What is a catastrophic health insurance plan?

Although the term "catastrophic plan" has long been used as a generic catch-all phrase to describe health insurance plans with high deductibles and little coverage for routine care, the Affordable Care Act assigned strict parameters to the term:

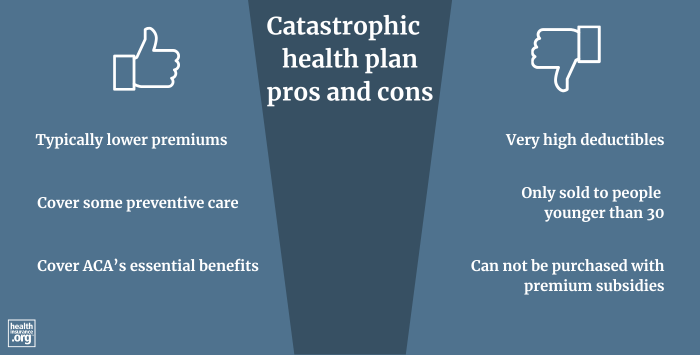

Catastrophic plans have limited eligibility guidelines, cannot be purchased with premium subsidies, and must provide certain limited benefits to enrollees before the deductible is met. (Details are available in the text of the ACA, section 1303(e)).1)

And for the purposes of the ACA's risk adjustment program, catastrophic plans are in a separate risk pool from the metal-level plans, although they're in the same general shared risk pool.2

This means that within a state, catastrophic plans transfer risk adjustment funds with other catastrophic plans, but not with metal-level plans. This is the primary reason catastrophic plans have lower prices than Bronze plans. (The coverage they offer is quite similar to Bronze plans, but catastrophic plans generally have lower premiums. Their enrollees are mostly fairly affluent and under the age of 30, and the plans don't have to share risk with metal-level plans that tend to have a less healthy pool of enrollees).

Catastrophic plans: High deductibles, plus primary care and preventive care

- Catastrophic plans cover all of the essential benefits defined by the ACA, but with very high deductibles, equal to the annual limit on out-of-pocket costs under the ACA (for 2025, this is $9,200 for a single individual, increasing to $10,600 in 2026).3

- They must still limit members' out-of-pocket costs for in-network services to no more than the annual out-of-pocket maximum that applies to all plans (again, this cap is $9,200 for an individual in 2025, and $10,600 in 2026).

- Catastrophic plans cover up to three primary care visits per year before the deductible is met (copays can apply for these visits, but at least part of the cost will be paid by the insurance company, even if you haven't met your deductible).

- Like all ACA-compliant plans, catastrophic plans cover certain preventive care with no cost-sharing.

- Other services beyond preventive care and some primary care will be paid by the insured until the deductible is met. There is no coinsurance for catastrophic plans, as the deductible is equal to the maximum allowable out-of-pocket limit.

Can I use premium subsidies to buy a catastrophic plan?

No. Premium subsidies cannot be used to purchase catastrophic plans4 (and cost-sharing subsidies are also not available for catastrophic plans, since those can only be obtained if you choose a Silver plan).

Depending on your income, you may be eligible for a premium subsidy that you could apply towards a metal-rated plan. This will likely make a metal-level plan more affordable than a catastrophic plan.5

The American Rescue Plan and Inflation Reduction Act have made premium subsidies larger and more widely available through the end of 2025. This is important to keep in mind if you've opted for a catastrophic plan in the past because you weren't subsidy-eligible. You may find that you are now eligible for subsidies. But without Congressional action, the subsidy enhancements will expire at the end of 2025, and the ACA's original subsidy rules will once again be in place as of 2026.

Who can enroll in a catastrophic plan?

Catastrophic plans are only available to people under age 30, or people 30 and older who qualify for a hardship/affordability exemption6 (which means that due to unaffordability of coverage, economic hardship, or certain other hardships – such as the death of a family member – the person is not required to maintain health insurance coverage).

