Home > Health Insurance Marketplace > South Carolina Heath Insurance Marketplace

South Carolina Health Insurance Marketplace for 2026

Compare ACA plans and check subsidy savings from a licensed third-party health insurance agency.

South Carolina Marketplace quick facts

South Carolina health insurance Marketplace guide

This guide, including the FAQs below, was developed to assist you in choosing the right South Carolina health insurance plan for you and your family. The plans available through South Carolina’s ACA Marketplace may be a good choice for you, and we’re here to help you understand the Marketplace and the available financial assistance.

South Carolina uses the federally-facilitated health insurance exchange/Marketplace, at HealthCare.gov, for residents to purchase ACA Marketplace plans.

The South Carolina Marketplace provides access to health insurance products from six private insurers for 2026, with coverage areas that vary by insurer.4 All six carriers also offered coverage for 2025.5 (See details below about premium changes for 2026.)

Depending on your income and other circumstances, you may qualify for financial help to lower your South Carolina Marketplace plan’s monthly insurance premium (the amount you pay to enroll in the coverage) and possibly also your out-of-pocket expenses.

Frequently asked questions about health insurance in South Carolina

Who can buy Marketplace health insurance in South Carolina?

To qualify for health coverage through the South Carolina Health Insurance Marketplace, you must:6

- Live in South Carolina

- Be lawfully present in the United States

- Not be incarcerated

- Not be enrolled in Medicare

Eligibility for financial assistance (premium subsidies and cost-sharing reductions) depends on your household income. In addition, to qualify for financial assistance with your Marketplace plan you must:

- Not have access to affordable health coverage offered by an employer. If your employer offers health benefits but you feel the coverage is too expensive, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies in the Marketplace.

- Not be eligible for Medicaid or CHIP.

- Not be eligible for premium-free Medicare Part A.7

- If married, file a joint tax return.8

- Not be able to be claimed by someone else as a tax dependent.8

When can I enroll in an ACA-compliant plan in South Carolina?

The open enrollment period for individual/family health coverage runs from November 1 to January 15 in South Carolina.9

If you need your coverage to start on January 1, you must submit your application by December 15. If you apply between December 16 and January 15, your coverage will begin on February 1.6

Because of a federal rule change, the open enrollment period will be shorter starting in the fall of 2026. At that point, for coverage effective in 2027 and future years, the open enrollment window will end on December 15 in South Carolina, and all plans selected during open enrollment will take effect January 1.

Outside of open enrollment, a special enrollment period (generally triggered by a specific qualifying life event) is necessary to enroll or make changes to your coverage.

If you have questions about open enrollment, you can learn more in our comprehensive guide to open enrollment. We also have a comprehensive guide to special enrollment periods.

How do I enroll in a South Carolina Marketplace plan?

To enroll in an ACA Marketplace plan in South Carolina, you can:

- Visit Healthcare.gov to access South Carolina’s health insurance marketplace. Here you will find an online platform to shop, compare, and choose the best health plans.

- Contact the HealthCare.gov call center at 1-800-318-2596 (TTY: 1-855-889-4325). The call center is available 24 hours a day, 7 days a week (closed on holidays).

- Purchase individual and family health coverage with the help of an insurance agent or broker, a Navigator, or a certified application counselor.

- Enroll via an approved enhanced direct enrollment entity.10

How can I find affordable health insurance in South Carolina?

South Carolina uses the federally-facilitated exchange for individual market plans, so residents who buy their own health insurance enroll through HealthCare.gov.

