What are essential health benefits?

Since 2014, under the Affordable Care Act, all new individual and small-group health insurance policies (including those sold in the ACA's health insurance exchanges and off-exchange) must cover essential health benefits for all enrollees.

And there cannot be annual or lifetime caps on the amount of money the insurer will pay for the services. (Note that there can still be a cap on the number of covered visits. For example, an insurer might cover 20 physical therapy visits in a year, and that's still allowed.)

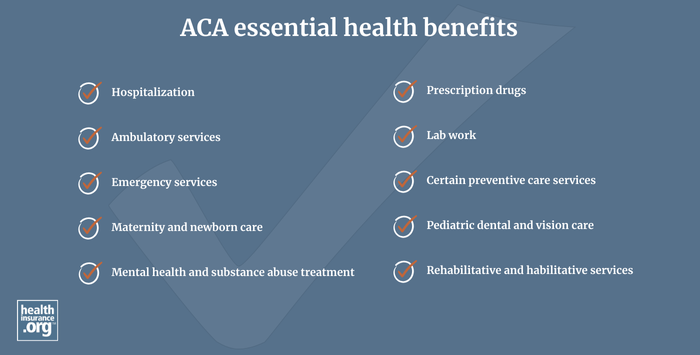

What are the 10 essential benefits mandated by the ACA?

The Affordable Care Act defines ten essential health benefits:

- Hospitalization

- Ambulatory services (visits to doctors and other healthcare professionals and outpatient hospital care)

- Emergency services

- Maternity and newborn care

- Mental health and substance abuse treatment

- Prescription drugs (including brand-name drugs and specialty drugs)

- Lab work

- Preventive care services recommended by the U.S. Preventive Services Task Force (USPSTF), the Health Resources and Services Administration (HRSA), and the CDC's Advisory Committee on Immunization Practices (ACIP). This amounts to a fairly extensive list of services,1 including things like contraception, blood pressure screening, breast cancer screening, colorectal cancer screening, obesity screening and counseling, tobacco use counseling and interventions, and breastfeeding counseling. It also includes recommended vaccines, including COVID vaccines. But not all preventive services are covered, so it’s important to understand how this works before scheduling a checkup. And some services — such as mammography and colonoscopy — are fully paid for by insurance if they’re done as preventive care in an asymptomatic person, but will require normal cost-sharing if they’re done for diagnostic reasons, such as investigating a lump that you or your doctor found.

- Pediatric dental and vision care (there is some flexibility on the inclusion of pediatric dental if the plan is purchased within the exchange)

- Rehabilitative and habilitative services

Has a lawsuit changed the rules for preventive care coverage?

Most health plans are still required to cover preventive care without any cost-sharing. In 2023, a federal judge ruled against requiring USPSTF recommendations to be covered by health insurers.2 An appeals court issued a ruling in 2024 that allows the plaintiffs in the case to no longer provide zero-cost USPSTF-recommended preventive care coverage to their employees. But it overturned the district court’s ruling that had extended that provision to all health plans. So most non-grandfathered health plans are still required to cover USPSTF-recommended preventive care with no cost-sharing. But other plaintiffs could file similar legal challenges in the future.

Is contraception an essential health benefit?

Yes, female contraception is part of the ACA's preventive care essential health benefit. To be clear, contraception coverage is not specifically spelled out in the ACA as one of the essential health benefits. Instead, the law directed the Health Resources and Services Administration (HRSA) to define woman-specific services that must be covered under the preventive care EHB category. So HRSA developed those guidelines,3 and they include coverage for the full range of female contraceptives approved by the FDA.

However, the rules for employer exemptions from the contraceptive coverage mandate have changed over the years.

The Obama administration created an exemption for religious organizations, and an accommodation process by which women with coverage under exempt organizations could still access zero-cost contraception. The Trump administration expanded the exemption to also include organizations with moral objections, and made the accommodation optional for plan issuers with exemptions.

But the Biden administration has proposed a rule change in 2023 that would eliminate the moral objection exemption,4 and that would ensure a way for women to obtain zero-cost contraception, even if they’re enrolled in a plan that has a religious exemption from the contraception mandate.

Are ACA essential benefits the same in every state?

