Qualifying life events that trigger ACA special enrollment

- Involuntary loss of coverage

- Individual plan renewing outside of the regular open enrollment

- Becoming a dependent or gaining a dependent?

- Marriage

- Divorce (in some state-run exchanges)

- Becoming a United States citizen or lawfully present resident

- A permanent move

- An error or problem with enrollment

- Employer-sponsored plan becomes unaffordable or stops providing minimum value

- An income increase that moves you out of the coverage gap

- Gaining access to a QSEHRA or Individual Coverage HRA

- An income or circumstance change that makes you newly eligible (or ineligible) for subsidies or CSR

- Various exceptional circumstances

Open enrollment for health insurance plans in the individual market (on- and off-exchange) runs from November 1 to January 15 in most states (some of the state-run exchanges have different deadlines).

But even outside of the annual open enrollment window, ACA-compliant plans can still be available to Americans who experience a qualifying life event.

(Note that the plans available outside of open enrollment without a qualifying life event are not regulated by the Affordable Care Act, and most are not a good choice to serve as stand-alone coverage. Short-term health insurance — which is available year-round and not regulated by the ACA — is intended to serve as stand-alone coverage for a short period of time, but it’s much less robust than ACA-compliant coverage.)

Qualifying life events that trigger ACA special enrollment

Outside of open enrollment, you can still enroll in a new plan if you have a qualifying life event that triggers your own special open enrollment (SEP) window.

People with employer-sponsored health insurance are used to both open enrollment windows and qualifying life events. In the employer group market, plans have annual open enrollment windows when members can make changes to their plans and eligible employees can enroll. Outside of that time frame, however, a qualifying life event is required to enroll or change coverage.

In the individual market, this was not how it worked before 2014 — people could apply for coverage anytime they wanted. But policies were not guaranteed issue in most states,1 so pre-existing conditions meant that some people couldn’t get coverage or had to pay more for their policies.

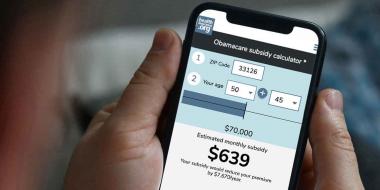

Obamacare subsidy calculator *

Estimated annual subsidy

$0

All of that changed thanks to the ACA. Individual coverage is now quite similar to group coverage. As a result, the individual market now utilizes annual open enrollment windows and allows for special enrollment windows triggered by qualifying life events.

So you could still have an opportunity to enroll in ACA-compliant coverage outside of the open enrollment window if you experience a qualifying life event. Depending on the circumstances, you may have a special open enrollment period – generally 60 days but sometimes there’s an additional 60-day window before the event as well – during which you can enroll or switch to a different plan.

Got a qualifying life event? You may need to provide proof

HHS began ramping up enforcement of special enrollment period eligibility in 2016, amid concerns that enforcement had previously been too lax.

In February 2016, HHS confirmed that they would begin requiring proof of eligibility to grant special enrollment periods triggered by birth/adoption/placement for adoption, a permanent move, loss of other coverage, and marriage (together, these account for three-quarters of all qualifying life events in Healthcare.gov states). The eligibility verification process was further stepped up in 2017, thanks to “market stabilization” rules that HHS finalized in April 2017.

Starting in June 2017, HHS was planning to implement a pilot program to further enhance SEP eligibility verification (this plan was created by HHS under the Obama administration). Fifty percent of SEP enrollees were to be randomly selected for the pilot program, and their enrollments would be pended until their verification documents were submitted. They’d have 30 days to submit their proof of SEP eligibility, and as long as they did so, their policy would be effective as of the date determined by the date of their application/plan selection.

Under the new rules finalized in April 2017, however, that SEP eligibility verification process began to apply to 100% of SEP applications, starting in June 2017. By 2022, under the Biden administration, SEP eligibility verification had been scaled back slightly, and applied to 90% of special enrollment period applications. The SEP verification program has generated controversy, with some consumer advocates noting that it could further deter healthy people from enrolling when they’re eligible for a SEP. And HHS has noted that the verification process is harmful to Black applicants, as they are less likely to submit the necessary documentation than white consumers.

