Home > States > Health insurance in New Mexico

See your New Mexico health insurance coverage options.

Find individual and family plans, small-group, short-term or Medicare plans through licensed agency partners.

New Mexico Health Insurance Consumer Guide

This guide to health insurance in New Mexico is designed to help you understand the coverage options and potential financial assistance available to you and your family.

Starting in the fall of 2021, New Mexico began using its own state-run health insurance exchange – beWellnm (also referred to as NMHIX, or New Mexico Health Insurance Exchange). Before that, the state used the federally run HealthCare.gov Marketplace platform.

New Mexico residents can use beWellnm to shop for individual and family health plans offered by five private health insurance carriers, including one newcomer for 2024.1 New Mexico’s Health Insurance Marketplace plans are used by people who aren’t eligible for Medicare, Medicaid, or an affordable employer-sponsored health plan.

New Mexico is among the states where additional state-funded subsidies are available through the Marketplace, in addition to federal subsidies. And New Mexico’s state-funded subsidies have been expanded for 2024.2

Explore our other comprehensive guides to coverage in New Mexico

Dental coverage in New Mexico

In 2023, New Mexico's health insurance Marketplace has certified individual and family dental plans from two insurers.3 Our guide will help you understand your dental coverage options in New Mexico.

New Mexico’s Medicaid program

Centennial Care – New Mexico’s Medicaid program – covers more than 900,000 low-income residents. New Mexico expanded Medicaid under the ACA, and Centennial Care enrollment has grown by 94% since 2013.4 After being paused for three years due to the pandemic, Medicaid disenrollments resumed in New Mexico in May 2023. By July, about 75,000 people had been disenrolled from the program.5

Medicare coverage and enrollment in New Mexico

More than 450,000 New Mexico residents had Medicare coverage as of 2023.6 Our New Mexico Medicare guide explains the various parts of Medicare, New Mexico coverage options for Medicare Advantage and Part D, and the state’s rules regarding Medigap (Medicare Supplement) availability.

Short-term health insurance coverage in New Mexico

As a result of the state’s strict rules regarding short-term health insurance, insurers currently don’t offer short-term health policies in the state.7

Frequently asked questions about health insurance in New Mexico

Who can buy Marketplace health insurance in New Mexico?

To be eligible to enroll in private health coverage through beWellnm, you must:8

- Be lawfully present in the United States, and live in New Mexico

- Not be incarcerated

- Not be enrolled in Medicare9

So most New Mexico residents can enroll in a health plan through the exchange.10 But a more pressing question for most people is eligibility for financial assistance in the form of state and federal subsidies through beWellnm.

To qualify for income-based federal Advance Premium Tax Credits (APTC), New Mexico Premium Assistance, federal cost-sharing reductions (CSR), or New Mexico’s State Out-of-Pocket Assistance (SOPA), you must:

- Not have access to an affordable plan offered by an employer. If you are eligible to sign up for an employer’s plan and aren’t sure whether it’s considered affordable, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies via beWellnm.

- Not be eligible for New Mexico Centennial Care (Medicaid).

- Not be eligible for premium-free Medicare Part A.11

In addition to those basic parameters, beWellnm subsidy eligibility will depend on your household’s income.

When can I enroll in an ACA-compliant plan in New Mexico?

In New Mexico, the open enrollment period begins November 1 and continues through January 15.12

(Note that for off-exchange plans — obtained outside of beWellnm — the enrollment period ends December 15 in New Mexico, and does not continue into January the way it does for on-exchange plans.13 This is fairly unique, as the open enrollment period in most states is the same for on-exchange and off-exchange plans.)

For 2024 coverage, beWellnm enrollments must be completed by December 31, 2023 to have coverage effective January 1. Enrollments completed between January 1 and January 15 will have coverage effective February 1.14

After the open enrollment period ends, you may still be able to enroll or make a plan change if you experience a qualifying life event, such as giving birth or losing other health coverage.

