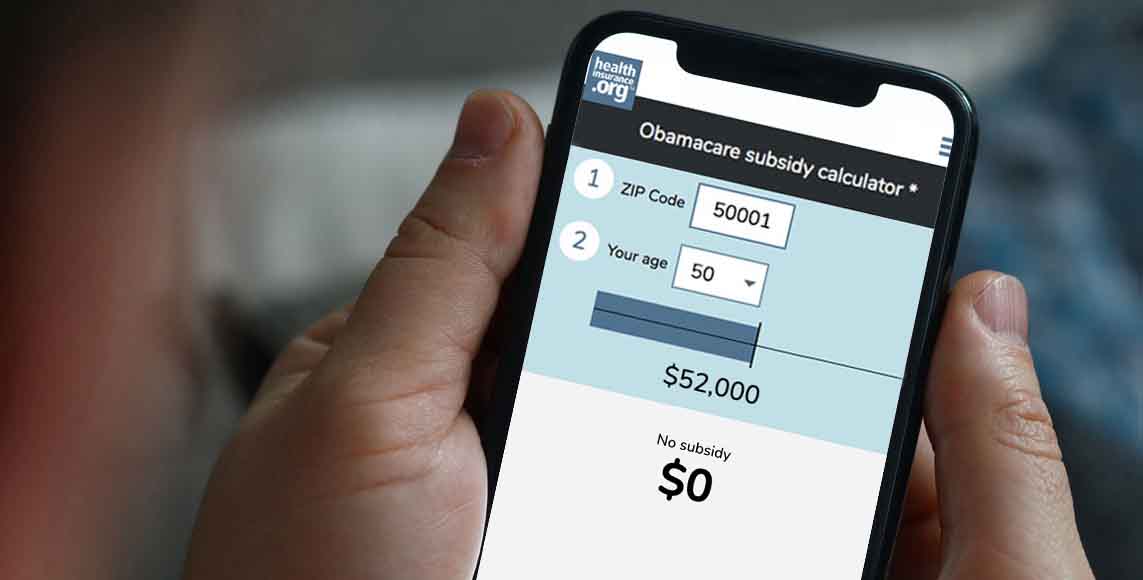

Q. Most Marketplace/exchange enrollees qualify for premium tax credits (premium subsidies), but not all. Can you explain what would make a person ineligible for Marketplace subsidies?

Obamacare subsidy calculator *

Estimated annual subsidy

$0

A. You aren't eligible for the ACA's federal subsidies to help cover health insurance premiums if:

- Your employer offers comprehensive, "affordable" coverage – which means that it pays for 60% of a standard population's average healthcare costs (including coverage for inpatient and physician services), and your portion of the premiums is no more than 8.39 of your household income in 2024.1 And there's no longer a "family glitch," which means that some employees' family members are eligible for subsidies in the exchange/marketplace even if they have access to the employer-sponsored health plan. But not all families that were affected by the family glitch are newly eligible for subsidies, since it depends on age, location, and total household income.

- You are eligible for Medicaid/CHIP, or premium-free Medicare Part A.2

- You earn less than 100% of the federal poverty level (FPL). This was not supposed to be a problem, as the Affordable Care Act called for everyone with income below the poverty level to be covered by Medicaid. But the Supreme Court ruled that Medicaid expansion would be optional for the states, and there are still nine states where there's a coverage gap as a result (there are ten states that haven't expanded Medicaid, but Wisconsin does cover people up to the poverty level under Medicaid, so there is no coverage gap in Wisconsin). However, if you're an immigrant who has been in the US for less than five years and are thus not eligible for Medicaid, the ACA does allow you to receive subsidies in the exchange even with an income below the poverty level.

- You earn enough that the premium for the benchmark plan (the second-lowest-cost silver plan in your area) is already considered affordable without a subsidy. Under the ACA, subsidies end abruptly when a household's income goes above 400% of the poverty level. But for 2021 through 2025, the American Rescue Plan and Inflation Reduction Act have eliminated that income cap. Instead, a household with income above 400% of the poverty level can qualify for a subsidy if the benchmark plan would otherwise cost more than 8.5% of the household's income. For households that earn less than 400% of the poverty level, the percentage of income they're expected to pay for the benchmark plan is lower than 8.5%, going all the way to 0% for those on the lower end of the income scale. (Note that contributions to an HSA or pre-tax retirement account will reduce your ACA-specific MAGI, which could make you newly eligible for a subsidy or eligible for a larger subsidy.)

- You're not legally present in the U.S., or you're incarcerated. However, some states are starting to offer or consider state-funded subsidies for undocumented immigrants and a way for them to enroll through a state-run platform.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written hundreds of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- Revenue Procedure 2023-29. Internal Revenue Service. Accessed January 2024. ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