Health insurance Marketplace by state

States vary in terms of how they manage their health insurance marketplace and health insurance exchanges. Here’s what you need to know.

Health insurance Marketplaces vary by state

The Affordable Care Act (ACA), enacted in March 2010, called for the creation of an exchange (Marketplace) in each state, but the practical implementation of those exchanges varies from one state to another.

This overview answers questions about what the exchanges are, what they offer, and how they work. You can select a state on the map below to see specific details about that state’s exchange.

How much could you save on 2025 coverage?

Compare health plans and check subsidy savings from a third-party insurance agency.

What is a health insurance Marketplace?

A health insurance Marketplace – also known as a health insurance exchange – is a platform where consumers in the United States can purchase ACA-compliant individual/family health insurance plans and receive income-based subsidies to make coverage and care more affordable.

During the open enrollment period for 2025 coverage, a record high of nearly 24.2 million people enrolled in Marketplace plans throughout the country — and that was a preliminary count, published before open enrollment had ended in some states.1

Each state has just one official Marketplace, operated either by the state, the federal government, or both. In the majority of the states, HealthCare.gov serves as the enrollment platform and runs the customer service call center. But some states run their own platforms, such as Covered California, New York State of Health, Connect for Health Colorado, and MNsure.

Frequently asked questions about health insurance Marketplaces

Do I have to buy my health insurance through a Marketplace?

You are not required to buy coverage through the Marketplace. There is no longer a federal penalty for not having health coverage (although DC and four states state-based penalties have for people who choose to remain uninsured). And even when there was a federal penalty, people could choose to purchase their coverage off-exchange instead of buying a plan through the Marketplace (with the exception of DC, where individual and small-group coverage is only available through the Marketplace).

But if you don’t buy your coverage through the exchange, you cannot obtain premium tax credits or cost-sharing reductions, even if you’d otherwise be eligible for them (and the vast majority of exchange enrollees are eligible for subsidies2). This is one of the primary reasons people shop in the Marketplace, as full-price individual health insurance premiums would simply be too costly for most people.

How do health insurance Marketplaces help consumers?

In each state, the health insurance Marketplace allows consumers to select from among a variety of private health insurance companies that offer different qualified health plans. (In a few rural areas of the United States, only one insurer offers medical plans for sale in the Marketplace, but there will still be a variety of plan options available).3

All qualified plans offered for sale in the Marketplace must be ACA-compliant – meeting standards established and enforced by the federal and state governments. So when a person shops in the health insurance Marketplace, they can be sure that the participating insurers will not use medical underwriting or exclude pre-existing conditions. All of the available plans will cover the ACA’s essential health benefits without annual or lifetime benefit caps.

Income-based premium subsidies and cost-sharing reductions are only available through the health insurance Marketplace, and are a key aspect of keeping health insurance premiums and out-of-pocket costs affordable for lower-income and middle-class Americans. (Note that it’s possible to enroll through the Marketplace via an enhanced direct enrollment entity, without using the Marketplace website.)

Who’s eligible to use the health insurance Marketplaces?

With the exception of people who are enrolled in Medicare coverage, virtually all Americans are eligible to use the health insurance Marketplace as long as they’re lawfully present in the U.S.

(Since November 1, 2024, DACA recipients have been able to use the Marketplace and qualify for income-based subsidies in many states (initially this was to be allowed nationwide, but a court ruling blocked Marketplace access for DACA recipients in 19 states). However, the Trump administration has proposed a rule change in 2025 that would end Marketplace access for DACA recipients nationwide.)

But practically speaking, the Marketplaces were designed to provide coverage for individuals and families who were either uninsured or already buying their own health insurance. This includes people who are self-employed, people who are employed by a small business that doesn’t offer health benefits, and people who have retired before age 65 and are thus too young to be covered by Medicare.

The majority of Americans under age 65 get their coverage from an employer,4 which means they don’t need to use the Marketplace. They can choose to decline their employer’s coverage and select a plan in the Marketplace instead, but they won’t be eligible for financial assistance unless the employer’s coverage wouldn’t be considered affordable and/or wouldn’t provide minimum value.

Most Americans under age 65 who are eligible for Medicaid can use the Marketplace to enroll in Medicaid, or at least to determine their eligibility for Medicaid. In some states, the Medicaid enrollment process is completed via the Marketplace, while in other states, the Marketplace sends the consumer’s information to the state Medicaid agency to finalize the eligibility and/or enrollment process.