New Mexico also has an Easy Enrollment Program that allows people to start the health insurance enrollment process via state tax returns.15

And some people can enroll year-round even without a specific qualifying life event. This includes the low-income special enrollment period, which is available to applicants with household income up to 200% of the poverty level in New Mexico.16 (The household income cutoff for this SEP is 150% in most states.)

Enrollment in New Mexico Centennial Care (Medicaid) is available year-round.

How do I enroll in a Marketplace plan in New Mexico?

To enroll in an ACA Marketplace/exchange plan in New Mexico, you can:

- Visit beWellnm – New Mexico’s health insurance exchange – to compare the health plans available in your area, determine whether you’re eligible for financial assistance (including federal and state subsidies), and enroll in coverage during open enrollment or during a special enrollment period.

- Enroll in a beWellnm plan with the help of an insurance agent or broker, Navigator, or certified application counselor.

- Contact beWellnm by phone at 1-833-862-3935.

How can I find affordable health insurance in New Mexico?

When you enroll in coverage through beWellnm, you may find that you’re eligible for financial assistance. And the assistance may be more robust than it is in many other states, as both federal and state subsidy programs are available in New Mexico.

As a result of the Affordable Care Act (ACA), federal premium subsidies (advance premium tax credits, or APTC) are available depending on your income. If you’re eligible for APTC, it will reduce the amount you pay for your health coverage each month, as long as you enroll in a metal-level plan through beWellnm.

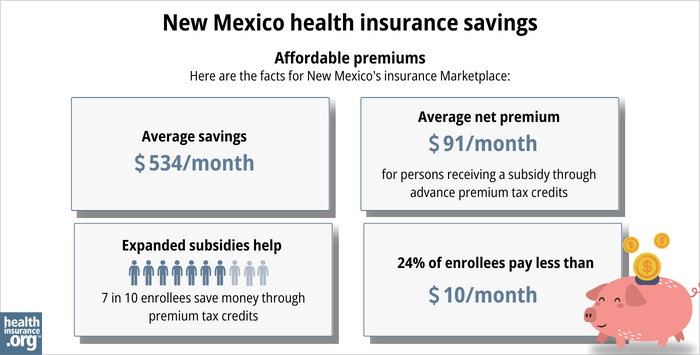

Seventy-nine percent of beWellnm enrollees were receiving APTC as of early 2023. These subsidies averaged $534 /month, reducing the average enrollee’s premium to $91/month.17

Applicants with household income up to 250% of the federal poverty level are also eligible for federal cost-sharing reductions (CSR), which will reduce the deductible and other out-of-pocket expenses for Silver-level plans. Seventeen percent of beWellnm enrollees were receiving CSR benefits as of 2023.17

And New Mexico is among the states where additional state-funded subsidies are available. As of 2023, New Mexico began offering state-funded premium subsidies (for applicants with income up to 400% of the poverty level) and cost-sharing assistance (for applicants with income up to 300% of the poverty level), in addition to the federal premium subsidies and cost-sharing reductions.18

New Mexico’s cost-sharing reductions (state out-of-pocket assistance, or SOPA) are being expanded for 2024, ensuring that people with household income up to 300% of the poverty level can get plans with 90% actuarial value (ie, platinum-level coverage).19

Plans with reduced cost-sharing, including federal CSR and SOPA benefits, are known as “Turquoise plans” in New Mexico, to make it easier for consumers to identify them.

Starting in 2023, New Mexico no longer allows health insurers in the individual/family market to add a tobacco surcharge to smokers’ premiums (the state joined several others that had already imposed similar rules).

Starting with the 2024 plan year, New Mexico has standardized plans available at the Silver, Gold, and Turquoise level.20

Source: CMS.gov17

Depending on your income and circumstances, you may be able to enroll in free or low-cost health coverage through Centennial Care (New Mexico Medicaid). Learn more about whether you might be eligible for Medicaid in New Mexico.

As was the case in all states, Medicaid disenrollments resumed in New Mexico in mid-2023, after being paused for three years during the pandemic. But New Mexico took some fairly unique steps to help people transition from Medicaid to the Marketplace: For those with income up to 400% of the poverty level, the state is covering their first month of after-subsidy premiums for the Marketplace plan, and beWellnm is also offering retroactive effective dates (the first of the month during which the person applied) for the new Marketplace plans when a person is transitioning away from Centennial Care Medicaid.21

How many insurers offer Marketplace coverage in New Mexico?

