Home > Health insurance Marketplace > Virginia

Virginia Health Insurance Marketplace for 2026

Compare ACA plans and check subsidy savings from a licensed third-party health insurance agency.

Virginia ACA Marketplace quick facts

Virginia health insurance Marketplace guide

This guide, including the FAQs below, was developed to help you choose the right health insurance plan for you and your family. The coverage options found in Virginia’s ACA Marketplace may be a good choice for many consumers, and we’re here to help explain the choices available. Scroll down to see frequently asked questions about health insurance in Virginia.

Prior to 2024, Virginia residents enrolled in individual/family health coverage through HealthCare.gov. But the state debuted a new state-based Marketplace plaftorm, called Virginia’s Insurance Marketplace, in the fall of 2023. This platform is where residents now shop for coverage.3

Virginia’s Insurance Marketplace offers plans from eight insurers for 2026,4 down from ten in 2025 (details below).

The federal government helps consumers pay for insurance through an income-based advance premium tax credit (premium subsidy) if they buy coverage from the exchange. Depending on your income and other circumstances, you may also get help to lower your out-of-pocket expenses.

Reinsurance, easy enrollment, benchmark plan changes

In addition to developing its own state-based exchange platform that debuted in the fall of 2023, Virginia also has a reinsurance program that took effect in 2023 and helped to reduce premiums for people who don’t get subsidies. Ongoing funding for this program was instrumental in preventing large rate increases for 2024.

Virginia also implemented an easy enrollment program in 2021, which helps people enroll in Medicaid or Marketplace coverage as part of the tax filing process. The Virginia tax return includes a box that filers can check to authorize having their information shared with Virginia Medicaid and the Virginia Marketplace, to determine their eligibility for coverage and financial assistance.5

Virginia received federal approval to update its essential health benefits benchmark plan starting in 2025. The benchmark plan is used to determine specific benefits that must be covered by individual and small-group health plans. The updates include additional coverage for certain prosthetic devices, and coverage of formula and enteral nutrition products for inherited metabolic disorders.6

Frequently asked questions about health insurance in Virginia

Who can buy Marketplace health insurance in Virginia?

To qualify for health coverage through the Virginia Marketplace, you must: 7

- Live in Virginia

- Be lawfully present in the United States

- Not be incarcerated

- Not be enrolled in Medicare

Eligibility for financial assistance (premium subsidies and cost-sharing reductions) depends on your income and how it compares with the cost of the second-lowest-cost Silver plan in your area – which depends on your age and location. In addition, to qualify for financial assistance with your Marketplace plan you must:

- Not have access to affordable health coverage through your employer. If your employer offers coverage but you feel it’s too expensive, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies in the Marketplace.

- Not be eligible for Medicaid or CHIP.

- Not be eligible for premium-free Medicare Part A.8

- File taxes jointly with your spouse, if you’re married9 (with very limited exceptions)10

- Not be able to be claimed as a tax dependent by someone else.9

When can I enroll in an ACA-compliant plan in Virginia?

The open enrollment period for 2026 individual/family health coverage runs from November 1, 2025 to January 30, 2026 in Virginia.11

If you need your coverage to start on January 1, you must apply by December 31 (this deadline is normally December 15, but was extended for 2026 coverage). If you apply between January 1 and January 30, your coverage will take effect February 1.12

Starting in the fall of 2026, for coverage effective in 2027 and subsequent years, open enrollment will end no later than December 31. And all plans selected during open enrollment will take effect January 1. This is due to a federal rule change that was finalized in 2025.

Outside of open enrollment, a special enrollment period (generally linked to a specific qualifying life event) is necessary to enroll or change your coverage.

If you have questions about open enrollment, you can learn more in our comprehensive guide to open enrollment. We also have a comprehensive guide to special enrollment periods.

How do I enroll in a Marketplace plan in Virginia?

To enroll in an ACA Marketplace plan in Virginia, you can:

- Visit Virginia’s health insurance Marketplace to access an online platform to shop, compare, and choose the best health plans.

- Purchase individual and family health coverage with the help of an insurance agent or broker, a Navigator or certified application counselor.

- Call Virginia’s Insurance Marketplace at 888-687-1501.

How can I find affordable health insurance in Virginia?

You may find affordable health insurance options in Virginia by signing up through Virginia’s Insurance Marketplace.

