What is a catastrophic health insurance plan?

Although the term “catastrophic plan” has long been used as a generic catch-all phrase to describe health insurance plans with high deductibles and little coverage for routine care, the Affordable Care Act assigned strict parameters to the term:

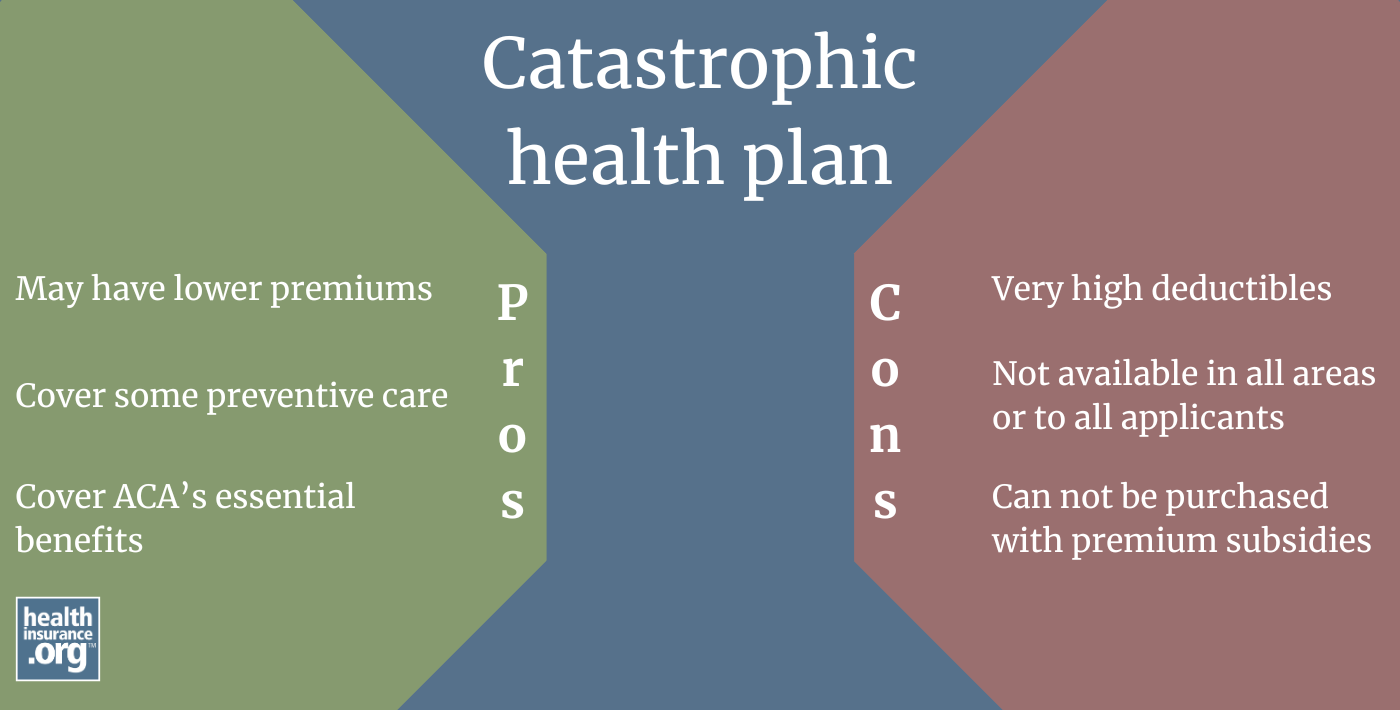

Catastrophic plans:

- are only available to certain applicants (as detailed below, eligibility for these plans has been expanded for 2026).

- have deductibles equal to the maximum annual out-of-pocket limit.

- pay at least part of the cost of up to three primary care visits before the deductible is met.

- cannot be used with premium subsidies.

- are not offered by all carriers and are not available in all areas.

The specific requirements for Catastrophic plans available in the text of the ACA, section 1303(e).1

Are catastrophic plans less expensive than Bronze plans?