HHS addressed this in the annual rule-change notification for 2023. They removed the SEP verification requirements for all SEPs other than loss of coverage. Loss of coverage does represent the majority of SEP applications, and people using this SEP still have to provide proof of their loss of coverage. But pre-enrollment eligibility verification is no longer required on HealthCare.gov for other qualifying life events.

Understand, however, that state-run exchanges can set their own protocols, and insurers can still require proof of any qualifying life event for an off-exchange enrollment. In some state-run exchanges, the insurers conduct the SEP verification even on-exchange, and they can continue to do so (in Colorado, for example, all SEP verification is done by the insurers, and they require proof for 100% of SEP applications, on-exchange or off-exchange).

Off-exchange special enrollment periods

Most qualifying life events apply both inside and outside the exchanges. There are a few exceptions, however. For policies sold outside the exchanges, there are a few qualifying life events that HHS does not require carriers to accept as triggers for special enrollment periods (however, the carriers can accept them if they wish).

These include gaining citizenship or a lawful presence in the US or being part of the American Indians and Alaska Natives population (within the exchanges, American Indians and Alaska Natives can make plan changes as often as once per month, and enrollment runs year-round. American Indians and Alaska Natives are also eligible for enhanced cost-sharing reductions, but only for plans obtained through the exchange).

The new SEP for people whose income doesn’t exceed 150% of the poverty level is only available on-exchange, as it’s based on the fact that applicants in this income range are eligible for subsidies that cover the full cost of the benchmark plan (and subsidies are not available outside the exchange).

In addition, when exchanges grant special enrollment periods based on “exceptional circumstances” those special enrollment periods apply within the exchanges; off-exchange, it’s up to the carriers as to whether or not they want to implement similar special enrollment periods.

And carriers tend to have fairly strict rules regarding proof of SEP eligibility. If you’re enrolling directly with an insurer, outside of open enrollment, you will need to provide proof of your qualifying life event (the insurer will let you know what will count as acceptable documentation; these same documentation requirements are generally enforced for on-exchange enrollments as well).

What counts as a qualifying life event?

Although special enrollment period windows are generally longer in the individual market, many of the same life events count as a qualifying life event for employer-based plans and individual market plans. But some are specific to the individual market under Obamacare.

(For reference, special enrollment period rules for employer-sponsored plans are detailed here; for individual market plans, they’re detailed here and described in more detail below and in our guide to special enrollment periods.)

When will coverage take effect if I enroll during a special enrollment period?

Before 2022, there was generally a deadline of the 15th of the month to have coverage start the first of the following month. Applications received after that would take effect the first of the second following month, although some qualifying life events — marriage, loss of other coverage, and birth/adoption — had different rules. But as of 2022, HealthCare.gov eliminated the requirement that applications be submitted by the 15th of the month to get coverage the first of the following month.

For all special enrollment periods, coverage simply take effect the first of the month after the HealthCare.gov application is submitted. States have the option to require this of off-exchange insurers, and fully state-run exchanges (there are 19 of them as of 2024) also have the option to switch all of their special enrollment periods to first-of-the-following-month effective dates, regardless of when the application is submitted is. (Massachusetts and Rhode Island have always allowed enrollees to sign up as late as the 23rd of the month and have coverage effective the first of the following month.) But a proposed federal rule change would require all state-run exchanges to adopt the first-of-the-following-month effective date rule, starting in 2025.2

12 Obamacare special open enrollment triggers

The qualifying life events that trigger special enrollment periods are discussed in more detail in our extensive guide devoted to qualifying life events and special enrollment periods. But here’s a summary:

(Note that in most cases, the market stabilization regulations now prevent enrollees from using a special enrollment period to move up to a higher metal level of coverage; so if you have a bronze plan and move to a new area mid-year, for example, you would not be allowed to purchase a gold plan during your special enrollment period.)

