Home > States > Health insurance in Pennsylvania

See your Pennsylvania health insurance coverage options.

Find individual and family plans, small-group, short-term or Medicare plans through licensed agency partners.

Pennsylvania Health Insurance Consumer Guide

This guide was developed to help you choose the right Pennsylvania health insurance plan for you and your family. The options found in Pennsylvania’s ACA Health Insurance Marketplace can be a good choice for individuals and families who don’t have access to employer-sponsored health insurance or government-run coverage like Medicare or Medicaid.

Pennsylvania uses a fully state-run health insurance Marketplace known as Pennie to enroll its residents in ACA Marketplace plans. The Marketplace provides access to health insurance products from private insurers. The Pennsylvania Health Insurance Marketplace is robust, with 14 insurers offering coverage for 2024 — including Jefferson Health Plans, which is new for 2024.1

Depending on your income and other circumstances, Pennsylvania Marketplace enrollees may also get help to lower their monthly insurance premium (the amount you pay to enroll in the coverage) and possibly out-of-pocket expenses.

Pennsylvania also has an “easy enrollment” program that allows uninsured residents to access Pennsylvania health insurance via their state tax returns.2 The state also established a reinsurance program that took effect in 2021, helping to keep unsubsidized individual/family health insurance premiums lower than they would otherwise be.3

Explore our other comprehensive guides to coverage in Pennsylvania

Dental coverage in Pennsylvania

In 2023, seven insurers offer stand-alone individual/family dental coverage through the health insurance Marketplace in Pennsylvania.4

Pennsylvania’s Medicaid program

Medicaid expansion in Pennsylvania took effect in January 2015. As of 2023, more than 3.4 million people were enrolled in Pennsylvania’s expanded Medicaid.5

Medicare coverage and enrollment in Pennsylvania

Medicare enrollment in Pennsylvania stood at 2,875,916 people as of May 2023.6 Our guide explains everything you need to know about Medicare and Medigap plans in Pennsylvania.

Short-term coverage in Pennsylvania

As of 2023, at least one insurer was selling short-term health insurance plans in Pennsylvania.7

Frequently asked questions about health insurance in Pennsylvania

Who can buy Marketplace health insurance?

To be eligible to enroll in Pennsylvania Health Insurance Marketplace coverage, you must:

- Live in Pennsylvania

- Be lawfully present in the United States

- Not be incarcerated.

- Not be enrolled in Medicare

Eligibility for financial assistance in the form of premium subsidies and cost-sharing reductions depends on your income and how it compares with the cost of the second-lowest-cost Silver plan in your area – which depends on your age and location. In addition, to qualify for financial assistance with your Marketplace plan you must:

- Not have access to affordable health coverage through your employer. If your employer offers coverage but you feel it’s too expensive, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies in the Marketplace.

- Not be eligible for Medicaid or CHIP, or premium-free Medicare Part A.

When can I enroll in an ACA-compliant plan in Pennsylvania?

In Pennsylvania the open enrollment period for individual and family coverage runs from November 1 to January 15.8

Your coverage starts on January 1 if you enroll before December 15. But if you apply between December 16 and January 15, your coverage will begin on February 1.8

Outside of open enrollment, you’ll need a special enrollment period (SEP) to enroll or make changes to your coverage. In most cases, a SEP requires a qualifying life event, but there are some SEPs that do not.

If you’re disenrolled from Pennsylvania Medicaid during the “unwinding” of the pandemic-era continuous coverage rule, you’ll have an opportunity to sign up for coverage through Pennie at that point, without having to wait for open enrollment. Medicaid disenrollments resumed in April 2023 in Pennsylvania (after being paused since March 2020), and by July, 12,813 people previously covered by Medicaid had enrolled in private health plans through Pennie.9

Pennsylvania also has an “easy enrollment” program that allows uninsured residents to begin the process of accessing health insurance via their state tax returns.2

How do I enroll in a Pennsylvania Marketplace plan?

To enroll in an ACA Marketplace plan in Pennsylvania, you can:

- Visit Pennie to enroll in Pennsylvania’s Marketplace. Here you will find an online platform to shop, compare plans and determine your subsidy eligibility.

- Purchase individual and family health coverage with the help of an insurance agent or broker, a Navigator or certified application counselor, or an approved enhanced direct enrollment entity.10

How can I find affordable health insurance in Pennsylvania?