This depends on the location and the specific plans in question. The short answer: Historically, catastrophic plans have often been less expensive than Bronze plans, although not always. And since not all carriers offer catastrophic plans, the lowest-cost carrier in a given area didn't always offer catastrophic plans. And for 2026, changes in the availability of catastrophic plans have resulted in some insurers significantly increasing the premiums of these plans. Here are the details, including some example premiums for 2026:

One of the reasons catastrophic plans have tended to be less expensive is that for the ACA's risk adjustment program, catastrophic plans are in a separate risk pool from the metal-level plans,2 even though they're in the same general shared risk pool.3 (The risk adjustment program transfers funds from carriers that insure healthier enrollees to carriers that insure sicker enrollees. This helps to stabilize the overall market, and removes the incentive for carriers to design plans that appeal more to healthy enrollees.)4

This means that within a state, catastrophic plans transfer risk adjustment funds with other catastrophic plans, but not with metal-level plans. This is one of the reasons catastrophic plans have tended to have lower prices than Bronze plans. (The coverage they offer is quite similar to Bronze plans: Bronze plans cover an average of 56% - 62% of costs for a standard population,5 while catastrophic plans must cover less than 60% of average costs,6 with the same maximum out-of-pocket limit that applies to other plans.

So because of the way the plans are grouped for risk adjustment, and because most catastrophic plan enrollees have historically been under age 30 and fairly affluent – since subsidies cannot be used with catastrophic plans — these plans have generally had lower premiums than Bronze plans.7

However, that's changing somewhat for 2026, as catastrophic plans access has been expanded (details below). As a result, insurers were allowed to refile premiums for 2026 coverage during a short window in late September 2025, to account for the fact that catastrophic plans would be more widely available to older enrollees.8 As an example of the impact, North Dakota's insurance department clarified that the expanded access to catastrophic plans "resulted in much higher rate increases for 2026 than was originally anticipated for those plans."9

But there is considerable variation from one area to another. For example:

- A 50-year-old in Orlando, Florida, who doesn't qualify for a 2026 Marketplace subsidy can get a catastrophic plan for as little as $462/month, whereas the cheapest Bronze plan is $700/month.

- On the other hand, if this same person is in Houston, Texas, they can get a Bronze plans for as little as $523/month, but would have to pay $628/month to get the cheapest catastrophic plan.10

The takeaway point: Don't assume catastrophic plans will be the cheapest option, even if you're not eligible for a Marketplace subsidy. It will depend on where you live and the plans that are available to you.

Catastrophic plans: High deductibles, plus primary care and preventive care

- Catastrophic plans cover all of the essential benefits defined by the ACA, but with very high deductibles, equal to the annual limit on out-of-pocket costs under the ACA. For 2026, this is $10,600 for a single individual.11

- They must still limit members’ out-of-pocket costs for in-network services to no more than the annual out-of-pocket maximum that applies to all plans. This cap is $10,600 for an individual in 2026.

- Catastrophic plans pay at least some of the cost of up to three primary care visits per year before the deductible is met. (Copays can apply for these visits, but at least part of the cost will be paid by the insurance company, even if you haven't met your deductible.)

- Like all ACA-compliant plans, catastrophic plans cover certain preventive care with no cost-sharing.

- Other services beyond preventive care and some primary care will be paid by the insured until the deductible is met. There is no coinsurance for catastrophic plans, as the deductible is equal to the maximum allowable out-of-pocket limit.

Can I use premium subsidies to buy a catastrophic plan?

No. An enrollee in a catastrophic plan is not eligible for premium subsidies.12 (and cost-sharing subsidies are also not available for Catastrophic plans, since those can only be obtained if you choose a Silver plan).

Depending on your income, you may be eligible for a premium subsidy that you could apply towards a metal-rated plan, however. This may make a metal-level plan more affordable than a catastrophic plan.13

Who can enroll in a catastrophic plan?

For coverage effective between 2014 and 2025, catastrophic plans were only available to people under age 30, or people 30 and older who qualified for a hardship/affordability exemption.14

For the 2026 plan year, CMS has made changes to allow more people to qualify for an automatic hardship exemption and thus be eligible to enroll in a catastrophic plan.15 Starting on November 1, 2025, when open enrollment began for 2026 coverage, consumers whose projected household income makes them ineligible for premium tax credits are automatically eligible for a hardship exemption and thus allowed to enroll in catastrophic coverage. (Assuming the federal subsidy enhancements are allowed to expire at the end of 2025, this will include anyone with a household income above 400% of the federal poverty level.) As discussed below, catastrophic plans are not available in all areas, so access also depends on where a person lives.

The new hardship exemption provision also applies to people whose household income is above 250% of FPL (and thus ineligible for cost-sharing reductions). But if these individuals select a catastrophic plan, they will be forfeiting their premium tax credits, as premium tax credits cannot be used with catastrophic plans. So people with household income between 250% and 400% of the poverty level should compare the full-price cost of a catastrophic plan (if any are available in their area) with the subsidized cost of metal-level plans, and determine what plan will best fit their needs and budget.

