Home > States > Health insurance in Maryland

See your Maryland health insurance coverage options now.

Find affordable individual and family, small-group, short-term, or dental plans through licensed agency partners.

Maryland Health Insurance Consumer Guide

This guide, including the FAQs below, is designed to help you understand the health coverage options and possible financial assistance available to you and your family in Maryland. For many, an Affordable Care Act (ACA) Marketplace (exchange) plan, also known as Obamacare, may be an affordable option.

In addition to federal subsidies, Maryland also offers state-funded subsidies for young adults ages 18-37, helping to make coverage even more affordable for this population (this program was previously available to adults up to age 34, but has been extended to age 37).1

Individual and family plans on the ACA Marketplace are available for:

- Self-employed people

- Early retirees needing coverage until Medicare

- Workers at small businesses that don’t offer health benefits

Maryland operates its own state-run exchange called Maryland Health Connection. The Maryland exchange follows an active purchaser model. This means the state negotiates with insurance companies to decide which plans will be available for people to buy. Aetna Health joined Maryland’s individual market for 2024, increasing the number of coverage options that enrollees have.

Maryland established a reinsurance program in 2019, which has kept full-price (unsubsidized) premiums lower than they would otherwise have been.2 Maryland also offers an easy enrollment program, which allows residents to connect with health coverage via their state tax return.

Explore our other comprehensive guides to coverage in Maryland

Dental coverage in Maryland

In 2023, there are four insurers who offer stand-alone individual/family dental coverage through the health insurance Marketplace in Maryland. Our state guide explains the coverage options that may be available to you.

Maryland’s Medicaid program

Maryland expanded Medicaid coverage under ACA. By April 2023, more than 1.7 million people were enrolled in Medicaid and CHIP in the state.3

Medicare coverage options and enrollment in Maryland

As of early 2023, more than 1.1 million Maryland residents have Medicare coverage.4 Learn more about Medicare in Maryland, including private plan options and Medigap plans.

Short-term coverage in Maryland

Maryland residents can buy short-term health plans with durations up to three months.

Frequently asked questions about health insurance in Maryland

Who can buy Marketplace health insurance?

To qualify for Marketplace coverage in Maryland, you must:5

- Live in Maryland

- Be a U.S. citizen, national, or lawfully present in the U.S.

- Not be incarcerated

- Not be enrolled in Medicare

Whether or not you qualify for financial assistance with your premium, deductible, or out-of-pocket costs depends on your income and how it compares with the cost of the second-lowest-cost Silver plan in your zip code.

Additionally, to qualify for subsidies, you must:

- Not have access to affordable health coverage through an employer. If you think your employer-sponsored health plan is too expensive, use our Employer Health Plan Affordability Calculator to check if you might qualify for premium subsidies in the Marketplace.

- Not be eligible for Medicaid or CHIP.

- Not be eligible for premium-free Medicare Part A.[efn_note]Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023.[/efn_note]

- If married, you must file a joint tax return6 (with very limited exceptions)7

- Not be able to be claimed by someone else as a tax dependent.8

When can I enroll in an ACA-compliant plan in Maryland?

Maryland’s open enrollment period for individual and family health plans runs from November 1 to January 15.9

- Enroll by December 31 for coverage to start January 1.

- Enroll between January 1 and January 15 for coverage to begin February 1.

Note that the deadline to get a January 1 effective date in Maryland is December 31. This differs from most other states, where the deadline is typically December 15.10

Outside of open enrollment, you generally need a qualifying life event, such as losing coverage, getting married, or permanently moving, to enroll or make changes. The qualifying life event will trigger a special enrollment period (SEP).

Note that Maryland is one of several states where pregnancy is considered a qualifying life event, giving a person 90 days from the date of the pregnancy confirmation to enroll in a health plan.11

Some people can enroll outside of open enrollment without a specific qualifying life event. For example:

- Native Americans can enroll year-round.

