What is private health insurance?

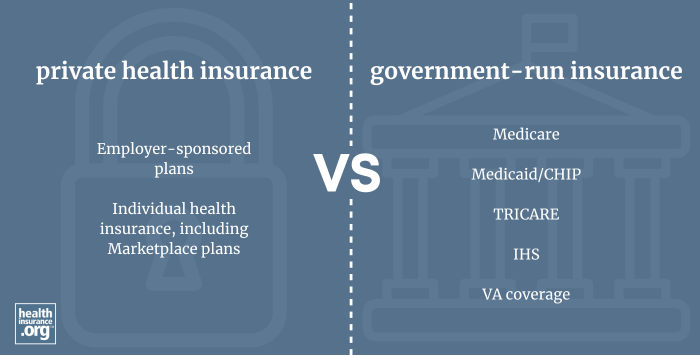

Private health insurance refers to health insurance plans marketed by private insurance companies or offered by self-insured employers, as opposed to government-run insurance programs such as Medicare, Medicaid, and CHIP. Private health insurance currently covers a little more than half of the U.S. population.

Private health insurance includes employer-sponsored plans, both self-insured and fully-insured (meaning the employer buys coverage from an insurance company), which cover almost half of the American population. Another 6% of Americans purchase private coverage outside of the workplace in the individual/family health insurance market, both on- and off-exchange.

There are also various types of private health insurance that are much less regulated than regular major medical coverage. This includes short-term health plans, fixed indemnity plans, critical illness insurance, accident supplements, dental and vision insurance, etc. These types of coverage are all sold by private health insurance companies, but are generally only suitable to serve as supplemental coverage as opposed to a person's only health coverage (or, in the case of short-term health insurance, to cover a person for a very limited amount of time).

Is private health insurance subsidized by the government?

Yes, in most cases. Employer-sponsored health insurance is subsidized via the tax code, as it's typically offered as a pre-tax benefit for employees. Over ten years from 2019-2028, the Congressional Budget Office projects that federal subsidies for employer-sponsored health coverage is projected to be $3.7 trillion (mostly because the value of this coverage is generally not subject to payroll or income taxes).

For private health insurance that people purchase themselves in the individual/family market, the Affordable Care Act created premium subsidies and cost-sharing reductions, which make coverage and care much more affordable than they would otherwise be. The same CBO report projected federal spending of $800 million for premium subsidies over that same ten-year period. But the federal government is no longer funding cost-sharing reductions, which has indirectly resulted in higher federal spending on premium subsidies.

Some people do not qualify for financial assistance from the federal government. But depending on their circumstances, they may be able to deduct their health insurance premiums on their tax return.

(The American Rescue Plan temporarily increased the number of people who qualify for premium assistance in the health insurance exchange, and these rules were extended through 2025 by the Inflation Reduction Act. They would have to be extended again by Congress to last beyond 2025. Even if the ARP's extra subsidies expire, the ability to deduct health insurance premiums will still exist, and so will the ACA's basic premium subsidies.)

Does private health insurance have to meet minimum standards?

Yes, there are a variety of minimum standards for private major medical health insurance, imposed by both the federal and state governments. Some are long-standing – such as the federal requirement that employer-sponsored plans with 15 or more employees must provide coverage for maternity care – while others are more recent, including the regulatory changes that the Affordable Care Act imposed on individual and small-group health insurance plans.

Individual and small-group health insurance plans have to cover the ACA's essential health benefits. Large-group plans have to provide minimum value to avoid the employer mandate penalty. And all non-grandfathered, non-grandmothered plans, in both the individual and group markets, have to cap in-network out-of-pocket costs (the upper limit is $9,200 for a single person in 20251).

States also impose a variety of regulations on health plans that aren't self-insured. (Self-insured plans are regulated by the federal government instead.) Each state's essential health benefits benchmark plan sets the minimum requirements for individual and small-group plans in that state.

Is private health insurance considered minimum essential coverage?

Most types of private health insurance are considered minimum essential coverage. This includes any employer-sponsored health coverage, as well as ACA-compliant plans sold in the individual market, and grandmothered or grandfathered plans.

But some types of less regulated private health insurance are not considered minimum essential coverage. This includes short-term health plans, fixed indemnity plans, critical illness plans, accident supplements, and dental/vision plans. It obviously also includes health plans that aren't actually insurance at all, such as Farm Bureau plans in some states, 2 direct primary care plans, and health care sharing ministry plans.