(Also note that HHS has finalized a technical change to clarify that if one member of a tax household qualifies for a special enrollment period, all members of the tax household are eligible for the special enrollment period. This is applicable as of 2024.3)

1. Involuntary loss of other coverage

The coverage you’re losing has to be minimum essential coverage, and the loss has to be involuntary. Canceling the plan or failing to pay the premiums does not count as involuntary loss, but voluntarily leaving a job and thus losing employer-sponsored health coverage does count as an involuntary loss of coverage. In most cases, loss of coverage that isn’t minimum essential coverage does not trigger a special open enrollment.

(There is an exception for pregnancy Medicaid, CHIP unborn child, and Medically Needy Medicaid: These types of coverage are not minimum essential coverage, but people who lose coverage under these plans do qualify for a special enrollment period (this includes a woman who has CHIP unborn child coverage for her baby during pregnancy, but no additional coverage for herself; she will qualify for a loss of coverage SEP for herself when the unborn child CHIP coverage ends). And although they are not technically considered minimum essential coverage, they do count as minimum essential prior coverage in the case of special enrollment periods that require a person to have previously had coverage (this is a requirement for most special enrollment periods).)

As noted above, loss of coverage is the most common qualifying life event, and applicants do have to provide proof of loss of coverage when they seek a special enrollment period for this.

Your special open enrollment begins 60 days before the termination date, so it’s possible to get a new ACA-compliant plan with no gap in coverage, as long as your prior plan doesn’t end mid-month. (See details in Section (d)(6)(iii) the code of federal regulations 155.420, and the updated regulation that makes advance open enrollment possible for people with individual coverage as well as employer-sponsored coverage.)

And a rule change took effect for HealthCare.gov as of 2024 that can help you avoid a coverage gap if the old plan does end mid-month. At the discretion of the exchange (optional for state-run exchanges), a person’s new coverage can now take effect the first day of the month in which their old coverage will end, as long as they apply before the first day of that month3 (ie, if coverage will end July 15, you can apply by June 30 and have the new plan take effect July 1, resulting in a two-week period of double coverage, but no gap in coverage).

If you enroll before the loss of coverage, the effective date is the first of the month following the loss of coverage, regardless of the date you enroll. But if you enroll in the 60 days after your plan ends, the exchange can either allow a first-of-the-following-month effective date regardless of the date you enroll, or they can have an earlier deadline. Before 2022, most states had a 15th-of-the-month deadline, but that’s no longer applicable in most states as of 2022. Instead, coverage will simply take effect the first of the month following enrollment. A proposed federal rule change would require state-run exchanges to follow this protocol as of 2025.2

Starting in 2024, HHS has finalized a rule change to give people 90 days to sign up for a plan in the exchange if they are losing coverage under Medicaid or CHIP, as opposed to the previous 60-day special enrollment period.3

2. Your health plan renews at a time other than January 1

HHS issued a regulation in late May 2014 that included a provision to allow a special open enrollment for people whose health plan is renewing — but not terminating — outside of regular open enrollment. Although ACA-compliant plans run on a calendar-year schedule, that is not always the case for grandmothered and grandfathered plans, nor is it always the case for employer-sponsored plans, including group plans or QSEHRA/ICHRA benefits.

Insureds with these plans may accept the renewal but are not obligated to do so. Instead, they can select a new ACA-compliant plan during the 60 days before the renewal date and 60 days following the renewal date. Initially, this special enrollment period was intended to be used only in 2014, but in February 2015 HHS issued a final regulation that confirmed this special enrollment period would be ongoing.

So it continues to apply to people who have grandfathered or grandmothered plans that renew outside of open enrollment each year. And HHS also confirmed that this SEP applies to people who have a non-calendar year group plan that’s renewing; they can keep that plan or switch to an individual market plan using an SEP. (Note that if the employer-sponsored plan is considered affordable and provides minimum value, the applicant is not eligible for premium subsidies in the exchange.)

