSRs reduce your deductible and out-of-pocket expenses, which means you can get the care you need at an affordable cost.

Source: CMS.gov11

Medicaid: Check if you’re eligible for Medicaid by going online to HealthCare.gov or through medicaid.utah.gov.12

Short-term health insurance: Short-term health insurance is a lower-cost option in Utah, where five insurers offer short-term plans. Short-term health insurance is generally only a reasonable option if you’re not eligible for any financial assistance through the exchange, or if you’re trying to enroll outside of open enrollment and don’t have a SEP.

How many insurers offer Marketplace coverage in Utah?

Utah’s exchange has eight insurers providing health plans in 2024, including two newcomers (Aetna Health and Imperial Health Plan of the Southwest).13

Coverage areas vary from one insurer to another, with just one or two insurers offering plans in several counties, and five or more insurers offering plans in the northern part of the state.14

Are Marketplace health insurance premiums increasing in Utah?

According to Utah’s Health Insurance Transparency webpage, the following average rate changes were approved for 2024 for Utah’s individual market insurers,15 amounting to an overall weighted average rate increase of 11.4%, before any subsidies are applied:16

Utah’s ACA Marketplace Plan 2024 Proposed Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| BridgeSpan Health Company | 12.14% |

| Cigna Health | 0% |

| Molina Healthcare of Utah | –5.7% |

| Regence BlueCross BlueShield of Utah | 8.8% |

| SelectHealth | 11.9% |

| University of Utah Health Plans | 10.06% |

| Imperial Health Plan of the Southwest | new for 2024 |

| Aetna Health of Utah | new for 2024 |

Source: Utah Health Insurance Transparency17

For perspective, here’s how average full-price premiums have changed in Utah’s individual/family market in previous years:

- 2015: Average increase of 5%18

- 2016: Average increase of 25%19

- 2017: Average increase of 31.7%20

- 2018: Average increase of 39.5%21

- 2019: Average increase of 0.5%22

- 2020: Average decrease of 2.3%%23

- 2021: Average rate changes ranged from -7% to +3%24

- 2022: Average increase of 1%25

- 2023: Average increase of 6%26

How many people are insured through Utah’s Marketplace?

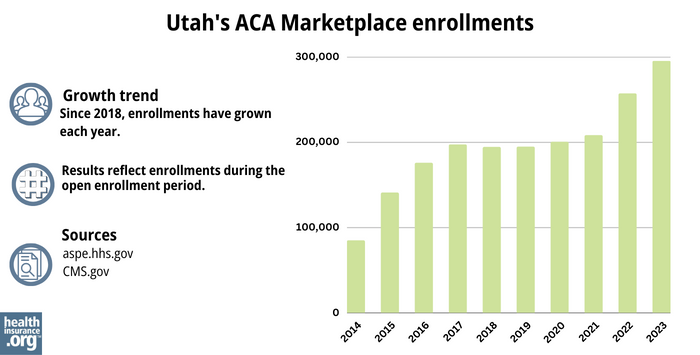

During the open enrollment period for 2024 coverage, 366,939 people enrolled in private plans through Utah’s health insurance Marketplace.27

This was a substantial record high, far exceeding the previous record high when 295,196 people enrolled for 2023.10

The chart below shows enrollment over time in Utah’s exchange. The sharp increase in enrollment in recent years has been driven in large part by the subsidy enhancements under the American Rescue Plan and Inflation Reduction Act, which made Marketplace plans more affordable. The increase for 2024 is also partially driven by Medicaid disenrollments, which resumed in 2023. Some people who are no longer eligible for Medicaid have obtained coverage in the Marketplace instead.

Source: 2014,28 2015,29 2016,30 2017,31 2018,32 2019,33 2020,34 2021,35 2022,36 202310

What health insurance resources are available to Utah residents?

HealthCare.gov

The official federal website where you can sign up for health insurance plans through the ACA Marketplace.

Utah Insurance Department

Oversees and licenses health insurance companies, brokers, and agents, offering information and help for various health insurance concerns.

Utah Senior Services

Supports Medicare beneficiaries by providing assistance, information, and valuable resources.

Take Care Utah

An initiative aimed at helping Utah residents understand and access health insurance options, including the ACA Marketplace and Medicaid.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- “Entities Approved to be Used Enhanced Direct Enrollment” Centers for Medicare and Medicaid Services, CMS.gov, 2019 ⤶

- Marketplace 2024 Open Enrollment Period Report: Final National Snapshot. Centers for Medicare and Medicaid Services. January 2024. ⤶

- “Medicaid Expansion: At a Glance” Utah Department of Health, July 2019 ⤶

- “Medicare Monthly Enrollment” CMS.gov, April 2023 ⤶

- “A quick guide to the Health Insurance Marketplace” HealthCare.gov, Accessed September 2023 ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- “When can you get health insurance?” HealthCare.gov, 2023 ⤶

- “Temporary Special Enrollment Period (SEP) for Consumers Losing Medicaid or the Children’s Health Insurance Program (CHIP) Coverage Due to Unwinding of the Medicaid Continuous Enrollment Condition– Frequently Asked Questions (FAQ)” CMS.gov, Jan. 27, 2023 ⤶

- “Applying for Health Insurance” Utah Department of Health & Human Services, Accessed September 2023 ⤶

- “2023 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 2023 ⤶ ⤶ ⤶

- “2023 OEP State-Level Public Use File (ZIP)” CMS.gov, March 23, 2023 ⤶

- “Utah Medicaid” Utah Department of Health and Human Services, medicaid.utah.gov, Accessed September 2023 ⤶

- ”Latest Rate Changes” Utah Health Insurance Transparency; Utah Insurance Department, Accessed October 2023 ⤶

- Plan Year 2024 Qualified Health Plan Choice and Premiums in HealthCare.gov Marketplaces. Centers for Medicare and Medicaid Services. October 25, 2023. ⤶

- “Latest Rate Changes” Utah Health Insurance Rate Transparency, Accessed October 2023 ⤶

- Utah: *Final* Avg. Unsubsidized 2024 #ACA Rate Changes: +11.4%; Aetna & Imperial Joining Indy Market. ACA Signups. October 2023. ⤶

- Latest Rate Changes. Utah Health Insurance Rate Transparency, Accessed October 2023 ⤶

- “Analysis Finds No Nationwide Increase in Health Insurance Marketplace Premiums” Commonwealth Fund. December 2014 ⤶

- “FINAL PROJECTION: 2016 Weighted Avg. Rate Increases: 12-13% Nationally*” ACA Signups. October 2015 ⤶

- “Avg. UNSUBSIDIZED Indy Mkt Rate Hikes: 25% (49 States + DC)” ACA Signups. August 2016 ⤶

- “2018 Rate Hikes” ACA Signups. October 2017 ⤶

- “2019 Rate Hikes” ACA Signups. October 2018 ⤶

- “2020 Rate Changes” ACA Signups. October 2019 ⤶

- “2021 Premium Changes on ACA Exchanges and the Impact of COVID-19 on Rates” KFF. October 2020 ⤶

- “2022 Rate Changes” ACA Signups. October 2021 ⤶

- “Utah: (Updated) Final Avg. Unsubsidized 2023 #ACA Premiums: +6.0%” ACA Signups. August 2022 ⤶

- Marketplace 2024 Open Enrollment Period Report: Final National Snapshot. Centers for Medicare and Medicaid Services. January 2024. ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