Expert analysis of health reform issues

Health insurance for the unemployed

April 26, 2024 – When it comes to obtaining health insurance for the self employed, consumers have several coverage options to consider, including ACA…

Where Medicaid unwinding and disenrollments stand at the one-year mark

April 22, 2024 – Here’s a look at what’s been happening with disenrollments that resulted from Medicaid unwinding – and also a look at the…

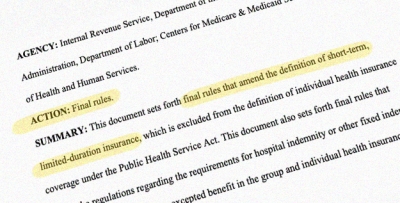

Finalized federal rule reduces total duration of short-term health plans to 4 months

April 3, 2024 – A finalized federal rule will impose new nationwide duration limits on short-term limited duration insurance (STLDI) plans. The rule…

Six ways proposed federal rule changes might affect Marketplace enrollees

February 15, 2024 – Federal health insurance rule changes that could take effect for coverage in 2025 (and beyond) could affect Marketplace enrollment…

6 lessons Mary Lou Retton’s health scare can teach us about coverage

January 23, 2024 – Mary Lou Retton’s health scare story included some important lessons for consumers, many of whom may assume that the celebrity’s health…

HMO vs PPO vs POS vs EPO: What’s the difference?

January 3, 2024 – The type of managed care your health plan falls under affects your healthcare costs and plan benefits – including access to medical…

Over 9 million Medicaid beneficiaries disenrolled as redeterminations continue

October 25, 2023 – Seven months after states received authorization to start Medicaid redeterminations, the process is proceeding mostly as expected, with…

50 populations whose lives are better thanks to the ACA

September 21, 2023 – Millions of Americans would have worse health insurance – or none at all – without Obamacare's provisions. But the law's protections…

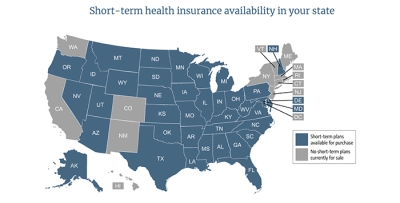

Proposed rule would limit duration of coverage under short-term health plans to 4 months

August 22, 2023 – Since late 2018, short-term health plans in many states have been able to last much longer than previously allowed. But the Biden…

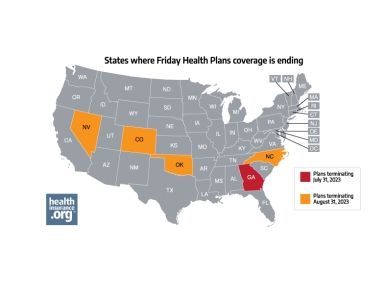

How Friday Health Plans insolvency will affect policyholders in five states

July 18, 2023 – Friday Health Plans, which offers coverage in five states, is winding down its business operations. And in at least four of those states,…

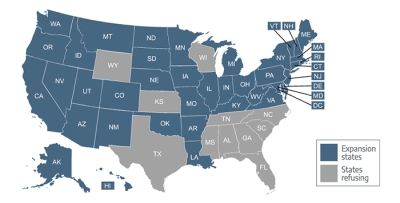

South Dakota Medicaid expansion is underway

July 14, 2023 – South Dakota is the 39th state to expand Medicaid eligibility to cover low-income adults, with coverage that can take effect as early as…

Are you losing Medicaid eligibility? Here’s what to do next.

July 5, 2023 – If you’re among the millions of Americans notified about potentially losing Medicaid eligibility in 2023 and 2024, learn how to avoid…