Where can I buy private health insurance?

If you're not eligible for private health insurance from an employer, and also not eligible for public health insurance (Medicare, Medicaid, CHIP, etc.), you can purchase private health insurance in the marketplace/exchange in your state.

Alternatively, you can choose to buy it directly from a health insurance company, but premium subsidies and cost-sharing reductions are not available if you go that route. (Even if you just want to claim the premium subsidy later on your tax return, you must have purchased your coverage through the exchange in order to do that.)

Private major medical health insurance can only be purchased during the annual open enrollment period or a special enrollment period (usually linked to qualifying life event). This is true regardless of whether you're buying coverage through Marketplace or directly from an insurance company.

What types of coverage are not private health insurance?

More than a third of the American population is covered by government-run health insurance, as opposed to private coverage. This includes Medicare, Medicaid, CHIP, Indian Health Service, and VA coverage.

To be clear, many people who have Medicare, Medicaid, or CHIP are covered under managed care plans that are run by private health insurance (this is why you might be enrolled in Medicaid but your ID card might say Anthem, UnitedHealthcare, etc.) The same is true for Medicare Advantage plans: the insurers have contracts with the federal government to offer Medicare benefits through a plan administered by a private health insurance company.

As of 2021, nearly three-quarters of the country's Medicaid enrollees were covered under private Medicaid managed care plans, and more than half of Medicare beneficiaries were enrolled in private Medicare Advantage plans as of 2024.3

However, these managed care plans are in contracts with the government to offer the public health benefits that they're providing, and the funding for these plans still comes from the government (federal for Medicare Advantage, and a combination of state and federal funding for Medicaid managed care). But it can be a bit confusing, since many of the insurers that contract with the government to offer Medicaid managed care coverage or Medicare Advantage plans are the same insurers that offer private health insurance to individuals and employers.

Medicare beneficiaries can also purchase Medigap and/or Medicare Part D plans. These are considered private health insurance, but they are heavily regulated by the federal government.

Is private health insurance expensive?

Private health insurance can vary considerably in price. For people who get their private coverage from an employer, employers tend to cover the bulk of the premium costs.4

For those who purchase private health insurance in the Marketplace/exchange, the price depends mainly on income, with premium subsidies offsetting a significant portion of the cost for most enrollees. As of 2024, 93% of marketplace enrollees were receiving premium subsidies that covered an average of almost $536 of their premiums each month (average full-price premiums were about $603/month, so subsidies cover the majority of the cost).5

However, for those who earn too much to be eligible for subsidies (which is fairly rare while the American Rescue Plan subsidy enhancements are in effect), the cost of private individual/family coverage will depend on age and location – some areas of the country have much more expensive coverage than other areas, and older applicants are charged three times as much as younger applicants (again, this is for people who don't qualify for subsidies; for those who do qualify for subsidies, the subsidies are larger for older enrollees and larger in areas where coverage is more expensive). In most states, tobacco users can also be charged more than those who do not use tobacco.

Why is private health insurance called ‘private’ health insurance?

Private health insurance is referred to as "private" because it's offered by privately-run health insurance companies and employers – as opposed to government-run programs like Medicare and Medicaid. But as noted above, most types of private health insurance have to comply with a variety of state and federal regulations, despite the fact that the companies offering the coverage are privately run.

Footnotes

- ”Premium Adjustment Percentage, Maximum Annual Limitation on Cost Sharing, Reduced Maximum Annual Limitation on Cost Sharing, and Required Contribution Percentage for the 2025 Benefit Year” Centers for Medicare & Medicaid Services. November 15, 2023. ⤶

- ”Private Health Coverage: Information on Farm Bureau Health Plans, Health Care Sharing Ministries, and Fixed Indemnity Plans” Government Accountability Office. July 26, 2023 ⤶

- "Medicare Advantage in 2024: Enrollment Update and Key Trends" KFF.org. Aug. 8, 2024 ⤶

- ”Employer Health Benefits, 2024 Annual Survey” KFF. Oct. 9, 2024. ⤶

- "Effectuated Enrollment: Early 2024 Snapshot and Full Year 2023 Average" CMS.gov, July 2, 2024 ⤶