Home > States > Health insurance in Oklahoma

See your Oklahoma health insurance coverage options.

Find individual and family plans, small-group, short-term or Medicare plans through licensed agency partners.

Oklahoma Health Insurance Consumer Guide

This guide was developed to help you understand the Oklahoma health insurance options available for you and your family. The options found in Oklahoma’s ACA Marketplace may be a good choice for many consumers, and we will guide you through them below.

Oklahoma uses the federally run health insurance exchange (Marketplace), Healthcare.gov, for residents to purchase its ACA Marketplace plans. The Marketplace provides access to health insurance plans from seven private insurers for 2024,1 although insurer participation varies significantly from one area to another.2

Depending on your income and other circumstances, you may also get help to lower your monthly insurance premium (the amount you pay to enroll in the coverage), and possibly your out-of-pocket expenses, when you enroll in a policy through the Oklahoma Health Insurance Marketplace.

Explore our other comprehensive guides to coverage in Oklahoma

Dental coverage in Oklahoma

Need dental coverage? Learn about available options and find the right dental plan in Oklahoma with our guide.

Oklahoma’s Medicaid program

Oklahoma Medicaid (SoonerCare) eligibility was expanded (as called for in the ACA) in July 2021. Oklahoma's total Medicaid enrollment has grown to more than 1 million people since the expansion of coverage limits.3

Medicare coverage and enrollment in Oklahoma

As of December 2022, there were 778,724 Oklahoma residents with Medicare coverage.4 Our Oklahoma Medicare guide explains the various parts of Medicare, as well as Oklahoma regulations pertaining to Medigap (Medicare Supplement) plans.

Short-term coverage in Oklahoma

As of 2023, there were at least seven insurers selling short-term health insurance plans in Oklahoma.5

Frequently asked questions about health insurance in Oklahoma

Who can buy Marketplace health insurance?

To be able to enroll in a health plan through the Oklahoma Marketplace, you must: 6

- Live in Oklahoma

- Be lawfully present in the United States

- Not be incarcerated

- Not be enrolled in Medicare

Eligibility for financial assistance (premium subsidies and cost-sharing reductions) depends on your income. In addition, to qualify for financial assistance with your Marketplace plan you must:

- Not have access to affordable health coverage offered by an employer. If your employer offers coverage but you feel it’s too expensive, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies in the Marketplace.

- Not be eligible for Medicaid or CHIP.

- Not be eligible for premium-free Medicare Part A.7

When can I enroll in an ACA-compliant plan in Oklahoma?

In Oklahoma, open enrollment for individual and family health coverage runs from November 1 to January 15.8

Your coverage will start on January 1 if you enroll before December 15. But if you apply between December 16 and January 15, your coverage will begin on February 1.8

Outside of open enrollment, a special enrollment period (typically linked to a specific qualifying life event) is necessary to enroll or make changes to your coverage.

If you have questions about open enrollment, you can learn more in our comprehensive guide to open enrollment. We also have a comprehensive guide to special enrollment periods.

How do I enroll in an Oklahoma Marketplace plan?

To enroll in an ACA Marketplace plan in Oklahoma, you can:

- Visit Healthcare.gov to access Oklahoma’s Health Insurance Marketplace. Here you will find an online platform to shop, compare, and choose the best health plans.

- Purchase individual and family health coverage with the help of an insurance agent or broker, a Navigator or certified application counselor, or an approved enhanced direct enrollment entity.9

You can reach HealthCare.gov’s call center by dialing 1-800-318-2596 (TTY: 1-855-889-4325). The call center is available 24 hours a day, seven days a week, except holidays.

How can I find affordable health insurance in Oklahoma?

Oklahoma uses the federally run exchange for individual market plans, so residents who buy their own health insurance enroll through HealthCare.gov.