3. Becoming a dependent or gaining a dependent

Becoming or gaining a dependent (as a result of birth, adoption, or placement in foster care) is a qualifying life event. Coverage is back-dated to the date of birth, adoption, or placement in foster care (subsequent regulations also allow parents the option to select a later effective date). Because of the special rules regarding effective dates, it’s wise to use a special enrollment period in this case, even if the child is born or adopted during the general open enrollment period.

The current regulation states that anyone who “gains a dependent or becomes a dependent” is eligible for a special open enrollment window, which obviously includes both the parents and the new baby or newly adopted or fostered child. But HealthCare.gov has long accepted applications for the entire family (including siblings) during the special open enrollment window. And as of 2024, it’s official policy that the entire household can enroll during the SEP even if only one household member has a qualifying event.3

4. Marriage

If you get married, you have a 60-day open enrollment window that begins on your wedding day. However, rules issued in 2017 limit this special enrollment period somewhat. At least one partner must have had minimum essential coverage (or lived outside the U.S. or in a U.S. Territory) for at least one of the 60 days before the marriage. In other words, you cannot use marriage to gain coverage if neither of you had coverage before getting married.

Assuming you’re eligible for a special enrollment period (which includes providing proof of marriage), your policy will be effective the first of the month following your application, regardless of what date you complete your enrollment (this is true in all states, including those with state-run exchanges). Since marriage triggers a special effective date rule, it might make sense to use your special enrollment period if you get married during the general open enrollment period.

For example, if you get married on November 27, you can select a new plan that day (or up until the 30th) and have coverage effective December 1 if you use your special enrollment period triggered by your marriage. But if you enroll under the general open enrollment period, your new coverage won’t be effective until January 1.

5. Divorce (in some state-run exchanges)

If you lose your existing health insurance because of a divorce, you qualify for a special open enrollment based on the loss of coverage rule discussed above.

If a court orders a parent to obtain health insurance for a child as part of a custody agreement, the exchange must allow the parent the option to backdate the coverage to the date the court order was issued, although the parent can also opt for the normal effective dates described above.

Exchanges also have the option of granting a special enrollment period for people who lose a dependent or lose dependent status as a result of a divorce or death, even if coverage is not lost as a result. This special enrollment period was due to become mandatory in all exchanges as of January 2017, but HHS removed that requirement in May 2016, so it’s still optional for the exchanges. In most states, including the 32 states that use HealthCare.gov, divorce without an accompanying loss of coverage will not trigger a special enrollment period.

6. Becoming a United States citizen or lawfully present resident

This qualifying life event only applies within the exchanges — carriers selling coverage off-exchange are not required to offer a special enrollment period for people who gain citizenship or lawful presence in the US.

There are special rules that allow recent immigrants to qualify for premium subsidies in the exchange even with an income below the poverty level, since they aren’t eligible for Medicaid until they’ve been in the US for at least five years.

7. A permanent move

This special enrollment period applies as long as you move to an area where different qualified health plans (QHPs) are available. This special enrollment period is only available to applicants who already had minimum essential coverage in force for at least one of the 60 days before the move (with exceptions for people moving back to the US from abroad, newly released from incarceration, or previously in the coverage gap in a state that did not expand Medicaid; there’s also an exemption for people who move from an area where there were no plans available in the exchange, although there have never been any areas without exchange plans).

For people who meet the prior coverage requirement, a permanent move to a new state will always trigger a special open enrollment period, because health insurance is regulated at the state level and different plans are available in each state. But even a move within a state can be a qualifying life event, as some states have QHPs that are only offered in certain regions of the state. So if you move to a part of the state that has plans that were not available in your old area, or if the plan you had before is not available in your new area, you’ll qualify for a special open enrollment period, assuming you had coverage before your move.

