Home > States > Health insurance in Massachusetts

See your Massachusetts health insurance coverage options.

Find individual and family plans, small-group, short-term or Medicare plans through licensed agency partners.

Massachusetts Health Insurance Consumer Guide

This guide was created to help you better understand the health coverage options available to you and your family in Massachusetts. The options found in Massachusetts’s ACA Marketplace may be a good choice for many consumers, and we will guide you through the options below.

Massachusetts residents use a fully state-run health insurance marketplace known as Health Connector to shop for and purchase ACA Marketplace plans offered by a variety of private health insurance companies.

Massachusetts also

- provides state-funded subsidies, in addition to the federal subsidies that are available nationwide. State-funded subsidies in Massachusetts have expanded for 2024, as described below.

- has stricter medical loss ratio requirement than most states (88%,1 as opposed to the 80% federal minimum),

- caps premiums for older enrollees at no more than double the rate for a 21-year-old (as opposed to a 3:1 ratio in most states),2

- requires residents to maintain health insurance, under a rule that predates the ACA.

Explore our other comprehensive guides to coverage in Massachusetts

Dental coverage in Massachusetts

In 2023, two insurers offer stand-alone individual/family dental coverage through Massachusetts Health Connector.3 Learn about other coverage options in the state.

Massachusetts’s Medicaid program

Medicaid expansion in Massachusetts took effect in 2014, and is known as MassHealth CarePlus. Over 2 million people were enrolled in the Massachusetts Medicaid program as of April 2023.4

Medicare coverage and enrollment in Massachusetts

Medicare enrollment in Massachusetts stood at 1,408,811 people as of 2023.5 Our guide will help you better understand Medicare coverage options and Medicare-specific regulations in Massachusetts.

Short-term coverage in Massachusetts

There are currently no short-term plans available for purchase in Massachusetts.6

Frequently asked questions about health insurance in Massachusetts

Who can buy Marketplace health insurance?

To purchase health coverage through the Massachusetts Marketplace, you must:7

- Live in Massachusetts

- Be lawfully present in the United States

- Not be incarcerated

- Not be enrolled in Medicare

Eligibility for premium subsidies and cost-sharing reductions through the Marketplace depends on your income and how it compares with the cost of the second-lowest-cost Silver plan in your area. In addition, to qualify for financial assistance with your Marketplace plan you must:

- Not have access to affordable health coverage through your employer. If your employer offers coverage but you feel it’s too expensive, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies in the Marketplace.

- Not be eligible for Medicaid or CHIP.

It’s important to note that Massachusetts is one of the states that has its own individual mandate, and residents who don’t have health insurance are subject to a penalty when they file their state tax returns.8 The individual mandate in Massachusetts pre-dates the ACA. It was paused from 2014 through 2018, when there was a federal penalty for not having health insurance. Massachusetts revived the state-based penalty in 2019.

When can I enroll in an ACA-compliant plan in Massachusetts?

The open enrollment period for individual/family health coverage in Massachusetts runs from November 1 to January 23. This is slightly longer than in most states.9

Outside of open enrollment, a qualifying life event is generally necessary to enroll in a plan or make coverage changes. But residents who are eligible for ConnectorCare can enroll anytime if they are newly eligible or haven’t previously enrolled.10

Massachusetts also has a “Simple Sign Up Program” that allows people to use their state tax return to gain access to health coverage.11 Several other states have similar programs.

How do I enroll in a Massachusetts Marketplace plan?

To enroll in an ACA Marketplace plan in Massachusetts, you can:

- Visit the Health Connector to access Massachusetts’s state-run health insurance marketplace. Here you will find an online platform to shop, compare, and choose the best health plans.

- Purchase individual and family health coverage with the help of an insurance agent or broker, a Navigator or certified application counselor, or an approved enhanced direct enrollment entity.12

The Massachusetts Health Connector debuted a program for automatic enrollment in 2022. It allows applicants to check a box on the application indicating that if they are eligible for a $0 premium ConnectorCare plan but don’t select a plan themselves, the exchange will automatically enroll them in a $0 premium plan. If the applicant had coverage in the past with a carrier that offers one of the available $0 premium plans, the exchange will enroll the person with that carrier. If not, and if multiple $0 premium plans are available, the exchange will randomly assign the person to one of the available plans. But applicants in this scenario have the option to select a different plan instead of the one to which they’re automatically assigned.13

The federal government reported that 1,568 people who previously had MassHealth coverage had been automatically enrolled into a qualified health plan by the Massachusetts Health Connector between April and June 2023.14

How can I find affordable health insurance in Massachusetts?

