Home > States > Health insurance in Oregon

See your Oregon health insurance coverage options.

Find individual and family plans, small-group, short-term or Medicare plans through licensed agency partners.

Oregon Health Insurance Consumer Guide

This guide is designed to help you understand the health coverage options and possible financial assistance available to you and your family in Oregon. Many people find that an ACA Marketplace (exchange) plan, often called Obamacare, is a cost-effective choice.

Oregon operates a state-run health insurance Marketplace but uses the HealthCare.gov enrollment platform (ie, an SBE-FP). That will change as of the fall of 2026, however, when Oregon will start running its own Marketplace platform, under the terms of legislation (SB972) the state enacted in 2023.1

(Oregon had a fully state-run exchange in 2014 but the website didn’t work well and the state opted to switch to an SBE-FP starting in the fall of 2014.2 The plan is now to transition back to an SBE in the fall of 2026.)

For now, you can visit OregonHealthCare.gov to gather information about health insurance plans, eligibility, and more.3 When you’re ready to apply and enroll, you’ll be directed to HealthCare.gov to complete the enrollment.

Explore our other comprehensive guides to coverage in Oregon

Dental coverage in Oregon

In 2023, six insurers offer stand-alone individual/family dental coverage through the health insurance Marketplace in Oregon.

Oregon’s Medicaid program

Oregon adopted the Medicaid eligibility expansion under the Affordable Care Act in 2014.4 Since then, the state has experienced one of the most significant percentage increases in Medicaid and CHIP enrollment.

Medicare coverage options and enrollment in Oregon

As of April 2023, more than 920,000 people in Oregon have Medicare coverage.5 Learn more about enrollment in Medicare and the state’s protections for Medigap enrollees.

Short-term coverage in Oregon

Duration of short-term health insurance plans in Oregon is restricted to three months. As of 2023, at least three insurers offer short-term health insurance plans in Oregon.

Frequently asked questions about health insurance in Oregon

Who can buy Marketplace health insurance?

You can buy a health plan through the Oregon exchange if:6

- You reside in Oregon.

- You are a U.S. citizen or national.

- You are not incarcerated.

- You are not already enrolled in Medicare.

To qualify for financial assistance (premium subsidies and cost-sharing reductions), you must meet additional requirements:

- Your eligibility for premium subsidies depends on your income and how it compares with the cost of the second-lowest-cost Silver plan in your area. The cost of that Silver plan varies based on your age and location.

- You must not have access to affordable health coverage offered by an employer. If your employer offers health insurance, but you feel it’s too expensive, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies in the Marketplace.

- You must not be eligible for Medicaid or CHIP.

- You must not be eligible for premium-free Medicare Part A.7

When can I enroll in an ACA-compliant plan in Oregon?

In Oregon, open enrollment for ACA Marketplace individual and family health coverage is from November 1 through January 15.

Enrolling in an exchange plan or changing your coverage outside of the open enrollment period is possible if you meet the criteria for a Special Enrollment Period (SEP).8 This means you must have a qualifying life event, such as losing your health insurance, getting married, or having a baby.

If the open enrollment deadline has passed and you don’t meet the SEP requirements, you can still sign up for an ACA plan. However, specific conditions need to be met, such as:

- Your income falls at or below 150% of the poverty level, and you’re eligible for premium tax credits. In this scenario, you can enroll anytime until at least the end of 2025 (HHS has proposed extending this indefinitely.9 However, Oregon will no longer be using the HealthCare.gov enrollment platform after 2026, so will have some flexibility to set its own SEP rules10).

- Native Americans can enroll or switch plans year-round.

For people who lose Medicaid or CHIP coverage between March 31, 2023, and July 31, 2024, there’s an extended SEP available for enrollment.11

Oregon also received federal approval to not disenroll people from Medicaid if their income isn’t more than 200% of the poverty level (the normal limit is 138%), while the state waits to implement a Basic Health Program that’s expected to be up and running by July 2024. So some people have been able to remain on Medicaid in Oregon even though they would have been disenrolled in most other states.

