Home > States > Health insurance in Florida

See your Florida health insurance coverage options.

Find affordable individual and family, small-group, short-term, or dental plans through licensed agency partners.

Florida Health Insurance Consumer Guide

This guide will help you understand the Florida health insurance options available to you and your family. Many people find that an Affordable Care Act (ACA) Marketplace plan – or Obamacare – helps them save money on health insurance expenses.

Florida uses the federally-run Health Insurance Marketplace: HealthCare.gov. Individual and family plans on the ACA exchange in Florida are available for:1

- Self-employed people

- People who retired early and need coverage until they become eligible for Medicare

- People who work for small businesses without health benefits

Numerous private insurance companies offer coverage through the Florida Health Insurance Marketplace, with plan availability varying from one area to another. Florida has by far the nation’s highest enrollment in Marketplace plans: A fifth of all Health Insurance Marketplace enrollees nationwide reside in Florida.2

Florida banned surprise balance billing starting in mid-2016, for state-regulated health plans.3 Florida’s law was lauded as a model for other states that wanted to implement similar consumer protections. The federal No Surprises Act took effect in 2022, providing nationwide protection from surprise balance bills, including for people with self-insured plans (which aren’t regulated by state laws).

Explore our other comprehensive guides to coverage in Florida

Dental coverage options in Florida

Our guide walks you through affordable dental plan options in Florida.

Florida’s Medicaid program

Florida has not adopted Medicaid expansion under ACA. Over 5 million people were enrolled in Medicaid and CHIP as of April 2023.4

Medicare coverage and enrollment in Florida

As of early 2023, nearly 5 million Floridians have Medicare coverage. That’s about 23% of the state’s total population.5

Short-term coverage in Florida

As of 2023, there were at least five insurers offering short-term health insurance in Florida.

Frequently asked questions about health insurance in Florida

Who can buy Marketplace health insurance?

To qualify for Florida Health Insurance Marketplace coverage, you must:1

- Live in Florida

- Be a U.S. citizen, national, or lawfully present in the U.S.

- Not be incarcerated

- Not be enrolled in Medicare

But those rules just allow a person to enroll in coverage through the exchange. Eligibility for financial assistance (premium subsidies and/or cost-sharing reductions) through the Health Insurance Marketplace depends on how your household income compares with the cost of the second-lowest-cost Silver plan in your area.

In addition, to qualify for financial assistance with your Marketplace plan you must:

- Not be eligible for Medicaid or CHIP (Florida KidCare), or premium-free Medicare Part A.6

- Not have access to affordable employer-sponsored health coverage. If your employer (or your spouse’s employer) offers coverage but you feel it’s too expensive, you can use our Employer Health Plan Affordability Calculator to learn whether you might be eligible for premium subsidies in the Florida Marketplace.

When can I enroll in an ACA-compliant plan in Florida?

The open enrollment period to sign up for ACA-compliant individual and family health insurance in Florida runs from November 1 to January 15.7

- Enroll by December 15 for coverage to start January 1.

- If you enroll between December 16 and January 15, coverage will begin on February 1.

If you miss open enrollment, you can still enroll or switch plans if you meet the special enrollment period (SEP) requirements. Most SEPs require a qualifying life event like losing coverage, getting married, or permanently moving.

But some SEPs don’t require a qualifying life event.8 For example:

- Native Americans can enroll year-round.9

- People earning less than 150% of the poverty level can enroll anytime until at least 2025.

People who lose Medicaid or CHIP between March 2023 and July 2024 may qualify for a temporary extended SEP.10

How do I enroll in a Florida health insurance Marketplace plan?

If you sign up for a Florida Health Insurance Marketplace plan, you have several enrollment options:

- Online through HealthCare.gov.

- By calling the Marketplace Call Center at (800) 318-2596.

- With the help of licensed agents, navigators, or certified application counselors or an approved enhanced direct enrollment entity.11

- Mailing in a paper application

Go to localhelp.HealthCare.gov to find a navigator, certified application counselor, or agent in your area.

How can I find affordable health insurance in Florida?

You can find affordable individual and family health insurance in Florida through HealthCare.gov, which is Florida’s ACA exchange/Marketplace.

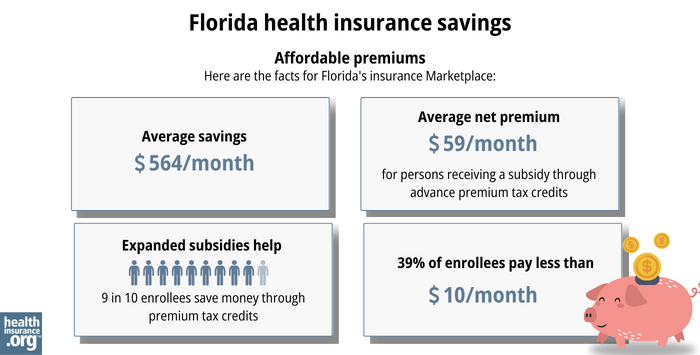

During 2023 open enrollment, more than 90% of Florida’s Health Insurance Marketplace enrollees qualified for subsidies.12 These subsidies, called Advance Premium Tax Credits (APTC), lower your monthly premiums.

