Medicare in New Mexico

New Mexico does not require Medigap insurers to offer coverage to beneficiaries under age 65, but the state does have a high-risk pool for these enrollees

Key Takeaways

- More than 462,000 New Mexico residents are enrolled in Medicare.1

- 50% of New Mexico Medicare beneficiaries are enrolled in Medicare Advantage plans.1

- Medicare Advantage availability in New Mexico ranges from three to more than 30+ plans for 2025, depending on the county.2

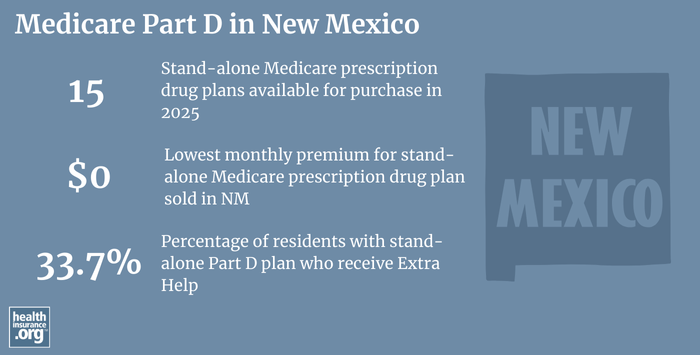

- There are 15 stand-alone Part D prescription drug plans available in New Mexico in 2025, with premiums that start at $0 per month .3

Medicare enrollment in New Mexico

There were 462,936 residents enrolled in Medicare in New Mexico as of September 2024, which amounts to about 20% of the state’s population.14

For most individuals, Medicare enrollment goes along with turning 65. But younger individuals become eligible for Medicare if they have been receiving disability benefits for 24 months, or if they have end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS). Both in New Mexico and nationwide, about 11% of all Medicare beneficiaries are under the age of 65.14

Learn about Medicare plan options in New Mexico by contacting a licensed agent.

Explore our other comprehensive guides to coverage in New Mexico

We’ve created this guide to help you understand the New Mexico health insurance options available to you and your family, and to help you select the coverage that will best fit your needs and budget.

Learn about health insurance coverage options in New Mexico.

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in New Mexico.

Learn about New Mexico’s Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in New Mexico.

Frequently asked questions about Medicare in New Mexico

What is Original Medicare?

Original Medicare, which includes Medicare Part A (hospital coverage) and Medicare Part B (physician/outpatient coverage), is the same in every state. So overall Medicare eligibility in New Mexico and Medicare enrollment in New Mexico both work the same way they do everywhere else. For people who aren’t yet receiving Social Security benefits and thus aren’t automatically enrolled when they turn 65, the Medicare application in New Mexico is done via the Social Security Administration, as is the case nationwide.

But the availability and pricing of Medicare coverage, including Medicare Advantage plans, Medigap plans, and Medicare Part D prescription drug plans, does vary from state to state.

- Read our guide to Medicare’s open enrollment.

- Understand the difference between Medigap, Medicare Advantage, and Medicare Part D.

- Learn about how New Mexico Medicaid can help Medicare beneficiaries with limited income and assets.

What is Medicare Advantage?

Medicare Advantage plans are an alternative to Original Medicare. Medicare Advantage plans include all of the healthcare benefits of Original Medicare (albeit with different out-of-pocket costs and typically a much more limited provider network), and many Medicare Advantage plans also include Medicare Part D prescription drug coverage as well as additional benefits like dental and vision coverage.

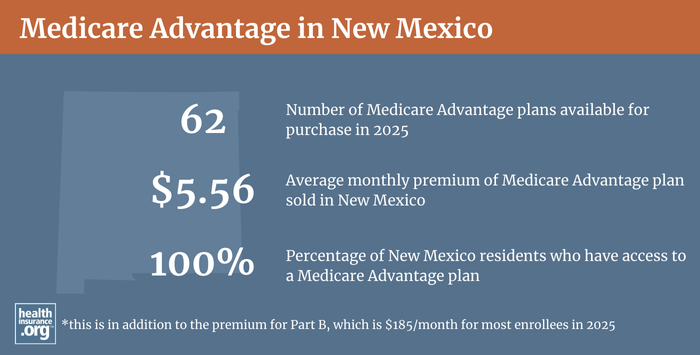

There are pros and cons to either option, and the right solution is different for each person. Medicare Advantage plan availability varies by county: In Union County, there are only three Medicare Advantage plans from which to choose for 2025 coverage, while several other counties have 30+ plans available.2