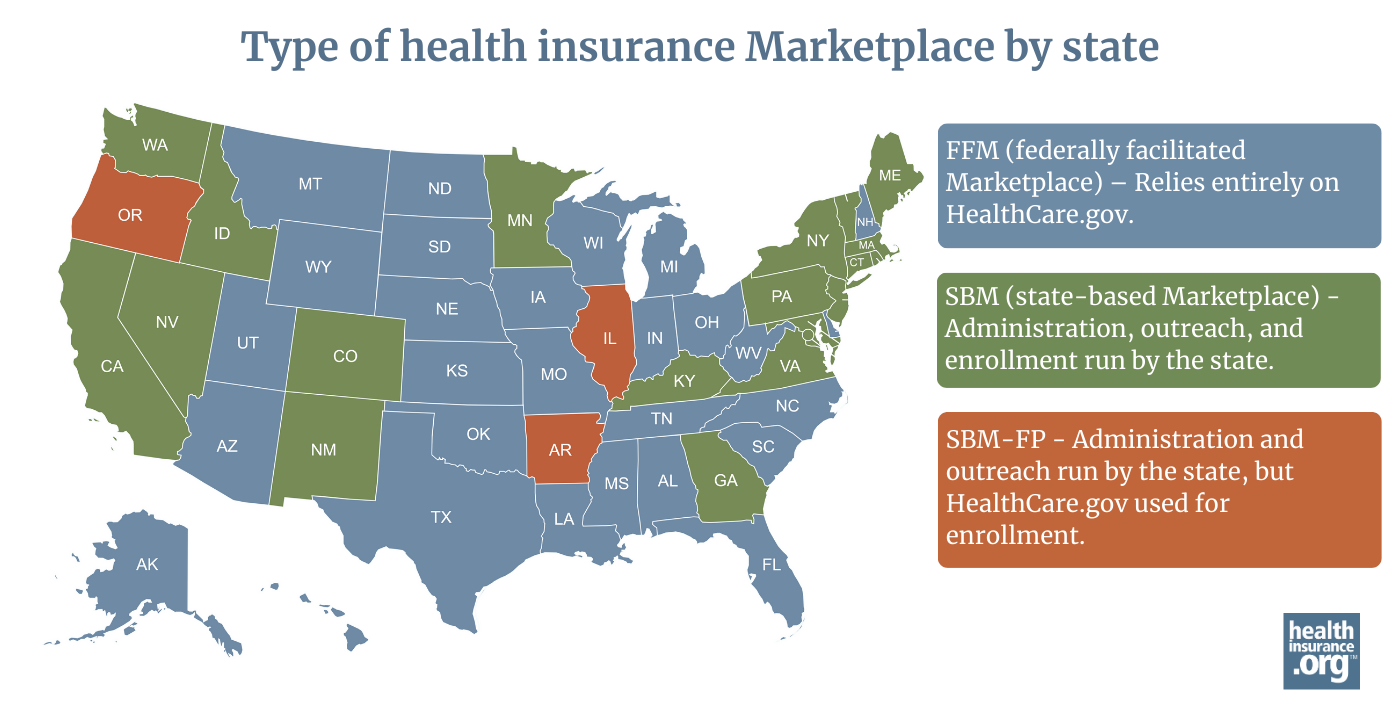

What are the types of health insurance Marketplaces?

A state’s health insurance Marketplace can be run by the state, by the federal government, or both. As of the 2025 plan year:

- DC and 19 states have fully state-run Marketplaces, which means they oversee the Marketplace and operate their own website and call center, and fund their own Navigator programs (examples are GetCoveredNJ, Pennie, Vermont Health Connect, Washington Healthplanfinder, etc.).

- Twenty-eight states rely fully on the federal government for their Marketplaces. They use the HealthCare.gov website and customer service call center, and receive federal Navigator funding.

- Three states (Arkansas, Illinois, and Oregon) have state-based Marketplaces that use the federal platform (SBM-FP), which means they oversee their own Marketplace and fund their own Navigator programs, but rely on HealthCare.gov for enrollment.

You can find more information here about the types of health insurance Marketplaces, how they work, which model each state uses, and how states’ approaches to this have changed over time.

When can consumers buy health insurance through their Marketplace?

There is an open enrollment period each fall when people can enroll in coverage through the Marketplace or change their coverage for the coming year (the same open enrollment window also applies to plans that are available outside the Marketplace, purchased directly from the insurance companies).

In most states, the open enrollment period is November 1 to January 15, with coverage effective either January 1 or February 1, depending on when the person enrolls. But there are some state-run exchanges that have different deadlines.

However, the Trump administration has proposed a rule change that calls for a shorter open enrollment period, nationwide. If this proposed rule is finalized, open enrollment will run from November 1 to December 15 in every state, starting with the open enrollment period for 2026 coverage.

Outside of the annual open enrollment period, a special enrollment period is necessary to enroll in a plan through the health insurance Marketplace (or outside the Marketplace, directly through an insurer) or change to a different plan. Special enrollment periods are triggered by a variety of qualifying life events, and will give you at least 60 days to select a new medical plan.

Footnotes

- ”Marketplace 2025 Open Enrollment Period Report: National Snapshot” CMS.gov. Jan. 17, 2025 ⤶

- ”Effectuated Enrollment: Early 2024 Snapshot and Full Year 2023 Average” CMS.gov, July 2, 2024 ⤶

- ”Plan Year 2025 Qualified Health Plan Choice and Premiums in HealthCare.gov Marketplaces” Centers for Medicare & Medicaid Services. Oct. 25, 2024 ⤶

- ”Employer-Sponsored Health Insurance 101” KFF.org. May 28, 2024 ⤶