You may find affordable health insurance options in Pennsylvania by utilizing the state’s health insurance exchange – Pennie. Here, residents can enroll in health coverage as well as determine their eligibility for financial assistance.

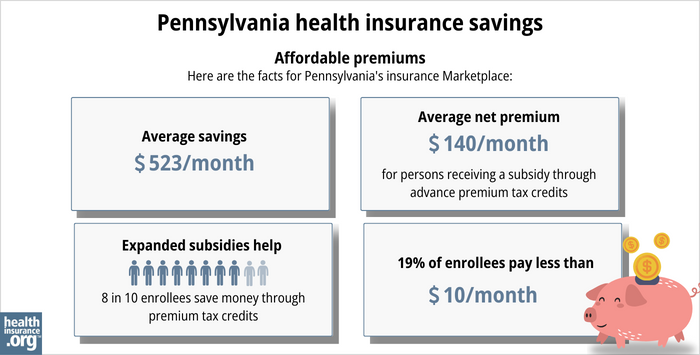

As of early 2023, nearly nine out of ten eligible enrollees on Pennie saved money on their premium payments amounting to an average savings of $523/month. With subsidies, enrollees paid an average of $140 per month for health coverage.11

The Affordable Care Act provides income-based advance premium tax credits (subsidies) that offset your premium payments to help keep your expenses down. People with household incomes below 250%of the federal poverty level also qualify for cost-sharing reductions (CSR) that may reduce your deductibles and out-of-pocket expenses when you buy a Silver plan. Between the premium subsidies and cost-sharing reductions, you may find that an ACA plan is the cheapest health insurance option for you.

Source: CMS.gov11

How many insurers offer Marketplace coverage in Pennsylvania?

The following insurers offer plans through Pennie for 2024, with varying coverage areas:12

- Capital Advantage Assurance

- Geisinger Health Plan

- Geisinger Quality Options

- Highmark, Inc.

- Highmark Benefits Group

- Highmark Coverage Advantage

- Keystone Health Plan East (Independence Blue Cross HMO)

- QCC Insurance Company (Independence Blue Cross PPO)

- UPMC Health Coverage

- UPMC Health Options

- PA Health and Wellness

- Oscar Health

- Cigna

- Jefferson Health Plans (new for 2024)13

Are Marketplace health insurance premiums increasing in Pennsylvania?

According to the Pennsylvania Insurance Department, the following average rate changes were approved for 2024 for individual/family health insurance in Pennsylvania:1

Pennsylvania’s ACA Marketplace Plan 2024 Approved Rate Changes by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Capital Advantage Assurance | 7.9% |

| Geisinger Health Plan | 7.3% |

| Geisinger Quality Options | 7.1% |

| Highmark, Inc. (EPO and PPO) | 10% |

| Highmark Benefits Group | 11.9% |

| Highmark Coverage Advantage | 8% |

| Keystone Health Plan East (Independence Blue Cross HMO) | –3.5% |

| QCC Insurance Company (Independence Blue Cross PPO) | –2.7% |

| UPMC Health Coverage | 7.6% |

| UPMC Health Options | 6.2% |

| PA Health and Wellness | 2.3% |

| Oscar Health | 6.8% |

| Cigna | 13.1% |

| Jefferson Health Plans | new for 2024 |

Source: Pennsylvania Insurance Department1

The overall average rate increase for 2024 amounts to 3.9%.14

Average rate changes are applicable to full-price health plans, but the majority of Pennsylvania health insurance marketplace enrollees receive premium subsidies, and thus do not pay full price.15 Net premium changes depend on how much the plan’s rate is changing as well as how much the person’s premium subsidy is changing for the coming year.

For perspective, here’s a summary of how average full price premiums for Pennsylvania health insurance have changed over time:

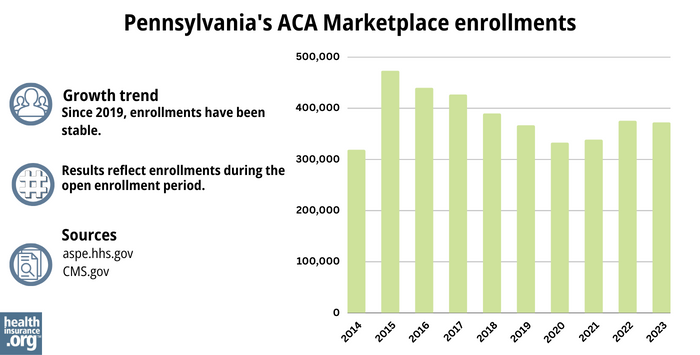

How many people are insured through Pennsylvania’s Marketplace?

