Home > Health insurance Marketplace > Pennsylvania

Pennsylvania Health Insurance Marketplace for 2026

Compare ACA plans and check subsidy savings from a licensed third-party health insurance agency.

Pennsylvania health insurance Marketplace guide

This guide, including the FAQs below, was developed to help you choose the right Pennsylvania health insurance plan for you and your family. The options found in Pennsylvania’s ACA Health Insurance Marketplace can be a good choice for individuals and families who don’t have access to employer-sponsored health insurance or government-run coverage like Medicare or Medicaid.

Pennsylvania uses a fully state-based health insurance Marketplace known as Pennie to enroll its residents in ACA Marketplace plans. The Marketplace provides access to health insurance products from private insurers. The Pennsylvania Health Insurance Marketplace is robust, with 14 insurers offering coverage for 2026. These are the same carriers that offered plans in 2025, although two of the carriers are transitioning their enrollees to new plans3 (details below).

Depending on income and other circumstances, most Pennsylvania Marketplace enrollees get help to lower their monthly insurance premium (the amount you pay to enroll in the coverage). And many also receive financial assistance with their out-of-pocket expenses. But unless Congress extends the subsidy enhancements that have been in place since 2025, after-subsidy premiums will increase significantly in 2026, and the “subsidy cliff” will return. Congress had not extended the subsidy enhancements as of mid-December 2025. For Pennie enrollees, this is resulting in an average net premium increase of 102% for 2026.4

As described below, Pennsylvania has been considering a state-funded subsidy program that would stack on top of the federal ACA subsidies to make coverage more affordable for lower-income Pennie enrollees, but that program is not yet available because state funding has not been allocated.5 Several other states already offer state-funded subsidies, in addition to the ACA’s federal subsidies.

Pennsylvania has an “easy enrollment” program that allows uninsured residents to access Pennsylvania health insurance via their state tax returns.6 The state also established a reinsurance program that took effect in 2021, helping to keep unsubsidized individual/family health insurance premiums lower than they would otherwise be.7

Frequently asked questions about health insurance in Pennsylvania

Who can buy Marketplace health insurance in Pennsylvania?

To be eligible to enroll in Pennsylvania Health Insurance Marketplace coverage, you must:

- Live in Pennsylvania

- Be lawfully present in the United States

- Not be incarcerated

- Not be enrolled in Medicare

Eligibility for financial assistance in the form of premium subsidies and cost-sharing reductions depends on your income and how it compares with the cost of the second-lowest-cost Silver plan in your area – which depends on your age and location. In addition, to qualify for financial assistance with your Marketplace plan you must:

- Not have access to affordable health coverage through your employer. If your employer offers coverage but you feel it’s too expensive, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies in the Marketplace.

- Not be eligible for Medicaid or CHIP, or premium-free Medicare Part A.8

- File a joint tax return, if married.9 (with very limited exceptions)10

- Not be able to be claimed by someone else as a tax dependent.9

When can I enroll in an ACA-compliant plan in Pennsylvania?

In Pennsylvania the open enrollment period for individual and family coverage runs from November 1 to January 15.11

Your coverage starts on January 1, 2026 if you enroll by December 31, 2025 (this was a last-minute extension from the original December 15 deadline).12 If you apply between January 1 and January 15, your coverage will begin on February 1.13

New federal rules finalized in 2025 will shorten the open enrollment period, starting in the fall of 2026. At that point, for enrollment in coverage for 2027 and future years, state-run exchanges will have to end their open enrollment periods no later than December 31. And all plans selected during open enrollment will take effect January 1.

Outside of open enrollment, you’ll need a special enrollment period (SEP) to enroll or make changes to your coverage. In most cases, a SEP requires a qualifying life event, but Native Americans can enroll year-round without a qualifying live event.

Pennsylvania also has an “easy enrollment” program that allows uninsured residents to begin the process of accessing health insurance via their state tax returns.6 Pennie confirmed by phone that about 900 people used Path to Pennie to obtain coverage in 2023, including Medicaid and private plans.