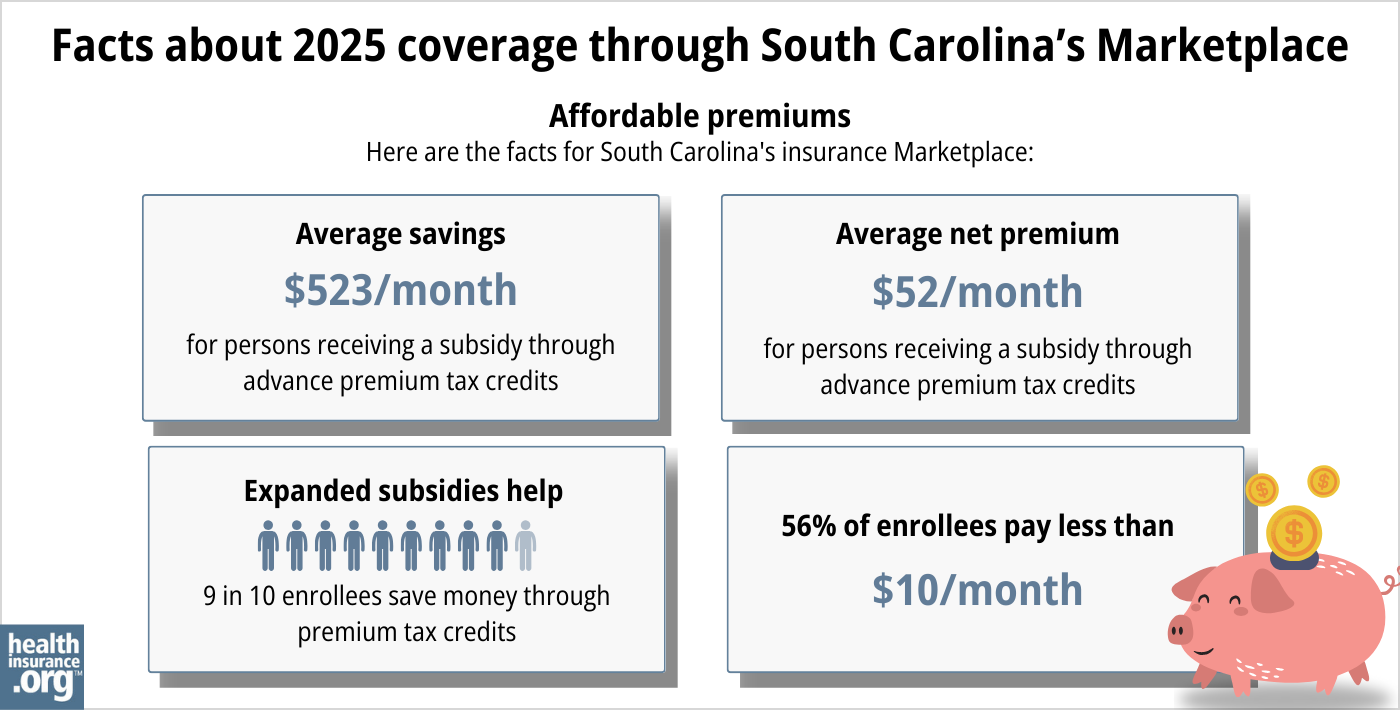

During the open enrollment period for 2025 coverage, more than 95% of enrollees qualified for premium subsidies, amounting to an average savings of $523/month. After the subsidies (premium tax credits) were applied, the average enrollee’s monthly cost was about $73/month. That figured included the enrollees who paid full price; for those who were subsidy-eligible, the average after-subsidy premium was only $52/month.11

Source: CMS.gov11

The Affordable Care Act also ensures that people with household incomes up to 250% of the poverty level can enroll in Silver-level plans that have reduced out-of-pocket costs (i.e. lower out-of-pocket costs than Silver plans available to people with higher incomes).12

Between the premium subsidies and cost-sharing reductions, you may find that a plan obtained through the South Carolina Health Insurance Marketplace will provide you with the best overall value.

South Carolina has not yet implemented the ACA’s expansion of Medicaid, so there is still a coverage gap in the state: Childless, non-disabled adults with income below the poverty level are not eligible for Medicaid (due to the lack of Medicaid expansion) and are also not eligible for Marketplace subsidies (because the ACA called for them to have Medicaid, which South Carolina has not implemented).

An estimated 65,000 low-income adults are in the coverage gap in South Carolina, ineligible for any financial assistance with their health coverage.13

How many insurers offer Marketplace coverage in South Carolina?

Six insurers offer Marketplace coverage in South Carolina for 2026, all of which offered overage for 2025:4

- Blue Cross Blue Shield of SC

- Ambetter/Absolute Total Care

- Molina

- Select Health

- UnitedHealthcare

- InStil Health

Marketplace insurers’ coverage areas vary, but in all but one of South Carolina’s counties, at least three insurers offered health plans through the Marketplace for 2025.5

Are Marketplace health insurance premiums increasing in South Carolina?

The following average premium changes were approved for 2026 for the insurance companies that offer plans through the South Carolina Health Insurance Marketplace,14 amounting to an overall average increase of about 21%.15 (premium changes are calculated before subsidies are applied):

South Carolina’s ACA Marketplace Plan 2026 APPROVED Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Blue Cross Blue Shield of SC | 17.5% |

| Ambetter/Absolute Total Care | 25.2% |

| Molina | 23.9% |

| Select Health | 25.2% |

| UnitedHealthcare | 25.2% |

| InStil Health | 20.6% |

Source: Federal Rate Review Database14

Although the average rate increase is about 21%,15 it’s important to understand that’s just for full-price (pre-subsidy) premiums.

Federal subsidy enhancements were in place from 2021 through 2025, which made Marketplace premium subsidies larger and more widely available. But Congress allowed those subsidy enhancements to expire at the end of 2025, meaning that subsidies no longer cover as much of enrollees’ premiums in 2026, and aren’t available to as many people. This resulted in substantial increases in the amount that people pay for their Marketplace coverage in 2026. But the issue was still under consideration in Congress in early 2026, so subsidy amounts could still change in 2026.