Residents in Massachusetts use the Health Connector to enroll in Marketplace health coverage as well as to determine subsidy eligibility. Both non-standardized and standardized health plans are available through the Health Connector.15

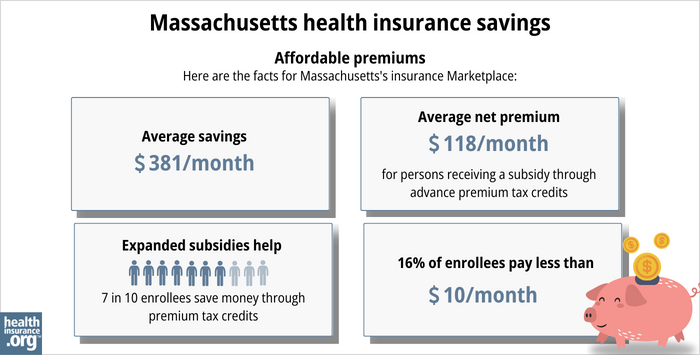

The Affordable Care Act provides income-based advance premium tax credits (subsidies) that offset premium payments to help keep your expenses down. More than 74% of Massachusetts Health Connector enrollees saved money on 2023 premiums. The average subsidy for these enrollees was $381/month, resulting in an average after-subsidy premium of $118/month.16

In addition to federal subsidies, Massachusetts residents may also qualify for ConnectorCare plans. ConnectorCare plans qualify for the federally funded ACA premium tax credits, but are also subsidized by the state, resulting in even lower premium and out-of-pocket costs for eligible residents.17

ConnectorCare has historically been available to applicants with income up to 300% of the poverty level. But starting in 2024, ConnectorCare eligibility has been expanded to 500% of the poverty level.18

ConnectorCare enrollment has been steadily increasing since mid-2023, due to the post-pandemic return to normal eligibility redeterminations and disenrollments for MassHealth (Medicaid). Many people who are no longer eligible for MassHealth are now eligible for ConnectorCare instead.19

In addition to premium subsidies, people with household incomes up to 250% of the federal poverty level also qualify for cost-sharing reductions (CSR). These subsidies reduce deductibles and other out-of-pocket expenses as long as the enrollee selects a Silver plan.20 Between the premium subsidies and cost-sharing reductions, you may find that an ACA plan is the cheapest health insurance option for you.

Source: CMS.gov16

How many insurers offer Marketplace coverage in Massachusetts?

Eight insurers offer exchange plans in the Massachusetts exchange.21 Coverage areas vary from one insurer to another, so plan availability depends on where you live.

There are also two insurers — HPIC Insurance Company and ConnectiCare of Massachusetts, Inc. — that only offer plans outside the exchange. However, their combined total enrollment in individual/family plans is fewer than 450 people.22

Are Marketplace health insurance premiums increasing in Massachusetts?

The following average rate changes were approved for 2024 for the insurers that offer coverage through Massachusetts Health Connector, amounting to an overall weighted average increase of 3.2%, before any subsidies are applied:23

Massachusetts’ ACA Marketplace Plan 2024 Approved Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Mass General Brigham Health Plan | 6.9% |

| Boston Medical Center Health Plan /WellSense Health Plan | -3.3% |

| Fallon Community Health Plan | 1.2% |

| Health New England (HNE) | 7.2% |

| Tufts Health Plan Direct | 2.9% |

| Blue Cross Blue Shield of Massachusetts (BCBSMA) | 3.7% |

| Harvard Pilgrim Health Care | 7% |

| UnitedHealthcare | 9.9% |

Source: Office of Consumer Affairs and Business Regulation24

Because Massachusetts has a merged individual and small-group market, each carrier’s rate changes apply to both individual and small-group plans.

For perspective, here’s a summary of how average premiums have changed in Massachusetts over time:

- 2015: 1.6% increase25

- 2016: 6.3% increase26

- 2017: 19% increase27

- 2018: 18% increase28

- 2019: 4.7% increase29

- 2020: 5.2% increase30

- 2021: 7.9% increase31

- 2022: 6.9% increase32

- 2023: 7.6% increase33

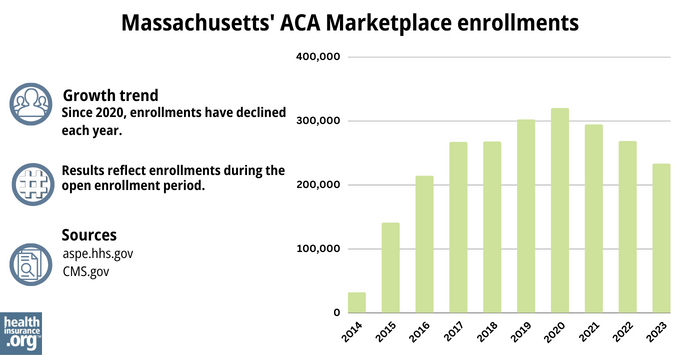

How many people are insured through Massachusetts’s Marketplace?