How do I enroll in a Pennsylvania Marketplace plan?

To enroll in an ACA Marketplace plan in Pennsylvania, you can:

- Visit Pennie to enroll in Pennsylvania’s Marketplace. Here you will find an online platform to shop, compare plans and determine your subsidy eligibility.

- Purchase individual and family health coverage with the help of an insurance agent or broker, a Navigator or certified application counselor.

How can I find affordable health insurance in Pennsylvania?

You may find affordable health insurance options in Pennsylvania by utilizing the state’s health insurance exchange – Pennie. Here, residents can enroll in health coverage as well as determine their eligibility for financial assistance.

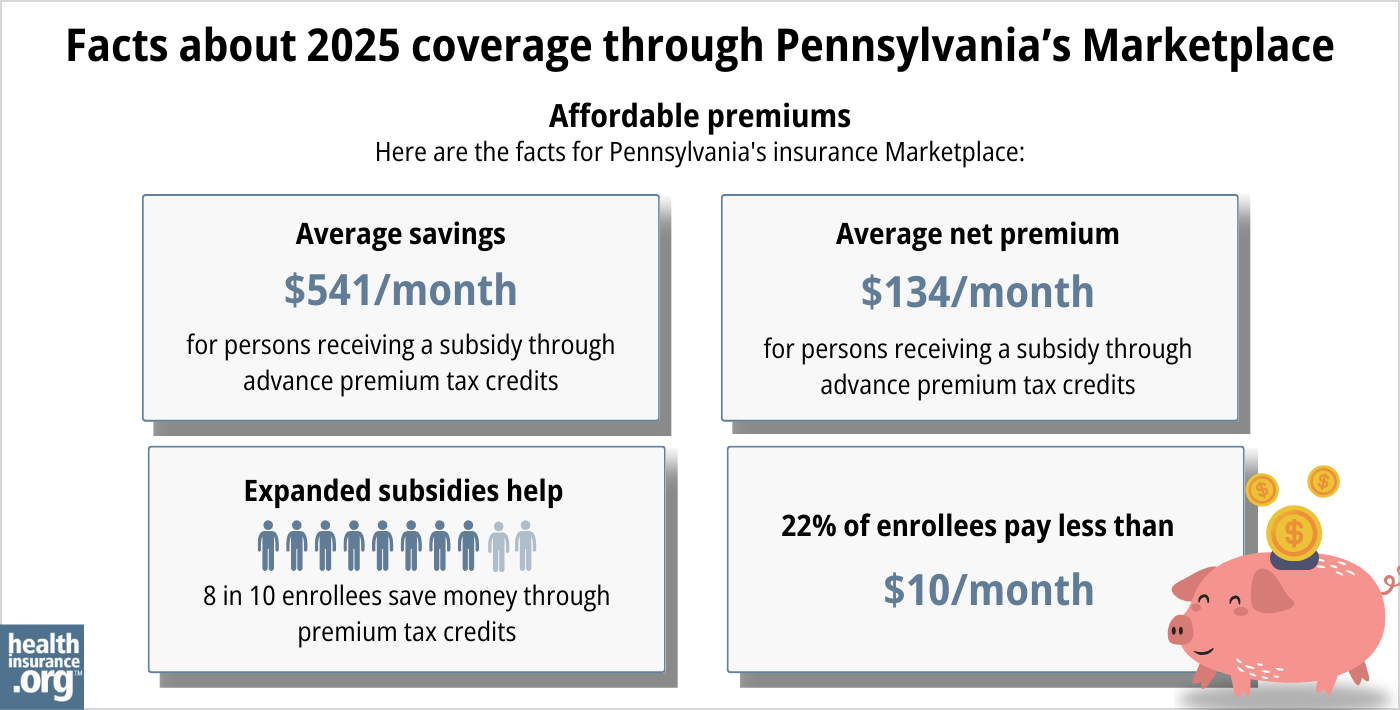

During the open enrollment period for 2025 coverage, about 86% of Pennie enrollees were receiving premium tax credits (premium subsidies). These tax credits amounted to an average savings of $541/month. With subsidies, enrollees paid an average of $187 per month for health coverage (including those who paid full price).14

