Home > States > Health insurance in Vermont

See your Vermont health insurance coverage options.

Find individual and family plans, small-group, short-term or Medicare plans through licensed agency partners.

Vermont Health Insurance Consumer Guide

This Vermont health insurance guide will help you understand the coverage options and potential financial assistance available to you and your family.

Vermont runs its own health insurance exchange (Marketplace), which is called Vermont Health Connect. The Vermont Health Connect platform allows residents to shop for individual and family health plans offered by two private health insurance carriers. These plans are used by people who aren’t eligible for Medicare, Medicaid, or an affordable employer-sponsored health plan. Vermont Health Connect can also be used to enroll in Medicaid or Dr. Dynasaur.

Vermont is among the states that offer state-funded subsidies in addition to the federal subsidies provided under the ACA. Vermont is also among the states that have individual mandates, but unlike the other states that have individual mandates, Vermont does not have a financial penalty for going without coverage.1

Explore our other comprehensive guides to coverage in Vermont

Dental coverage in Vermont

In 2023, one insurer offers stand-alone individual/family dental coverage through the health insurance Marketplace, in Vermont.2 Learn about other dental coverage options in the state.

Vermont’s Medicaid program

Vermont offers Medicaid for low-income adults, and Dr. Dynasaur for low-income children and pregnant women.3 Vermont expanded Medicaid under the ACA, and enrollment has grown by 21% since 2013.4 After being paused for three years due to the pandemic, Medicaid disenrollments resumed in Vermont at the end of May 2023. By July, more than 11,000 people had been disenrolled from the program.5

Medicare coverage and enrollment in Vermont

More than 160,000 people in Vermont had Medicare coverage as of early 2023. Most were eligible due to age, but nearly 20,000 were under 65 and eligible for Medicare due to a disability.6 Our Vermont Medicare guide explains the various parts of Medicare, coverage options for Medicare Advantage and Part D, and Vermont’s rules regarding Medigap (Medicare Supplement) availability.

Short-term health insurance coverage in Vermont

No insurers currently offer short-term health insurance in the state. This is due in part to the fact that the state has extensive rules for all health plans, including a requirement that Essential Health Benefits be covered, and a ban on pre-existing condition exclusions.7

Frequently asked questions about health insurance in Vermont

Who can buy Marketplace health insurance in Vermont?

To be eligible to enroll in private health coverage through Vermont Health Connect, you must:

- Be a resident of Vermont and lawfully residing in the United States

- Not be incarcerated

- Not be enrolled in Medicare

So most people in Vermont are eligible to enroll in a health plan through Vermont Health Connect. But there are some additional parameters must be met in order to qualify for state and federal subsidies through Vermont Health Connect.

To qualify for income-based federal Advance Premium Tax Credits (APTC), federal cost-sharing reductions (CSR), or Vermont’s state-funded financial assistance you must:

- Not have access to an affordable plan offered by an employer. If you are eligible to sign up for an employer’s plan and aren’t sure whether it’s considered affordable, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies via beWellnm.

- Not be eligible to enroll in Vermont Medicaid or Dr. Dynasaur coverage, or premium-free Medicare Part A.

- If you receive premium subsidies, you must file a tax return for the year the coverage is in effect (must be a joint return if married).8

In addition to those basic parameters, Vermont Health Connect premium subsidy eligibility will depend on your household’s income and how it compares with the premium for the second-lowest-cost Silver plan in your area (unlike most states, premiums do not vary by age or location within the state of Vermont).

When can I enroll in an ACA-compliant plan in Vermont?

The open enrollment period in Vermont begins November 1 and continues through January 15.9

Enrollments must be completed by December 15 in order to have coverage effective January 1. Enrollments completed between December 16 and January 15 will have a February 1 effective date.10

Outside of the annual open enrollment period, you may still be able to enroll or make a plan change if you experience a qualifying life event, such as giving birth or losing other health coverage.

Some people can enroll year-round even without a specific qualifying life event. This includes the low-income special enrollment period, which is available to Vermont applicants with household income up to 200% of the poverty level.11 (The household income cutoff for this SEP is 150% in most states.)

Enrollment in Vermont Medicaid and Dr. Dynasaur is available year-round for eligible applicants.

How do I enroll in a Marketplace plan in Vermont?

To enroll in an ACA Marketplace/exchange plan in Vermont, you can:

- Visit Vermont Health Connect – the state’s health insurance exchange/Marketplace – to compare the health plans that are available in your area, determine whether you’re eligible for financial assistance, and enroll in coverage during open enrollment or during a special enrollment period. You can reach Vermont Health Connect’s call center at 855-899-9600.

- Enroll in a Vermont Health Connect plan with the help of an insurance agent or broker, or a certified enrollment assister.12

How can I find affordable health insurance in Vermont?

You may find that you’re eligible for financial assistance through Vermont Health Connect, which can make your coverage and medical care more affordable. And the assistance may be more robust than it is in many other states, as both federal and state subsidy programs are available in Vermont.