- People who utilize Maryland’s easy enrollment period can begin the process of obtaining health insurance by checking a box on their tax return.12

People who qualify for Medicaid, the Maryland Children’s Health Program (MCHP), or MCHP Premium can enroll anytime.9

How do I enroll in a Marketplace plan in Maryland?

There are several ways to enroll in an ACA Marketplace plan in Maryland:9

- Online: Go to MarylandHealthConnection.gov to create an account and apply.

- Phone: Contact the Call Center at 855-645-8572. Those who are deaf and hard of hearing use the Relay service. Help is available in over 200 languages.

- Talk to a broker: Get help from an authorized insurance broker through Broker Connect.13

- Talk to a navigator: Get help from one of the local navigator organizations in Maryland.

- Mobile app: Apply from your phone by downloading the mobile app, Enroll MHC.

How can I find affordable health insurance in Maryland?

You can find affordable individual and family health plans in Maryland through MarylandHealthConnection.gov, the state’s ACA exchange.

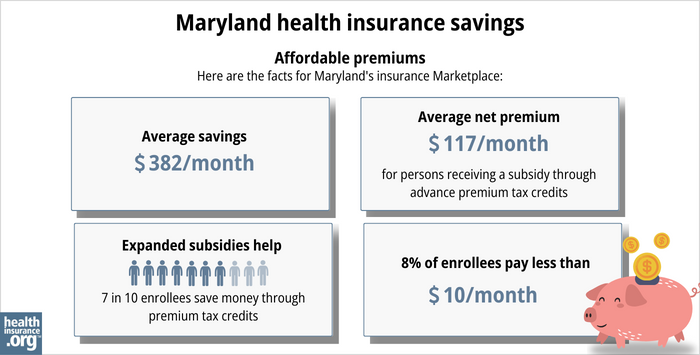

More than seven out of ten eligible enrollees receive subsidies, saving about $382 monthly on their 2023 premiums.14 These subsidies are called Advance Premium Tax Credits (APTC). With subsidies, Maryland residents pay about $117 monthly on average in premiums.14

If your income is under 250% of the federal poverty level, you may qualify for cost-sharing reductions (CSR) to lower your deductibles and out-of-pocket costs.15

Thanks to a state-funded subsidy program, young adults aged 18 to 37 may qualify for additional help paying their monthly premiums. This assistance is in addition to the federal APTC.16

The young adult subsidy program was initially slated to be available in 2022 and 2023, but legislation (HB814 and SB601) enacted in 2023 made it permanent. And although it initially only applied to adults up to age 34, the state has extended the eligible age range up to 37.1

Although Maryland does not have plan standardization, the exchange does offer “Value Plans,” which have lower out-of-pocket costs for certain frequently-used services.17 And for 2024, changes were made to the Value Plans “to make the costs for common health care services clearer and more consistent across insurance companies.”18

For Maryland residents who aren’t eligible for premium subsidies or Medicaid, short-term health insurance can be a lower-cost coverage option, although Maryland limits short-term health plans to three-month durations and it’s important to understand that these plans are not ACA-compliant. For example, they don’t have to cover pre-existing conditions or essential health benefits..

How many insurers offer Marketplace coverage in Maryland?

For 2024, six insurance companies are offering coverage through the Maryland exchange, including one new insurer:19

Are Marketplace health insurance premiums increasing in Maryland?

The 2024 approved individual market rate increases in Maryland are as follows:20

Maryland’s ACA Marketplace Plan 2024 Approved Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Change |

| Aetna Health, Inc. | new for 2024 |

| CareFirst BlueChoice, Inc. | 4.9% |

| CareFirst of Maryland, Inc. (CareFirst Blue Cross Blue Shield) | 2.5% decrease |

| Group Hospitalization and Medical Services, Inc. (GHMSI) | 2.5% decrease |

| Kaiser Foundation Health Plan of the Mid-Atlantic States, Inc. | 8.3% |

| Optimum Choice, Inc. | 1.2% decrease |

Source: Maryland Insurance Administration21

Overall, the average rate change for 2024 amounts to a 4.7% increase, which is a little lower than the insurers initially requested.

