Home > Health insurance Marketplace > Arkansas

Arkansas Health Insurance Marketplace for 2026

Compare ACA plans and check subsidy savings from a licensed third-party health insurance agency.

Arkansas ACA Marketplace quick facts

Arkansas health insurance Marketplace guide

We designed this guide, including the FAQs below, to help you understand your health insurance coverage options in Arkansas. For many people, an Affordable Care Act (ACA) Marketplace plan – also called Obamacare – is a cost-effective choice.

Arkansas residents enroll in ACA-compliant plans through a state-based exchange/Marketplace that utilizes the federal enrollment platform (SBE-FP). This means people enroll through HealthCare.gov, but the state (via the Arkansas Insurance Department) oversees the exchange plans and runs its own outreach and assistance programs.3 Arkansas has used this approach since 2016.

Six private insurers offer plans through the Arkansas Marketplace in 2026. Arkansas also began requiring Marketplace insurers to use “premium alignment” (Silver loading) for 2026, adding a 46% load4 to the cost of Silver plans to account for the fact that the federal government stopped funding cost-sharing reductions back in 2017 (insurers were already adding a load factor for this, but Arkansas standardized it for 2026). This helps to ensure that premium subsidies are larger and that Bronze and Gold plans become more affordable than they were in previous years.5 (See below for more details about premium changes for 2026.)

Arkansas also purchases Marketplace health plans for people who are eligible for expanded Medicaid.

Frequently asked questions about health insurance in Arkansas

Who can buy Marketplace health insurance in Arkansas?

To be eligible for health coverage through the Arkansas Marketplace, you must meet certain criteria. Typically, you can apply if you:6

- Reside in Arkansas

- Are either a U.S. citizen, U.S. national, or lawfully present in the U.S.

- Are not incarcerated

- Are not enrolled in Medicare

So most Arkansas residents are eligible to enroll in a Marketplace plan. However, a more important question for most people is whether they’re eligible for financial assistance (premium subsidies and cost-sharing reductions) in the Marketplace.

Eligibility for financial assistance depends on your income. In addition, to qualify for financial assistance with your Marketplace plan you must:

- Not have access to affordable employer-sponsored health insurance. If your employer offers coverage but you feel it’s too expensive, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies in the Marketplace.

- Not be eligible for Medicaid or CHIP.

- Not be eligible for premium-free Medicare Part A 7

- File a joint tax return with your spouse, if you’re married.8 (with very limited exceptions)9

- Not be able to be claimed by someone else as a tax dependent.8

When can I enroll in an ACA-compliant plan in Arkansas?

The open enrollment period to buy individual and family health coverage in Arkansas runs from November 1 to January 15. Starting in the fall of 2026, however, the open enrollment period will be shorter. It will end on December 15, and all plans selected during open enrollment will take effect January 1.

For coverage effective in 2026, here are some key dates:10

- November 1: Open enrollment starts! This is when you can first sign up for or change plans for the 2026.

- December 15: Last day to enroll or change plans to start on January 1. After this date, any changes or new plans won’t start until February 1.

- January 15: Open enrollment ends. After this, you only change or enroll in coverage through a special enrollment period (SEP).

An SEP allows you to make plan changes outside open enrollment if you’ve had a qualifying life event, like getting married, having a baby, or losing other health coverage.11

Native Americans can enroll in Marketplace plans year-round, without needing a qualifying life event.

How do I enroll in a Marketplace plan in Arkansas?

If you’re eligible for an ACA Marketplace plan in Arkansas, you can enroll:

- Online through HealthCare.gov

- By phone at (800) 318-2596

- With the help of a local insurance agent/broker, Navigator, or certified application counselor

- Via an approved enhanced direct enrollment entity.12

How can I find affordable health insurance in Arkansas?

You can find affordable health plans in Arkansas on the ACA Marketplace (HealthCare.gov).