How do I enroll in a Marketplace plan in Oregon?

Here are the main ways to enroll in a Marketplace health plan in Oregon:

- Online: You can visit OregonHealthCare.gov to learn more about health insurance plans and eligibility.12 When it’s time to apply and enroll, you’ll be redirected to the federal Marketplace website, HealthCare.gov. (Oregon’s new state-run Marketplace platform is expected to debut in the fall of 2026.)

- By Phone: Dial 1-800-318-2596 (TTY: 1-855-889-4325) to enroll with a Marketplace representative. The call center is available 24 hours a day, seven days a week, but it’s closed on holidays.

- In-person: Enrollment assistance is also available from trained Navigators and assisters who can answer your questions. Go to localhelp.HealthCare.gov or OregonHealthCare.gov/GetHelp to find local help in your area.13

Assistance is available from local Navigators and brokers. Enrollments can also be completed via an approved enhanced direct enrollment (EDE) entity, using the EDE’s website.14

How can I find affordable health insurance in Oregon?

Oregon’s ACA Marketplace (HealthCare.gov) is a one-stop shop where individuals and families can find affordable health insurance coverage in Oregon. There are two types of financial assistance available through the Marketplace:

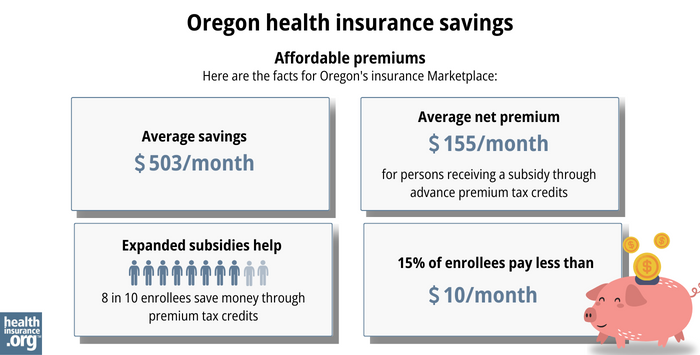

- Premium subsidies: You may qualify for income-based subsidies known as Advance Premium Tax Credits (APTC) that help lower your monthly premiums through the ACA Marketplace. About eight out of 10 Oregon exchange enrollees qualified for premium subsidies in 2023, saving around $503 monthly. People who receive these subsidies pay an average monthly premium of $155 in 2023.15

- Cost-sharing reductions: You may be eligible for cost-sharing reductions (CSR) if your income is no more than 250% of the federal poverty level,16 and you enroll in a Silver-level plan through the Oregon Marketplace. CSRs help lower your out-of-pocket costs, making coverage more affordable.17

Oregon implemented a reinsurance program starting in 2018, using a 1332 waiver that allows the state to capture federal savings generated by the program.18 Reinsurance is designed to keep unsubsidized (full-price) premiums lower than they would otherwise be. Although most enrollees do qualify for premium subsidies, the reinsurance program helps to minimize premiums for those who don’t.

Oregon also requires all state-regulated health plans, including Marketplace plans, to cover both female and male contraception (including vasectomies), as well as abortion, all without out-of-pocket costs.19

Medicaid: Oregon residents may qualify for Medicaid coverage if eligible based on income. Medicaid in Oregon is called Oregon Health Plan, and has no monthly premiums.20

Basic Health Program — available starting mid-2024: Oregon is working to create a Basic Health Program that is expected to be available by July 2024, pending federal approval. Coverage under this program would be available to Oregon residents with income above 138% of the poverty level but not above 200% of the poverty level.21

Short-term health insurance: If you’re not eligible for subsidies, Medicare, or Medicaid, short-term health insurance, available in Oregon with terms of up to three months, might be an affordable temporary solution.

