What is a qualifying life event?

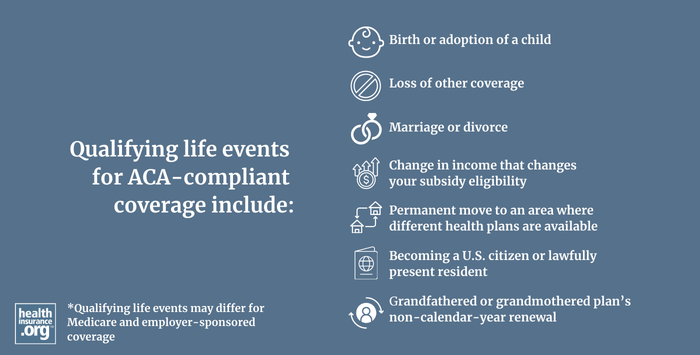

A qualifying life event is an event that triggers a special enrollment period (SEP) for an individual or family to purchase health insurance outside of the regular annual ACA open enrollment period.

This article will help you understand more about qualifying events, and has detailed information about all of the qualifying events that apply to coverage obtained in the individual/family market (on-exchange or off-exchange).

Are qualifying life events different for different types of coverage?

The articles linked above are specific to qualifying life events that trigger special enrollment periods for individual market coverage.

Learn more about qualifying life events and special enrollment periods for Medicare coverage.

For employer-sponsored health coverage, SEPs usually only continue for 30 days following the qualifying life event, as opposed to 60 days for SEPs in the individual market. And while some of the qualifying life events are the same as those for the individual market, there are some differences.1 For example, the loss of a short-term health insurance policy will not trigger a SEP in the individual market, but it will trigger a SEP for employer-sponsored coverage.2

Footnotes

- "Title 29 § 2590.701-6 Special enrollment periods" Code of Federal Regulations. Accessed Feb. 3, 2026 ⤶

- “Short-Term, Limited-Duration Insurance” page 51. Federal Register. Accessed Feb. 3, 2026 ⤶

Have you experienced a qualifying life event?

Get your free quote now through licensed agency partners!