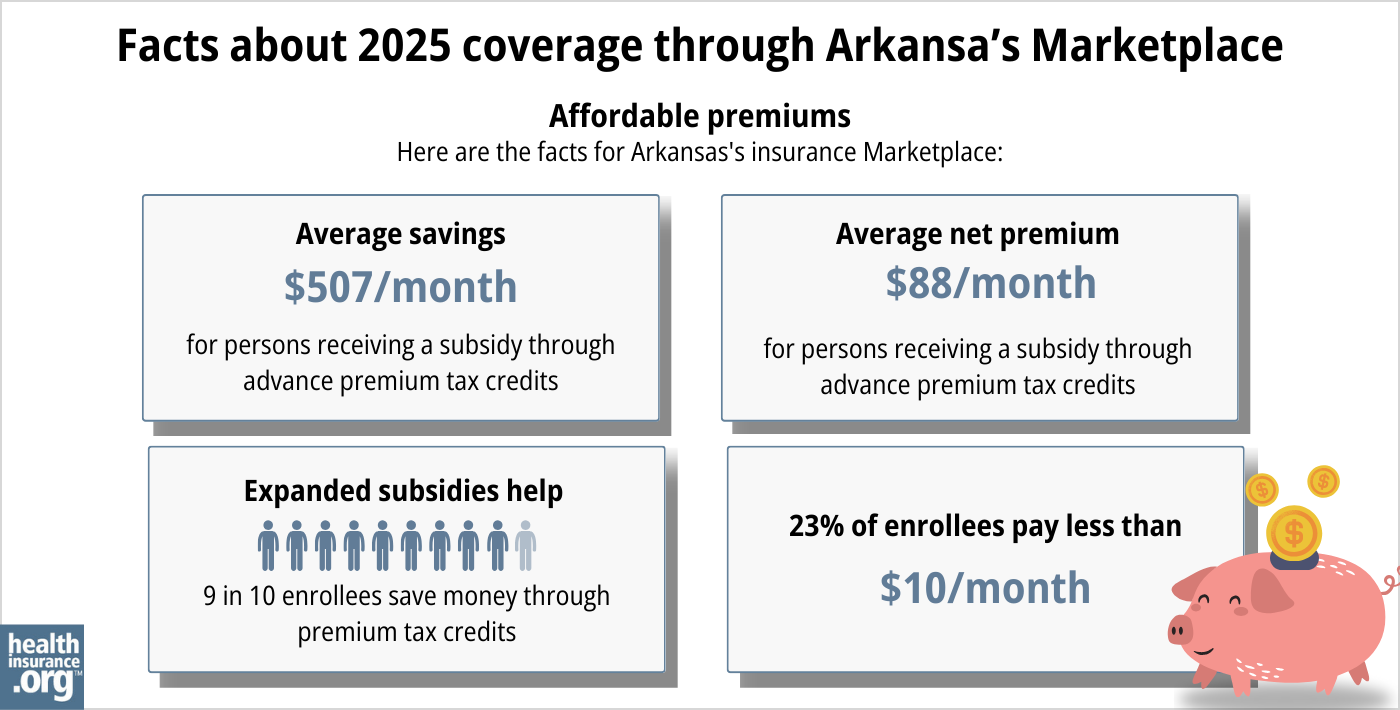

During the open enrollment period for 2025 coverage, 92% of Arkansas Marketplace enrollees were eligible for advance premium tax credits (APTC, or premium subsidies). The average subsidy amount was about $507/month, leaving the average enrolling paying only about $124/month for their coverage; that average includes the 8% who paid full price.13

Source: CMS.gov14

If your income isn’t more than 250% of the federal poverty level, you may also qualify for cost-sharing reductions (CSR) to lower your deductibles and out-of-pocket costs.15

You may enroll in Medicaid coverage if eligible. Arkansas expanded Medicaid under the ACA, and the state purchases Marketplace health plans for people who are eligible for expanded Medicaid.

Short-term plans can be a lower-cost coverage option for people not eligible for Medicaid, Medicare, or subsidized Marketplace coverage. But it’s important to understand the drawbacks of short-term coverage before purchasing it, as these plans are not regulated by the ACA.

How many insurers offer Marketplace coverage in Arkansas?

The Arkansas health insurance Marketplace offers individual and family health plans from six insurers, although some are subsidiaries or licensees of a single parent entity:16

- Celtic Insurance Company (Ambetter)

- HMO Partners, Inc (Health Advantage)

- QCA Health Plan, Inc.

- QualChoice Life and Health Insurance Company, Inc.

- USAble Mutual Insurance Co. (AR Blue Cross & Blue Shield)

- USAble HMO, Inc. (Octave)

Each insurer sets its own coverage area, so different plans are available in each part of the state.

Are Marketplace health insurance premiums increasing in Arkansas?