How many insurers offer Marketplace coverage in Oregon?

Are Marketplace health insurance premiums increasing in Oregon?

The following average rate changes were approved for 2024 for Oregon’s individual/family market health insurers, amounting to an overall weighted average rate increase of 6.2%:24

Oregon’s ACA Marketplace Plan 2024 Approved Average Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| BridgeSpan Health Company | 8.4% |

| Kaiser Foundation Healthplan of the NW | 7.9% |

| Moda Health Plan, Inc. | 3.9% |

| PacificSource Health Plans | 3.5% |

| Providence Health Plan | 8.5% |

| Regence BlueCross BlueShield of Oregon | 4.7% |

Source: Oregon.gov24

The average rate changes apply to full-price premiums. However, about 81% of Oregonians who enrolled in ACA plans received subsidies in 2023 – which means they did not pay the full rate.15

In addition, subsidy amounts are adjusted each year based on the cost of the second-lowest-priced Silver plan. So, as coverage costs increase, subsidies may also grow to offset part of the change.

If your plan’s rates are increasing next year, consider exploring other options on the ACA Marketplace. You may find a more affordable plan that still meets your coverage needs.

For perspective, here’s a summary of how average full-price (unsubsidized) premiums have changed in Oregon’s individual market over the years:

- 2015: Average decrease of 5%.25

- 2016: Average increase of 24.2%.26

- 2017: Average increase of 26.5%.27

- 2018: Average increase of 15.7%.28 (reinsurance took effect;18 Federal CSR funding eliminated29)

- 2019: Average increase of 7.3%30

- 2020: Average increase of 1.5%.31

- 2021: Average increase of 2.1%.32

- 2022: Average increase of 1.5%.33

- 2023: Average increase of 6.7%.34

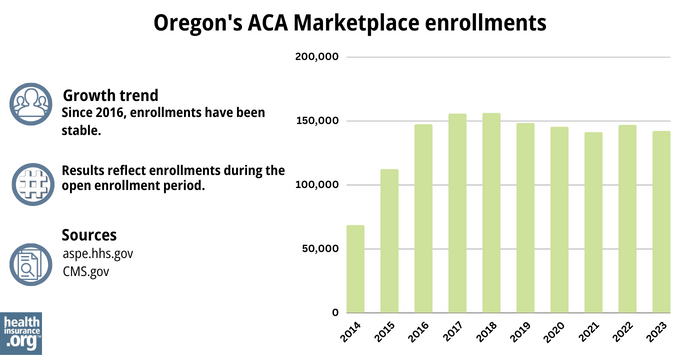

How many people are insured through Oregon’s Marketplace?

During the 2023 open enrollment period, 141,963 people signed up for individual/family health coverage through the Oregon exchange.15

Enrollment in Oregon declined slightly from 2022 to 2023, although enrollment nationwide hit a record high.

Source: 2014,35 2015,36 2016,37 2017,38 2018,39 2019,40 2020,41 2021,42 2022,43 202344

What health insurance resources are available to Oregon residents?

OregonHealthCare.gov

A state-run service that connects Oregon residents with health coverage options.

HealthCare.gov

The Marketplace for individuals and families buying their own health coverage; premium subsidies and cost-sharing reductions are available for eligible enrollees who use the Marketplace.

Oregon Division of Financial Regulation

Licenses and regulates health insurance companies in Oregon, as well as agents and brokers. Can address consumer questions and complaints about regulated entities.

Medicare Rights Center

A nationwide resource that can answer questions about Medicare and provide information that beneficiaries need.

