Medicare in Delaware

Original Medicare, Medicare Advantage, Part D prescription drug, and Medigap coverage in Delaware

Key takeaways

- More than 21% of residents are enrolled in Medicare in Delaware.1

- Over 78,000 Delaware Medicare beneficiaries select Medicare Advantage plans.1

- Residents in Delaware can select from 39 Medicare Advantage plans in 2023.2

- More than half of Delaware Medicare beneficiaries have stand-alone Medicare Part D prescription coverage.1

Medicare enrollment in Delaware

As of July 2024, there were 243,507 people enrolled in Medicare in Delaware.1 That’s more than 21% of the state’s total population, compared with about 17% of the United States population enrolled in Medicare.3

Medicare enrollment in Delaware covers both aged and disabled populations (including people with ALS or end-stage renal disease), 91% of Medicare beneficiaries in Delaware are eligible due to being at least 65 years old, versus just 9% who are eligible due to a disability.1

Medicare options

Medicare beneficiaries can choose among several options to access Medicare coverage. The first choice is between Medicare Advantage plans, where coverage is provided by private insurers, or Original Medicare, where coverage is paid for directly by the federal government. Medicare beneficiaries also have options around Medigap policies and Medicare Part D (prescription drug) coverage.

Original Medicare includes Part A (also called hospital insurance, which helps pay for inpatient stays, like at hospitals, skilled nursing facilities, or hospice centers) and Part B (also called medical insurance, which helps pay for outpatient care like doctor appointments or a preventive healthcare services, such as most vaccinations).

Medicare Advantage plans bundle Parts A and B under a single monthly premium and often include other services like prescription drug and vision coverage. There are pros and cons to either option, and the “right” solution is different for each individual.

Learn about Medicare plan options in Delaware by contacting a licensed agent.

Explore our other comprehensive guides to coverage in Delaware

The ACA Marketplace allows individuals and families to shop for and enroll in ACA-compliant health insurance plans. Subsidies may be available based on household income to help lower costs.

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in Delaware.

Learn about Delaware’s Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in Delaware.

Frequently asked questions about Medicare in Delaware

What is Medicare Advantage?

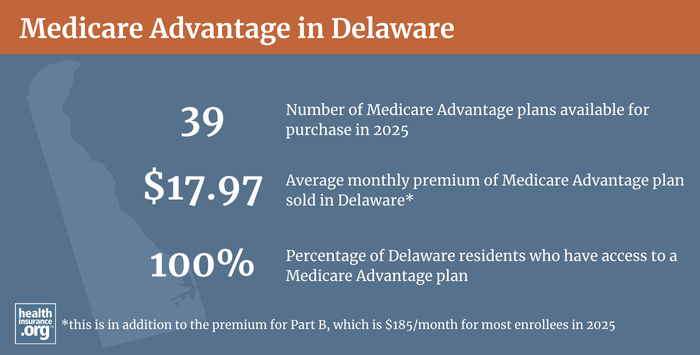

By July 2024, there were 78,169 Delaware Medicare beneficiaries with Advantage coverage, which was about 32% of the state’s total Medicare population.1

Nationwide, about 50% of Medicare beneficiaries had Medicare Advantage coverage as of July 2024.4 Medicare Advantage enrollment has been increasing steadily since the early 2000s, but Original Medicare remains much more popular in Delaware than it does in many other states, with about 68% of Delaware Medicare beneficiaries opting for Original Medicare.1

While most eligible Medicare beneficiaries opt into Original Medicare, there is widespread availability of Medicare Advantage plans in Delaware, and residents can choose from among 39 different Medicare Advantage plans for 2025.2

Medicare Advantage enrollment is available when people are first eligible for Medicare benefits, and also during the annual open enrollment period in the fall (October 15 to December 7). During the Medicare Advantage open enrollment period (January 1 to March 31) people who are already enrolled in Medicare Advantage plans can change Medicare Advantage plans or switch to Original Medicare.

Medigap enrollment and regulations in Delaware

As of 2023, 65,300 Delaware residents supplemented their Original Medicare with private Medigap coverage.5

Learn how Medigap plans are regulated and standardized.

Delaware’s Medigap birthday rule

Under federal rules, there is no annual window to switch from one Medigap plan to another without medical underwriting. But Delaware enacted legislation in 2025 to create a Medigap “birthday rule.”

Starting in January 2026, Delaware Medigap enrollees will have an annual plan change window, starting 30 days before their birthday and continuing for “at least” 30 days after their birthday. During this window, Medigap enrollees can switch to a different Medigap policy that offers the same or lesser benefits, without medical underwriting.6

Access to Medigap for Delaware residents under 65

Under federal rules, people are granted a six-month window, when they’re at least 65 and enrolled in Medicare Part A and Part B, during which coverage is guaranteed issue for Medigap plans. But federal rules do not guarantee access to a Medigap plan if you’re under 65 and eligible for Medicare as a result of a disability.