The insurers that offer coverage through the Arkansas Marketplace have implemented the following average rate changes for 2026, before any subsidies are applied.16

Arkansas’ ACA Marketplace Plan 2026 APPROVED Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Celtic Insurance Company (Ambetter) | 26.1% |

| HMO Partners, Inc (Health Advantage) | 12.3% |

| QCA Health Plan, Inc. | 27.5% |

| QualChoice Life and Health Insurance Company, Inc. | 29.8% |

| USAble Mutual Insurance Co. (AR Blue Cross & Blue Shield) | 16.9% |

| USAble HMO, Inc. (Octave) | 20.6% |

Source: Arkansas Insurance Department17

This amounts to an overall weighted average increase of 22.2%, before any subsidies are applied.18

The average rate changes are for full-price premiums. But most people in Arkansas receive subsidies to lower their costs, and the impending expiration of the federal subsidy enhancements means that subsidies will be available to fewer people in 2026, and will cover a smaller portion of the full-price premiums.

But it’s important to note that Arkansas has implemented a standardized premium alignment (Silver loading) approach for 2026, requiring insurers to add a 46% load to the cost of Marketplace Silver plans4 to account for the fact that the federal government stopped funding cost-sharing reductions back in 2017 (insurers were already adding a load factor for this, but Arkansas standardized it for 2026).5

Since premium subsidy amounts are based on the cost of the second-lowest Silver plan, increasing the prices for Silver plans results in larger premium subsidies for everyone who qualifies for premium subsidies. This helps to ensure that Bronze and Gold plans become more affordable than they were in previous years.5 (See below for more details about premium changes for 2026.)

Several states have mandated premium alignment rules, including Texas (40% load),19 Washington (43.5% load),20 and Vermont (41.9%).21 But the 46% load that Arkansas is using is the highest we’ve seen (to clarify, this is beneficial for consumers, because it results in a more significant increase in Silver plan rates, and thus a larger increase in subsidy amounts).

Here are examples of how net premiums are changing in Arkansas for 2026, including the impact of the expiration of federal subsidy enhancements and the state’s new approach to premium alignment:22

40-year-old earning $40,000

- Lowest-cost plan in 2025: $84/month

- Lowest-cost plan in 2026: $0.04/month (impact of the federal subsidy enhancement expiration is more than offset by the new premium alignment rules in Arkansas, which make Bronze and Gold plans more affordable for people who get premium subsidies)

- Lowest-cost Gold plan in 2025: $224/month

- Lowest-cost Gold plan in 2026: $160/month (also due to the new premium alignment rule)

60-year-old earning $63,000

- Lowest-cost plan in 2025: $299/month

- Lowest-cost plan in 2026: $756/month (premium alignment doesn’t help here, because this person loses access to premium subsidies altogether due to the failure of Congress to extend the federal subsidy enhancements)

For perspective, here’s an overview of how unsubsidized average premiums have changed in Arkansas over the years:

- 2015: Average decrease of 2%.23

- 2016: Average increase of 4.4%.24

- 2017: Average increase of 9.1%.25

- 2018: Average increase of 17.5%.26

- 2019: Average increase of 4.1%.27

- 2020: Average increase of 2.3%.28

- 2021: Average increase of 3.4%.29

- 2022: Average increase of 4.4%.30

- 2023: Average increase of 5.9%.31

- 2024: Average increase of 4.1%.32

- 2025: Avearge increase of 6.2%.33

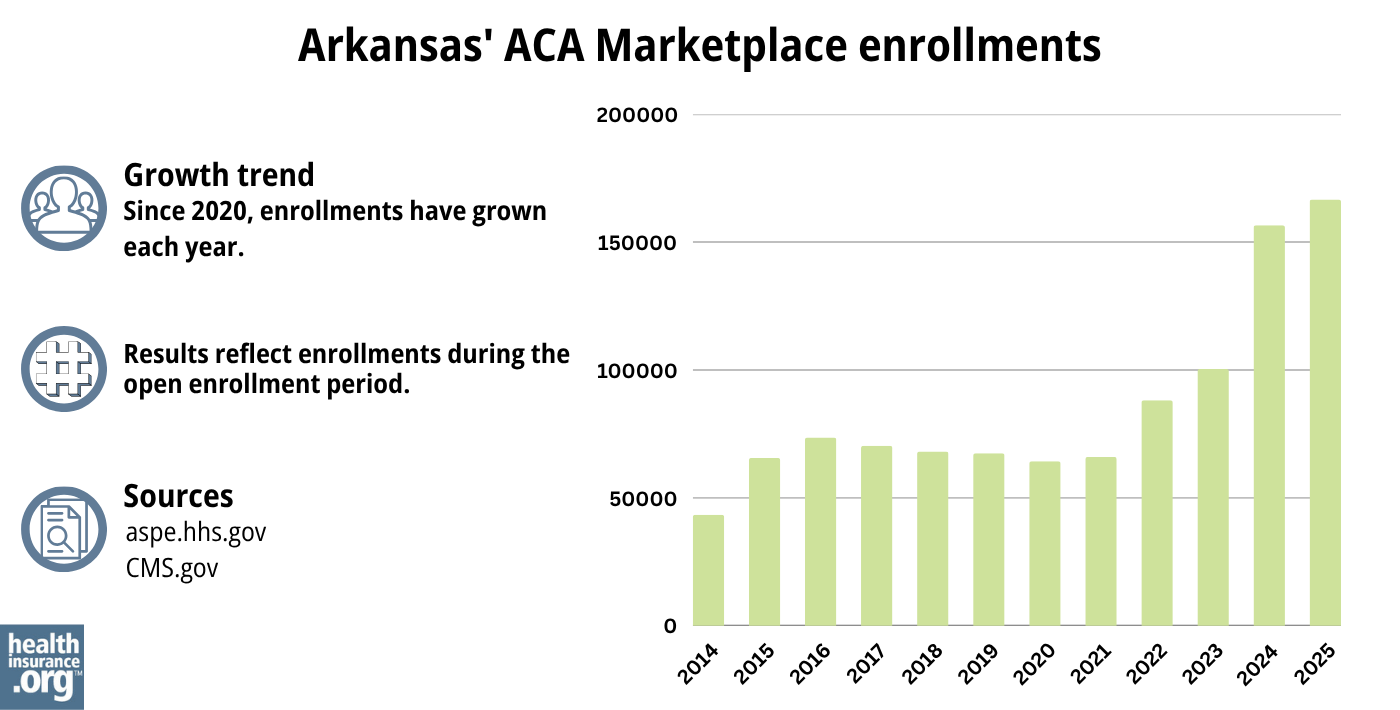

How many people are insured through Arkansas’ Marketplace?

During the open enrollment period for 2025 coverage, a record-breaking 166,639 people enrolled in private plans through the Arkansas Marketplace.34 (See chart below with historical enrollment data.)

The enrollment growth in recent years was driven in large part by the American Rescue Plan’s subsidy enhancements, which have been extended through 2025 by the Inflation Reduction Act. These subsidy enhancements make coverage more affordable than it was before 2021.

The enrollment spike in 2024 and 2025 was also partially due to the “unwinding” of the pandemic-era Medicaid continuous coverage rule. Medicaid disenrollments resumed in the spring of 2023, and Arkansas had completed the unwinding process by October 2023, with more than 427,000 people disenrolled from Medicaid.35

By April 2024, nearly 65,000 people had transitioned from Arkansas Medicaid to a private plan offered in the Arkansas Marketplace,36 helping to drive 2024 enrollment higher than it had been in recent years.

Source: 2014,37 2015,38 2016,39 2017,40 2018,41 2019,42 2020,43 2021,44 2022,45 2023,46 2024,47 202548

What health insurance resources are available to Arkansas residents?

HealthCare.gov

This is the ACA Marketplace where you can enroll in a health insurance plan online. You may also get help by calling (800) 318-2596.

Arkansas Center for Health Improvement

Nonprofit focused on improving healthcare access and public health in Arkansas.

Arkansas Insurance Department Consumer Services Division

Regulates insurance companies and assists consumers. Can help with health insurance questions, complaints, and more.

ARKids First

Arkansas’ Children’s Health Insurance Program. Provides low-cost health coverage for children in families who earn too much for Medicaid but can’t afford other insurance.

Arkansas Senior Health Insurance Information Program

Provides local Medicare counseling and assistance. Can help answer questions, resolve issues, and enroll in Medicare plans.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written hundreds of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Arkansas?

Explore more resources for options in AR including short-term health insurance, dental, Medicaid and Medicare.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- ”2025 OEP State-Level Public Use File (ZIP)” Centers for Medicare & Medicaid Services, Accessed May 13, 2025 ⤶ ⤶

- ”Health Insurance Rate Changes for 2026” Arkansas Insurance Department. Accessed Aug. 7, 2025 *The above is based on the most current data available. ⤶

- My Arkansas Insurance. Arkansas Insurance Department. Accessed November 2023. ⤶

- ”Plan Year 2026 Individual, On-Marketplace Rate Filings” Arkansas Insurance Department. Mar. 7, 2025 ⤶ ⤶

