Medicaid eligibility and enrollment in California

California is reinstating its asset limit for elderly Medi-Cal enrollees in 2026, and will no longer accept new Medi-Cal applications from undocumented immigrant adults.

Who is eligible for Medicaid in California?

California has generous standards for covering various Medicaid populations.1 Children from birth through age 18 are covered with family income levels up to 266% of FPL (and this includes undocumented immigrant children). Pregnant women qualify with incomes up to 213% of FPL, and non-elderly adults — both those with and without dependent children — are covered up to 138% of FPL (note that all of these limits include a built-in 5% income disregard that’s used for MAGI-based Medicaid eligibility determinations).

MCAP (Medi-Cal Access Program) is also available to pregnant women with household incomes between 213% and 322% of FPL (for Medi-Cal and MCAP eligibility, a pregnant woman counts as two people when determining household income relative to the poverty level).2 MCAP enrollment was integrated with Covered California in October 2015.

California has also opted to use state funds to cover undocumented immigrants who meet the income requirements. However, the state is limiting that somewhat starting in 2026: New enrollees will not be accepted after the end of 2025 if they’re undocumented. And starting in July 2027, existing enrollees will have to start paying a $30/month premium if they’re undocumented.3 (federal funds cannot be used to cover undocumented immigrants).

In addition, California became the first state to eliminate Medicaid asset limits for disabled and elderly applicants (ie, non-MAGI applicants), starting in 2024.4 However, California is reinstating a Medicaid asset limit for these populations, starting in January 2026. The asset limit will be $130,000 for an individual and $195,000 for couples.5 But this is still much higher than the asset limits used for the non-MAGI Medicaid applicants in other states (typically $2,000 for a single person and $3,000 for a couple).6

During the pandemic, California suspended premiums and cost-sharing for Medicaid and CHIP, and has since made that permanent using a state plan amendment.7 The state also established an auto-enrollment program to ensure that a person who lost Medi-Cal during the “unwinding” of the pandemic-era continuous coverage rules could transition to a private plan via Covered California (the state-run exchange/marketplace) without a gap in coverage.8

for 2026 coverage

0.0%

of Federal Poverty Level

Apply for Medicaid in California

Online on the Covered California website. Fill out an application and mail it to P.O. Box 989725 West Sacramento, CA 95798-9725. Apply in person at a county social service office.

Eligibility: Children from birth through age 18 with family income levels up to 266% of FPL; pregnant women with incomes up to 213% of FPL; and nonelderly adults — with or without dependent children — with incomes up to 138% of FPL. Pregnant women with incomes up to 322% of FPL are eligible for MCAP.

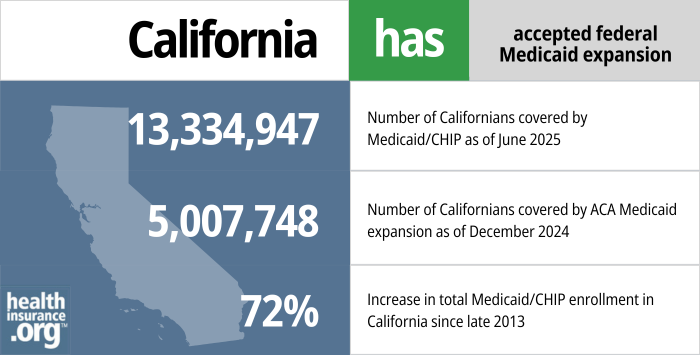

Is the ACA’s Medicaid expansion implemented in California?

California’s Medicaid program is called Medi-Cal. It covered nearly 15 million people as of mid-2025.9 Over a third of Californians rely on the program to get health insurance coverage. (Note that the federal government puts the total quite a bit lower, at 13.2 million.)10

California expanded Medicaid under the ACA, and total enrollment was 75% higher in mid-2024 than it had been in late 2013, before the ACA’s Medicaid expansion took effect.11

- 13,226,087 – Number of Californians covered by Medicaid/CHIP as of August 202510

- 5,007,748 – Number of Californians covered by ACA Medicaid expansion as of December 202412

- 72% – Increase in total Medicaid/CHIP enrollment in California since late 201313

Explore our other comprehensive guides to coverage in California

The ACA Marketplace allows individuals and families to shop for and enroll in ACA-compliant health insurance plans. Subsidies may be available based on household income to help lower costs.

