Home > States > Health insurance in New York

See your New York health insurance coverage options.

Find individual and family plans, small-group, short-term or Medicare plans through licensed agency partners.

New York Health Insurance Consumer Guide

We’ve created this guide and the FAQs below to help you understand the health coverage options and financial assistance available to you and your family in New York. The options found in New York’s Marketplace may be a good choice for many consumers, and we will guide you through the options below.

New York residents use a fully state-run health insurance Marketplace known as NY State of Health, where a dozen private insurers offer health plans for 2024.1

The Marketplace also provides residents access to apply for the state’s Basic Health Program known as the Essential Plan (BHP),2 which offers premium-free coverage to residents whose income is too high to qualify for Medicaid or Child Health Plus, but not more than 200% of the poverty level. This income limit is increasing to 250% of the poverty level as of April 2024, making premium-free Essential Plan coverage newly available to 100,000 additional New Yorkers.3

NY State of Health also offers a small business portal where employers with up to 100 employees can compare group health plans. In most states, “small group” means up to 50 employees, but New York is one of four states where small group plans are available to groups of up to 100 employees.4

Explore our other comprehensive guides to coverage in New York

Dental coverage in New York

In 2023, seven insurers offer stand-alone individual/family dental coverage through NY State of Health.5

New York’s Medicaid program

Medicaid expansion in New York took effect in 2014. Total Medicaid enrollment in the state has increased to more than 7 million people in 2023.6

Medicare coverage and enrollment in New York

Medicare enrollment in New York stood at nearly 3.8 million people as of 2023.7 Our guide will help you better understand Medicare coverage options and Medicare-specific regulations in New York.

Short-term coverage in New York

The sale of short-term health plans is not permitted in New York.8

Frequently asked questions about health insurance in New York

Who can buy Marketplace health insurance?

To purchase health coverage through the New York Health Insurance Marketplace, you must:9

- Live in New York

- Be lawfully present in the United States

- Not be incarcerated

- Not be enrolled in Medicare10

Eligibility for financial assistance (premium subsidies and cost-sharing reductions) depends on your household income. In addition, to qualify for financial assistance with your New York Marketplace plan you must:

- Not have access to affordable employer-sponsored health coverage. If your employer offers coverage but you feel it’s too expensive, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies in the Marketplace.

- Not be eligible for Medicaid, Child Health Plus, or The Essential Plan.

- Not be eligible for premium-free Medicare Part A.11

- If married, file a joint tax return.12

- Not be able to be claimed by someone else as a tax dependent.12

When can I enroll in an ACA-compliant plan in New York?

In New York, the open enrollment period has both a start and end date that differ from the schedule used in most other states. Open enrollment in New York starts November 16, and normally continues through January 3113

For 2024 coverage, however, New York State of Health is keeping enrollment open through May 31, 2024, due to the “unwinding” of the pandemic-era continuous coverage rule for Medicaid. So enrollment in 2024 qualified health plans in New York continues through May 2024, without the need for a qualifying life event. After that, a qualifying event will be necessary to sign up for 2024 coverage.14

(For 2025 and future years, the federal government has proposed a rule change that would require all state-run exchanges to begin open enrollment on November 1, and end it no sooner than January 15.15 If that rule is finalized, New York would have to change its open enrollment start date.)

Enrollment in Medicaid, Child Health Plus, and the Essential Plan continues year-round for eligible people.

For qualified health plans (ie, not Medicaid, CHP, or the Essential Plan), enrollment outside of the annual open enrollment window is only possible if you qualify for a special enrollment period, which is typically triggered by a specific qualifying life event.

New York is one of several states where pregnancy counts as a qualifying event. In most states, it’s the birth that triggers a special enrollment period, but New York allows the expectant mother to sign up for health insurance due to the pregnancy.16

If you have questions about open enrollment, you can learn more in our comprehensive guide to open enrollment. We also have a comprehensive guide to special enrollment periods.

How do I enroll in a New York Marketplace plan?

To enroll in an ACA Marketplace plan in New York, you can:

- Visit NY State of Health to access New York’s Marketplace, an online platform where you can compare plans, determine whether you’re eligible for financial assistance, and enroll in the plan that best meets your needs.

- Purchase NY State of Health Marketplace health coverage with the help of an insurance agent or broker, a Navigator, or a certified application counselor.17

You can contact NY State of Health by phone at 1-855-355-5777 (TTY: 1-800-662-1220)

How can I find affordable health insurance in New York?

