Medicare in Texas

Texas requires Medigap insurers to offer at least Plan A to disabled beneficiaries under the age of 65

Key takeaways

- Over 4.7 million people in Texas have Medicare plans.1

- More than half of Texas Medicare beneficiaries had Medicare Advantage plans as of late-2024.1

- Premiums for stand-alone Medicare Part D prescription drug plans in Texas start at $0 per month for 2025 coverage.2

- Around 1.5 million Texas Medicare beneficiaries have stand-alone Medicare Part D prescription drug plans, and more than 2 million have Medicare Part D prescription drug plans integrated with Medicare Advantage plans.1

Texas Medicare enrollment

The number of Medicare beneficiaries in Texas stood at over 4.7 million as of September 2024.1

Although most people become eligible for Medicare coverage enrollment when they turn 65, Medicare also provides coverage for people under age 65. Those who have been receiving disability benefits for 24 months or more have end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS) are eligible for Medicare. About 10% of all Medicare beneficiaries in Texas were under the age of 65 as of late-2024.1

Medicare options

In most areas of the country, Medicare beneficiaries can choose Original Medicare or a Medicare Advantage plan.

Original Medicare is provided directly by the federal government and includes Medicare Part A and Medicare Part B. Medicare Part A, also called hospital insurance, helps to pay for inpatient stays at hospitals, skilled nursing facilities, and hospice centers.

Part B, also called medical insurance, helps pay for outpatient care like physician services, kidney dialysis, preventive care, durable medical equipment, etc.

Medicare Advantage plans are administered by private insurance companies that have contracts with the federal government. Medicare Advantage plans include all of the benefits of Original Medicare (albeit with different cost-sharing, as the plans set their own deductibles, coinsurance, and copays, within the limits established by the federal government), and they typically have additional benefits, such coverage for prescription drugs, dental, and vision.

But provider networks are often limited with Medicare Advantage plans, and out-of-pocket costs are typically higher than a person would have if they opted for Original Medicare plus a Medigap plan. In short, there are pros and cons either way, and no one-size-fits-all solution.

Medicare beneficiaries can switch between a Medicare Advantage plan and Original Medicare (and can add or drop a Medicare Part D prescription drug plan) during the Medicare Annual Election Period, which runs from October 15 to December 7 each year. Medicare Advantage enrollees also have the option to switch to a different Medicare Advantage plan or to Original Medicare during the Medicare Advantage Open Enrollment Period, which runs from January 1 to March 31.

Learn about Medicare plan options in Texas by contacting a licensed agent.

Explore our other comprehensive guides to coverage in Texas

The ACA Marketplace allows individuals and families to shop for and enroll in ACA-compliant health insurance plans. Subsidies may be available based on household income to help lower costs.

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in Texas.

Learn about Texas’ Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in Texas.

Frequently asked questions about Medicare in Texas

What is Medicare Advantage?

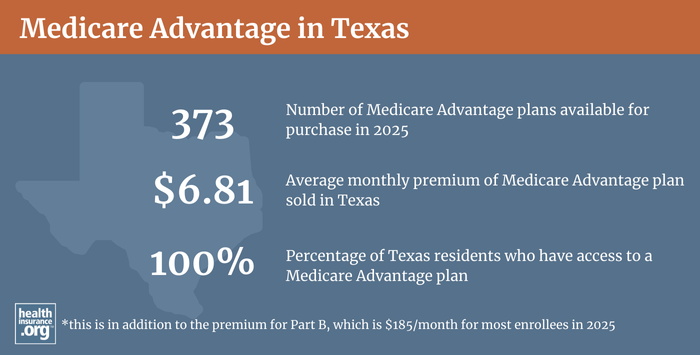

Medicare Advantage plans are available in all counties in Texas in 2025, but plan availability ranges from county to county.3

As of September 2024, 54% of Texas Medicare beneficiaries enrolled in Medicare Advantage plans.1 The other 46% of Medicare beneficiaries in Texas were enrolled in Original Medicare instead.1

Medigap enrollment and regulations in Texas

According to AHIP, 945,247 Texas residents had Medigap coverage as of 2023,4 to supplement their Original Medicare coverage.

There are 46 insurers licensed to sell Medigap plans in Texas.5

Learn how Medigap plans are regulated and standardized.

Unlike other Medicare plan coverage (Medicare Advantage and Medicare Part D prescription drug plans), there is no annual open enrollment window for Medigap plans. Instead, federal rules provide a one-time six-month window when Medigap coverage is guaranteed-issue. This window opens when a person is at least 65 and enrolled in Medicare Part B (you must be enrolled in both Part A and Part B to purchase a Medigap plan).

Although disabled Americans under the age of 65 are eligible for Medicare, federal rules do not guarantee access to Medigap plans for people who are under 65. But the majority of the states – including Texas – have implemented rules to ensure that disabled Medicare beneficiaries have at least some access to Medigap plans.

