What is an indemnity health plan?

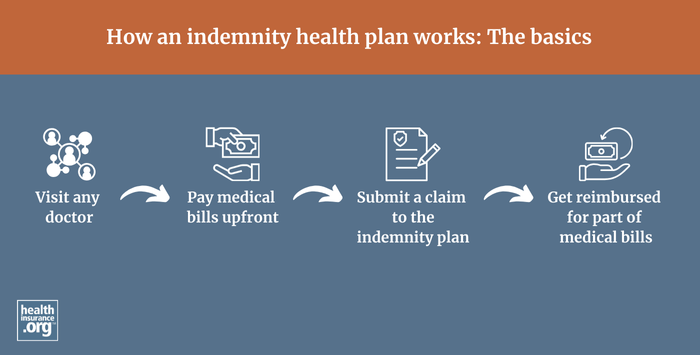

An indemnity health plan will reimburse an enrollee for a portion of their healthcare costs, regardless of what medical provider the member uses or how much the provider bills.

This is called a fee-for-service approach. The indemnity health plan pays a pre-determined percentage of the reasonable and customary charges for a given service, and the policyholder pays the rest.1

Indemnity plans do not have provider networks, so patients can choose their own doctors and hospitals. The amount the plan will pay varies by service but is defined by the plan and pre-determined (typically a certain percentage of the reasonable and customary charges for that procedure), regardless of how much the medical provider bills for the service. This leaves the insured on the hook for potentially large and possibly unexpected medical bills, depending on how much the provider charges for the service.

Providers can balance bill the patient for any billed amounts above what the insurance company pays, since the providers don't have contracts with the insurer requiring them to accept the insurer's "reasonable and customary" amounts as payment in full.

How common are indemnity health plans?

Indemnity plans, sometimes referred to as “traditional” or “conventional” plans, dominated the health coverage landscape before the rise of HMOs, PPOs, and other managed care plans in the 1980s and 90s.2 But they are quite rare today. In the employer-sponsored health insurance market, where almost half of all Americans get their coverage,3 they accounted for just 1% of all enrollment in 2024.1 And all plans available in the health insurance Marketplace are managed care plans (HMO, PPO, EPO, or POS).

However, people can still purchase fixed indemnity plans, which are a subset of indemnity health plans, and use them to supplement a major medical plan obtained from an employer or in the individual market. Fixed indemnity plans are not regulated by the ACA, so they don't have to cover the essential health benefits or pre-existing conditions. They are not suitable to serve as a person's only coverage and are instead a supplement to major medical coverage.

Footnotes

- “Indemnity Plans” Scout HRO. Accessed Sep. 3, 2025 ⤶

- “Conventional Health Insurance: A Decade Later” CMS.gov. Accessed Sep. 3, 2025 ⤶

- “Health Insurance Coverage of the Total Population” KFF.org. Accessed Sep. 3, 2025 ⤶