HHS finalized a provision in February 2015 that allows people advance access to a special enrollment period starting 60 days before a move, but this is optional for the exchanges. It was originally scheduled to be mandatory starting in January 2017 (ie, that exchanges would have to offer a special enrollment period in advance of a move), but HHS removed that deadline in May 2016, making it permanently optional for exchanges to allow people to report an impending move and enroll in a new health plan, as opposed to applying for coverage after the move is complete.

In early 2016, HHS clarified that moving to a hospital in another area for medical treatment does not constitute a permanent move, and would not make a person eligible for a special enrollment period. And a temporary move to a new location also does not trigger a special enrollment period.

However, a person who has homes in more than one state (for example, a “snowbird” early retiree) can establish residency in both states, and can switch policies to coincide with a move between homes. HHS has noted that this person might be better served by a plan with a nationwide network to avoid resetting deductibles mid-year, although such plans are not available in many areas.

8. An error or problem with enrollment

If the enrollment error (or lack of enrollment, as the case may be) was the fault of the exchange, HHS, or an enrollment assister, a special enrollment period can be granted. In this case, the exchange can properly enroll the person (or allow them to change plans) outside of open enrollment to remedy the problem.

9. Employer-sponsored plan becomes unaffordable or stops providing minimum value

An employer-sponsored plan is considered affordable in 2024 as long as the employee’s share of the premium isn’t more than 8.39% of their household income household income.4

A plan provides minimum value as long as it covers at least 60% of expected costs for a standard population of people covered by employer-sponsored insurance, and also provides substantial coverage for inpatient and physician services.

A plan design change could result in a plan no longer providing minimum value. There are a variety of situations that could result in a plan no longer being affordable, including a reduction in work hours (with the resulting pay cut meaning that the employee’s insurance takes up a larger share of their household income) or an increase in the premiums that the employee has to pay for their coverage.

In either scenario, a special enrollment period is available, during which the person can switch to an individual market plan instead. And premium subsidies are available in the exchange if the employer-sponsored coverage doesn’t provide minimum value and/or isn’t affordable.

10. An income increase that moves you out of the coverage gap

There are nine states where there is still a Medicaid coverage gap, and nearly 2 million people are unable to access affordable health coverage as a result. (Wisconsin has not expanded Medicaid under the ACA, but does not have a coverage gap).

For people in the coverage gap, enrollment in full-price coverage is generally an unrealistic option. HHS recognized that, and allows a special enrollment period for these individuals if their income increases during the year to a level that makes them eligible for premium subsidies (ie, to at least the poverty level).

As mentioned above, a special enrollment period is triggered by marriage only if at least one partner already had minimum essential coverage before getting married. However, if two people in the coverage gap get married, their combined income may put their household above the poverty level, making them eligible for premium subsidies. In that case, they would have access to a special enrollment period even if neither of them had coverage before getting married.

11. Gaining access to a QSEHRA or Individual Coverage HRA

This is a new special enrollment period that became available in 2020, under the terms of the Trump administration’s new rules for health reimbursement arrangements that reimburse employees for individual market coverage. QSEHRAs became available in 2017 (as part of the 21st Century Cures Act) and allow small employers to reimburse employees for the cost of individual market coverage (up to limits imposed by the IRS). But before 2020, there was no special enrollment period for people who gained access to a QSEHRA.

As of 2020, the Trump administration’s new guidelines allow employers of any size to reimburse employees for the cost of individual market coverage. The new rules also add a special enrollment period — listed at 45 CFR 155.420(d)(14) — for people who become eligible for a QSEHRA benefit or an Individual Coverage HRA (ICHRA) benefit.

This includes people who are newly eligible for the benefit, as well as people who were offered the option in prior years but either didn’t take it or took it temporarily and now have another opportunity to opt into the benefit for the employer’s upcoming plan year (which might not align with the calendar year). In other words, anyone who is transitioning to QSEHRA or Individual Coverage HRA benefits — regardless of their prior coverage — has access to a special enrollment period during which they can select an individual market plan (or switch from their existing individual market plan to a different one), on-exchange or outside the exchange.