In addition to premium tax credits, Marketplace enrollees with household incomes up to 250% of the federal poverty level also qualify for cost-sharing reductions (CSR) that result in lower out-of-pocket costs (deductible, coinsurance, copays) on Silver plans. As of early 2025, three out of ten Pennie enrollees were receiving CSR benefits.15

Source: CMS.gov16

Between the premium subsidies and cost-sharing reductions, you’ll likely find that a plan obtained via Pennie provides you with the best overall value.

At some point, if state funding is allocated, Pennsylvania may start to offer additional subsidies, beyond the federal subsidies that are already available.17 But as of December 2025, state funding had not yet been allocated for this purpose,18 so Pennsylvania is not among the states that offer additional state-funded subsidies.

Governor Shapiro’s proposed 2024-25 budget calls for the state to create “an additional subsidy wrap” to make Pennie coverage more affordable for low-income and middle-income applicants.19

Legislation to create an “affordability assistance program” passed the Pennsylvania House in June 2024 and was sent to the Senate for consideration, but ultimately did not advance during the 2024 session.20 As a result, Pennie’s board of directors noted that funding for the state subsidy program was not available for plan year 2025.21 Funding still had not been secured by August 2025, making it unlikely that the subsidy program would be available for 2026 either.

The 2024 legislation did not contain any specific parameters for how the subsidies would have worked (premium subsidies or cost-sharing reductions) or who would have been eligible for them. It only noted that the program should be designed “to incentivize enrollment in on-exchange policies based on income or other eligibility criteria.”22

As of May 2024, the Pennie Board of Directors was recommending a sliding scale premium subsidy for gold and silver plans, for households earning between 151% and 300% of the federal poverty level.23

That structure was still the assumption as of August 2024, but the program had been delayed until at least plan year 2026 by that point (as noted above, funding still had not been allocated as of December 2025, so the earliest this program could become available is 2027). So board members noted that if the American Rescue Plan’s federal subsidy enhancements aren’t extended past 2025, the lower income bound for Pennie’s additional premium subsidies could be reduced.21 (As of December 2025, the federal subsidy enhancements had not been extended, and were scheduled to expire at the end of 2025.)

The state will only be able to proceed with the subsidy program if the legislation is enacted and if the state can secure alternate funding for its reinsurance program, so that some of the funds currently being used for reinsurance can be diverted to the affordability assistance program.24

As of mid-2025, Pennie’s board of directors noted that the state’s existing reinsurance funding was about $2 million short of what was needed, and was recommending the approval of the additional funds. But the additional state subsidy program was not discussed at that meeting.25

How many insurers offer Marketplace coverage in Pennsylvania?

There continue to be 14 Marketplace insurers in Pennsylvania in 2026,26 although Pennsylvania Health & Wellness will be Ambetter in 2026, and UPMC will be UPMC Health Plan.3 Enrollees in the 2025 versions of those plans will be transitioned to the new plans unless they select different coverage during open enrollment.

Are Marketplace health insurance premiums increasing in Pennsylvania?

The following average rate changes were approved for 2026 for the insurers that offer Marketplace coverage in Pennsylvania, amounting to a weighted average increase of 21.5%26 (calculated before subsidies; the after-subsidy rate increase will be much larger for most enrollees — an average of 102%4 — unless Congress extends the subsidy enhancements that are scheduled to expire at the end of 2025; see examples below to illustrate the scope of these net premium increases).