Oregon Senior Health Insurance Benefits Assistance

A local service that can provide assistance, information, and enrollment counseling to Medicare beneficiaries and their caregivers.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- Oregon Senate Bill 972. BillTrack50. Enacted August 2023. ⤶

- Oregon decides to ditch its online health exchange for federal site. PBS News Hour. April 2014. ⤶

- “Explore your coverage and savings options” OregonHealthCare.gov, Accessed September 2023 ⤶

- “Oregon’s Medicaid Expansion Drove Shifts in Health Care Spending“ Center for Health Systems Effectiveness” November 2018 ⤶

- “Medicare Monthly Enrollment” CMS.gov, April 2023 ⤶

- “Are you eligible to use the Marketplace?” HealthCare.gov, 2023 ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- “Enroll in or change 2023 plans – only with a Special Enrollment Period” HealthCare.gov, 2023 ⤶

- HHS Notice of Benefit and Payment Parameters for 2025 Proposed Rule. Centers for Medicare and Medicaid Services. November 2023. ⤶

- A state-based health insurance exchange in Oregon would protect access to coverage. Korbulic, Heather. Oregon Capital Chronicle. October 2023. ⤶

- “Temporary Special Enrollment Period (SEP) for Consumers Losing Medicaid or the Children’s Health Insurance Program (CHIP) Coverage Due to Unwinding of the Medicaid Continuous Enrollment Condition– Frequently Asked Questions (FAQ)” CMS.gov, Jan. 27, 2023 ⤶

- “Explore your coverage and savings options” OregonHealthCare.gov, Accessed September 2023 ⤶

- “Find Local Help” OregonHealthCare.gov, Accessed September 2023 ⤶

- “Entities Approved to Use Enhanced Direct Enrollment” CMS.gov, April 28, 2023 ⤶

- “2023 Marketplace Open Enrollment Period Public Use Files”CMS.gov, March 2023 ⤶ ⤶ ⤶

- “Federal Poverty Level (FPL)” HealthCare.gov, 2023 ⤶

- APTC and CSR Basics. Centers for Medicare and Medicaid Services. June 2023. ⤶

- Section 1332: State Innovation Waivers-Oregon. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶ ⤶

- Reproductive Health Equity Act FAQs. Planned Parenthood. Accessed November 2023. ⤶

- Oregon Health Plan. Oregon Health Authority. Accessed November 2023. ⤶

- Oregon receives state approval for Basic Health Program. Oregon Health Authority. September 2023. ⤶

- ACA-Compliant Plans 2024 Health Insurance Rate Requests Oregon.gov, 2023. ⤶

- Oregon finalizes 2024 health rates for individual, small group markets; sees robust options in all counties. Oregon.gov, September 2023. ⤶

- Oregon finalizes 2024 health rates for individual, small group markets; sees robust options in all counties. Oregon.gov, September 2023. ⤶ ⤶

- Analysis Finds No Nationwide Increase in Health Insurance Marketplace Premiums. The Commonwealth Fund. December 2014. ⤶

- Oregon: Final 2016 Rate Hikes Approved…24.2% Weighted Average Increase, But… ACA Signups. July 2015. ⤶

- Avg. UNSUBSIDIZED Indy Mkt Rate Hikes: 25% (49 States + DC). ACA Signups. October 2016. ⤶

- 2018 Rate Hikes. ACA Signups. October 2017. ⤶

- State announcement regarding Trump administration discontinuation of cost-sharing reduction payments. Oregon.gov. October 2017. ⤶

- 2019 Rate Hikes. ACA Signups. October 2018. ⤶

- Final health insurance rate decisions lower 2020 premiums by $44 million. Oregon.gov. July 2019. ⤶

- Oregon: Final Avg. 2021 ACA Rate Change: +2.1%; +3.7% For Sm. Group. ACA Signups. October 2020. ⤶

- ACA-Compliant Plans 2022 Health Insurance Rate Requests. Oregon Department of Financial Regulation. September 2021. ⤶

- ACA-Compliant Plans 2023 Health Insurance Rate Requests. Oregon Department of Financial Regulation. September 2022. ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- “Health Insurance Marketplaces 2023 Open Enrollment Report” CMS.gov, 2023 ⤶