For 2025, five insurers offer exchange plans in New Mexico,22 including UnitedHealthcare, which is new for 2024.1 Unlike most states, all exchange carriers in New Mexico offer plans statewide, so consumers in all areas of the state have access to the same plans.23

For several years, New Mexico had one of the few remaining ACA-created CO-OPs, but it closed at the end of 2020, leaving just three CO-OPs still operational (as of 2024, those three CO-OPs offer coverage in five states).

Are Marketplace health insurance premiums increasing in New Mexico?

For 2024, New Mexico’s Marketplace insurers have implemented the following average rate changes, applicable to full-price (pre-subsidy) premiums:24 The weighted average rate increase is about 7% for 2024, before any subsidies are applied.25

New Mexico’s ACA Marketplace Plan 2024 Proposed Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Blue Cross Blue Shield of New Mexico | 5.75% |

| Molina | 1.1% |

| Presbyterian Health Plan | 10.7% |

| Western Sky Community Care | 9.1% |

| UnitedHealthcare of New Mexico | New for 2024, so no rate change |

Source: HealthCare.gov24

While average rate changes apply to full-price premiums, most enrollees do not pay full price. Seventy-nine percent of beWellnm enrollees were receiving federal premium subsidies in 2023.17 And many beWellnm enrollees also receive additional state-funded premium subsidies.

For perspective, here’s an overview of how average full-price premiums have changed over the years in New Mexico’s individual/family market:

- 2015: Average decrease of 1.7%.26

- 2016: Average increase of 4%.27

- 2017: Average increase of 28.4%.28

- 2018: Average increase of 30%.29

- 2019: Average decrease of 1%.30

- 2020: Average increase of 0.9%.31

- 2021: Average decrease of 1.5%.32

- 2022: Average increase of 15.5%.33

- 2023: Average increase of 11.3%.34 (before Friday Health Plans, which had the largest increase, announced that they would exit the market).

How many people are insured through New Mexico's Marketplace?

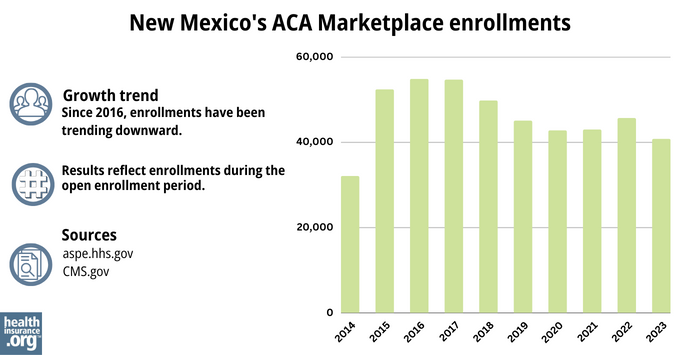

During the open enrollment period for 2023 coverage, 40,778 people selected private plans through beWellnm.17

But enrollment has swelled for 2024, with more than 50,000 people enrolled in medical plans by mid-December, with another month left in the open enrollment period.35 (2017 was the last time enrollment surpassed 50,000 people in New Mexico’s Health Insurance Marketplace.)36

Source: 2014,37 2015,38 2016,39 2017,36 2018,40 2019,41 2020,42 2021,43 2022,44 202317

What health insurance resources are available to New Mexico residents?

beWellnm

The state’s exchange for small businesses, individuals, and families.

Health Action New Mexico

A consumer advocacy organization working to improve healthcare access and affordability in New Mexico.

New Mexico Human Services Department

Administers Centennial Care (Medicaid) and various other social services programs in the state.

New Mexico Office of the Superintendent of Insurance

Licenses and regulates health insurance companies in New Mexico, as well as brokers and agents; can provide assistance and information to consumers who have questions or complaints about regulated entities.