What health insurance resources are available to Massachusetts residents?

Massachusetts Health Connector

877-MA-ENROLL (877-623-6765)

State Exchange Profile: Massachusetts

The Henry J. Kaiser Family Foundation overview of Massachusetts’s progress toward creating a state health insurance exchange.

Health Care for All – Massachusetts Consumer Assistance Program

Assists people insured by private health plans, Medicaid, or other plans in resolving problems pertaining to their health coverage; assists uninsured residents with access to care.(800) 272-4232

Office of Patient Protection, Department of Public Health

800-436-7757 (toll-free nationwide)

Serves residents and other consumers who receive health coverage from a Massachusetts carrier, insurer, or HMO.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- “Chapter 288; An Act to Promote Cost Containment, Transparency, and Efficiency in the Provision of Quality Health Insurance for Individuals and Small Businesses” Massachusetts Legislature ⤶

- “Market Rating Reforms State Specific Rating Variations” Centers for Medicare and Medicaid Services. ⤶

- “Massachusetts dental insurance guide 2023” healthinsurance.org, Accessed September 2023 ⤶

- “April 2023 Medicaid & CHIP Enrollment Data Highlights” Medicaid.gov, April 28, 2023 ⤶

- “Medicare Monthly Enrollment” CMS.gov, April 2023. ⤶

- “Availability of short-term health insurance in Massachusetts” healthinsurance.org, Feb. 2, 2023 ⤶

- ”A quick guide to the Health Insurance Marketplace” HealthCare.gov ⤶

- “Health Care Reform for Individuals” Mass.gov, 2023 ⤶

- “Request for Open Enrollment Waiver” Mass.gov, 2023 ⤶

- “ConnectorCare Health Plans” masshealthconnector.org ⤶

- Simple Sign Up Program. Massachusetts Health Connector. Accessed December 2023. ⤶

- “Entities Approved to Use Enhanced Direct Enrollment” CMS.gov, April 28, 2023 ⤶

- “Source is a discussion with the Massachusetts Health Connector Public Affairs Office” October 2023 ⤶

- “State-based Marketplace (SBM) Medicaid Unwinding Report” Medicaid.gov. September 29, 2023 ⤶

- “2024 Health and Dental Plan Proposed Seal of Approval (SOA)” Massachusetts Health Connector Board of Directors Meeting, March 2023 ⤶

- “2023 Marketplace Open Enrollment Period Public Use Files”CMS.gov, 2023 ⤶ ⤶ ⤶

- “ConnectorCare Health Plans” masshealthconnector.org, 2023 ⤶

- ”Massachusetts expands access to affordable health care” Massachusetts Health Connector. August 15, 2023. ⤶

- Massachusetts Health Connector Membership During MassHealth Redeterminations. Massachusetts Health Connector. December 2023. ⤶

- ”APTC and CSR Basics” Centers for Medicare and Medicaid Services. June 2023 ⤶

- ”Massachusetts Rate Review Submissions” HealthCare.gov, 2023 ⤶

- 2024 Health Insurance Rates. Office of Consumer Affairs and Business Regulation, Mass.gov, Accessed December 2023 ⤶

- 2024 Health Insurance Rates. Office of Consumer Affairs and Business Regulation, Mass.gov, Accessed August 2023 ⤶

- “2024 Health Insurance Rates”Office of Consumer Affairs and Business Regulation, Mass.gov, Accessed August 2023 ⤶

- “Final Award of 2015 Seal of Approval” Massachusetts Health Connector. ⤶

- ”Massachusetts health insurance costs set to rise by 6.3 percent in 2016” Mass Live. August 30, 2015. ⤶

- ”Board of the Commonwealth Health Insurance Connector Authority Minutes” September 8, 2016 ⤶

- ”2018 Rate Hikes” ACA Signups ⤶

- ”Health Connector Rates Going Up 4.7%” The Sun. September 13, 2018. ⤶

- ”Massachusetts: *Final* Avg. Unsubsidized 2020 Premiums: 5.2% Increase” ACA Signups. October 30, 2019. ⤶

- ”Do You Live In Massachusetts? You’ll Probably Pay More For Health Insurance Next Year” WGBH. September 17, 2020. ⤶

- ”Board of the Commonwealth Health Insurance Connector Authority Minutes” September 9, 2021 ⤶

- ”Final Award of the 2023 Seal of Approval (VOTE)” Massachusetts Health Connector Board of Directors Meeting, September 2022 ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- “Health Insurance Marketplaces 2023 Open Enrollment Report”CMS.gov, Accessed August 2023 ⤶