This special enrollment period is available starting 60 days before the QSEHRA or Individual Coverage HRA benefit takes effect, to allow people time to enroll in an individual market plan that will be effective on the day that the QSEHRA or Individual Coverage HRA takes effect.

12. An income or circumstance change that makes you newly eligible (or ineligible) for subsidies or CSR, or an income that doesn’t exceed 150% of poverty

If your income or circumstances change such that you become newly eligible or newly ineligible for premium tax credits or cost-sharing subsidies, you’ll have an opportunity to switch plans. This rule already existed for people who were already enrolled in a plan through the exchange (and as noted above, for people in states that have not expanded Medicaid who experience a change in income that makes them eligible for subsidies in the exchange — even if they weren’t enrolled in any coverage at all prior to their income change).

But in the 2020 Benefit and Payment Parameters, HHS finalized a proposal to expand this special enrollment period to include people who are enrolled in off-exchange coverage (ie, without any subsidies, since subsidies aren’t available off-exchange), and who experience an income change that makes them newly-eligible for premium subsidies or cost-sharing subsidies.

This special enrollment period was added at 45 CFR 155.420(d)(6)(v), although it is optional for state-run exchanges.

This is an important addition to the special enrollment period rules, particularly given the “silver switch” approach that many states have taken with regards to the loss of federal funding for cost-sharing reductions (CSR). In 2018 and 2019, people who opted for lower-cost off-exchange silver plans (that didn’t include the cost of CSR in their premiums) were stuck with those plans throughout the year, even if their income changed mid-year to a level that would have been subsidy-eligible.

That’s because an income change was not a qualifying life event unless you were already enrolled in a plan through the exchange (or moving out of the Medicaid coverage gap). But the addition of this SEP addressed that problem.

(It’s important to keep in mind, however, that a mid-year plan change will result in deductibles and out-of-pocket maximums resetting to $0, so this may or may not be a worthwhile change, depending on the circumstances.)

As of 2022, there is also a special enrollment period for exchange enrollees with silver plans who have cost-sharing reductions and then experience a change in income or circumstances that make them newly ineligible for cost-sharing subsidies. This allows people in this situation to switch to a plan at a different metal level, rather than being limited to picking only from among the other available silver plans.

And also as of 2022, there is a special enrollment period for people whose income doesn’t exceed 150% of the poverty level, as long as they’re eligible for premium subsidies in the marketplace (so it’s not available to people who are in the coverage gap in the states that haven’t expanded Medicaid, as they’re not eligible for subsidies). This SEP will continue to be available through at least 2025, as the Inflation Reduction Act has extended the American Rescue Plan provision that made benchmark plans premium-free for people with household income up to 150% of the poverty level. (A proposed federal rule change would make this SEP permanently available, regardless of whether the enhanced subsidies continue.2) This SEP is optional for state-run exchanges, but most of them are offering it, and some are offering it at higher income levels due to additional state-funded subsidies.

13. Various exceptional circumstances

Special enrollment periods can be granted due to certain exceptional circumstances. In some cases, these apply to everyone in a given area — for example, an area where a hurricane hits during open enrollment, preventing people from completing their enrollments in a timely fashion. In other cases, they apply on a case-by-case basis — for example, a house fire during open enrollment that prevents the family from completing their enrollment.

For the most part, exceptional circumstances will only trigger a special enrollment period if the event happened during open enrollment or during a special enrollment period that had already been triggered by another qualifying life event. In the example of a hurricane, a widespread special enrollment period would only apply if the hurricane struck (and resulted in a FEMA-declared disaster) during open enrollment. A hurricane that occurs in September (ie, outside of open enrollment) would not generate a widespread special enrollment period. But it would essentially extend an already-existing special enrollment period that some people might have had at that point, due to a previous qualifying life event.

