Home > States > Health insurance in South Carolina

See your South Carolina health insurance coverage options.

Find individual and family plans, small-group, short-term or Medicare plans through licensed agency partners.

South Carolina Health Insurance Consumer Guide

This guide was developed to assist you in choosing the right South Carolina health insurance plan for you and your family. The plans available through South Carolina’s ACA Marketplace may be a good choice for you, and we’re here to help guide you through the coverage options.

South Carolina uses the federally run health insurance exchange/Marketplace, at HealthCare.gov, for residents to purchase ACA Marketplace plans. The Marketplace provides access to health insurance products from six private insurers,1 with insurer participation that varies from one area of the state to another. 2

Depending on your income and other circumstances, you may qualify for financial help to lower your South Carolina Marketplace plan’s monthly insurance premium (the amount you pay to enroll in the coverage) and possibly also your out-of-pocket expenses.

Explore our other comprehensive guides to coverage in South Carolina

Dental coverage in South Carolina

Looking to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in South Carolina.

South Carolina’s Medicaid program

Although South Carolina still has not accepted federal funding to expand Medicaid eligibility under the ACA, the state did increase the income limits for low-income parents to qualify for coverage. South Carolina’s total Medicaid enrollment has grown to more than 1 million people as of 2023.3

Medicare coverage and enrollment in South Carolina

As of September 2022, there were 1,159,851 people enrolled in Medicare in South Carolina.4 Our guide will help you confidently understand Medicare Parts A, B, C and D plans — as well as Medicare supplement (Medigap) plans available in the South Carolina.

Short-term coverage in South Carolina

South Carolina has its own state regulations regarding short-term health insurance policies. Short-term health insurance in South Carolina can’t last more than 11 months, with a total duration of 33 months (including renewals).5 As of 2023, there were at least five insurers selling short-term health insurance plans in South Carolina.

Frequently asked questions about health insurance in South Carolina

Who can buy Marketplace health insurance?

To qualify for health coverage through the South Carolina Health Insurance Marketplace, you must:6

- Live in South Carolina

- Be lawfully present in the United States

- Not be incarcerated

- Not be enrolled in Medicare

Eligibility for financial assistance (premium subsidies and cost-sharing reductions) depends on your household income. In addition, to qualify for financial assistance with your Marketplace plan you must:

- Not have access to affordable health coverage offered by an employer. If your employer offers health benefits but you feel the coverage is too expensive, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies in the Marketplace.

- Not be eligible for Medicaid or CHIP.

- Not be eligible for premium-free Medicare Part A.7

When can I enroll in an ACA-compliant plan in South Carolina?

The open enrollment period for individual/family health coverage runs from November 1 to January 15 in South Carolina.8

If you need your coverage to start on January 1, you must submit your application by December 15. If you apply between December 16 and January 15, your coverage will begin on February 1.6

Outside of open enrollment, a special enrollment period (generally triggered by a specific qualifying life event) is necessary to enroll or make changes to your coverage.

If you have questions about open enrollment, you can learn more in our comprehensive guide to open enrollment. We also have a comprehensive guide to special enrollment periods.

How do I enroll in a South Carolina Marketplace plan?

To enroll in an ACA Marketplace plan in South Carolina, you can:

- Visit Healthcare.gov to access South Carolina’s health insurance marketplace. Here you will find an online platform to shop, compare, and choose the best health plans.

- Contact the HealthCare.gov call center at 1-800-318-2596 (TTY: 1-855-889-4325). The call center is available 24 hours a day, 7 days a week (closed on holidays).

- Purchase individual and family health coverage with the help of an insurance agent or broker, a Navigator, or a certified application counselor.

- Enroll via an approved enhanced direct enrollment entity.9

How can I find affordable health insurance in South Carolina?

South Carolina uses the federally run exchange for individual market plans, so residents who buy their own health insurance enroll through HealthCare.gov.