For 2025, the total number of Medicare Advantage plans available in New Mexico is dropping to 62, down from 66 in 2024 (but again, not all plans are available in all areas).3

Nationwide, and in New Mexico, more than a third of all Medicare beneficiaries were enrolled in Medicare Advantage plans as of 2018.56 By September 2024, there were 231,911 New Mexico Medicare Advantage beneficiaries with coverage.1 The other 49% of New Mexico’s Medicare beneficiaries had Original Medicare as of late 2024.1

The Medicare Annual Election Period (October 15 to December 7 each year) allows Medicare beneficiaries the chance to switch between Medicare Advantage and Original Medicare (and add, drop, or switch to a different Medicare Part D prescription drug plan). There is also a Medicare Advantage enrollment window that allows people who are already enrolled in Medicare Advantage plans to switch to a different Medicare Advantage plan or to Original Medicare. This is the Medicare Advantage Open Enrollment Period, which runs from January 1 to March 31.

What are Medigap plans?

Original Medicare does not limit out-of-pocket costs, so most enrollees maintain some form of supplemental coverage. Nationwide, more than half of Original Medicare beneficiaries get their Medicare Supplemental coverage through an employer-sponsored plan or Medicaid.7 But for those who don’t, Medigap policies (also known as Medicare Supplement insurance plans, or Medigap) will pay some or all of the out-of-pocket costs they would otherwise have to pay if they had only Original Medicare.

According to America’s Health Insurance Plans (AHIP) analysis, there were 71,380 New Mexico Medicare beneficiaries with Medigap coverage as of December 2022.8 The New Mexico Office of the Superintendent of Insurance used to maintain a page that listed the state’s Medigap insurers, but they removed it in 2019 as it was outdated. They confirmed that they do not currently maintain a listing of Medigap insurers in the state, although filing data is available on SERFF. But Medicare’s Medigap plan finder tool shows all of the insurers that offer Medigap plans; there are 30 separate insurers offering Medigap plans in New Mexico as of 2025.9

Although Medigap plans are sold by insurance carriers, the plans are standardized under federal rules, with ten different plan designs (differentiated by letters, A through N). The benefits offered by a particular plan (Plan A, Plan M, etc.) are the same regardless of which insurer sells the plan. However, coverage may vary.10

Unlike other Medicare plan coverage (Medicare Advantage and Medicare Part D prescription drug plans), there is no annual enrollment period window for Medigap plans. Instead, federal rules provide a one-time six-month window when Medigap coverage is guaranteed issue. This window starts when a person is at least 65 and enrolled in Medicare Part B (you must be enrolled in both Medicare Part A and Medicare Part B to buy a Medigap plan).

People who aren’t yet 65 can enroll in Medicare if they’re disabled and have been receiving disability benefits for at least two years; about 11% of New Mexico Medicare beneficiaries are under age 65.1 Federal rules do not guarantee access to Medigap plans for people who are under 65. Although the majority of the states have taken action to ensure access to Medigap coverage for disabled enrollees, New Mexico is not among them.

The New Mexico Office of the Superintendent of Insurance confirmed that Medigap insurers in the state are not required to offer coverage to applicants under the age of 65. But insurers can do so voluntarily.

New Mexico is also one of several states where pre-Affordable Care Act (ACA) high-risk pools remain operational, with coverage available to supplement Medicare if the enrollee is unable to obtain Medigap coverage.

New Mexico is one of several states where private Medigap insurers are not required to offer plans to people under age 65, but state high-risk pool coverage provides a back-up option. The others are Alaska, Iowa, Nebraska, North Dakota, South Carolina, Washington, and Wyoming.

Disabled Medicare beneficiaries have access to the Medigap Open Enrollment Period when they turn 65. At that point, they can enroll in a Medigap plan with the normal premiums that apply to people who are enrolling in Medicare due to age, rather than disability.

Disabled Medicare beneficiaries have the option to enroll in a Medicare Advantage plan instead of Original Medicare (this includes people with kidney failure, who were not eligible to enroll in most Medicare Advantage plans prior to 2021). Medicare Advantage monthly plan premiums are not higher for those under 65. But Medicare Advantage plans may have more limited provider networks than Original Medicare, and total out-of-pocket costs can be as high as $9350 in 2025 for in-network care, plus the out-of-pocket cost of prescription drugs.11

Although the Affordable Care Act eliminated pre-existing condition exclusions in most of the private health insurance market, those rules don’t apply to Medigap plans. Medigap insurers can impose a pre-existing condition waiting period of up to six months if you didn’t have at least six months of continuous coverage prior to your enrollment (although not all of them choose to do so). And if you apply for a Medigap plan after your initial enrollment window closes (assuming you aren’t eligible for one of the limited guaranteed-issue rights), the Medigap insurer can consider your medical history in determining whether to accept your application and at what premium.