States can set their own rules, however, and Delaware enacted a law in 20137 that grants a six-month guaranteed issue window for Medigap when people become eligible for Medicare as a result of a disability.8

Delaware allows Medigap insurers to charge higher premiums when the applicant is under age 65, and even higher premiums if the person has kidney failure (end-stage renal disease, or ESRD).9

Because Delaware’s rules allow Medigap insurers to have separate risk pools (and premiums) for under-65 Medicare beneficiaries with ESRD, Medigap premiums have historically been dramatically higher for under-65 Delaware residents with ESRD.10

Under federal Medigap rules, all Medicare beneficiaries have a guaranteed-issue open enrollment period when they’re at least 65 years old and enrolled in Medicare Part B. So enrollees in Delaware who are under-65, including those with ESRD, have the option to get a new plan with standard age-65 rates when they turn 65.

What is Medicare Part D?

Original Medicare does not cover outpatient prescription drugs. Medicare beneficiaries can get needed prescription coverage via Medicaid, an employer-sponsored plan, or Medicare Part D — which is available as part of most Medicare Advantage plans or as a stand-alone prescription drug plan (PDP).

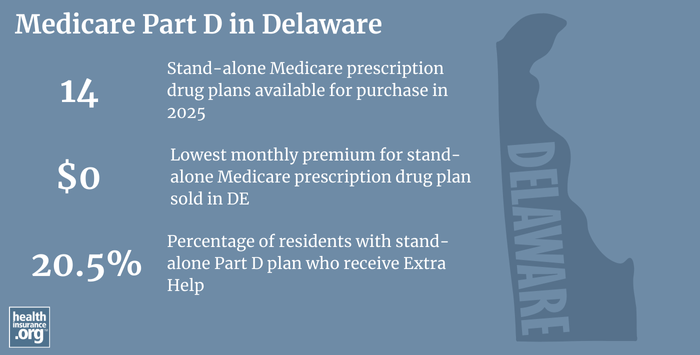

As of July 2024, 128,580 of those receiving Medicare benefits in Delaware were enrolled in stand-alone Medicare Part D prescription drug plans.1 In areas where Medicare Advantage enrollment is lower, enrollment in stand-alone Medicare Part D plans tends to be higher.

For 2025 Medicare Part D enrollment, there are 14 stand-alone Part D plans providing service in Delaware, with monthly premiums starting at $0/month.2

Medicare Part D enrollment is available during the annual open enrollment period in the fall (October 15 to December 7). The plan you select during this window will take effect January 1. It’s recommended that all Medicare beneficiaries review their Part D coverage during open enrollment and consider switching policies if a different plan will better meet their needs (keeping in mind that covered drug lists, in-network pharmacies, and out-of-pocket drug costs can all change from one year to the next, in addition to any changes to a person’s own prescription needs).

What additional resources are available for Medicare beneficiaries and their caregivers in Delaware?

If you need assistance with Medicare enrollment in Delaware or have questions about Medicare eligibility in Delaware, here are some resources for you. They are available free of charge.

- You can contact the Delaware Medicare Assistance Bureau (formerly called Elderinfo) with any questions related to Medicare in Delaware. Visit the website or call 1-800-336-9500 or (302) 674-7364 for help over the phone or to arrange an in-person visit.

- The Delaware Prescription Assistance Program can help low-income seniors afford their medications. Download an application from their website or call 1-844-245-9580 for assistance.

- The Delaware Aging and Disability Resource Center (ADRC) can provide various assistance to elderly and disabled Delaware residents. The phone number is 1-800-223-9074.

- Visit the Medicare Rights Center. This nationwide resource provides helpful information geared to Medicare beneficiaries, caregivers, and professionals.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written hundreds of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Delaware?

Explore more resources for options in DE including ACA coverage, short-term health insurance, dental and Medicaid.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- “Medicare Monthly Enrollment – Delaware.” Centers for Medicare & Medicaid Services Data. Accessed November, 2024. ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶

- ”Fact Sheet: Medicare Open Enrollment for 2025” (25) Centers for Medicare & Medicaid Services. Sep. 27, 2024 ⤶ ⤶ ⤶

- “U.S. Census Bureau Quick Facts: Delaware.” United States Census Bureau, Accessed October, 2024. ⤶

- “Medicare Monthly Enrollment – National.” Centers for Medicare & Medicaid Services Data. Accessed November, 2024. ⤶

- “The State of Medicare Supplement Coverage” AHIP. May 2025. Accessed Oct. 4, 2025 ⤶

- ”Delaware SB71” BillTrack50. Enacted Sep. 3, 2025 ⤶

- “Delaware Senate Bill 42” LegiScan. Enacted July 15, 2013 ⤶

- “Commissioner Stewart Warns That Time is Running Out for Disabled Medicare Recipients Under Age 65 to Purchase Medigap Policies” Delaware Insurance Commissioner. June 11, 2014 ⤶

- “Delaware Medicare Supplement Insurance Guide, 2025” Delaware Department of Insurance. Accessed Oct. 4, 2025 ⤶

- “Delaware Medicare Supplement Insurance Shopper’s Guide, 2019” Delaware Medicare Assistance Bureau. Accessed Oct. 4, 2025 ⤶