What is a QSEHRA?

A Qualified Small Employer Health Reimbursement Arrangement allows small employers who don't offer group health insurance benefits to reimburse employees – tax-free – for some or all of the premiums they pay for coverage purchased in the individual market, on or off-exchange. The QSEHRA can also be used to reimburse employees for out-of-pocket medical expenses.

Is there a limit on how much can be reimbursed with a QSEHRA?

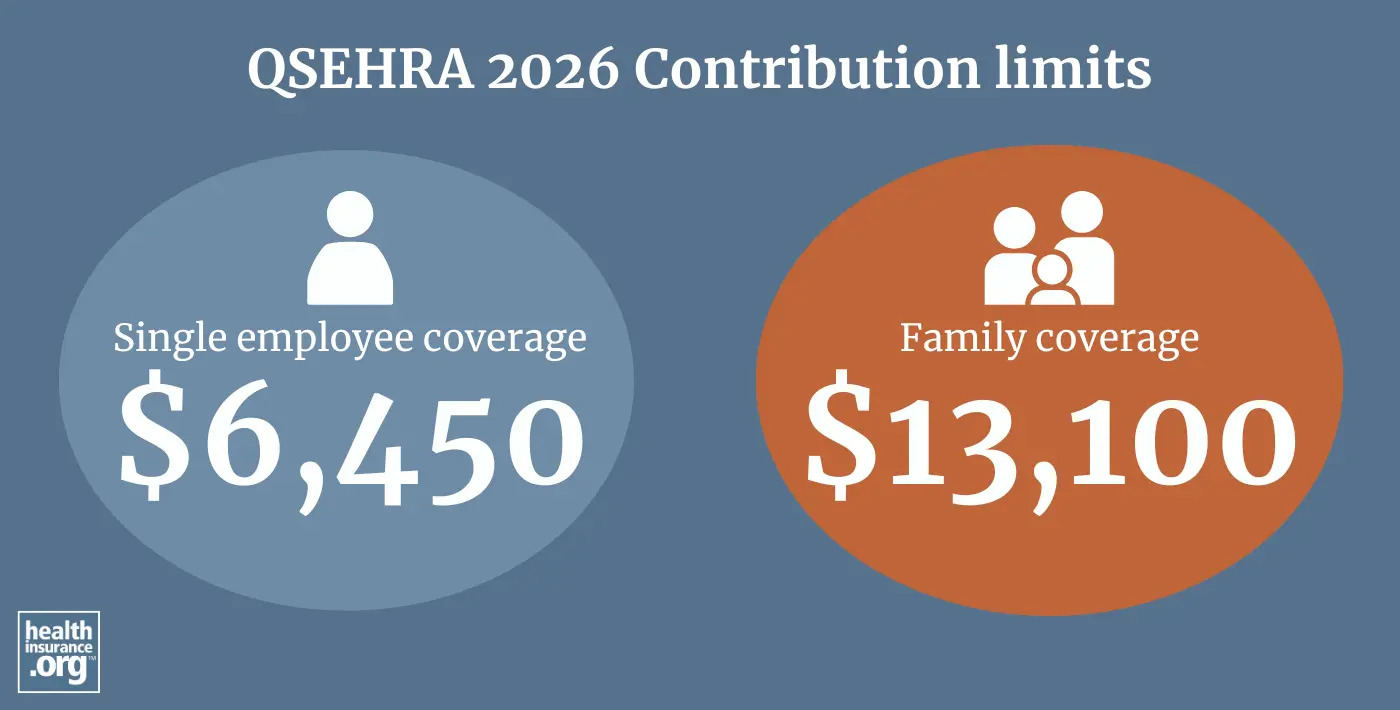

Yes. The maximum amount that an employer can reimburse through a QSEHRA in 2026 is:1

- $6,450 for a single employee’s coverage ($537.50 per month)

- $13,100 for family coverage ($1,091.66 per month)

These amounts are indexed annually by the IRS.

(For 2025, the annual limits were $6,350 for a single employee’s coverage and $12,800 for family coverage.)2

Which employers are eligible to offer QSEHRAs?

QSEHRAs can be used by any employer that is not considered an "applicable large employer" and that does not offer a group health plan for employees (applicable large employers are those that have at least 50 full-time equivalent employees).

Can an employee get a premium tax credit in addition to a QSEHRA?

Yes. Unlike ICHRAs, it is possible to have both a QSEHRA benefit and a premium tax credit in the Marketplace.

But in situations like this, the Marketplace premium tax credit will be reduced by the amount of the QSEHRA benefit. In other words, the total benefit won't be more than the person would have had with the premium tax credit alone, but it is possible to receive some premium tax credit in addition to the amount the person would have received via the QSEHRA alone.

Can an employer offer a QSEHRA to some employees and a small group health plan to others?

No. Employers that provide a QSEHRA benefit cannot offer a group health plan to any employees.3

Employers interested in offering a group plan to some classes of employees and a reimbursement plan to other classes (assuming they are bona fide employee classifications) could use an ICHRA instead.

Read more about health insurance coverage for small groups, and the comprehensive list of FAQs that the IRS has published regarding QSEHRAs.

Footnotes

- "Revenue Procedure 2025-32" Internal Revenue Service. Accessed Dec. 7, 2025 ⤶

- "Revenue Procedure 2024-40" Internal Revenue Service. Accessed Dec. 7, 2025 ⤶

- "Health Reimbursement Arrangements (HRAs) for small employers" HealthCare.gov. Accessed Mar. 14, 2025 ⤶