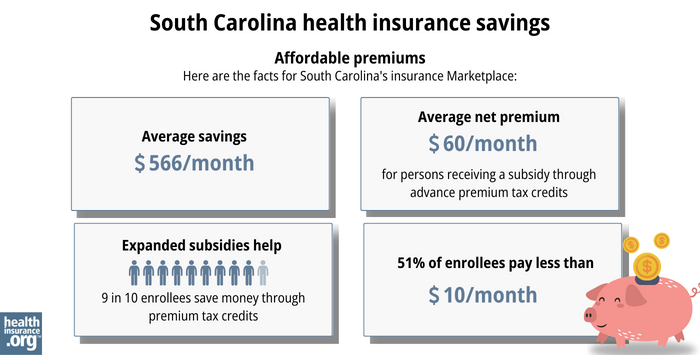

In the South Carolina Marketplace, about nine out of ten eligible enrollees save money on premium payments amounting to an average savings of $566/month in 2023. After subsidies (premium tax credis) were applied, the average enrollee’s monthly cost was about $60/month.10

The Affordable Care Act also ensures that people with household incomes up to 250% of the poverty level can enroll in Silver-level plans that have reduced out-of-pocket costs (i.e. lower out-of-pocket costs than Silver plans available to people with higher incomes).11

Between the premium subsidies and cost-sharing reductions, you may find that a plan obtained through the South Carolina Health Insurance Marketplace will provide you with the best overall value.

Source: CMS.gov10

South Carolina has not yet implemented the ACA’s expansion of Medicaid, so there is still a coverage gap in the state: Childless, non-disabled adults with income below the poverty level are not eligible for Medicaid (due to the lack of Medicaid expansion) and are also not eligible for Marketplace subsidies (because the ACA called for them to have Medicaid, which South Carolina has not implemented).

An estimated 94,000 low-income adults are in the coverage gap in South Carolina, ineligible for any financial assistance with their health coverage.12

How many insurers offer Marketplace coverage in South Carolina?

There are six insurers offering health plans through the South Carolina exchange for 2024 coverage.1 This includes one newcomer, as UnitedHealthcare has joined the South Carolina Health Insurance Marketplace for 2024:13

Marketplace insurers’ coverage areas vary, but in nearly all of South Carolina’s counties, at least three insurers are offering health plans through the Marketplace for 2024.2

Are Marketplace health insurance premiums increasing in South Carolina?

The following average 2024 rate changes were approved for insurance companies that offer plans through the South Carolina Health Insurance Marketplace, amounting to a weighted average rate increase (before subsidies are applied) of 2.7%.1

South Carolina’s ACA Marketplace Plan 2024 Approved Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Blue Cross Blue Shield of SC | 2.7% |

| Ambetter/Absolute Total Care | 1.4% |

| Molina | 4.6% |

| Cigna | 17.8% |

| Select Health | 1.25% |

| UnitedHealthcare | new for 2024 |

Source: South Carolina Department of Insurance.1

For perspective, here’s an overview of how weighted average full-price (pre-subsidy) individual/family premiums have changed in South Carolina over time:

- 2015: Average increase of less than 1%.14

- 2016: Average increase of 12.3%.15

- 2017: Average increase of 25.6%.16

- 2018: Average increase of 30.7%.17

- 2019: Average increase of 5.26%18

- 2020: Average decrease of 3.9%.19

- 2021: Average decrease of 1.5%.20

- 2022: Average increase of 3.1%.21

- 2023: Average increase of 7.1%.22

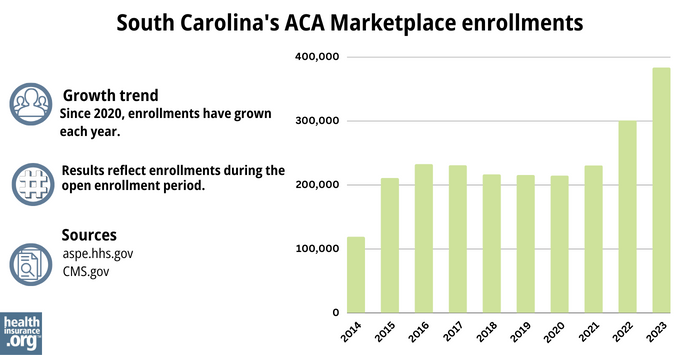

How many people are insured through South Carolina’s Marketplace?