What is Medicare Part D?

Original Medicare does not provide coverage for outpatient prescription drugs. More than half of Original Medicare beneficiaries nationwide have supplemental coverage via an employer-sponsored plan (from a current or former employer or spouse’s employer) or Medicaid, and these plans often include prescription coverage.7

But Medicare beneficiaries who do not have prescription drug coverage through Medicaid or an employer-sponsored plan may need Medicare Part D in order to have coverage for prescription drugs. Medicare Part D can be purchased as a stand-alone Medicare Part D prescription drug plan or integrated with a Medicare Advantage plan. Medicare Part D prescription drug plan was created under the Medicare Modernization Act of 2003, which was signed into law by President George W. Bush.

Medicare Part D prescription drug plan enrollment is available when a beneficiary first becomes eligible for Medicare. And the Medicare Annual Election Period each fall (October 15 to December 7) allows beneficiaries the opportunity to change to a different Medicare Part D prescription drug plan or enroll for the first time if they didn’t do so when they were first eligible, albeit with a late enrollment penalty if they didn’t have creditable coverage prior to enrolling.

In terms of plan availability, there are 15 stand-alone Medicare Part D prescription drug plans in New Mexico in 2025, with premiums that start at $0 per month.3

A total of 360,751 New Mexico Medicare beneficiaries had Medicare Part D prescription drug coverage as of September 2024.1 That included 140,554 with stand-alone Medicare Part D prescription drug plans, and 220,197 with Part D prescription drug coverage integrated with Medicare Advantage.1

How does Medicaid provide financial assistance to Medicare beneficiaries in New Mexico?

Many Medicare beneficiaries receive financial assistance through Medicaid with the cost of Medicare premiums and services Medicare doesn’t cover – such as long-term care.

Our guide to financial assistance for Medicare enrollees in New Mexico includes overviews of these programs, including long-term care coverage, Medicare Savings Programs, and eligibility guidelines for assistance.

What additional resources are available for Medicare beneficiaries and their caregivers in New Mexico?

You can contact the New Mexico State Health Insurance Assistance Program with questions related to Medicare eligibility in New Mexico and Medicare enrollment in New Mexico.

The New Mexico Office of the Superintendent of Insurance (Russell Toal) can provide assistance and customer service with a variety of insurance-related issues, and they license and oversee the health insurers, brokers, and agents that offer coverage in the state.

The page details how New Mexico Medicaid can provide assistance to Medicare beneficiaries in the state who have limited financial means.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in New Mexico?

Explore more resources for options in New Mexico including ACA coverage, short-term health insurance, dental insurance and Medicaid.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- “Medicare Monthly Enrollment – New Mexico ” Centers for Medicare & Medicaid Services Data. Accessed January, 2025. ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶

- ”Medicare Advantage 2025 Spotlight: First Look” KFF.org Nov. 15, 2024 ⤶ ⤶

- ”Fact Sheet: Medicare Open Enrollment for 2025” (95) Centers for Medicare & Medicaid Services. Sep. 27, 2024 ⤶ ⤶ ⤶

- “U.S. Census Bureau Quick Facts: U.S. & New Mexico.” U.S. Census Bureau, July 1, 2024. ⤶ ⤶

- Monthly Medicare Enrollment – US (2018).” Centers for Medicare & Medicaid Services Data, May 2018. ⤶

- “Medicare Monthly Enrollment – New Mexico ” Centers for Medicare & Medicaid Services Data, June 2023. ⤶

- Ochieng, Nancy, Gabrielle Clerveau, and Tricia Neuman. “A Snapshot of Sources of Coverage among Medicare Beneficiaries.” Kaiser Family Foundation, August 14, 2023. ⤶ ⤶

- ”The State of Medicare Supplement Coverage” AHIP. May 2024 ⤶

- “Explore your Medicare coverage options.” Medicare.gov. Accessed October, 2024. ⤶

- “Compare Medigap Plan Benefits.” Medicare.gov. Accessed September 26, 2023. ⤶

- ”Final Contract Year (CY) 2025 Standards for Part C Benefits, Bid Review and Evaluation” Centers for Medicare & Medicaid Services. May 6, 2024 ⤶