New York residents use NY State of Health to enroll in health coverage and obtain income-based subsidies.

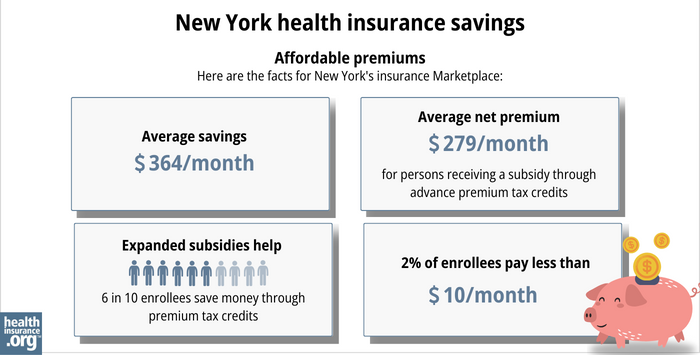

In the New York exchange, about 60% of enrollees were receiving premium subsidies as of early 2023 with an average subsidy of $364/month. After applying subsidies, enrollee premiums averaged $279/month.18

In addition to the private qualified health plans available through the state exchange, almost 1.2 million people were enrolled in Basic Health Program coverage through New York’s Essential Plan as of January 2024. Essential Plan enrollment is completed via NY State of Health, just like qualified health plan enrollment. But BHP coverage in New York dwarfs qualified health plan enrollment.19

The Essential Plan has zero premiums and low cost-sharing. It has thus-far been available to adults with household incomes up to 200% of the poverty level. But the state has obtained federal permission to extend the eligibility limit to 250% of FPL, starting in April 2024.3 For a single adult in 2024, this will allow access to the Essential Plan with a household income up to $37,650.

(New York had previously paused the proposal to extend Essential Plan eligibility in the fall of 2023,20 but subsequently asked the federal government to continue with the review and approval process,21 including an addition to ensure that DACA recipients can enroll in the Essential Plan — which was granted as part of the waiver approval.3)

Source: CMS.gov18

In addition to the ACA’s premium tax credits (subsidies), people with household incomes up to 250% of the federal poverty level also qualify for cost-sharing reductions (CSR) that reduce the out-of-pocket costs on Silver plans.

Because Essential Plan coverage extends to 200% of the poverty level in New York, relatively few enrollees (only those with income between 200% and 250% of FPL) are eligible for CSR benefits. This amounted to about 14% of the people who enrolled in private plans through NY State of Health during the open enrollment period for 2023 coverage.18

Starting in April 2024, there will no longer be anyone eligible for CSR benefits in New York, as Essential Plan coverage will extend to 250% of the poverty level.

A note about standardization of qualified health plans in New York: Insurers that offer plans through NY State of Health must offer one standard plan design in each metal level in every county where the insurer offers plans (here are the 2024 standardized plan details). Carriers can also offer up to two non-standard plan designs at each metal level.22

Since 2021, New York has required state-regulated (non-self-insured) health plans, including Marketplace plans, to cap out-of-pocket costs for insulin at no more than $100 per month.23 Legislation passed in the Senate in 2023 to lower that cap to $30, but did not advance in the Assembly.24 In 2024, the Senate passed legislation to eliminate cost-sharing for insulin, but it had not been taken up by the Assembly as of early March.[/efn_note]”New York S504” BillTrack50. Accessed March 4, 2024.[/efn_note]

How many insurers offer Marketplace coverage in New York?

Twelve insurers offer 2024 qualified health plans on the New York exchange. There are also a dozen insurers that offer Essential Plan coverage for 2024 (the two lists are nearly the same, but there are some insurers that only offer one or the other).1

Are Marketplace health insurance premiums increasing in New York?

The overall weighted average rate change for 2024 qualified health plans in New York amounted to an increase of 13.5%, before any subsidies were applied.25 As is typically the case in New York, the approved rates were quite a bit lower than the insurers had initially proposed, with significant modifications made during the rate review process.