For perspective, here’s an overview of how weighted average full-price (pre-subsidy) individual/family premiums have changed in South Carolina over time:

- 2015: Average increase of less than 1%16

- 2016: Average increase of 12.3%17

- 2017: Average increase of 25.6%18

- 2018: Average increase of 30.7%19

- 2019: Average increase of 5.26%20

- 2020: Average decrease of 3.9%21

- 2021: Average decrease of 1.5%22

- 2022: Average increase of 3.1%23

- 2023: Average increase of 7.1%24

- 2024: Average increase of 2.7%25

- 2025: Average decrease of 1.35%.26

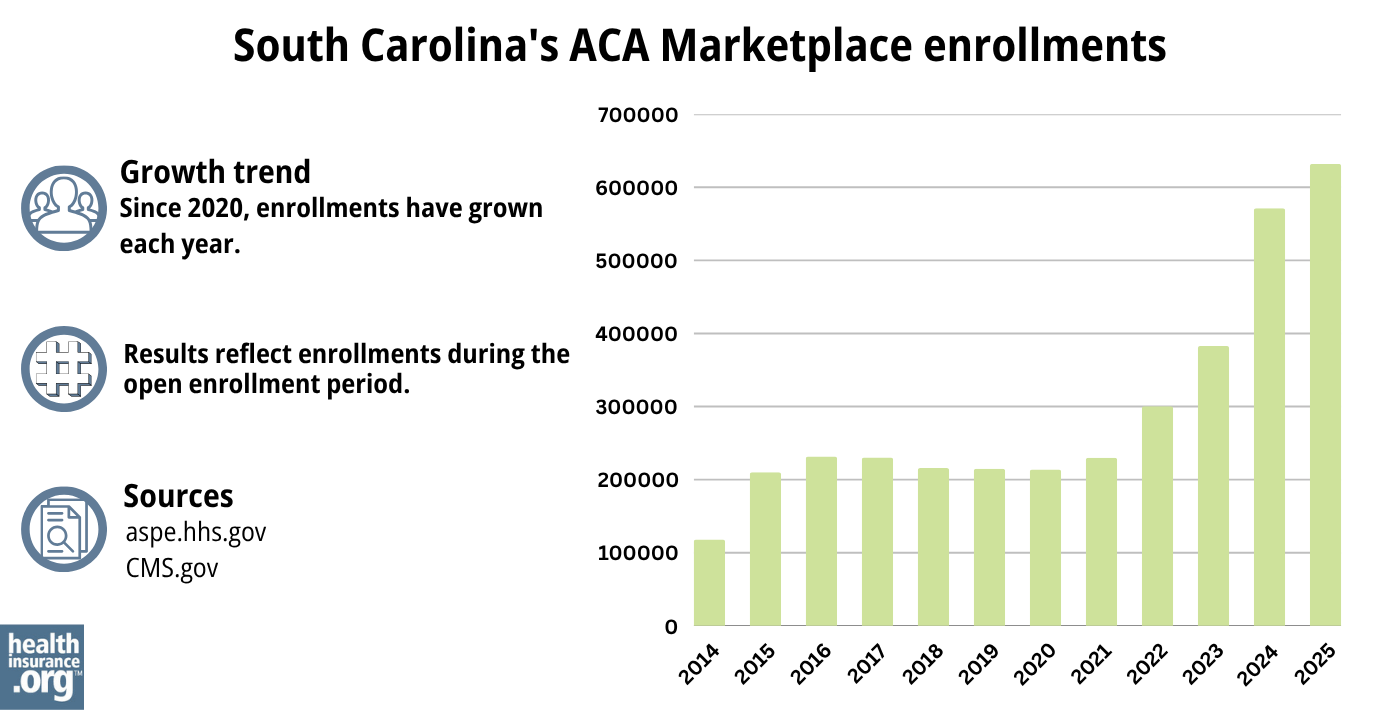

How many people are insured through South Carolina’s Marketplace?

In the South Carolina marketplace, a record high 631,948 people enrolled in private plans during the open enrollment period for 2025 coverage.27

The surge in enrollment in recent years was due in large part to the American Rescue Plan (ARP) which made the ACA’s premium subsidies more substantial and more widely available.28 These premium subsidy enhancement provisions were extended through 2025 by the Inflation Reduction Act. But unless Congress acts to extend them again, Marketplace plans will become much less affordable in 2026.