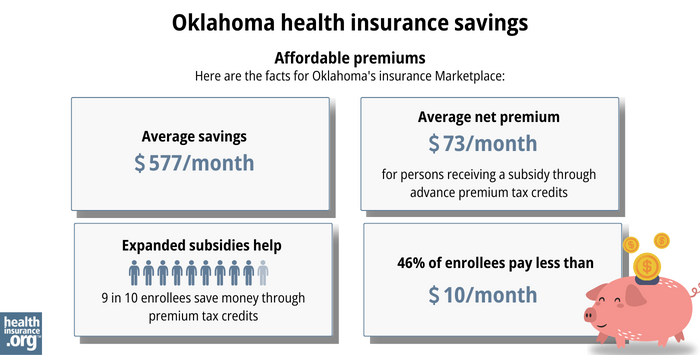

About nine out of ten eligible enrollees save money on 2023 premium payments amounting to an average savings (via the premium tax credit) of $577/month. After subsidies were applied, the average enrollee’s monthly cost was about $73/month.10

In addition to premium tax credits (subsidies), the Affordable Care Act provides cost-sharing reductions (CSR) that will reduce out-of-pocket costs on Silver-level plans if your household income isn’t more than 250% of the poverty level.11 In 2023, 96% of Oklahoma Marketplace enrollees were receiving CSR benefits.12

Between the premium subsidies and cost-sharing reductions, you may find that an ACA plan in the Oklahoma Health Insurance Marketplace provides the best value for your health insurance needs.

Source: CMS.gov10

Oklahoma implemented the ACA’s expansion of Medicaid starting in mid-2021, under the terms of a voter-approved ballot measure. So Medicaid is available to Oklahoma adults under age 65 with household income up to 138% of the poverty level — currently a little more than $20,000 in annual income for a single person.13 (Medicaid was already available to children with even higher household income,14 and is available to older adults but with both income and asset limits.)

How many insurers offer Marketplace coverage in Oklahoma?

Are Marketplace health insurance premiums increasing in Oklahoma?

For premiums on their 2024 coverage, Oklahoma’s exchange insurers have implemented the following average rate changes,15 which amount to an overall weighted average rate increase of about 4.4%.16

Oklahoma’s ACA Marketplace Plan 2024 Approved Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| BCBSOK | 5.0% |

| Oscar | 4.5% |

| Medica | -0.4% |

| CommunityCare | 1.6% |

| UnitedHealthcare | –3.5% |

| Ambetter (Centene/Celtic) | 6.1% |

| Taro Health | New for 2024, so no applicable rate change |

Source: HealthCare.gov15

Note that rate changes are applicable to full-price premiums, but most Marketplace enrollees qualify for premium subsidies and thus do not pay full price for their coverage.

Oklahoma is one of only two states that do not have their own effective rate review programs, so Oklahoma health insurance rates are reviewed by federal regulators.17

For perspective, here’s an overview of how full-price (pre-subsidy) premiums have changed over time in Oklahoma’s individual/family market:

- 2015: Average increase of 12.2%.18

- 2016: Average increase of 25.8%.19

- 2017: Average increase of 76%20 (CSR cost added to 2017 rates, a year ahead of other states)21

- 2018: Average increase of 8.7%.22

- 2019: Average decrease of 1.9%.23

- 2020: Average increase of 2.7%.24

- 2021: Rates mostly unchanged.25

- 2022: Average increase of 4.4%.26

- 2023: Average increase of 8%-10%.27

Oklahoma submitted a 1332 waiver proposal to the federal government in 2017. The goal was to create a reinsurance program to reduce full-price premiums in the state’s individual market, followed by additional extensive state-led reforms. But amid approval delays the state withdrew the waiver proposal and has not revisited the issue since.28

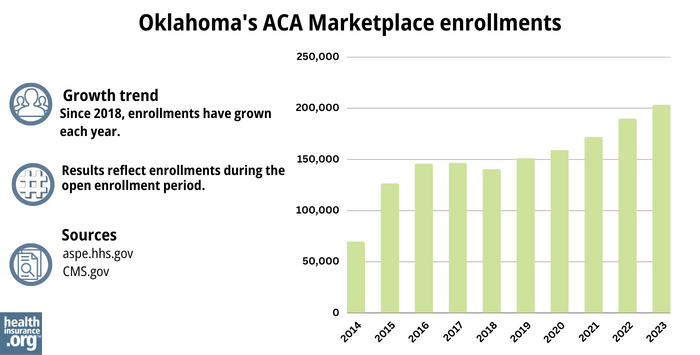

How many people are insured through Oklahoma’s Marketplace?

During the open enrollment period for 2023 coverage, 203,157 people enrolled in private individual market plans through Oklahoma’s exchange.29 This was a record high for the state, on the heels of previous record highs in 2022 and 2021.