CMS is rolling out a new online application process for the hardship exemption (as opposed to just the existing paper application process), but the agency has noted that it will initially only be available to those who aren’t eligible for premium tax credits, and will later be expanded to include those who are only ineligible for cost-sharing reductions.16

Until that happens, the existing paper application process for a hardship exemption will need to be used for those who are applying based on ineligibility for cost-sharing reductions. But CMS has noted that they are working toward a “goal of streamlining hardship exemption paper application processing and reducing the administrative burden on consumers,” making it easier for people to obtain an exemption.17

To this end, HealthCare.gov is automatically displaying catastrophic plans (where available) for applicants 30 and older if they enter an income above 400% of the 2025 poverty level. However, catastrophic plans are not being automatically displayed when a person age 30+ projects an income above 250% of the poverty level but not above 400%.18

The new hardship exemption rules apply in almost all states. This includes all states that use the federally-run HealthCare.gov exchange platform, as well as all states that run their own exchange platforms except California, Connecticut, Maryland, and the District of Columbia (those four states have their own hardship exemption processes, whereas the rest of the state-run exchanges use HealthCare.gov’s exemption process).19

The first Trump administration previously expanded access to hardship exemptions in April 2018,20 allowing exemptions for people in areas where all plans cover abortions, areas where only one insurer (or zero insurers) offers plans in the exchange, or where a personal hardship is created due to the plan options available in the exchange.

In particular, the provision for people in areas where just one insurer offers plans in the exchange made a hardship exemption available to far more people, allowing them to potentially purchase a catastrophic plan (albeit without premium subsidies, making this a realistic alternative only for people who aren't otherwise eligible for subsidies). But insurer participation in the exchanges has increased significantly since 2018, with very few enrollees currently having access to just one insurer's plans.21

Can I contribute to an HSA if I have a catastrophic plan?

Starting in 2026, you will be able to contribute to a health savings account (HSA) if you have a catastrophic plan purchased through the health insurance Marketplace. This is due to Section 71307 of the One Big Beautiful Bill Act (OBBBA), enacted in July 2025.22 But before 2026, enrollment in a catastrophic plan will not allow a person to contribute to an HSA.

How many people enroll in catastrophic plans?

During the open enrollment period for 2025 coverage, only 54,109 people enrolled in catastrophic plans, out of more than 24 million exchange enrollees nationwide.23 (People can enroll in catastrophic plans outside the exchange, but off-exchange enrollment is quite low across all types of plans, and the same eligibility rules apply to catastrophic plans on-exchange or off-exchange.)

Why is catastrophic plan enrollment so low?

Prior to November 2025, catastrophic plans were only displayed in Marketplace plan finder tools for applicants who were under 30. And premium subsidies can't be used with catastrophic plans. More than nine out of ten Marketplace enrollees qualified for advance premium tax credits in 2025,24 and those would be forfeited for anyone who opted for a Catastrophic plan.

Obtaining a hardship exemption has not historically been a quick process, as it required the applicant to submit an exemption application and wait to see if it was approved. If it was, the person was given an Exemption Certificate Number (ECN) that could be used to apply for a catastrophic plan.25

As noted above, however, a new streamlined online application process for hardship exemptions debuted in November 2025 on HealthCare.gov, allowing people who are ineligible for premium tax credits to obtain a hardship exemption in a more automated fashion. And HealthCare.gov is also displaying catastrophic plans (where available) alongside other options when an applicant projects an income above 400% of the federal poverty level.

Other reasons for low catastrophic plan enrollment

In addition to the limited eligibility, cumbersome exemption process, and the lack of catastrophic plans displayed as an option for people 30+ who might be eligible for an affordability exemption (prior to 2026), there are other reasons for low catastrophic plan enrollment, including:

- Catastrophic plans aren't always the lowest-cost option for people who don't get premium subsidies. This was already true in some areas before 2026, but it's even more widespread in 2026, due to the fact that carriers were allowed to refile rates for catastrophic plans after CMS announced the expanded eligibility rules (details above). For example, in Houston, Texas, a 45-year-old who isn't eligible for Marketplace subsidies has access to two catastrophic plans, with monthly premiums for $507 and $647. But they have access to numerous Bronze plans with premiums starting as low as $423/month.26 So although catastrophic plan availability has been expanded for 2026, enrollment might not increase significantly.