Exceptional circumstances can also include things like spousal abandonment/domestic abuse, and in a few states, pregnancy.

For people already enrolled in the exchange, SEP applies if the plan substantially violates its contract

A special enrollment period is available in the exchange (only for people who are already enrolled through the exchange) if the insured is enrolled in a QHP that “substantially violated a material provision of its contract in relation to the enrollee.”

This does not mean that enrollees can switch to a new plan simply because their existing carrier has done something they didn’t like – it has to be a “substantial violation” and there’s an official channel through which such claims need to proceed. It’s noteworthy that a mid-year change in the provider network or drug formulary (covered drug list) does not constitute a material violation of the contract, so enrollees are not afforded a SEP if that happens.

Who doesn’t need a qualifying life event?

In some circumstances, enrollment is available year-round, without a need for a qualifying life event:

- Native Americans/Alaska Natives – as defined by the Indian Health Care Improvement Act – can enroll anytime during the year. Native Americans/Alaska Natives may also switch from one QHP to another up to once per month (the special enrollment periods for Native Americans/Alaska Natives only apply within the exchanges – carriers selling off-exchange plans do not have to offer a monthly special enrollment period for American Indians).

- Medicaid and CHIP enrollment are also year-round. For people who are near the threshold where Medicaid eligibility ends and exchange subsidy eligibility begins, there may be some “churning” during the year, when slight income fluctuations result in a change in eligibility. If income increases above the Medicaid eligibility threshold, there’s a special open enrollment window triggered by loss of other coverage. Unfortunately, in states that have not expanded Medicaid, the transition between Medicaid and QHPs in the exchange is nowhere near as seamless as lawmakers intended it to be.

- In addition to Medicaid/CHIP, some states have other types of coverage that can be obtained outside of open enrollment:

- Basic Health Programs in New York and Minnesota (Oregon plans to have a Basic Health Program by mid-2024).

- The ConnectorCare program in Massachusetts (for people who are newly eligible or who haven’t enrolled before).

- The CoveredConnecticut program for eligible Connecticut residents.

- Employers can select SHOP plans (or small group plans sold outside the exchange) year-round. But employees on those plans will have the same sort of annual open enrollment windows that applies to any employer group plans.

Need coverage at the end of the year?

If you find yourself without health insurance towards the end of the year, you might want to consider a short-term policy instead of an ACA-compliant policy (especially if you aren’t eligible for a special enrollment period). There are pros and cons to short-term insurance, and it’s not the right choice for everyone. But for some, it’s an affordable solution to a temporary problem.

Short-term insurance doesn’t cover pre-existing conditions, so it’s generally only an appropriate solution for healthy applicants. And for applicants who qualify for premium subsidies in the exchange, an ACA-compliant plan is also likely to be the best value, since there are no subsidies available to offset the cost of short-term insurance.

But if you’re healthy, don’t qualify for premium subsidies (or aren’t eligible for a special enrollment period and thus can’t get an effective date prior to January 1), and find yourself without coverage for a month or two at the end of the year, a short-term plan is worth considering. You can enroll in a short-term plan for the remainder of the year, and sign up for ACA-compliant coverage during open enrollment with an effective date of January 1.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- Health Insurance Market Reforms: Guaranteed Issue. KFF. June 2012. ⤶

- Patient Protection and Affordable Care Act, HHS Notice of Benefit and Payment Parameters for 2025; Updating Section 1332 Waiver Public Notice Procedures; Medicaid; Consumer Operated and Oriented Plan (CO-OP) Program; and Basic Health Program. U.S. Treasury Department and U.S. Centers for Medicare and Medicaid Services. November 2023. ⤶ ⤶ ⤶

- Patient Protection and Affordable Care Act, HHS Notice of Benefit and Payment Parameters for 2024. Centers for Medicare and Medicaid Services. April 2023. ⤶ ⤶ ⤶ ⤶

- Revenue Procedure 2023-29. Internal Revenue Service. Accessed January 2024. ⤶