Note that the average rate changes affect full-price premiums, and most enrollees don’t pay the full amount. Around 77% of the people who signed up for private plans through Maryland Health Connection in 2023 received financial assistance with their costs through premium subsidies.14 These subsidy amounts are adjusted annually to match the cost of the second-lowest-cost Silver plan.

Maryland established a reinsurance program in 2019, and federal approval was granted in 2023 to extend this program for another five years. The reinsurance program has kept Maryland’s individual market premiums much lower than they would otherwise have been.22

The entry of Aetna Health to Maryland’s Marketplace in 2024 gave consumers additional coverage options. But it’s also important to understand how the entry of a new insurer can affect premium subsidies, depending on how the new plans are priced relative to existing plans.

If your premiums are increasing from one year to the next, you might want to consider other Maryland Health Connection plans that better fit your budget and offer the benefits you need.

Here’s a look at how overall average premiums have changed each year in Maryland:

How many people are insured through Maryland’s Marketplace?

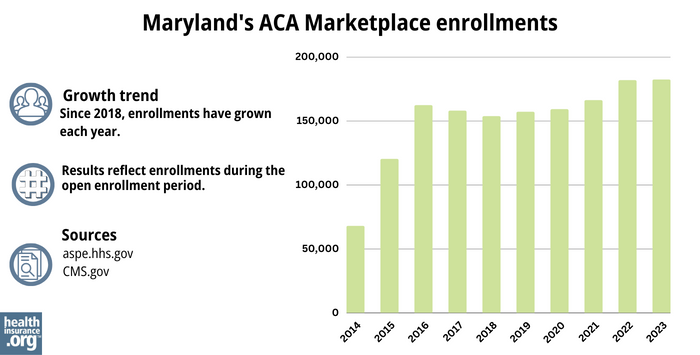

213,895 people enrolled in private plans through Maryland Health Connection during the open enrollment period for 2024 coverage.32 This was a significant record high (see below for a chart of prior year enrollment totals).

This surge in enrollment in recent years was due largely to the American Rescue Plan, which improved affordability starting in 2021. The Inflation Reduction Act extended these improvements until 2025, ensuring coverage remains more affordable than it was before the ARP became law.

Another factor in the 2024 enrollment spike was the end of the pandemic-era Medicaid continuous coverage rule. Medicaid disenrollments resumed in 2023, after being paused for three years. By November 2023, more than 38,000 Maryland residents had transitioned from Medicaid to a private plan obtained via Maryland Health Connection, including nearly 20,000 who were automatically enrolled33 (most states do not have an automatic enrollment process for people transitioning away from Medicaid, but Maryland does).

(Maryland Health Connection reported that more than 14,000 of the people who enrolled during the open enrollment period for 2024 coverage had transitioned away from Medicaid,32 but the disenrollments and coverage transitions had begun in mid-2023, well before the start of open enrollment.)

Source: 2014,34 2015,35 2016,36 2017,37 2018,38 2019,39 2020,40 2021,41 2022,42 202314

What health insurance resources are available to Maryland residents?

Maryland Health Connection

This is the state’s official health insurance Marketplace, where residents can shop for and enroll in health coverage plans.

Maryland Department of Health

This department oversees various health-related programs in the state, including providing information and managing enrollment for Medicaid.

Maryland Health Education and Advocacy Unit

This unit offers education and support to help individuals understand and navigate their health insurance options, making informed decisions about their coverage.

Health Care Access Maryland

This organization ensures that Maryland residents can access quality healthcare services, assisting with enrollment, navigation, and resources.