What health insurance resources are available to Pennsylvania residents?

Pennie

The official Pennsylvania health coverage Marketplace.

State Exchange Profile: Pennsylvania

The Henry J. Kaiser Family Foundation overview of Pennsylvania’s progress toward creating a state health insurance exchange.

Health Care Matters, Pennsylvania Office of the Attorney General

Serves Pennsylvania consumers with health-related problems.

(717) 705-6938 / Toll-free: 1-877-888-4877 (only in Pennsylvania)

Pennsylvania Consumer Assistance Program

Assists people with private insurance, Medicaid, or other insurance with resolving problems pertaining to their health coverage; assists uninsured residents with access to care.

(877) 881-6388 / [email protected]

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- “Affordable Care Act Health Rate Filings; ACA-Related Rate Filings for 2024 Plans” Pennsylvania Insurance Department. Accessed October 2023 ⤶ ⤶ ⤶

- ”Path to Pennie” Pennie.com. Accessed October 2023. ⤶ ⤶

- Section 1332 Waiver. Pennsylvania Insurance Department. Accessed November 2023. ⤶

- “Pennsylvania dental insurance guide 2023” healthinsurance.org, Accessed September 2023 ⤶

- “April 2023 Medicaid & CHIP Enrollment Data Highlights” Medicaid.gov, April 28, 2023 ⤶

- “Medicare Monthly Enrollment” CMS.gov, May 2023. ⤶

- “Availability of short-term health insurance in Pennsylvania” healthinsurance.org, Sept. 5, 2022 ⤶

- “When can you get health insurance?” HealthCare.gov, 2023 ⤶ ⤶

- State-based Marketplace (SBM) Medicaid Unwinding Report. Medicaid.gov. October 31, 2023. ⤶

- “Entities Approved to Use Enhanced Direct Enrollment” CMS.gov, April 28, 2023 ⤶

- “2023 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2023 ⤶ ⤶ ⤶ ⤶

- “Pennsylvania Rate Review Submissions” HealthCare.gov, Accessed August 2023 ⤶

- ”Pennsylvania 2024 rate filing details for Jefferson Health Plans” Pennsylvania Insurance Department. Accessed October 2023. ⤶

- ”Shapiro Administration Announces 2024 Health Insurance Rates” Pennsylvania Pressroom. September 28, 2023. ⤶

- ”Effectuated Enrollment: Early 2023 Snapshot and Full Year 2022 Average” Centers for Medicare and Medicaid Services. Accessed October 2023. ⤶

- ”Analysis Finds No Nationwide Increase in Health Insurance Marketplace Premiums” The Commonwealth Fund. December 2014. ⤶

- ”Pennsylvania: APPROVED 2016 Avg. Rate Hike: 12.0% (Reduced From 15.6%)” ACA Signups. October 2015. ⤶

- ”ACA Rates Q&A” Pennsylvania Insurance Department. Accessed October 2023. ⤶

- ”ACA Insurance Rates Spike 30.6% in Pennsylvania, on Average” National Federation of Independent Businesses. October 2017. ⤶

- ”Rate Change Request Summary – 2019” Pennsylvania Insurance Department. Accessed October 2023. ⤶

- ”Pennsylvania: *Final* 2020 Avg. #ACA Exchange Rate Changes: 3.8% Increase” ACA Signups. October 2019. ⤶

- ”PA’s ACA Marketplace Rates to Decrease by an Average of 3.3% in 2021” Pennsylvania Health Access Network. October 2020. ⤶

- ”Pennsylvania: Approved 2022 #ACA Rate Changes: +0.2% Individual Market, +4.8% Sm. Group Market” ACA Signups. October 2021. ⤶

- ”Pennsylvania: Final 2023 Unsubsidized #ACA Rate Changes: +5.5% (Down From +7.1%)” ACA Signups. October 2022. ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