New Mexico State Health Insurance Assistance Program

A resource for New Mexico Medicare beneficiaries and their caregivers.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- New 2024 Individual Exchange plans and prior authorization information. UnitedHealthcare. October 2023. ⤶ ⤶

- 2024 Plan Year Health Insurance Marketplace Affordability Program Policy and Procedures Manual. New Mexico Office of the Superintendent of Insurance. April 2023. ⤶

- “New Mexico dental insurance guide 2023” healthinsurance.org, Accessed September 2023 ⤶

- "Total Monthly Medicaid & CHIP Enrollment and Pre-ACA Enrollment" KFF. April 2023 ⤶

- ”Departmental Performance Scorecard Public Health Emergency (PHE) Unwinding Measures” New Mexico Human Services Department. August 2023 ⤶

- "Medicare Monthly Enrollment" CMS.gov, April 2023 ⤶

- “Bulletin 2019-05, Sale of Short-Term Limited Duration Plans” New Mexico Office of the Superintendent of Insurance. April 25, 2019 ⤶

- New Mexico Health Insurance Exchange Policy Manual for Plan Year 2024. beWellnm, NMHIX. Accessed December 2023. ⤶

- Medicare and the Health Insurance Marketplace. Medicare.gov. Accessed December 2023. ⤶

- “Frequently Asked Questions; New Mexico State-Based Exchange” beWellnm, Accessed September 2023 ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- “Enrollment” beWellnm, Accessed September 2023 ⤶

- Application of open enrollment and special enrollment periods to individual off-exchange plans. New Mexico Office of the Superintendent of Insurance. December 2023. ⤶

- New Mexico Health Insurance Exchange Policy Manual for Plan Year 2024. beWellnm, NMHIX. Accessed December 2023. ⤶

- NM Easy Enrollment Program. Health Action New Mexico. Accessed December 2023. ⤶

- “Special enrollment period for consumer at or below 200% FPL” beWellnm, March 2022 ⤶

- “2023 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 2023 ⤶ ⤶ ⤶ ⤶ ⤶ ⤶

- “Health Insurance Marketplace Affordability Program” NM Office of the Superintendent of Insurance, October 2022 ⤶

- “2024 Plan Year Health Insurance Marketplace Affordability Program Policy and Procedures Manual” New Mexico Office of the Superintendent of Insurance, April 13, 2023 ⤶

- “Standardized Health Plan Requirements for the 2024 Plan Year” beWellnm. January 2023 ⤶

- Minimizing Coverage Disruptions After the Federal Medicaid Continuous Coverage Requirement Expires During the 2023 Plan year. New Mexico Office of the Insurance Commissioner. February 2023. ⤶

- “New Mexico SERFF Filings” ⤶

- Statewide coverage requirement confirmed via conversation with NM Office of the Superintendent of Insurance, December 2023. ⤶

- “New Mexico Rate Review Submissions” HealthCare.gov, Accessed December 2023 ⤶ ⤶

- Calculated by healthinsurance.org, based on premium and enrollment data in New Mexico SERFF filings. NM SERFF. Accessed December 2023. ⤶

- New Mexico: 2015 QHP Premiums To DROP 1.65% (Weighted Average). ACA Signups. September 2014. ⤶

- FINAL PROJECTION: 2016 Weighted Avg. Rate Increases: 12-13% Nationally* ACA Signups. October 2015. ⤶

- Avg. UNSUBSIDIZED Indy Mkt Rate Hikes: 25% (49 States + DC). ACA Signups. October 2016. ⤶

- 2018 Rate Hikes. ACA Signups. October 2017. ⤶

- 2019 Rate Hikes. ACA Signups. October 2018. ⤶

- 2020 Rate Changes. ACA Signups. October 2019. ⤶

- 2021 Rate Changes. ACA Signups. October 2020. ⤶

- 2022 Rate Changes. ACA Signups. October 2021. ⤶

- UPDATED: FINAL Unsubsidized 2023 Premiums: +6.2% Across All 50 States +DC. ACA Signups. Accessed November 2023. ⤶

- Open Enrollment for Plan Year 2024 Summary. beWellnm. December 15, 2023. ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶ ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