Medicare in Florida

Original Medicare, Medicare Advantage, Part D prescription drug, and Medigap coverage in Florida

Key takeaways

- Over 5 million people are enrolled in Medicare in Florida.1

- Over half of Florida Medicare beneficiaries select Medicare Advantage plans.1

- Depending on where they live, some Florida residents can select from among fewer than 10 Medicare Advantage plans in 2024, while others have more than 60 plan options.2

- 1.4 million Florida Medicare beneficiaries are enrolled in stand-alone Medicare Part D prescription drug plans.1

Medicare enrollment in Florida

Medicare enrollment in Florida stood at 5,112,499 as of July 2024.1 That’s nearly 22% of the state’s total population.3

For most people, Medicare coverage enrollment happens when they turn 65. But Medicare eligibility is also triggered for younger people if they’re disabled and have been receiving disability benefits for 24 months, or if they have ALS or end-stage renal disease. Individuals in these situations are eligible for Medicare benefits even if they’re not yet 65 years old.

Almost 9% percent of Medicare beneficiaries in Florida are eligible due to disability, while the other 91% are at least 65 and are eligible for Medicare due to their age.1 Nationwide, about 89% percent of Medicare beneficiaries are eligible due to age, while about 11% percent are eligible due to disability.4

But Florida has the second-highest percentage of 65+ residents in the country, so it makes sense that a greater percentage of the state’s Medicare beneficiaries are eligible due to age.5

Medicare options

Medicare beneficiaries can choose among several options to access Medicare coverage. The first choice is between Medicare Advantage plans, where coverage is provided via private health insurance companies, or Original Medicare, where benefits are provided directly by the federal government.

Medicare beneficiaries also have options around Medigap policies (which cover out-of-pocket costs under Original Medicare) and Medicare Part D (coverage for prescription drugs).

Original Medicare includes Medicare Part A and Part B. Medicare Part A (also called hospital insurance) helps pay for inpatient stays, like at a hospital, skilled nursing facility, or hospice center. Medicare Part B (also called medical insurance) helps pay for outpatient care like a visit to a doctor (or nurse practitioner or physician assistant) and preventive healthcare service, such as most vaccinations.

Medicare Advantage plans include all of the benefits of Medicare Parts A and B; most Medicare Advantage plans include prescription drug coverage (Part D) and may offer extra benefits like dental and vision — for a single monthly premium.

There are pros and cons to Original Medicare and Medicare Advantage plans, and the right solution is different for each person.

Learn about Medicare plan options in Florida by contacting a licensed agent.

Explore our other comprehensive guides to coverage in Florida

The ACA Marketplace allows individuals and families to shop for and enroll in ACA-compliant health insurance plans. Subsidies may be available based on household income to help lower costs.

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in Florida.

Learn about Florida’s Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in Florida.

Frequently asked questions about Medicare in Florida

When can I enroll in Medicare?

Medicare Advantage enrollment is available when a person is initially eligible for Medicare, but there’s also an annual enrollment window each fall called the Annual Election Period (AEP) (October 15 – December 7) when Medicare beneficiaries can select a different Medicare Advantage plan, or switch between Medicare Advantage and Original Medicare.

There is also a Medicare Advantage open enrollment period (January 1 to March 31) during which people who are already enrolled in Medicare Advantage plans can switch to a different Medicare Advantage plan or drop their Medicare Advantage plan and enroll in Original Medicare instead.

What is Medicare Advantage?

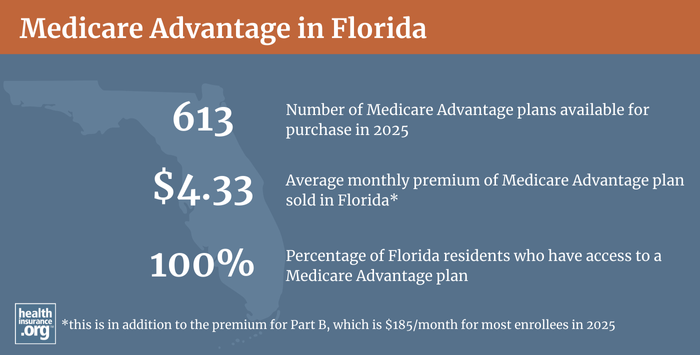

By July 2024, nearly 57% of all Florida residents with Medicare were enrolled in private Medicare Advantage plans. 1 The growth in Medicare Advantage enrollment in Florida is in keeping with the general nationwide trend towards Medicare Advantage enrollment; enrollment had grown to approximately 50% of all Medicare beneficiaries nationwide as of mid-2024.4

Medicare Advantage service areas are defined/available on a county-by-county basis, and the number of plans available in a given county can vary greatly across a single state. In Florida, residents in some counties can choose from more than 61 different Medicare Advantage plans in 2024, while residents of other counties only have fewer than 10 options.2

What are Medigap plans?