- ”EXCLUSIVE: Arkansas Insurance Dept. going all in on Premium Alignment…but are they overplaying their hand?” ACA Signups. Sep. 15, 2025 ⤶ ⤶ ⤶

- ”A quick guide to the Health Insurance Marketplace” HealthCare.gov ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed Dec. 17, 2025 ⤶

- Premium Tax Credit — The BasicsInternal Revenue Service. Accessed Dec. 17, 2025 ⤶ ⤶

- Updates to frequently asked questions about the Premium Tax Credit. Internal Revenue Service. February 2024. ⤶

- “When can you get health insurance?” HealthCare.gov, 2023 ⤶

- “Understanding special enrollment periods” CMS.gov, March 2023 ⤶

- “Entities Approved to Use Enhanced Direct Enrollment” CMS.gov, Aug. 9, 2024 ⤶

- ”2025 Marketplace Open Enrollment Period Public Use Files“ CMS.gov. Accessed Aug. 7, 2025 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶

- ”APTC and CSR Basics” Centers for Medicare and Medicaid Services. June 2023. ⤶

- ”Health Insurance Rate Changes for 2026” Arkansas Insurance Department. Accessed Aug. 7, 2025 ⤶ ⤶

- ”Health Insurance Rate Changes for 2026” Arkansas Insurance Department. Accessed Dec. 17, 2025 ⤶

- ”2026 Final Gross Rate Changes: Arkansas +22.2% (updated MANY times…)” ACA Signups. Oct. 9, 2025 ⤶

- ”Subchapter F. Rate Review for Health Benefit Plans, 28 TAC §3.505” Texas Department of Insurance. Accessed Dec. 17, 2025 ⤶

- ”Rule Making Order” Washington Office of the Insurance Commissioner. June 29, 2025 ⤶

- ”2026 FINAL Gross Rate Changes – Vermont: +6.7%, WAY down from 17.4% requested…but BCBS is on verge of insolvency??” ACA Signups. Aug. 29, 2025 ⤶

- ”See Plans & Prices” (zip code 72002). HealthCare.gov. Accessed Dec. 17, 2025 ⤶

- 2015 Projected Qualified Health Plan Individual Premium Rates for Arkansas. Arkansas Insurance Department. Accessed November 2023. ⤶

- Arkansas: Approved 2016 Rate Hikes Confirmed At 4.4% Weighted Avg. ACA Signups. August 2015. ⤶

- Avg. UNSUBSIDIZED Indy Mkt Rate Hikes: 25% (49 States + DC). ACA Signups. October 2016. ⤶

- 2018 Rate Hikes. ACA Signups. October 2017. ⤶

- Arkansas: APPROVED 2019 ACA Rate Hikes: 4.1%, But Would Have DROPPED By ~1% W/Out #ACASabotage. ACA Signups. August 2018. ⤶

- Arkansas: *Approved* Avg. 2020 #ACA Exchange Rate Changes: 2.3% Increase. ACA Signups. September 2019. ⤶

- Arkansas: Approved Avg. 2021 #ACA Rate Changes: +3.4% Indy Market, -0.4% Sm. Group Market. ACA Signups. October 2020. ⤶

- Arkansas: Approved Avg. 2022 #ACA Premium Rate Changes: +4.4% Indy Market; +4.0% Sm. Group. ACA Signups. October 2021. ⤶

- Arkansas: (Updated) Final Avg. Unsubsidized 2023 #ACA Rate Changes: +5.9%. ACA Signups. July 2022. ⤶

- Arkansas *Final* Avg. Unsubsidized 2024 #ACA Rate Changes: +4.1%. ACA Signups. September 2023. ⤶

- ”Arkansas: *Final* avg. unsubsidized 2025 #ACA rate changes: +6.2% (updated)” ACA Signups. Sep. 19, 2024 ⤶

- ”Marketplace 2024 Open Enrollment Period Report: Final National Snapshot” Centers for Medicare and Medicaid Services. January 2024. ⤶

- Unwinding data for April, May, June, July, August, and September. Arkansas Department of Human Services. Accessed December 2, 2023. ⤶

- HealthCare.gov Marketplace Medicaid Unwinding Report. Centers for Medicare and Medicaid Services. Data through April 2024, Accessed Aug. 3, 2024 ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- “Health Insurance Marketplaces 2023 Open Enrollment Report” CMS.gov, 2023 ⤶

- ”HEALTH INSURANCE MARKETPLACES 2024 OPEN ENROLLMENT REPORT” CMS.gov, 2024 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