Maryland Senior Health Insurance Program

Designed for older adults, this program offers valuable information and assistance related to Medicare.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- Young Adult Subsidy Program Expands Age Range. Maryland Health Connection. Accessed November 2023. ⤶ ⤶

- Reinsurance Program. Maryland Health Benefit Exchange. Accessed December 2023. ⤶

- "Total Monthly Medicaid & CHIP Enrollment and Pre-ACA Enrollment" KFF.org, April 2023 ⤶

- “Medicare Monthly Enrollment” CMS.gov, April 2023 ⤶

- “Are you eligible to use the Marketplace?” HealthCare.gov, 2023 ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed MONTH. ⤶

- Updates to frequently asked questions about the Premium Tax Credit. Internal Revenue Service. February 2024. ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed January 23, 2024. ⤶

- “Maryland Health Connection Frequently Asked Questions” Marylandhealthconnection.gov, Accessed September 18, 2023 ⤶ ⤶ ⤶

- “Maryland Health Connection Frequently Asked Questions” Marylandhealthconnection.gov, Accessed September 2023 ⤶

- ”Special Enrollment” Marylandhealthconnection.gov, Accessed September 18, 2023 ⤶

- ”Easy Enrollment Program” Marylandhealthconnection.gov, Accessed September 2023 ⤶

- “Maryland Health Connection Find Help” Marylandhealthconnection.gov, Accessed September 2023 ⤶

- “2023 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 2023 ⤶ ⤶ ⤶ ⤶

- “Federal Poverty Level (FPL)” HealthCare.gov, 2023 ⤶

- “Young Adult Premium Assistance” Maryland Health Connection, Marylandhealthconnection.gov, Accessed November 2023 ⤶

- ”All About Value Plans” Maryland Health Connection. ⤶

- Maryland Health Connection’s Open Enrollment For 2024 Health Plans Starts Today, November 1. Maryland Health Connection. November 1, 2023. ⤶

- ”Maryland Insurance Administration Approves 2024 Affordable Care Act Premium Rates“ Maryland Insurance Administration, September 18, 2023. ⤶

- “Exhibit 1: 2024 Maryland ACA Individual Market Rate Filing Summary“ Maryland Insurance Administration, insurance.maryland.gov, September 2023. ⤶

- “Exhibit 1: 2024 Maryland ACA Individual Market Rate Filing Summary” Maryland Insurance Administration, insurance.maryland.gov, September 2023. ⤶

- “Maryland Insurance Administration Approves 2024 Affordable Care Act Premium Rates“ Maryland Insurance Administration, September 18, 2023. ⤶

- “Modest Premium Changes Ahead in Health Insurance Marketplaces in Washington State and Maryland“ The Commonwealth Fund, October 20, 2014. ⤶

- “Maryland: *Approved* 2016 Weighted Avg. Hikes: 20.0% Overall (Updated)“ ACA Signups. September 4, 2015. ⤶

- “Maryland: *Approved* 2017 Avg. Rate Hikes Revised: 25.2% Vs. 27.9% Requested“ ACA Signups. September 24, 2016. ⤶

- “2018 Rate Hikes“ ACA Signups. ⤶

- “Marylanders to see premiums drop 13% on average for 2019 ACA plans” Baltimore Business Journal. September 21, 2018. ⤶

- “Maryland: *Approved* 2020 ACA Exchange Premium Rate Changes: 10.3% Reduction“ ACA Signups. September 19, 2019. ⤶

- “2021 ACA Approved Health Insurance Rates Individual Non-Medigap & Small Group Markets“ Maryland Insurance Administration. September 21, 2020. ⤶

- “Maryland Insurance Administration Approves 2022 Affordable Care Act Premium Rates“ Maryland Insurance Administration. September 3, 2021. ⤶

- “Maryland Insurance Administration Approves 2023 Affordable Care Act Premium Rates“ Maryland Insurance Administration. September 16, 2022. ⤶

- ”Nearly 215,000 Enroll in 2024 Coverage, Most Ever for Maryland Health Connection” Maryland Health Connection. January 18, 2024. ⤶ ⤶

- ”State-based Marketplace (SBM) Medicaid Unwinding Report” Centers for Medicare & Medicaid Services. Data through November 2023. ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- ”Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