For those who enrolled in private plans through Virginia’s Insurance Marketplace during the open enrollment period for 2025 coverage, more than 86% were eligible for advance premium tax credits (APTC, or premium subsidies). These subsidies averaged $410/month, reducing the average net premium of subsidy-eligible enrollees to $87/month after subsidies.13

The Affordable Care Act provides the income-based APTC to make premiums much more affordable than they would otherwise be. People with household incomes up to 250% of the federal poverty level also qualify for cost-sharing reductions (CSR) that reduce out-of-pocket expenses on Silver plans (CSR benefits aren’t available at other metal levels).

Due to premium subsidies and cost-sharing reductions, you may find that a plan obtained through Virginia’s Insurance Marketplace is the best option.

Source: CMS.gov14

How many insurers offer Marketplace coverage in Virginia?

Eight insurers offer health plans in Virginia’s exchange for 2026.4 Ten carriers offered plans for 2025, but Aetna and Innovation Health (an Aetna affiliate)15 are exiting the individual market at the end of 2025.

Aetna is leaving the individual market nationwide at the end of 2025. Enrollees with Aetna or Innovation Health coverage will need to select a new plan for 2026. They can do so as late as December 31, 2025 and have the new plan effective January 1, 2026.

Are Marketplace health insurance premiums increasing in Virginia?

The following average rate changes were approved for 2026 for the insurers that offer coverage through Virginia’s health insurance Marketplace, calculated before subsidies are applied.16

Virginia’s ACA Marketplace Plan 2026 APPROVED Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Aetna Health (HMO) | Exiting market |

| CareFirst | 18.2% |

| Cigna | 22.8% |

| Group Hospitalization and Medical Services Inc. | 1.1% |

| HealthKeepers (Anthem) | 20.9% |

| Innovation Health Plan | Exiting market |

| Kaiser Foundation Health Plan of the Mid-Atlantic | 11.8% |

| Optimum Choice | 35.4% |

| Oscar Health | 3% |

| Sentara Health Plan (formerly Optima) | 22.4% |

Source: Virginia State Corporation Commission, Bureau of Insurance;17 Virginia SERFF;18 and RateReview.HealthCare.gov19

The average rate increases listed above amount to an overall average increase of about 21.6%.20 But that’s calculated before any subsidies are applied, and most enrollees are subsidy-eligible. Unfortunately, the federal subsidy enhancements that have been in place since 2021 are expiring at the end of 2025, because Congress failed to extend them. This means subsidies will cover a smaller share of premiums in 2026, and will be available to fewer people. This will cause substantial increases in the net (after-subsidy) premiums that Marketplace enrollees pay.

For perspective, here’s a summary of how overall average pre-subsidy premiums have changed in Virginia’s Marketplace over the years:

- 2015: 10.2% increase

- 2016: 8.5% increase21

- 2017: 16.4% increase22

- 2018: 57.7% increase23

- 2019: 9.6% increase24

- 2020: 3.6% decrease25

- 2021: 3.7% decrease26

- 2022: 3% decrease27

- 2023: 12.9% decrease28 (reinsurance took effect)

- 2024: 1.1% increase29 (much lower than proposed, due to extension of reinsurance)