Although the ACA's individual mandate penalty was eliminated after the end of 2018, the mandate itself continues to exist – there just isn't a penalty for noncompliance anymore. So people can still seek hardship exemptions from the mandate to gain access to catastrophic plans. (Affordability exemptions are included under the "general hardship exemption" category, as described below.)

The Trump administration expanded access to hardship exemptions in April 2018,7 allowing exemptions for people in areas where all plans cover abortions, areas where only one insurer (or zero insurers) offers plans in the exchange, or where a personal hardship is created due to the plan options available in the exchange.

In particular, the provision for people in areas where just one insurer offers plans in the exchange made a hardship exemption available to far more people, allowing them to potentially purchase a catastrophic plan (albeit without premium subsidies, making this a realistic alternative only for people who aren't otherwise eligible for subsidies). But insurer participation in the exchanges has increased significantly since 2018, with very few enrollees currently having access to just one insurer's plans.8

Regardless of age or income, catastrophic plans were initially available for people whose health insurance policies were canceled because they were not ACA compliant, but that exemption ceased to be available after the end of 2016.

Can I contribute to an HSA if I have a catastrophic plan?

Starting in 2026, you will be able to contribute to a health savings account (HSA) if you have a catastrophic plan purchased through the health insurance Marketplace. This is due to Section 71307 of the One Big Beautiful Bill Act (OBBBA) that was enacted in July 20259 But before 2026, enrollment in a catastrophic plan will not allow a person to contribute to an HSA.

How many people enroll in catastrophic plans?

During the open enrollment period for 2025 coverage, only 54,109 people enrolled in catastrophic plans, out of more than 24 million exchange enrollees nationwide.10 (People can enroll in catastrophic plans outside the exchange, but off-exchange enrollment is quite low across all types of plans, and the same eligibility rules apply to catastrophic plans on-exchange or off-exchange.)

Why is catastrophic plan enrollment so low?

The fact that premium subsidies can't be used with catastrophic plans is a primary reason for the low uptake of catastrophic plans. The American Rescue Plan's subsidy enhancements, which will continue to be available through at least the end of 2025, make catastrophic plans even less popular than they were before 2021, since more people are eligible for subsidies.

Obtaining a hardship exemption is not typically a quick process, and catastrophic plans don't automatically show up on the list of available plan options for people who are 30 or older. So applicants may be unaware that they could seek a hardship (including affordability) exemption and obtain a catastrophic plan. A knowledgeable broker can inform applicants about catastrophic plans and guide them through the process of obtaining an exemption, but the process isn't necessarily easy or seamless even with assistance.

For most people, this is not applicable through at least 2025, thanks to the American Rescue Plan's enhancement of premium subsidies (extended through 2025 by the Inflation Reduction Act). Under that law, households are not expected to pay more than 8.5% of their income for the second-lowest-cost Silver plan, regardless of how high the household's income is. This means the lowest-cost plan — which is generally quite a bit cheaper than the second-lowest-cost Silver plan — is unlikely to be more than 7.28% of their modified adjusted gross income (MAGI), which is the threshold for an affordability exemption in 2025.11

But if the ARP's provisions are not extended past the end of 2025, affordability exemptions will once again be important in 2026 and future years. But with the current system, there's no readily available way for these applicants to see catastrophic plans when they browse their options. The form for obtaining an exemption is lengthy and the process can take several weeks, which makes it challenging for a person to obtain an exemption number during the annual open enrollment period unless they start early in the enrollment window.

A savvy broker can use rate sheets to manually get catastrophic plan quotes for their clients, but there is not a readily available DIY option, and even for brokers, there isn't an automated way to display catastrophic plan pricing for applicants who are 30 or older.