Texas law requires Medigap insurers to offer at least Medigap Plan A to disabled enrollees under age 65, during the six-month period that begins when they’re enrolled in Medicare Part B.6 Medigap Plan A is the least comprehensive of the Medigap plans, but it will cover the 20% Part B coinsurance that the enrollee would otherwise have to pay out-of-pocket.7

Although only Medigap Plan A is guaranteed-issue for most under-65 Medicare beneficiaries in Texas, state legislation enacted in 2025 requires all Medigap plans to be guaranteed-issue for people under 65 who have ESRD or ALS. The new legislation also limits how high premiums can be for Medigap enrollees with ESRD or ALS.8 (This is quite unusual; it’s much more common to see state Medigap protections not apply to people with ESRD, as opposed to stronger protections for people with ESRD.)

What is Medicare Part D?

Original Medicare does not cover the cost of outpatient prescription drugs. As noted above, more than half of Original Medicare beneficiaries have supplemental coverage via an employer-sponsored plan (from a current or former employer or spouse’s employer) or Medicaid, and these plans often include prescription coverage. But Medicare beneficiaries who don’t have prescription drug coverage through Medicaid or an employer-sponsored plan need to obtain Medicare Part D prescription drug coverage (prior to 2006, some Medigap plans included prescription coverage; people who still have those plans can keep them, but they have not been available since the end of 2005).

Part D coverage can be purchased as a stand-alone plan, or as part of a Medicare Advantage plan that includes Part D prescription drug coverage.

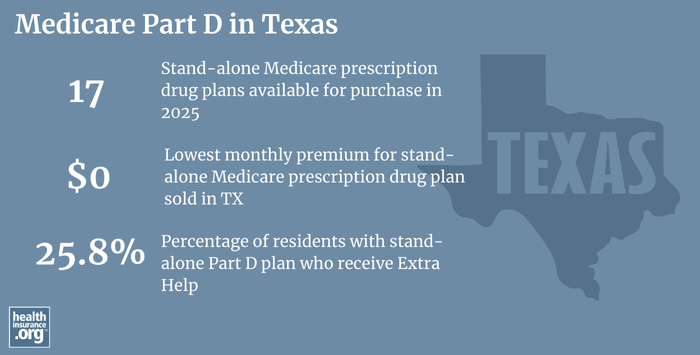

In Texas, there are 17 stand-alone Medicare Part D prescription drug plans for 2025, with premiums starting at $0.2

As of late-2024, there were about 1.5 million Medicare beneficiaries in Texas with stand-alone Medicare Part D prescription drug plans.1 More than 2 million Texas residents had Medicare Part D prescription drug coverage integrated with their Medicare Advantage plans.1 As Medicare Advantage enrollment has grown, the number of people with Medicare Part D prescription drug coverage integrated with Medicare Advantage plans has also grown, while the number of people with stand-alone Medicare Part D prescription drug plans (used in conjunction with Original Medicare) has decreased.

Medicare Part D prescription drug plan enrollment follows the same schedule as Medicare Advantage plan enrollment. Beneficiaries can enroll in Medicare Part D prescription drug plans when they’re first eligible for Medicare, and there’s also an annual enrollment window (October 15 to December 7) when people can enroll or switch to a different Medicare Part D prescription drug plan.

How does Medicaid provide financial assistance to Medicare beneficiaries in Texas?

Many Medicare beneficiaries receive financial assistance through Medicaid with the cost of Medicare premiums and services Medicare doesn’t cover – such as long-term care.

Our guide to financial assistance for Medicare enrollees in Texas includes overviews of these benefits, including Medicare Savings Programs, long-term care coverage, and eligibility guidelines for assistance.

What additional resources are available for Medicare beneficiaries and their caregivers in Texas?

Need help with your Medicare application in Texas, or have questions about Medicare eligibility in Texas? These resources provide free assistance and information.

- The Health Information, Counseling, and Advocacy Program (HICAP), with any questions related to Medicare coverage in Texas. Visit the website or call 1-800-252-9240.

The Texas Department of Insurance has a resources page for Texas residents with Medicare coverage.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written hundreds of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Texas?

Explore more resources for options in TX including ACA coverage, short-term health insurance, dental and Medicaid.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- “Medicare Monthly Enrollment – Texas.” Centers for Medicare & Medicaid Services Data. Accessed January, 2025. ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶

- ”Fact Sheet: Medicare Open Enrollment for 2025” (131) Centers for Medicare & Medicaid Services. Sep. 27, 2024 ⤶ ⤶

- ”Medicare Advantage 2025 Spotlight: First Look” KFF.org Nov. 15, 2024 ⤶

- “The State of Medicare Supplement Coverage” AHIP. May 2025. Accessed Oct. 3, 2025 ⤶

- “Companies with Medicare supplement insurance” Texas Department of Insurance. Accessed Oct. 4, 2025 ⤶

- “Medicare supplement insurance guide” Texas Department of Insurance. Accessed Oct. 4, 2025 ⤶

- “Compare Medigap Plan Benefits” Medicare.gov. Accessed Oct. 4, 2025 ⤶

- ”Texas HB2516” BillTrack50. Enacted June 20, 2025 ⤶