- 2025: 3.9% increase30

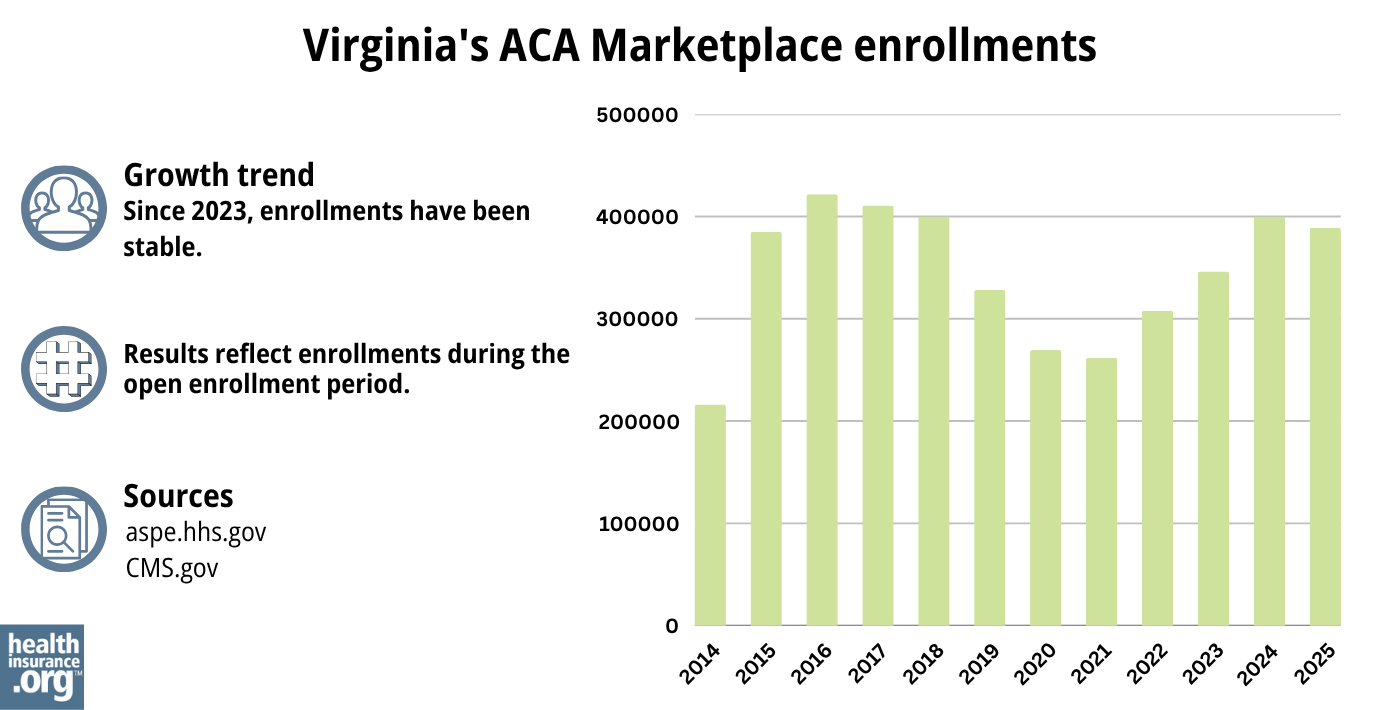

How many people are insured through Virginia’s Marketplace?

During the open enrollment period for 2025 coverage, 388,856 Virginia residents enrolled in private qualified health plans (QHPs) through the Virginia ACA marketplace.31

Unlike most states, where 2025 enrollment reached a record high,32 Virginia’s 2025 enrollment was lower than 2024 enrollment had been (see chart below).

Enrollment had grown in each of the three previous years, however, as was the case in other states. The enrollment growth from 2022 through 2024 stemmed from the subsidy enhancements under the American Rescue Plan (ARP) and Inflation Reduction Act, as well as the “unwinding” of the pandemic-era Medicaid continuous coverage rule. Virginia began disenrolling people from Medicaid in 2023 (after a three-year pause on disenrollments), and more than 27,000 people transitioned from Medicaid to a Marketplace plan in Virginia during the unwinding process.33

Source: 2014,34 2015,35 2016,36 2017,37 2018,38 2019,39 2020,40 2021,41 2022,42 2023, 43 2024,44 202531

What health insurance resources are available to Virginia residents?

Virginia’s Insurance Marketplace

The state-based exchange began to be used starting in November 2023, and is used for all plans with effective dates of 2024 or later.

Virginia Health Care Foundation

Virginia Consumer Assistance Program

Assists people insured by private health plans, Medicaid, or other plans in resolving problems pertaining to their health coverage; assists uninsured residents with access to care.

(877) 310-6560 / [email protected]

State Exchange Profile: Virginia

The Henry J. Kaiser Family Foundation overview of Virginia’s progress toward creating a state health insurance exchange.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written hundreds of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Virginia?