Other reasons for low catastrophic plan enrollment

In addition to the limited eligibility, cumbersome exemption process, and the lack of catastrophic plans displayed as an option for people 30+ who might be eligible for an affordability exemption, there are other reasons for low catastrophic plan enrollment, including:

- Catastrophic plans aren't always the lowest-cost option for people who don't get premium subsidies. For example, in Cook County, Illinois, the lowest-cost plan for a 27-year-old in 2025 is $267/month (a Bronze plan), while the lowest-cost catastrophic plan for this person is $290/month.12

- In some areas, there are no catastrophic plans available. And in some areas, the lowest-cost insurer doesn't offer catastrophic plans, so even if other insurers do, the Bronze plan from the lowest-cost insurer might be less expensive than another insurer's catastrophic plan.

- Some applicants are specifically looking for HSA-qualified plans so that they can contribute money to an HSA. Through the end of 2025, catastrophic plans cannot be HSA-qualified high-deductible health plans – despite their high deductibles – because they pay for some non-preventive services before the deductible and because their out-of-pocket maximum is too high. So a person who wants to be able to contribute to an HSA cannot enroll in a catastrophic plan. But as noted above, this will change in 2026, when a Marketplace catastrophic plan will make a person eligible to contribute to an HSA.9

Where can I buy a catastrophic plan?

Catastrophic plans are available both in and out of the ACA's health insurance exchanges, but hardship (including affordability) exemptions for those 30 and older must be obtained from the exchange.

The Trump administration issued guidance in 2018 that allows people to claim hardship exemptions on their tax returns instead of having to obtain them from the exchange in their state. But that was only useful in terms of avoiding the ACA's individual mandate penalty (which still applied for 2018 but is no longer applicable). Exemptions via a tax return are granted after the year is over. An applicant who wants to apply for a catastrophic plan must get their hardship exemption in advance to be able to apply for the catastrophic plan during open enrollment or a special enrollment period.

If you're shopping for health insurance in your state's exchange, you'll see catastrophic plans (assuming they're available in your area) in addition to the Bronze, Silver, and Gold plans (and in some areas, Platinum plans) when you browse the available options, but only if you're under 30 years old. If you're 30 or older, it won't show up as an option unless you have your exemption certificate from the exchange.

Footnotes

- "Compilation of Patient Protection and Affordable Care Act" 111th Congress, Legislative Counsel. May 2010. ⤶

- HHS-Operated Risk Adjustment Methodology Meeting. Centers for Medicare & Medicaid Services. March 2016. ⤶

- "Patient Protection and Affordable Care Act; Marketplace Integrity and Affordability" U.S. Department of Health and Human Services. June 25, 2025 ⤶

- How to pick a health insurance plan. Healthcare.gov. Accessed December 18, 2024. ⤶

- "How to pick a health insurance plan — Catastrophic health plans" HealthCare.gov. Accessed July 8, 2025 ⤶

- Health coverage exemptions: Forms & how to apply. Healthcare.gov. Accessed December 18, 2024. ⤶

- Guidance on Hardship Exemptions from the Individual Shared Responsibility Provision for Persons Experiencing Limited Issuer Options or Other Circumstances. Centers for Medicare & Medicaid Services. April 9, 2018. ⤶

- Plan Year 2025 Qualified Health Plan Choice and Premiums in HealthCare.gov Marketplaces. Centers for Medicare and Medicaid Services. October 25, 2024 ⤶

- "H.R.1 - One Big Beautiful Bill Act" (Section 71307). Congress.gov. Enacted July 4, 2025 ⤶ ⤶

- "2025 Marketplace Open Enrollment Period Public Use Files" (Columns H and BQ). Centers for Medicare & Medicaid Services. March 2024. ⤶

- Premium Adjustment Percentage, Maximum Annual Limitation on Cost Sharing, Reduced Maximum Annual Limitation on Cost Sharing, and Required Contribution Percentage for the 2025 Benefit Year. Centers for Medicare and Medicaid Services. Nov. 15, 2023 ⤶

- See Plans and Prices. HealthCare.gov. Accessed Dec. 18, 2024. ⤶