Medigap plans are used to supplement Original Medicare, covering some or all of the out-of-pocket costs (for coinsurance and deductibles) that people would otherwise incur if they only had Original Medicare on its own.

The Florida Office of Insurance Regulation (FLOIR) has a very user-friendly website people can use to compare premiums for Medigap plans available in each county in the state.

Medigap plans are standardized under federal rules, and people are granted a six-month window, when they turn 65 and enroll in Original Medicare, during which coverage is guaranteed issue for Medigap plans. Federal rules do not, however, guarantee access to a Medigap plan if you’re under 65 and eligible for Medicare as a result of a disability.

But Florida is among the majority of the states that have adopted rules to ensure at least some access to Medigap plans for people under age 65 who are eligible for Medicare in Florida. Since 2009, Florida residents under age 65 are granted a six-month window (starting when they’re enrolled in Medicare Part B) during which coverage under a Medigap plan is guaranteed-issue. The premiums are typically higher for enrollees under age 65, although they are given another enrollment window when they turn 65, so they can then switch to lower-cost Medigap coverage at that point.

What is Medicare Part D?

Original Medicare does not cover outpatient prescription drugs. But Medicare beneficiaries can get prescription coverage via a Medicare Advantage plan, an employer-sponsored plan (offered by a current or former employer), or a stand-alone Medicare Part D plan.

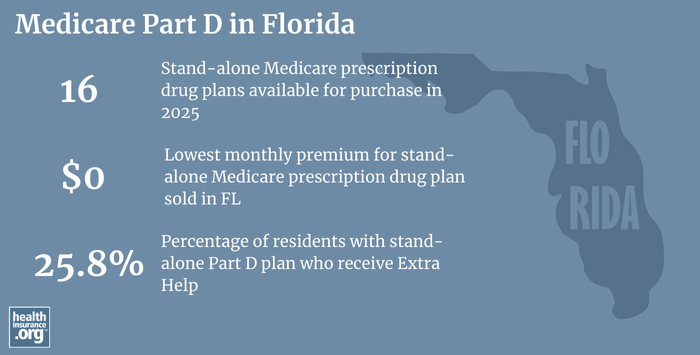

As of July 2024, there were about 1.4 million Florida Medicare beneficiaries who were enrolled in stand-alone Medicare Part D prescription drug plans.1 But over 2.7 million Medicare beneficiaries in Florida had Part D coverage integrated with a Medicare Advantage plan.1

For 2025 coverage, there are 16 stand-alone Medicare Part D plans available in Florida, with premiums starting at $0 per month.6 Medicare Part D enrollment is available during the same fall enrollment window (October 15 – December 7) that applies to Medicare Advantage plans.

What additional resources are available for Medicare beneficiaries and their caregivers in Florida?

These resources provide free assistance and information about Medicare beneficiaries in Florida:

- Contact SHINE, Florida’s health insurance assistance program for seniors, with questions about Medicare eligibility in Florida or Medicare enrollment in Florida. Visit the SHINE website or call 1-800-963-5337.

- Visit the Medicare Rights Center. This website provides helpful information geared to Medicare beneficiaries, caregivers, and professionals.

- Contact the Florida Office of Insurance Regulation for questions or complaints about agents and brokers who sell Medicare plans, as well as Medigap plans (these are mostly regulated by the state, whereas Medicare Part D and Medicare Advantage plans are mostly regulated at the federal level).

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Florida?

Explore more resources for options in FL including ACA coverage, short-term health insurance, dental and Medicaid.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- “Medicare Monthly Enrollment – Florida.” Centers for Medicare & Medicaid Services Data. Accessed November, 2024. ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶

- ”Medicare Advantage 2024 Spotlight: First Look” KFF.org Nov. 15, 2023 ⤶ ⤶

- U.S. Census Bureau Quick Facts: United States & Florida.” U.S. Census Bureau, July 2023. ⤶

- “Medicare Monthly Enrollment – US” Centers for Medicare & Medicaid Services Data, November 2024. ⤶ ⤶

- Kilduff, Lillian. “Which U.S. States Have the Oldest Populations?” Population Reference Bureau, December 22, 2021. ⤶

- ”Fact Sheet: Medicare Open Enrollment for 2025” (29) Centers for Medicare & Medicaid Services. Sep. 27, 2024 ⤶