Explore more resources for options in VA including short-term health insurance, dental, Medicaid and Medicare.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- ”2025 OEP State-Level Public Use File (ZIP)” Centers for Medicare & Medicaid Services, Accessed May 13, 2025 ⤶ ⤶

- ”2026 ACA Individual Market Rate Summary” Virginia State Corporation Commission, Bureau of Insurance. July 31, 2025 *The above is based on the most current data available. ⤶

- “Health Benefit Exchange” SCC.Virginia.gov ⤶

- ”2026 ACA Individual Market Rate Summary” Virginia State Corporation Commission, Bureau of Insurance. July 31, 2025 ⤶ ⤶

- ”2025 Virginia Form 760 Resident Income Tax Return” Virginia Department of Revenue. Accessed Dec. 29, 2025 ⤶

- “Virginia Essential Health Benefits Benchmark Plan Receives Federal Approval“ SCC.Virginia.gov. September 21, 2023. ⤶

- “A quick guide to the Health Insurance Marketplace“HealthCare.gov ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed Dec. 29, 2025 ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed Dec. 29, 2025 ⤶ ⤶

- Updates to frequently asked questions about the Premium Tax Credit. Internal Revenue Service. February 2024. ⤶

- ”How to Enroll” Virginia’s Insurance Marketplace. Accessed Dec. 29, 2025 ⤶

- ”Virginians: Enroll Before December 31 for Health Coverage Starting January 1, 2026” Virginia State Corporation Commission. Dec. 17, 2025 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, Accessed Sep. 2, 2025 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶

- ”SERFF Filing AETN-134522152″ Virginia SERFF. Accessed Sep. 2, 2025 ⤶

- ”2026 ACA Individual Market Rate Summary” Virginia State Corporation Commission, Bureau of Insurance. Oct. 2, 2025. And “Virginia SERFF filings” (for revision details). Accessed Sep. 2, 2025. And RateReview.HealthCare.gov. Accessed Nov. 2, 2025 ⤶

- ”2026 ACA Individual Market Rate Summary” Virginia State Corporation Commission, Bureau of Insurance. Oct. 2, 2025 ⤶

- ”Virginia SERFF filings” (for revision details). Accessed Sep. 2, 2025 ⤶

- ”Virginia 2026 rate filings” RateReview.HealthCare.gov. Accessed Nov. 2, 2025 ⤶

- ”2026 Final Gross Rate Changes – Virginia: +21.6% (updated)” ACA Signups. Sep. 23, 2025 ⤶

- “Virginia: *Approved* 2016 Avg. Rate Hikes: 8.5% Individual, 2.9% Small Group” ACA Signups. October 2015 ⤶

- “Avg. UNSUBSIDIZED Indy Mkt Rate Hikes: 25% (49 States + DC)” ACA Signups. October 2016 ⤶

- “Virginia: APPROVED Unsubsidized Indy Mkt Rate Hikes: 57.7%, Big Chunk Due To CSR Sabotage” ACA Signups. September 2017 ⤶

- “Virginia: APPROVED (?) 2019 #ACA Rate Hikes Drop *Another* 1.7 Points; Still Would’ve Been Much Lower W/Out #ACASabotage” ACA Signups. August 2018. ⤶

- “2020 Rate Changes” ACA Signups. October 2019 ⤶

- “2021 ACA Rate Filing Data” Virginia State Corporation Commission. August 2020. ⤶

- “Virginia: Approved Avg. 2022 #ACA Rate Changes: -2.9% Indy Market; +3.6% Sm. Group; 3 New Carriers Join Market” ACA Signups. October 2021 ⤶

- “Virginia: Final Avg. Unsubsidized 2023 #ACA Rate Changes: -12.9% Thanks To New Reinsurance Waiver (Updated)” ACA Signups. September 2022 ⤶

- ”Virginia: *Final* avg. unsubsidized 2024 #ACA rate changes plummet from +22.4% to +1.1% via reinsurance renewal” ACA Signups. Sept. 22, 2023 ⤶

- ”Virginia SERFF filings” (for approval and revisions, along with enrollment numbers). Virginia State Corporation Commission. Sep. 18, 2024 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶ ⤶

- ”Marketplace Enrollment, 2014-2025” KFF.org. Accessed Sep. 2, 2025 ⤶

- ”HealthCare.gov Marketplace Medicaid Unwinding Report” and ”State-based Marketplace (SBM) Medicaid Unwinding Report” Centers for Medicare & Medicaid Services. Data through April 2024; Accessed Aug. 16, 2024. ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- “Health Insurance Marketplaces 2023 Open Enrollment Report” CMS.gov, Accessed August 2023 ⤶

- ”HEALTH INSURANCE MARKETPLACES 2024 OPEN ENROLLMENT REPORT” CMS.gov, 2024 ⤶