Pennsylvania’s ACA Marketplace Plan 2026 APPROVED Rate Changes by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Capital Advantage Assurance | 24.6% |

| Geisinger Health Plan | 11.6% |

| Geisinger Quality Options | 13.8% |

| Highmark, Inc. (EPO and PPO) | 17.8% |

| Highmark Benefits Group | 18.4% |

| Highmark Coverage Advantage | 14.5% |

| Keystone Health Plan East (Independence Blue Cross HMO) | 22% |

| QCC Insurance Company (Independence Blue Cross PPO) | 15.2% |

| UPMC Health Plan (previously UPMC Health Coverage) | 24.8% |

| UPMC Health Options | 20.2% |

| Ambetter (previously PA Health and Wellness) | 37.9% |

| Oscar Health | 23.1% |

| Jefferson Health Plans HMO (Health Partners Plans, Inc.) | 16.7% |

| Jefferson Health Plans PPO (Partners Insurance Company) | -10.1% |

Source: Commonwealth of Pennsylvania326

Average rate changes apply to full-price health plans, but the majority of Pennsylvania health insurance marketplace enrollees receive premium subsidies, and thus do not pay full price.27 However, if Congress doesn’t extend the federal subsidy enhancements that have been in effect since 2021, subsidies will be smaller than they would otherwise have been, and available to fewer enrollees in 2026. This will result in significant increases in after-subsidy premiums, and the expected enrollment decline (due to the larger net premiums) was a driving factor in pushing overall premiums higher for 2026.3

As of the start of the open enrollment period for 2026 coverage, Congress had not taken action to extend the subsidy enhancements. As a result, here are some examples of the sort of net premium increases that people are seeing in Philadelphia for 2026:28

- 40-year-old earning $40,000:

- Lowest-cost plan in 2025 is $41/month

- Lowest-cost plan in 2026 is $116/month

- 60-year-old earning $63,000:

- Lowest-cost plan in 2025 is $205/month

- Lowest-cost plan in 2026 is $631/month

For perspective, here’s a summary of how average full-price premiums for Pennsylvania health insurance have changed over time:

- 2015: Average increase of 12%29

- 2016: Average increase of 12%30

- 2017: Average increase of 32.5%31

- 2018: Average increase of 30.6%

- 2019: Average decrease of 2.3%32

- 2020: Average increase of 3.8%33

- 2021: Average decrease of 3.3%34

- 2022: Average increase of 0.2%35

- 2023: Average increase of 5.5%36

- 2024: Average increase of 3.9%37

- 2025: Average increase of 6%38

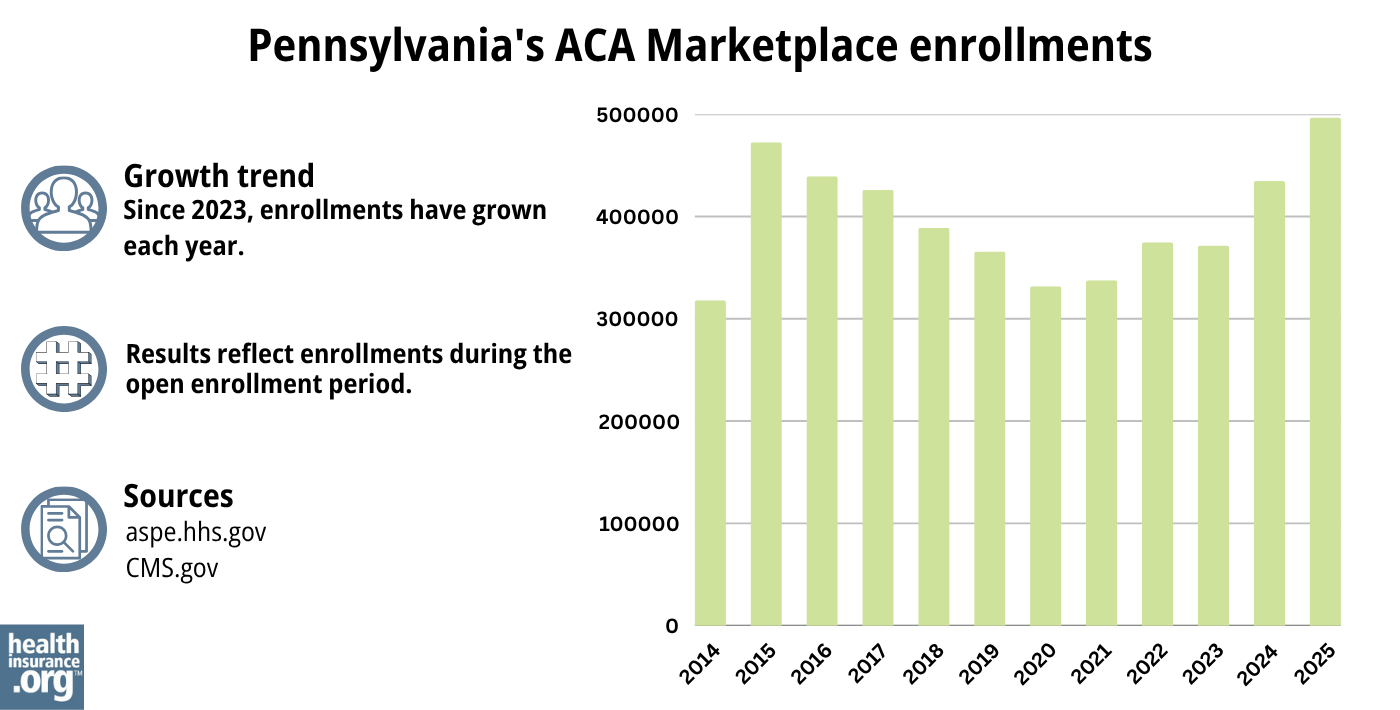

How many people are insured through Pennsylvania’s Marketplace?

During the open enrollment period for 2025 coverage, 496,661 people signed up for private plans through the Pennsylvania Marketplace.39 This was a record high, as shown in the chart below.

But Pennie’s board of directors has noted that if the federal subsidy enhancements are allowed to expire at the end of 2025, it could result in an enrollment drop of more than 30% in 2026.25

Source: 2014,40 2015,41 2016,42 2017,43 2018,44 2019,45 2020,46 2021,47 2022,48 2023,49 2024,50 202551

What health insurance resources are available to Pennsylvania residents?

Pennie

The official Pennsylvania health coverage Marketplace.

State Exchange Profile: Pennsylvania

The Henry J. Kaiser Family Foundation overview of Pennsylvania’s progress toward creating a state health insurance exchange.

Health Care Matters, Pennsylvania Office of the Attorney General

Serves Pennsylvania consumers with health-related problems.

(717) 705-6938 / Toll-free: 1-877-888-4877 (only in Pennsylvania)

Pennsylvania Consumer Assistance Program

Assists people with private insurance, Medicaid, or other insurance with resolving problems pertaining to their health coverage; assists uninsured residents with access to care.

(877) 881-6388 / [email protected]

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written hundreds of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Pennsylvania?

Explore more resources for options in PA including short-term health insurance, dental, Medicaid and Medicare.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- ”2025 OEP State-Level Public Use File (ZIP)” Centers for Medicare & Medicaid Services, Accessed May 13, 2025 ⤶ ⤶

- “Shapiro Administration Announces Proposed 2026 Health Insurance Rate Updates” Pennsylvania Insurance Department. Aug. 1, 2025 *The above is based on the most current data available. ⤶

- “Shapiro Administration Announces Proposed 2026 Health Insurance Rate Updates” Pennsylvania Insurance Department. Aug. 1, 2025 ⤶ ⤶ ⤶ ⤶

- ”Pennie Board of Directors Meeting” Pennie. Oct. 2025 ⤶ ⤶

- ”Establishing a State Health Insurance Affordability Program” Pennie. Accessed Dec. 14, 2025 ⤶

- ”Path to Pennie” Pennie.com. Accessed Dec. 14, 2025 ⤶ ⤶

- ”Act 42 & Pennsylvania’s Section 1332 Waiver Reinsurance Program” Pennsylvania Insurance Department. Accessed Dec. 14, 2025 ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed Dec. 14, 2025 ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed Dec. 14, 2025 ⤶ ⤶