In the South Carolina marketplace, 382,968 people enrolled in private plans for the 2023 coverage period.23 This was by far a record high for the state, and was an increase of 27% over 2022’s enrollment. But 2022 enrollment in South Carolina Marketplace plans had also been a record-high.24

The surge in enrollment during these years was due in large part to the American Rescue Plan (ARP) which made the ACA’s premium subsidies more substantial and more widely available.25 These premium subsidy enhancement provisions have been extended through 2025 by the Inflation Reduction Act.

Source: 2014,26 2015,27 2016,28 2017,29 2018,30 2019,31 2020,32 2021,33 2022,34 202325

What health insurance resources are available to South Carolina residents?

HealthCare.gov

800-318-2596

State Exchange Profile: South Carolina

The Henry J. Kaiser Family Foundation overview of South Carolina’s progress toward creating a state health insurance exchange.

South Carolina Primary Health Care Association (Navigator organization)

South Carolina Consumer Assistance Program

Assists people insured by private health plans, Medicaid, or other plans in resolving problems pertaining to their health coverage; assists uninsured residents with access to care.

(800) 768-3467 / [email protected]

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- 2024 Health Insurance Plans Rate Changes for Individual Market Coverage. South Carolina Department of Insurance. Accessed December 2023. ⤶ ⤶ ⤶ ⤶

- Plan Year 2024 Qualified Health Plan Choice and Premiums in HealthCare.gov Marketplaces. Centers for Medicare and Medicaid Services. October 25, 2023. ⤶ ⤶

- “April 2023 Medicaid & CHIP Enrollment Data Highlights” Medicaid.gov, April 28, 2023 ⤶

- “Medicare Monthly Enrollment ” CMA.gov, Accessed August 2023 ⤶

- “Availability of short-term health insurance in South Carolina” healthinsurance.org, Jan. 7, 2023 ⤶

- ”A quick guide to the Health Insurance Marketplace” HealthCare.gov ⤶ ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- “When can you get health insurance?” HealthCare.gov, 2023 ⤶

- “Entities Approved to Use Enhanced Direct Enrollment” CMS.gov, April 28, 2023 ⤶

- “2023 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2023 ⤶ ⤶

- APTC and CSR Basics. Centers for Medicare and Medicaid Services. June 2023. ⤶

- How Many Uninsured Are in the Coverage Gap and How Many Could be Eligible if All States Adopted the Medicaid Expansion? KFF. March 2023. ⤶

- ”UnitedHealthcare to Offer Individual and Family Plans on the Health Insurance Marketplace in 26 States for 2024” UnitedHealthGroup. October 2023. ⤶

- 2015 Health Insurance Plans Rate Changes for Individual Market Coverage. South Carolina Department of Insurance. Accessed December 2023. ⤶

- 2016 Health Insurance Plans Rate Changes for Individual Market Coverage. South Carolina Department of Insurance. Accessed December 2023. ⤶

- Avg. UNSUBSIDIZED Indy Mkt Rate Hikes: 25% (49 States + DC). ACA Signups. October 2016. ⤶

- 2018 Rate Hikes. ACA Signups. October 2017. ⤶

- 2019 Health Insurance Plans Rate Changes for Individual Market Coverage. South Carolina Department of Insurance. Accessed December 2023. ⤶

- 2020 Health Insurance Plans Rate Changes for Individual Market Coverage. South Carolina Department of Insurance. Accessed December 2023. ⤶

- 2021 Rate Changes. ACA Signups. October 2020. ⤶

- South Carolina: Approved Avg. 2022 #ACA Rate Changes: +3.1% Indy Market; +2.1% Sm. Group Market. ACA Signups. October 2023. ⤶

- 2023 Health Insurance Plans Rate Changes for Individual Market Coverage. South Carolina Department of Insurance. Accessed December 2023. ⤶

- “Marketplace 2023 Open Enrollment Period Report: Final National Snapshot” CMS.gov, January 2023 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- “Health Insurance Marketplaces 2023 Open Enrollment Report” CMS.gov, 2023 ⤶ ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