Health insurance companies in New York have implemented the following rate changes for 2024, as approved by the New York State Department of Financial Services.26

New York’s ACA Marketplace Plan 2024 Approved Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Capital District Physicians’ Health Plan (CDPHP) | 12.1% |

| Emblem (Health Insurance Plan of Greater New York) | 25.1% |

| Anthem HP (formerly Empire HealthPlus) | 8.6% |

| Excellus Health Plan | 12.2% |

| Fidelis (New York Quality Health Care Corp) | 15.9% |

| Healthfirst PHSP | 12.5% |

| Highmark Western and Northeastern New York (formerly HealthNow) | 13% |

| Independent Health Benefits Corporation | 25.3% |

| Metro Plus Health Plan | 17.6% |

| MVP Health Plan | 6.5% |

| Oscar | 7.9% |

| UnitedHealthcare of New York | 12.2% |

Source: New York State Department of Financial Services26

It’s important to understand that net rate changes for people who receive premium subsidies can be quite different from the overall rate changes for that person’s plan, since it also depends on how the benchmark plan (second-lowest-cost silver plan) premium changes.

For perspective, here’s a summary of how average full-price (pre-subsidy) premiums for qualified health plans in New York’s individual/family market have changed over the years:

- 2015: Average increase of 5.7%.27

- 2016: Average increase of 7.1%.28

- 2017: Average increase of 16.6%.29

- 2018: Average increase of 13.9%.30

- 2019: Average increase of 8.6%.31

- 2020: Average increase of 6.8%.32

- 2021: Average increase of 1.8%.33

- 2022: Average increase of 3.7%.34

- 2023: Average increase of 9.7%.35

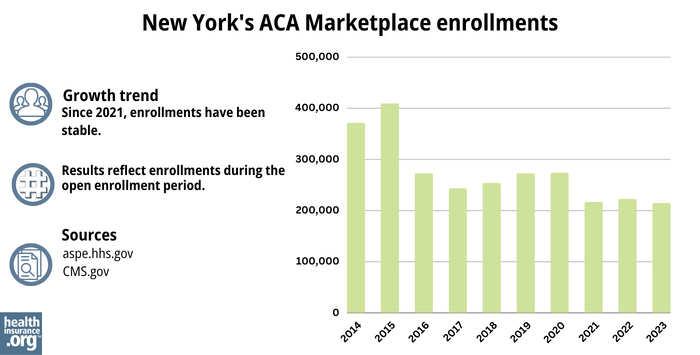

How many people are insured through New York’s Marketplace?

As of January 13, 2024, CMS reported that 279,879 people had enrolled in private qualified health plans through NY State of Health (this total does not include Essential Plan enrollments).36

By February 1, 2024, NY State of Health reported that 288,647 people were enrolled in qualified health plans through the exchange.37

Open enrollment continues through May 31, 2024 in New York (it normally ends January 31, but has been extended due to the “unwinding” of the Medicaid continuous coverage rule).14 But the enrollment total by early 2024 was the highest enrollment had been in New York’s Marketplace since 2015.

(See chart below; enrollment in QHPs dropped in 2016 when the Essential Plan debuted, because many people previously eligible for subsidized QHPs transitioned to the Essential Plan starting in 2016.)

The enrollment growth in 2024 was likely driven by a combination of the continued subsidy enhancements under the American Rescue Plan, as well as the Medicaid unwinding process that began in the spring of 2023. By early 2024, about 1.1 million people in New York had been disenrolled from Medicaid.38

Some of them had transitioned to QHPs in the Marketplace, helping to drive 2024 enrollment. CMS reported that by November 2024, more than 48,000 New York residents had transitioned from Medicaid to a qualified health plan in the Marketplace (another 223,507 had transitioned to Essential Plan coverage).39

The chart below shows QHP enrollment by year in New York. But it’s important to note that New York’s Basic Health Program (BHP) covers far more people than the QHPs in the state, with nearly 1.2 million people enrolled in New York’s BHP as of early 2024.37

Source: 2014,40 2015,41 2016,42 2017,43 2018,44 2019,45 2020,46 2021,47 2022,48 202318

What health insurance resources are available to New York residents?

NY State of Health

855-355-5777

State Exchange Profile: New York

The Henry J. Kaiser Family Foundation overview of New York’s progress toward creating a state health insurance exchange.