With subsidies, Floridians who enrolled through the Marketplace during the 2023 open enrollment saved about $564 per month on premiums. Those receiving subsidies paid approximately $59 per month in premiums.12

If your household income is between 100% and 250% of the federal poverty level and you select a Silver plan through the Florida Health Insurance Marketplace, you will also receive cost-sharing reductions (CSR).13 62% of Florida’s Marketplace enrollees were receiving CSR benefits as of early 2023.14

While APTCs help reduce health insurance costs, CSRs reduce out-of-pocket costs like deductibles, copayments, or coinsurance.

Medicaid and Florida KidCare (CHIP) are options for affordable health insurance in Florida if you qualify for either program. Alternatively, short-term plans also offer low-cost health coverage.

Source: CMS.gov15

How many insurers offer Marketplace health insurance in Florida?

Fourteen insurers are offering plans on Florida’s Marketplace for 2024.16

One insurer, Oscar, paused new enrollments in Florida for 2023, starting in mid-December 2024. But enrollments resumed in August 2023, and Oscar is continuing to offer coverage in Florida’s Marketplace for 2024.17

Bright Health stopped offering health coverage in Florida at the end of 2022.

How much is health insurance in Florida and did premiums rise in 2024?

In 2023, the average Florida Health Insurance Marketplace enrollee was paying about $73/month in premiums, after premium subsidies (premium tax credits) were applied.18

Nearly all (97%) of the people enrolled in Florida health insurance coverage through the Marketplace are eligible for subsidies, and the subsidies cover the majority of the cost: Average full-price health insurance premiums are about $623/month in Florida, but the average subsidy is about $565/month.18

The 14 insurance companies offering individual/family plans through Florida’s Health Insurance Marketplace implemented the following average rate increases for 2024, amountaing to a weighted average rate increase of 5.3%:19

Florida’s ACA Marketplace Plan 2024 Proposed Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Aetna CVS Health / Coventry Health Plan of Florida | 6.2% |

| AmeriHealth Caritas | 17.2% |

| AvMed | 1.6% |

| Blue Cross Blue Shield of Florida, Inc. | 7.2% |

| Capital Health Plan | 2.4% |

| Celtic Insurance Company (Ambetter) |

1.7% |

| Cigna | 6% |

| Florida Health Care Plan, Inc. | 6% |

| Health First Commercial Plans | 3.3% |

| Health Options (Florida Blue HMO) | 5.6% |

| Molina Healthcare of Florida, Inc. | 3.7% |

| Oscar Insurance Company of Florida | 4.3% |

| Sunshine State Health Plan | 8.4% |

| UnitedHealthcare | 4.2% |

Remember that these rate changes are calculated before subsidies are applied. Most Florida exchange enrollees receive subsidies, so they may find coverage more affordable than expected.20

For perspective, here’s a summary of how full price premiums in Florida’s ACA-compliant market have changed over the years:

- 2015: Average increase of 7%.21

- 2016: Average increase of 9.5%.22

- 2017: Average increase of 19.1%.23

- 2018: Average increase of 44.7%.24 (federal funding for cost-sharing reductions was eliminated)

- 2019: Average increase of 5.2%.25

- 2020: Average increase of 0%.26

- 2021: Average increase of 3.1%.27

- 2022: Average increase of 6.6%.28

- 2023: Average increase of 7.2%.29

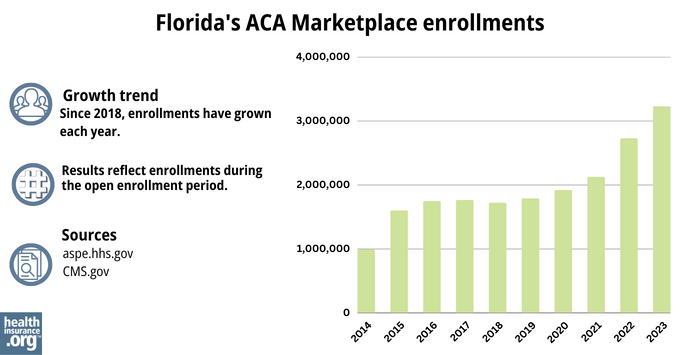

How many people are insured through Florida’s Marketplace?

During the open enrollment period for 2024 coverage, a significant new record high of 4,211,902 people enrolled in health insurance through Florida’s Marketplace.30

The previous record high, in 2023, had been 3,225,435,31 so the increase for 2024 was substantial. (See chart below for a comparison of year-by-year enrollment.)

This surge in enrollment in recent years is due in part to the American Rescue Plan, which improved affordability starting in 2021. The Inflation Reduction Act then extended these improvements until 2025, ensuring coverage remains more affordable than it was before the ARP became law.32

Source: 2014,33 2015,34 2016,35 2017,36 2018,37 2019,38 2020,39 2021,40 2022,41 202342

What health insurance resources are available to Florida residents?

Healthcare.gov

This is the ACA Marketplace, where you can enroll in a health insurance plan online. You may also get help by calling (800) 318-2596.