The ACA outlined the essential health benefits as broad categories of care, and it's up to each state to define exactly what has to be covered under each essential health benefit category. States do this by designating an essential health benefits (EHB) benchmark health plan.

So although the ACA's essential health benefit categories are the same in every state, the specifics of exactly what has to be covered by individual and small group health plans will vary from one state to another.

We can look at physical therapy – which is part of the habilitative/rehabilitative EHB – for a good example of how this works in a couple of states:

- New York has designated an Oxford EPO small group plan as its benchmark.5 That plan includes coverage for up to 60 physical therapy visits per year, but notes that “Speech & physical therapy are only covered following a hospital stay or surgery.” So insurers offering individual and small group coverage in New York are not required to cover physical therapy if the patient has not had a hospital stay. They can choose to go above and beyond that coverage level, but they don’t have to.

- Now let’s consider another state. Colorado’s benchmark plan limits physical therapy to just 20 visits per year, but physical therapy is “covered if, in the judgment of a Plan Physician, significant improvement is achievable within a two-month period.” So insurers in Colorado must cover up to 20 physical therapy visits per year, and cannot limit coverage only to those who had a prior hospital stay.6

This is just one example of how “covered” doesn’t mean covered in the same way from one state to another. It all depends on the benchmark plan in your state, as well as state-specific benefits mandates that a state has implemented via the legislative process (for example, requiring all state-regulated health plans to cover male contraception,which goes beyond what the federal government requires in terms of contraceptive coverage7).

How many people have coverage for the ACA's essential health benefits?

Millions of Americans have coverage for the ACA's essential health benefits, including:

- More than 21.4 million people enrolled in on-exchange individual market coverage during the open enrollment period for 2024 coverage, plus another 1.3 million who enrolled in the Basic Health Programs in New York and Minnesota.8

- In addition, there were an estimated 1.7 million people with ACA-compliant off-exchange coverage in 2022.9 These plans provide all of the same essential health benefits coverage as on-exchange plans, but enrollees do not qualify for the ACA's financial assistance.

- All non-grandfathered, non-grandmothered small group health insurance plans also include coverage for essential health benefits.

- Medicaid also covers the essential health benefits,10 and total enrollment in Medicaid/CHIP has grown by more than 25 million people since 2013,11 due in large part to Medicaid expansion under the ACA (enrollment was even higher during the COVID pandemic, began to decrease when disenrollments resumed in 2023).

Grandmothered and grandfathered plans are not required to cover the ACA's essential health benefits, although grandmothered plans are required to cover recommended preventive care with no cost-sharing.

Large group plans and self-insured plans are also not required to cover essential health benefits (but if they do, they cannot impose dollar limits on the benefit), although they are required to cover recommended preventive care without any cost-sharing, unless they're grandfathered.

Footnotes

- "Preventative health services" Healthcare.gov. ⤶

- "Explaining Litigation Challenging the ACA’s Preventive Services Requirements: Braidwood Management Inc. v. Becerra" KFF.org. May 15, 2023 ⤶

- "Women’s Preventive Services Guidelines" HRSA.gov. March, 2024 ⤶

- "Biden-Harris Administration Proposes New Rules to Expand Access to Birth Control Coverage Under the Affordable Care Act" CMS.gov. January 30, 2023 ⤶

- "NEW YORK EHB BENCHMARK PLAN" CMS.gov. May 15, 2015 ⤶

- "Benefits for Health Care Coverage: Colorado Benchmark Plan" doi.colorado.gov. July 20, 2022 ⤶

- "Insurance Coverage of Contraceptives" guttmacher.org. October 31, 2024 ⤶

- ”Health Insurance Marketplaces 2024 Open Enrollment Period Report” CMS.gov. March 22, 2024 ⤶

- "As ACA Marketplace Enrollment Reaches Record High, Fewer Are Buying Individual Market Coverage Elsewhere" KFF.org. Sept. 7, 2023 ⤶

- "Essential Health Benefits in the Medicaid Program " Medicaid.gov. November 20, 2012 ⤶

- "Total Monthly Medicaid & CHIP Enrollment and Pre-ACA Enrollment" KFF.org. August, 2024 ⤶