- Updates to frequently asked questions about the Premium Tax Credit. Internal Revenue Service. February 2024. ⤶

- “What Is Open Enrollment?” Pennie.com. Accessed Dec. 14, 2025 ⤶

- ”Special Deadline Extension” Pennie. Dec. 16, 2025 ⤶

- “What Is Open Enrollment?” Pennie.com. Accessed Dec. 14, 2025 ⤶

- ”2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, Accessed Aug. 18, 2025 ⤶

- ”Effectuated Enrollment: Early 2025 Snapshot and Full Year 2024 Average” CMS.gov, July 24, 2025 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶

- ”Pennie Board of Directors Strategic Planning Session” (pages 27-30). Pennie Board of Directors. February 22, 2024, AND “Pennie Board Meeting Recording” and Pennie Board Meeting Deck” Aug. 8, 2024 ⤶

- ”Spotlight on Affordability: Establishing a State Health Insurance Affordability Program” Pennie. Accessed Dec. 14, 2025 ⤶

- ”Governor Josh Shapiro Executive Budget 2024-2025” Budget.pa.gov. February 6, 2024 ⤶

- ”Pennsylvania HB2234” BillTrack50. Legislation dead Dec. 31, 2024 ⤶

- ”Pennie Board Meeting Recording” and Pennie Board Meeting Deck” Pennie Board of Directors. Aug. 8, 2024 ⤶ ⤶

- ”Pennsylvania HB2234” BillTrack50. Accessed Aug. 16, 2024 ⤶

- ”Pennie Board of Directors Meeting” Pennie.com. May 16, 2024 ⤶

- ”Fiscal Note, HB2234” Pennsylvania House Committee on Appropriations. June 5, 2024 ⤶

- ”Pennie Board of Directors Meeting” Pennie. May 2025 ⤶ ⤶

- ”2026 Final Gross Rate Changes – Pennsylvania: +21.5% (updated)” ACA Signups. Oct. 15, 2025 ⤶ ⤶ ⤶

- ”Effectuated Enrollment: Early 2025 Snapshot and Full Year 2024 Average” CMS.gov, July 24, 2025 ⤶

- ”Estimated monthly premium for 2026 and 2025” (zip 19132) Pennie. Accessed Nov. 1, 2025 ⤶

- ”Analysis Finds No Nationwide Increase in Health Insurance Marketplace Premiums” The Commonwealth Fund. December 2014. ⤶

- ”Pennsylvania: APPROVED 2016 Avg. Rate Hike: 12.0% (Reduced From 15.6%)” ACA Signups. October 2015. ⤶

- ”ACA Rates Q&A” Pennsylvania Insurance Department. Accessed October 2023. ⤶

- ”Rate Change Request Summary – 2019” Pennsylvania Insurance Department. Accessed October 2023. ⤶

- ”Pennsylvania: *Final* 2020 Avg. #ACA Exchange Rate Changes: 3.8% Increase” ACA Signups. October 2019. ⤶

- ”PA’s ACA Marketplace Rates to Decrease by an Average of 3.3% in 2021” Pennsylvania Health Access Network. October 2020. ⤶

- ”Pennsylvania: Approved 2022 #ACA Rate Changes: +0.2% Individual Market, +4.8% Sm. Group Market” ACA Signups. October 2021. ⤶

- ”Pennsylvania: Final 2023 Unsubsidized #ACA Rate Changes: +5.5% (Down From +7.1%)” ACA Signups. October 2022. ⤶

- ”Shapiro Administration Announces 2024 Health Insurance Rates” Pennsylvania Pressroom. September 28, 2023. ⤶

- ”Affordable Care Act Health Rate Filings” Pennsylvania Insurance Department. Accessed Dec. 18, 2024 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, Accessed Aug. 18, 2025 ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- “2023 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2023 ⤶

- ”HEALTH INSURANCE MARKETPLACES 2024 OPEN ENROLLMENT REPORT” CMS.gov, 2024 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