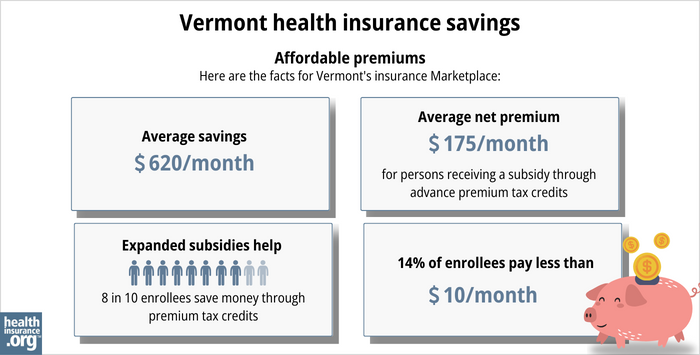

The Affordable Care Act (ACA) created federal premium subsidies (advance premium tax credits, or APTC), which are available depending on your income. Nearly nine out of ten Vermont Health Connect enrollees were receiving APTC as of early 2023. These subsidies covered an average of $620/month, reducing the average enrollee’s premium to about $175/month.13

Vermont also offers state-funded premium subsidies for applicants with household income up to 300% of the federal poverty level. The additional subsidies stack on top of the federal APTC, and reduce (by 1.5 percentage points) the percentage of income that applicants have to pay to purchase the second-lowest-cost Silver plan.14

Federal cost-sharing reductions (CSR) are available to applicants with household income up to 250% of the poverty level, and Vermont offers additional cost-sharing reductions to bring eligibility for this program up to 300% of the poverty level in Vermont.15

Cost-sharing reductions reduce the deductible and other out-of-pocket expenses for Silver-level plans. More than a quarter of Vermont Health Connect enrollees were receiving CSR benefits as of 2023.13

Depending on your income and circumstances, you may be able to enroll in free or low cost health coverage through Vermont Medicaid or Dr. Dynasaur. Learn more about whether you might be eligible for these programs in Vermont.

Source: CMS.gov13

How many insurers offer Marketplace coverage in Vermont?

Two insurance companies offer health plans through Vermont Health Connect:

- Blue Cross Blue Shield of Vermont

- MVP

Are Marketplace health insurance premiums increasing in Vermont?

The following table highlights Vermont’s Marketplace insurers’ approved rate changes for 2024 individual/family health plans. (Note that in both cases, the approved rate increase is a little smaller than the insurer had initially proposed).16

Vermont’s ACA Marketplace Plan 2024 Approved Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Blue Cross Blue Shield of Vermont | 14% |

| MVP | 11% |

Source: Green Mountain Care Board16

It’s important to note that average rate changes apply to full-price premiums, and most enrollees do not pay full price. Eighty-eight percent of Vermont Health Connect enrollees were receiving federal premium subsidies in 2023.13

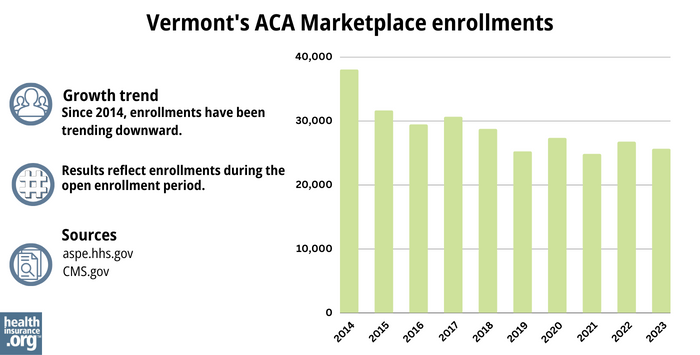

How many people are insured through Vermont’s Marketplace?

What health insurance resources are available to Vermont residents?

Vermont Health Connect

The state-run health insurance Marketplace/exchange. Individuals and families use the Marketplace to obtain health coverage, with financial assistance based on income. Vermont Health Connect can also be used to enroll in Medicaid and Dr. Dynasaur.

Vermont Insurance Division

Consumer assistance with insurance questions and complaints.

Green Mountain Care Board

An independent five-member board, created by Vermont’s 2011 health care reform legislation and tasked with improving health care transparency, advancing innovation in health care payment and delivery, and regulating various aspects of health care in the state. The Green Mountain Care Board is also responsible for reviewing and approving health insurance rates.

Vermont State Health Insurance Program

A local service that provides enrollment counseling and assistance for Medicare beneficiaries.

Vermont Medicaid and Dr. Dynasaur

Health coverage for low-income Vermont residents.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- “Individual Mandate FAQ” Vermont Health Connect ⤶

- “Vermont dental insurance guide 2023” healthinsurance.org, Accessed September 2023 ⤶

- “Medicaid and Dr. Dynasaur for Vermonters” Department of Vermont Health Access ⤶

- "Total Monthly Medicaid & CHIP Enrollment and Pre-ACA Enrollment" KFF.org, April 2023 ⤶

- ”Vermont Medicaid Renewal Dashboard” Department of Vermont Health Access ⤶

- "Medicare Monthly Enrollment" CMS.gov, April 2023 ⤶

- “Rule I-2018-03 Short-Term, Limited Duration Health Insurance” Vermont Department of Financial Regulation, Accessed September 2023 ⤶

- “My wife and I each make about $40,000 a year. If we file our taxes separately, can we each qualify for an exchange subsidy?” healthinsurance.org, July 6, 2023 ⤶

- “Vermont Communications Toolkit for 2023 Open Enrollment” Vermont Health Connect. ⤶

- “When can you get health insurance?” HealthCare.gov, 2023 ⤶

- “Special enrollment period offers lower costs for thousands of Vermont households” Department of Vermont Health Access, July 2022. ⤶

- “Find an Assister” Vermont Health Connect ⤶

- “2023 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 2023 ⤶ ⤶ ⤶ ⤶ ⤶

- “2021-2025 Applicable Percentages” Vermont Health Connect, Accessed September 2023 ⤶

- “Financial Help” Department of Vermont Health Access ⤶

- “View Filings” Vermont Rate Review, Green Mountain Care Board ⤶ ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- “Health Insurance Marketplaces 2023 Open Enrollment Report” CMS.gov, 2023 ⤶