The enrollment spike in 2024 and 2025 was also driven by the “unwinding” of the pandemic-era Medicaid continuous coverage rule, when Medicaid disenrollments resumed after a three-year pause during the pandemic. CMS reported that more than 169,000 South Carolina residents transitioned from Medicaid to a Marketplace plan during the unwinding process.29

Source: 2014,30 2015,31 2016,32 2017,33 2018,34 2019,35 2020,36 2021,37 2022,38 2023,28 2024,39 202527

What health insurance resources are available to South Carolina residents?

HealthCare.gov

800-318-2596

State Exchange Profile: South Carolina

The Henry J. Kaiser Family Foundation overview of South Carolina’s progress toward creating a state health insurance exchange.

South Carolina Primary Health Care Association (Navigator organization)

South Carolina Consumer Assistance Program

Assists people insured by private health plans, Medicaid, or other plans in resolving problems pertaining to their health coverage; assists uninsured residents with access to care.

(800) 768-3467 / [email protected]

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written hundreds of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in South Carolina?

Explore more resources for options in SC including short-term health insurance, dental, Medicaid and Medicare.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- ”Marketplace 2026 Open Enrollment Period Report: National Snapshot” Centers for Medicare & Medicaid Services, Accessed Feb. 16, 2026 ⤶

- ”South Carolina Rate Review Submissions” RateReview.HealthCare.gov. Accessed Sep. 20, 2025 *The above is based on the most current data available. ⤶

- ”Marketplace 2026 Open Enrollment Period Report: National Snapshot” and “Marketplace 2025 Open Enrollment Period Report: National Snapshot” Centers for Medicare & Medicaid Services, Accessed Feb. 16, 2026 ⤶

- ”South Carolina Rate Review Submissions” RateReview.HealthCare.gov. Accessed Sep. 20, 2025 ⤶ ⤶

- ”Individual Market Open Enrollment for 2025 Plans” South Carolina Department of Insurance. Oct. 17, 2024 ⤶ ⤶

- ”A quick guide to the Health Insurance Marketplace” HealthCare.gov ⤶ ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed Jan. 7, 2026 ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed Jan. 7, 2026 ⤶ ⤶

- “When can you get health insurance?” HealthCare.gov, 2023 ⤶

- “Entities Approved to Use Enhanced Direct Enrollment” CMS.gov, Dec. 8, 2025 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶ ⤶

- APTC and CSR Basics. Centers for Medicare and Medicaid Services. June 2023. ⤶

- How Many Uninsured Are in the Coverage Gap and How Many Could be Eligible if All States Adopted the Medicaid Expansion? KFF. Feb. 25, 2025 ⤶

- ”South Carolina Rate Review Submissions” RateReview.HealthCare.gov. Accessed Nov. 20, 2025 ⤶ ⤶

- ”2026 Final Gross Rate Changes – South Carolina: +21.0%; over 600,000 enrollees facing MASSIVE rate hikes (updated)” ACA Signups. Oct. 16, 2025 ⤶ ⤶

- 2015 Health Insurance Plans Rate Changes for Individual Market Coverage. South Carolina Department of Insurance. Accessed December 2023. ⤶

- 2016 Health Insurance Plans Rate Changes for Individual Market Coverage. South Carolina Department of Insurance. Accessed December 2023. ⤶

- Avg. UNSUBSIDIZED Indy Mkt Rate Hikes: 25% (49 States + DC). ACA Signups. October 2016. ⤶

- 2018 Rate Hikes. ACA Signups. October 2017. ⤶

- 2019 Health Insurance Plans Rate Changes for Individual Market Coverage. South Carolina Department of Insurance. Accessed December 2023. ⤶

- 2020 Health Insurance Plans Rate Changes for Individual Market Coverage. South Carolina Department of Insurance. Accessed December 2023. ⤶

- 2021 Rate Changes. ACA Signups. October 2020. ⤶

- South Carolina: Approved Avg. 2022 #ACA Rate Changes: +3.1% Indy Market; +2.1% Sm. Group Market. ACA Signups. October 2023. ⤶

- 2023 Health Insurance Plans Rate Changes for Individual Market Coverage. South Carolina Department of Insurance. Accessed December 2023. ⤶

- 2024 Health Insurance Plans Rate Changes for Individual Market Coverage. South Carolina Department of Insurance. Accessed December 2023. ⤶

- ”2025 Health Insurance Plans Rate Changes for Individual Market Coverage” South Carolina Department of Insurance. Oct. 17, 2024 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶ ⤶

- “Health Insurance Marketplaces 2023 Open Enrollment Report” CMS.gov, 2023 ⤶ ⤶

- ”HealthCare.gov Marketplace Medicaid Unwinding Report” Centers for Medicare & Medicaid Services. Data through April 2024 ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- ”HEALTH INSURANCE MARKETPLACES 2024 OPEN ENROLLMENT REPORT” CMS.gov, 2024 ⤶