Health Care For All New York (HCFANY)

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- Press Release: NY State of Health Offers Broad Choices of Affordable, Comprehensive Health and Dental Insurance Plans for 2024. New York State of Health. October 2023. ⤶ ⤶

- “Essential Plan Fact Sheet” nystateofhealth.ny.gov, March 2022 ⤶

- ”Governor Hochul Announces Federal Approval to Expand Access to High-Quality, Affordable Health Insurance” New York State Governor Kathy Hochul. March 4, 2024. ⤶ ⤶ ⤶

- Market Rating Reforms — State Specific Rating Variations. Centers for Medicare and Medicaid Services. Accessed December 2023. ⤶

- “New York dental insurance guide 2023” healthinsurance.org, Accessed September 2023 ⤶

- “April 2023 Medicaid & CHIP Enrollment Data Highlights” Medicaid.gov, April 28, 2023 ⤶

- “Medicare Monthly Enrollment” CMS.gov, April 2023 ⤶

- “Availability of short-term health insurance in New York” healthinsurance.org, March 3, 2023 ⤶

- Qualified Health Plans Information. New York State of Health. Accessed December 2023. ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed MONTH. ⤶ ⤶

- “Enrollment Periods” newyorkstateofhealth.ny.gov, Accessed September 2023 ⤶

- Press Release: On the Tenth Anniversary of New York’s Marketplace, NY State of Health Announces the Beginning of the 2024 Annual Open Enrollment Period for Health Insurance. NY State of Health. November 2023. ⤶ ⤶

- Patient Protection and Affordable Care Act, HHS Notice of Benefit and Payment Parameters for 2025; Updating Section 1332 Waiver Public Notice Procedures; Medicaid; Consumer Operated and Oriented Plan (CO-OP) Program; and Basic Health Program. U.S. Treasury Department and U.S. Centers for Medicare and Medicaid Services. November 2023. ⤶

- Special Enrollment Periods. NY State of Health. Accessed December 2023. ⤶

- Assistors. New York State of Health. Accessed December 2023. ⤶

- “2023 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2023, 2023 ⤶ ⤶ ⤶ ⤶

- Recipients Enrolled in QHP or EP as of January 1, 2024 by Issuer. NY State of Health. January 2024. ⤶

- Letter asking Biden administration to pause consideration of NY’s pending 1332 waiver. State of New York. September 2023. ⤶

- New York Addendum to 1332 Waiver. New York Department of Health. December 2023. ⤶

- Invitation and Requirements for Insurer Certification and Recertification for Participation in 2024. NY State of Health. Accessed December 2023. ⤶

- Insulin Cost-Sharing Limit Q&A Guidance. New York State Department of Financial Services. Accessed December 2023. ⤶

- NY Senate Bill 504. BillTrack50. Accessed December 2023. ⤶

- 2024 Individual and Small Group Requested and Approved Rate Actions. New York State Department of Financial Services. October 2023. ⤶

- 2024 Individual and Small Group Requested and Approved Rate Actions. New York State Department of Financial Services. October 2023. ⤶ ⤶

- New York health insurance rates to rise in 2015. Long Island Business News. September 2023. ⤶

- FINAL PROJECTION: 2016 Weighted Avg. Rate Increases: 12-13% Nationally* ACA Signups. October 2015. ⤶

- Department of Financial Services Announces 2017 Health Insurance Rates. New York State Department of Financial Services. August 2016. ⤶

- DFS Announces 2018 Health Insurance Rates in a Continued Robust New York Market. New York State Department of Financial Services. August 2017. ⤶

- 2019 Rate Hikes. ACA Signups. October 2018. ⤶

- 2020 Rate Changes. ACA Signups. October 2019. ⤶

- DFS Announces 2021 Health Insurance Premium Rates, Protecting Consumers During COVID-19 Pandemic. New York Department of Financial Services. August 2020. ⤶

- DFS Announces 2022 Health Insurance Premium Rates, Saving New Yorkers $607 Million. August 2021. ⤶

- “DFS Announces 2023 Health Insurance Premium Rates” NY Dept. of Financial Services, April 17, 2022 ⤶

- Marketplace 2024 Open Enrollment Period Report: Final National Snapshot. Centers for Medicare and Medicaid Services. January 2024. ⤶

- ”Recipients Enrolled in QHP or EP – as of February 1, 2024 by County and Issuer” NY State of Health. Accessed March 4, 2024. ⤶ ⤶

- Medicaid Enrollment and Unwinding Tracker. KFF. February 2024. ⤶

- State-based Marketplace (SBM) Medicaid Unwinding Report, data through November 2023. Centers for Medicare & Medicaid Services. Accessed March 4, 2024. ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