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in California.

Use our guide to learn about Medicare, Medicare Advantage, and Medigap coverage available in California as well as the state’s Medicare supplement (Medigap) regulations.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage.

Frequently asked questions about California Medicaid eligibility and enrollment

How do I enroll in Medicaid in California?

You can visit California’s Department of Health Care Services website to check if you are eligible to enroll in Medicaid.

The application process for Medicaid in California is integrated with Covered California, the health insurance marketplace. You can apply:

- Online on the Covered California website.

- By mail: complete an application, which is available in 12 languages, and mail it to Covered California at P.O. Box 989725 West Sacramento, CA 95798-9725.

- Seniors and people with Medicare can apply using this printable application, which can be mailed or submitted at a local social services office.

- In person at a county social service office. The directory includes phone numbers for each county office if you need more information or assistance.

How does Medicaid provide financial assistance to Medicare beneficiaries in California?

Many Medicare beneficiaries receive Medicaid financial assistance that can help them with Medicare premiums, lower prescription drug costs, and pay for expenses not covered by Medicare – including long-term care.

Our guide to financial assistance for Medicare enrollees in California includes overviews of these programs, including Medicaid nursing home benefits, Extra Help, and eligibility guidelines for assistance.

Note that although people with disabilities and those who are 65 or older are subject to both income and asset limits for Medicaid eligibility, California eliminated the asset restrictions for 2024 and 2025. The state is reinstating an asset limit in 2026, but at $130,000 for a single adult, this is much higher than the $2,000 asset limit that’s used in most states.14

How did California handle Medicaid renewals after the pandemic?

During the COVID pandemic, from March 2020 through March 2023, states received additional federal Medicaid funding but were also prohibited from disenrolling anyone from Medicaid, even if they no longer met the eligibility guidelines. That rule ended on March 31, 2023, and states resumed eligibility redeterminations and disenrollments in a year-long process referred to as “unwinding” of the pandemic-era continuous coverage requirement.

California’s first round of disenrollments came in June 2023, and the state wrapped up the unwinding process in June 2024.15

More than 2 million people were disenrolled from Medi-Cal during the unwinding process. About three-quarters of the disenrollments were procedural, meaning the state didn’t have enough information to determine whether the person was still eligible or not.16

Most people disenrolled from Medicaid could either reenroll (if they were actually still eligible but just didn’t complete the renewal paperwork) or had access to an employer’s health plans. But those who need to obtain their own new coverage can enroll in a plan offered through Covered California, the state-run health insurance Marketplace.

California implemented an automatic enrollment program for people whose Medi-Cal was terminated, allowing CoveredCA (the state-run exchange) to automatically enroll them into the lowest-cost silver plan available in their area, with coverage effective the day after Medi-Cal ends.17

The person had to then effectuate their coverage, either by paying the first month’s premium by the end of the first month of coverage, or, if premium subsidies cover the entire premium, by agreeing to the terms and conditions of the coverage within the first month. People could opt out of this program, or select a different plan, or choose not to effectuate their auto-selected plan. By March 2024, more than 112,000 people had been automatically enrolled in a Covered California plan under this program.8

California Medicaid history and details

California's evolving approach to Medicaid for undocumented immigrants

In 2024 and 2025, immigration status did not prevent anyone in California from receiving Medi-Cal benefits, regardless of their age. California implemented changes over the last several years to achieve this incrementally, starting with children, then young adults and older adults, and then the rest of the adult population. As long as they qualify based on household income (asset limits were also eliminated in California starting in 2024), undocumented immigrants can enroll in Medi-Cal.

- Undocumented immigrant children gained access to California Medicaid starting in May 2016, under the terms of SB4.

- Starting in January 2020, that eligibility applies to young adults through the age of 25, under the terms of SB104.

- Starting in May 2022, adults age 50 and older became eligible for Medi-Cal regardless of immigration status., under the terms of AB133.