- In some areas, there are no catastrophic plans available. For example, Wyoming has no catastrophic plans available in 2026.27 And in some areas, the lowest-cost insurer doesn't offer catastrophic plans, so even if other insurers do, the Bronze plan from the lowest-cost insurer might be less expensive than another insurer's catastrophic plan.

Footnotes

- “Compilation of Patient Protection and Affordable Care Act”111th Congress, Legislative Counsel. May 2010. ⤶

- “Summary Report on Individual and Small Group Market Risk Adjustment Transfers for the 2024 Benefit Year” Centers for Medicare & Medicaid Services. June 30, 2025 ⤶

- “HHS-Operated Risk Adjustment Methodology Meeting.” Centers for Medicare & Medicaid Services. March 2016. ⤶

- “Explaining Health Care Reform: Risk Adjustment, Reinsurance, and Risk Corridors” KFF.org. Aug. 17, 2016 ⤶

- “Patient Protection and Affordable Care Act; Marketplace Integrity and Affordability” (Levels of Coverage/Actuarial Value). Centers for Medicare & Medicaid Services. June 25, 2025 ⤶

- “What is actuarial value?” PeopleKeep. Feb. 4, 2025 ⤶

- “What is a catastrophic health insurance plan?” PeopleKeep. Sep. 19, 2024 ⤶

- "Additional Guidance on Qualified Health Plan Certification and City of Columbus v. Kennedy" Centers for Medicare & Medicaid Services. Sep. 23, 2025 ⤶

- "North Dakotans Could See Significant Health Insurance Premium Increases in 2026 if Federal Subsidies End" North Dakota Insurance & Securities Department. Oct. 15, 2025 ⤶

- “See Plans and Prices” (zip code 32789 and 77001) HealthCare.gov. Accessed Nov. 9, 2025 ⤶

- “Patient Protection and Affordable Care Act; Marketplace Integrity and Affordability” U.S. Department of Health and Human Services. June 25, 2025 ⤶

- “Explaining Health Care Reform: Questions About Health Insurance Subsidies” KFF.org. Oct. 25, 2024 ⤶

- “How to pick a health insurance plan — Catastrophic health plans” HealthCare.gov. Accessed July 8, 2025 ⤶

- “Health coverage exemptions: Forms & how to apply” HealthCare.gov. Accessed December 18, 2024. ⤶

- “Expanding Access to Health Insurance: Consumers to Gain Access to “Catastrophic” Health Insurance Plans in 2026 Plan Year” Centers for Medicare & Medicaid Services. Sep. 4, 2025 ⤶

- ”Expanding Access to Health Insurance: Consumers to Gain Access to “Catastrophic” Health Insurance Plans in 2026 Plan Year” Centers for Medicare & Medicaid Services. Sep. 4, 2025 ⤶

- “Guidance on Hardship Exemptions for Individuals Ineligible for Advance Payment of the Premium Tax Credit or Cost-sharing Reductions Due to Income, and Streamlining Exemption Pathways to Coverage” Centers for Medicare & Medicaid Services. Sep. 4, 2025 ⤶

- "See Plans & Prices" HealthCare.gov. Accessed Nov. 9, 2025 ⤶

- ”Guidance on Hardship Exemptions for Individuals Ineligible for Advance Payment of the Premium Tax Credit or Cost-sharing Reductions Due to Income, and Streamlining Exemption Pathways to Coverage” Centers for Medicare & Medicaid Services. Sep. 4, 2025 ⤶

- “Guidance on Hardship Exemptions from the Individual Shared Responsibility Provision for Persons Experiencing Limited Issuer Options or Other Circumstances” Centers for Medicare & Medicaid Services. April 9, 2018. ⤶

- “Plan Year 2025 Qualified Health Plan Choice and Premiums in HealthCare.gov Marketplaces” Centers for Medicare and Medicaid Services. October 25, 2024 ⤶

- “H.R.1 - One Big Beautiful Bill Act” (Section 71307). Congress.gov. Enacted July 4, 2025 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” (Columns H and BQ). Centers for Medicare & Medicaid Services. March 2024. ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” Centers for Medicare & Medicaid Services. Accessed Aug. 1, 2025 ⤶

- “Health coverage exemptions: Forms & how to apply” HealthCare.gov. Accessed Aug. 1, 2025 ⤶

- “See Plans and Prices” (zip code 77001) HealthCare.gov. Accessed Nov. 9, 2025 ⤶

- “See Plans & Prices” (zip code 82001) HealthCare.gov. Accessed Nov. 9, 2025 ⤶