Florida Consumer Action Network (FCAN)

Nonprofit consumer advocacy group that helps Floridians understand their health insurance options.

Florida KidCare

Florida’s health insurance program for children.

FloridaHealthFinder.gov

State-run site to compare and enroll in health plans.

Federally funded Navigator organizations:

- University of Florida/Florida Covering Kids & Families – Helps people enroll in and understand health coverage.

- Urban League of Broward County – Helps underserved and vulnerable populations.

Florida Office of Insurance Regulation

Licenses and oversees health insurers, brokers, and agents. Helps consumers with complaints.

Medicare Rights Center

National service with a call center providing advice and information for people with Medicare.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- ”A quick guide to the Health Insurance Marketplace” HealthCare.gov ⤶ ⤶

- ”Effectuated Enrollment: Early 2023 Snapshot and Full Year 2022 Average” Centers for Medicare and Medicaid Services. ⤶

- ”Florida House Bill 221” BillTrack50. Enacted 2015. ⤶

- "Total Monthly Medicaid & CHIP Enrollment and Pre-ACA Enrollment" KFF.org, April 2023 ⤶

- “Medicare Monthly Enrollment” CMS.gov, April 2023 ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- “A quick guide to the Health Insurance Marketplace®” HealthCare.gov, Accessed August, 2023 ⤶

- “Who doesn’t need a special enrollment period?“ healthinsurance.org, Accessed August 2023 ⤶

- “AIAN ACA 2021” CMS.gov, Accessed September 2023 ⤶

- “temp-sep-unwinding-faq.pdf” CMS.gov, Jan. 27, 2023 ⤶

- “Entities Approved to Use Enhanced Direct Enrollment” CMS.gov, April 28, 2023 ⤶

- “2023 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 2023 ⤶ ⤶

- “Federal Poverty Level (FPL)” HealthCare.gov, 2023 ⤶

- ”Effectuated Enrollment: Early 2023 Snapshot and Full Year 2022 Average” Centers for Medicare and Medicaid Services. ⤶

- “2023 OEP State-Level Public Use File (ZIP)” CMS.gov, March 23, 2023 ⤶

- Individual PPACA Market Monthly Premiums for Plan Year 2024 Florida Office of Insurance Regulation, September 2022 ⤶

- ”Oscar set to begin enrolling members in Florida after temporary pause on sign-ups” Fierce Healthcare, Aug. 9, 2023 ⤶

- ”Effectuated Enrollment: Early 2023 Snapshot and Full Year 2022 Average” Centers for Medicare and Medicaid Services, Accessed October 2023 ⤶ ⤶

- Individual PPACA Market Monthly Premiums for Plan Year 2024 Florida Office of Insurance Regulation, August 2023. ⤶

- “Effectuated Enrollment: Early 2023 Snapshot and Full-Year 2022 Average” CMS.gov, March 15, 2023. ⤶

- Analysis Finds No Nationwide Increase in Health Insurance Marketplace Premiums. The Commonwealth Fund. December 2014. ⤶

- Individual PPACA Market Monthly Premiums for Plan Year 2016. Florida Office of Insurance Regulation, August 2015. ⤶

- Individual PPACA Market Monthly Premiums for Plan Year 2017. Florida Office of Insurance Regulation, September 2016. ⤶

- 2018 Rate Hikes. ACA Signups. October 2017. ⤶

- 2019 Rate Hikes. ACA Signups. October 2018. ⤶

- 2020 Rate Changes. ACA Signups. October 2019. ⤶

- Individual PPACA Market Monthly Premiums for Plan Year 2021 Florida Office of Insurance Regulation, September 2020. ⤶

- Florida Office of Insurance Regulation Announces 2022 PPACA Individual Market Health Insurance Plan Rates. Florida Office of Insurance Regulation, September 2021. ⤶

- Individual PPACA Market Monthly Premiums for Plan Year 2023 Florida Office of Insurance Regulation, September 2022 ⤶

- Marketplace 2024 Open Enrollment Period Report: Final National Snapshot. Centers for Medicare and Medicaid Services. January 2024. ⤶

- “Marketplace 2023 Open Enrollment Period Report: Final National Snapshot” CMS.gov, January 2023 ⤶

- “Health Insurance Marketplaces 2023 Open Enrollment Report” CMS.gov, Accessed August 2023 ⤶

- “ASPE Issue Brief (2014) ” ASPE, 2015 ⤶

- “ Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report ”, HHS.gov, 2015 ⤶

- “ HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files ” CMS.gov, 2017 ⤶

- “ 2018 Marketplace Open Enrollment Period Public Use Files ” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files ” CMS.gov, 2019 ⤶

- “ 2020 Marketplace Open Enrollment Period Public Use Files ” CMS.gov, 2020 ⤶

- “ 2021 Marketplace Open Enrollment Period Public Use Files ” CMS.gov, 2021 ⤶

- “ 2022 Marketplace Open Enrollment Period Public Use Files ” CMS.gov, 2022 ⤶

- “ Health Insurance Marketplaces 2023 Open Enrollment Report ” CMS.gov, 2023 ⤶