The surge in enrollment during these years was due in part to American Rescue Plan (ARP) provisions that made ACA’s premium subsidies more substantial. Under the ARP – now extended by the Inflation Reduction Act – subsidies are more significant and accessible through the end of 2025.29

Source: 2014,30 2015,31 2016,32 2017,33 2018,34 2019,35 2020,36 2021,37 2022,38 202329

What health insurance resources are available to Oklahoma residents?

HealthCare.gov

800-318-2596

State Exchange Profile: Oklahoma

The Henry J. Kaiser Family Foundation overview of Oklahoma’s progress toward creating a state health insurance exchange.

Oklahoma Insurance Department

Assists people insured by private health plans, Medicaid, or other plans in resolving problems pertaining to their health coverage; assists uninsured residents with access to care. (405) 521-2991 / Toll Free in OK: (800) 522-0071 / [email protected]

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- Health Insurance Marketplace Open Enrollment Begins in Oklahoma: Secure Your Health Coverage for 2024. Oklahoma Insurance Department. October 2023. ⤶ ⤶

- Plan Year 2024 Qualified Health Plan Choice and Premiums in HealthCare.gov Marketplaces. Centers for Medicare and Medicaid Services. October 25, 2023. ⤶ ⤶

- “April 2023 Medicaid & CHIP Enrollment Data Highlights” Medicaid.gov, April 28, 2023 ⤶

- “Medicare Monthly Enrollment ” CMS.gov, Accessed August 2023 ⤶

- “Availability of short-term health insurance in Oklahoma” healthinsurance.org, Aug. 14, 2023 ⤶

- ”A quick guide to the Health Insurance Marketplace” HealthCare.gov ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- “When can you get health insurance?” HealthCare.gov, 2023 ⤶ ⤶

- “Entities Approved to Use Enhanced Direct Enrollment” CMS.gov, April 28, 2023 ⤶

- “2023 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 2023 ⤶ ⤶

- APTC and CSR Basics. Centers for Medicare and Medicaid Services. June 2023. ⤶

- “Effectuated Enrollment: Early 2023 Snapshot and Full Year 2022 Average” CMS.gov, March 15, 2023 ⤶

- 2023 Poverty Guidelines. U.S. Department of Health and Human Services. Accessed December 2023. ⤶

- Medicaid, Children’s Health Insurance Program, & Basic Health Program Eligibility Levels. Centers for Medicare and Medicaid Services. December 2023. ⤶

- “Oklahoma Rate Review Submissions” HealthCare.gov, 2023 ⤶ ⤶

- So How’d I Do On My 2024 Avg. Rate Change Project? Not Bad At All! ACA Signups. December 2023. ⤶

- State Effective Rate Review Programs. Centers for Medicare and Medicaid Services. Accessed December 2023 ⤶

- Oklahoma 2015 Rates: 12.2% Avg. Increase (Weighted); 5.6% Net QHP Increase Since 4/19? ACA Signups. September 2014. ⤶

- FINAL PROJECTION: 2016 Weighted Avg. Rate Increases: 12-13% Nationally* ACA Signups. October 2015. ⤶

- Avg. UNSUBSIDIZED Indy Mkt Rate Hikes: 25% (49 States + DC). ACA Signups. October 2016. ⤶

- Iowa & Oklahoma: Approved Rate Hikes Of 51% And 8.7% Respectively; BCBSOK Baked In CSR Cost LAST Year! ACA Signups. October 2017. ⤶

- 2018 Rate Hikes. ACA Signups. October 2017. ⤶

- 2019 Rate Hikes. ACA Signups. October 2018. ⤶

- 2020 Rate Changes. ACA Signups. October 2019. ⤶

- 2021 Rate Changes. ACA Signups. October 2020. ⤶

- Oklahoma: Approved Avg. 2022 #ACA Rate Changes: +4.4% Indy Market (Weighted); +6.3% Sm. Group (Unweighted). ACA Signups. October 2021. ⤶

- Insurance Department Announces Health Plans Participating in the 2023 Oklahoma Marketplace. Oklahoma Insurance Department. ⤶

- Section 1332: State Innovation Waivers. Centers for Medicare and Medicaid Services. Accessed December 2023. ⤶

- “Health Insurance Marketplaces 2023 Open Enrollment Report” CMS.gov, 2023 ⤶ ⤶ ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