- Starting in 2024, this provision also applied to undocumented immigrants age 26 through 49, under the terms of SB184. California ensured that young adults who had aged out of the program and could potentially lose Medi-Cal in the latter half of 2023 during the COVID continuous coverage “unwinding” would have their coverage maintained until the start of 2024, when they would be eligible under the new rules. This was done by pushing these enrollees’ renewal dates to the latter end of the unwinding period.

But after two years of full access to Medi-Cal for undocumented immigrants, California has decided to start scaling back this access. Starting in January 2026, new enrollees will not be accepted by Medi-Cal if they’re undocumented (but existing enrollees will be able to keep their coverage). Starting in July 2027, existing undocumented enrollees will be charged $30/month premium to keep their Medi-Cal.3

California is using state funds to cover undocumented immigrants under Medi-Cal. Medicaid is jointly funded by the state and federal government, but states can opt to add services or eligibility categories that are fully funded by the state.

California had previously considered allowing undocumented immigrants to enroll in full-price private plans through Covered California (the state’s health insurance exchange), but that has not come to pass. SB10, which passed during the 2016 legislative session, initially called for allowing adults age 19 and over to enroll in Medi-Cal without regard for immigration status. But the final version of the bill instead called for the state to request a 1332 waiver from HHS to allow undocumented immigrants to enroll in unsubsidized qualified health plans (QHPs) through Covered California (without a waiver from HHS, this isn’t possible, as the ACA requires all exchange enrollees to be legally present U.S. residents, regardless of whether they receive any subsidies).

The state did submit a waiver to HHS, but on January 18, 2017, two days before Trump’s first inauguration, the state withdrew the waiver, noting that they didn’t trust the Trump administration to ensure “people’s privacy and health” in implementing the waiver. They were concerned that the Trump administration would use Covered California data to deport people and separate families. State Senator Ricardo Lara, who had championed SB10, asked for the waiver withdrawal, calling it “the first California casualty of the Trump presidency.”

(Washington state obtained permission from CMS to allow undocumented immigrants to enroll through the exchange starting in 2024 and use state-funded subsidies. Colorado has created a separate platform that allows undocumented immigrants to enroll with state-funded subsidies.)

How does California handle Medicaid estate recovery?

Longstanding federal regulations, which predate the ACA, require states to “seek recovery of payments from the individual’s estate for nursing facility services, home and community-based services, and related hospital and prescription drug services” for any Medicaid enrollee over the age of 55. But states can choose to go further, using estate recovery to recoup any Medicaid costs.

This has become more of a problem since the ACA Medicaid expansion took effect in 2014, as people are now funneled into California’s Medicaid system in much greater numbers than they used to be (this is the case in every state that has expanded Medicaid). Covered California enrollees under age 65 with income up to 138% of the poverty level are directed to Medi-Cal, regardless of the value of their assets (there’s no asset test for subsidy eligibility or Medicaid coverage under the ACA). As a result, some families began receiving bills from California’s Medicaid program after their loved ones passed away, including bills to cover the cost of payments that the state made to managed care plans, even if the deceased didn’t use any medical services.

California S.B.826, the Budget Act of 2016, included a provision to bring Medi-Cal estate recovery into line with federal rules. For people who pass away January 1, 2017 or later, the state only uses estate recovery to recoup long-term care costs that were incurred by Medi-Cal. But that includes In-Home Supportive Services, which the state did not previously recoup through estate recovery.

In addition, estate recovery is now limited to assets that were owned by the deceased at the time of death and are subject to probate. For people who passed away prior to 2017, the state could seek to recoup costs from any assets owned by the deceased at the time of death.

Minnesota implemented similar legislation in 2016, but unlike California, they made their limits on estate recovery retroactive back to January 2014.

Funding for Medi-Cal

Because California is an affluent state, they don’t get as much in federal matching funds for Medicaid. But this is referring to the traditional Medicaid program, which is funded jointly by the states and the federal government. For the ACA expansion population, the federal government will always pay the lion’s share of the tab — 90% as of 2020 and beyond — and there’s no difference from one state to another. (Note that the only way this could change is if Congress were to make legislative adjustments to the ACA.)

California and the federal government split traditional Medi-Cal costs roughly equally, with the federal government paying about one dollar for every dollar the state spends.18 In poorer states, the federal government matches at a rate of double or even triple that amount. (In all states, the federal funding rate was increased by 6.2 percentage points during the COVID pandemic, but that additional funding was phased out by the end of 2023.)

