What is a Consumer Operated and Oriented Plan (CO-OP)?

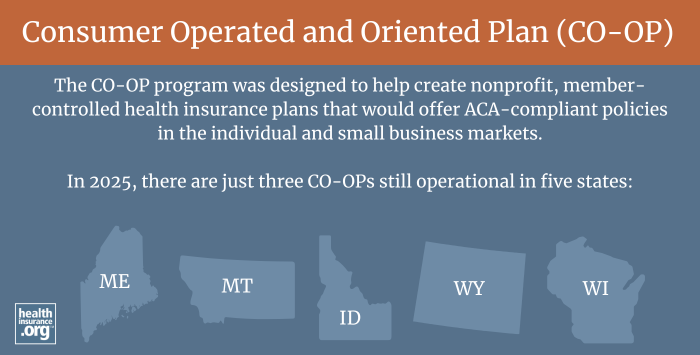

Created by the Affordable Care Act, the CO-OP (Consumer Operated and Oriented Plan) program was designed to help create nonprofit, member-controlled health insurance plans that would offer ACA-compliant policies in the individual and small business markets.

How many states still have ACA CO-OPs?

Twenty-four states had CO-OP plans available in their exchanges starting in October 2013. But nearly all of them have since closed. As of 2026, there are just three CO-OPs still operational in four states:

- Community Health Options in Maine

- Mountain Health CO-OP (Montana Health CO-OP) in Montana and Idaho

- Common Ground Healthcare Cooperative in Wisconsin

CO-OP coverage was available in five states in 2025, but Mountain Health CO-OP is exiting the Wyoming market at the end of 2025.1 So Mountain Health CO-OP plans are only available in Montana and Idaho for 2026.2

CO-OPs were initially supposed to get $10 billion in grant money, but that ended up being changed to $6 billion in loans, with fairly short repayment timelines. CO-OPs also fell victim to the risk corridors fiasco in far greater numbers than long-established health insurance companies. And the ACA's risk adjustment program was also challenging for CO-OPs.

When can I enroll in a CO-OP?

CO-OPs are just like any other ACA-compliant individual market health plan, which means you can enroll during the annual open enrollment period or during a special enrollment period. This is true regardless of whether you're enrolling through the Marketplace/exchange or directly through the CO-OP.

- Montana and Wisconsin use HealthCare.gov as their Marketplace, with open enrollment that runs from Nov. 1 to Jan. 15. (Starting in the fall of 2026, open enrollment on HealthCare.gov will end sooner, on December 15.)

- Maine and Idaho run their own health insurance Marketplaces (CoverME and Your Health Idaho). CoverME uses the same Nov. 1 - Jan. 15 open enrollment window as HealthCare.gov, while Your Health Idaho has a different schedule — Oct. 15 to Dec. 15.3 (Starting in the fall of 2026, CoverME will have to end open enrollment no later than December 31.)

Special enrollment periods usually require a qualifying life event, although Native Americans can enroll in Marketplace coverage year-round in every state.

Note that if you work for a small business in a state where one of the remaining CO-OPs offers small-group health insurance, your employer might purchase group coverage from the CO-OP. They can do this at any time of the year, but your ability to enroll in the plan will be limited to your initial eligibility window, the annual open enrollment period designated by your employer, or a special enrollment period triggered by a qualifying life event.

Read more about CO-OP health insurance plans.

Footnotes

- "Your Health Coverage with us in Wyoming is ending on December 31, 2025" Mountain Health CO-OP. Accessed Aug. 18, 2025 ⤶

- "Mountain Health Co-Op insurance provider to cease coverage for Wyoming residents" Insurance News Net. Aug. 15, 2025 ⤶

- "Apply and Enroll" YourHealthIdaho. Accessed Aug. 18, 2025 ⤶