But since the federal government pays 90% of the cost of covering the Medicaid expansion population, the federal government ultimately pays more than half the total cost of California Medicaid.

To make funds permanently available for the state’s portion of Medi-Cal costs (via a hospital fee that had already been implemented temporarily), Proposition 52 was on the November 2016 ballot in the state, and passed with 70% of the vote. Another ballot measure, Proposition 56, which passed with 64% of the vote, raises the tax on cigarettes, with a portion of the revenue being directed to various aspects of Medi-Cal.

California Medicaid History

Medi-Cal was established in 1966, and is now the nation’s largest Medicaid program in terms of enrollment. California Medicaid enrollment expanded significantly during the first three years of Medicaid expansion through the ACA, growing by more than four million people from 2013 to 2018.

Medi-Cal has expanded coverage and implemented new policies over the years, including introducing Medicaid managed care plans in 1973, implementing selective contracting strategies with hospitals in 1982, expanding access to family planning services in 1997, extending coverage to families at 100% of FPL in 2000, and expanding coverage to uninsured adults in 2010.

As of 2022, more than 88% of Medi-Cal enrollees were in managed care programs (funded by the state but administered and managed by a private insurance company), while less than 12% were covered under fee-for-service Medicaid (meaning directly administered by the government).19

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in California?

Explore more resources for options in CA including ACA coverage, short-term health insurance, dental and Medicare.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- ”Medicaid, Children’s Health Insurance Program, & Basic Health Program Eligibility Levels” Centers for Medicare & Medicaid Services. Accessed Dec. 14, 2025 ⤶

- ”Welcome to the Medi-Cal Access Program” California DHCS. Accessed Dec. 14, 2025 ⤶

- ”Medi-Cal Immigrant Eligibility FAQs” California DHCS. Accessed Dec. 14, 2025 ⤶ ⤶

- ”Medi-Cal’s Asset Limit is Now Eliminated” California Health Advocates. Jan. 8, 2024 ⤶

- ”2026 Asset Limit Reinstatement Frequently Asked Questions” CANHR. Nov. 17, 2025 ⤶

- ”Medicaid Eligibility: 2026 Income, Asset & Care Requirements for Nursing Homes & Long-Term Care” American Council on Aging. Nov. 26, 2025 ⤶

- ”Medi-Cal COVID-19 Public Health Emergency and Continuous Coverage Operational Unwinding Plan” California DHCS. Sep. 18, 2023 ⤶

- ”Clearing the Path: Streamlining Enrollment in Covered California for Californians Transitioning from Medi-Cal” California Health Care Foundation. Aug. 23, 2024 ⤶ ⤶

- ”Fast Facts” California DHCS. Accessed Dec. 14, 2025 ⤶

- ”August 2025 Medicaid & CHIP Enrollment Data Highlights” , Medicaid.gov, Accessed Dec. 14, 2025 ⤶ ⤶

- “Total Monthly Medicaid & CHIP Enrollment and Pre-ACA Enrollment” KFF.org, Accessed August 2024 ⤶

- “Medicaid Enrollment – New Adult Group” , KFF.org, Accessed October 2025 ⤶

- “Total Monthly Medicaid & CHIP Enrollment and Pre-ACA Enrollment” , KFF.org, Accessed Dec. 14, 2025 ⤶

- ”Medicaid Eligibility: 2026 Income, Asset & Care Requirements for Nursing Homes & Long-Term Care” American Council on Aging. Nov. 26, 2025 ⤶

- ”Medicaid Enrollment and Unwinding Tracker” KFF. Sep. 12, 2024. ⤶

- ”Medicaid Enrollment and Unwinding Tracker” (California state data) KFF. Sep. 12, 2024. ⤶

- ”Covered California’s Facilitation of Continuous Coverage for Consumers Losing Medi‐Cal” Covered California. April 15, 2022 ⤶

- ”Medi-Cal and the Federal Government — Policy at a Glance” California Health Care Foundation. Jan. 22, 2025 ⤶

- ”Share of Medicaid Population Covered under Different Delivery Systems” KFF. July 1, 2022 ⤶