Key takeaways

- Health insurers sent $1 billion in rebates to consumers in 2022, bringing 11-year total to $10.8 billion

- Rebate amounts vary considerably by state and insurer

- For people who get a premium subsidy, rebate amounts can exceed net premiums

- How the MLR requirement and rebates work

- Why most Americans do not get a rebate check

- Total rebates sent to consumers in each state in 2022

In the 11th year of MLR rebates, the rebate checks in 2022 amounted to more than $1 billion

Ever since 2012, millions of Americans have received rebates from their health insurers each fall, refunding portions of prior-year premiums that were essentially too high.

It’s all thanks to the Affordable Care Act’s medical loss ratio (MLR) — a provision sponsored by Minnesota’s former Senator, Al Franken — that forces health insurance companies to use your premium dollars to provide actual health care and quality improvements for plan participants, or return that money to you (or your employer, if your employer sponsors your health coverage).

In 2022, insurers were required to pay more than $1 billion in rebates to more than 6 million consumers. That was based on insurer revenue and spending for 2019-2021, and was a lower rebate total than any of the three previous years (see below for a summary of each year’s total rebates).

Rebate checks were first sent to consumers in 2012, and totaled $1.1 billion that year. That was based on performance in 2011, before the bulk of the ACA’s provisions had taken effect; the individual market was still medically underwritten in nearly every state at that point.

Rebate totals were smaller over the next several years, but spiked sharply from 2019 through 2021, driven in large part by the individual market. The individual market only covers about 6% of the US population, but it’s a volatile market and premiums increased drastically in 2017 and 2018, leading to significant insurer profits starting in 2018.

Of the consumers who received rebates in 2019, more than 41% had individual market coverage. And 46% of the consumers receiving rebates in 2020 had individual market coverage; their rebates amounted to nearly 70% of the total amount that insurers sent in rebates in 2020 (more than $1.7 billion of the $2.5 billion that insurers sent to consumers went to people who had individual market coverage). That trend continued in 2021: 49% of the consumers receiving rebates in 2021 had individual market coverage, and the rebates that insurers sent to individual market consumers amounted to two-thirds of the total rebate amount.

But by 2022, individual market consumers represented 38% of the people to whom rebates were owed. This was still quite disproportionate to the percentage of people who have individual market coverage, but it was a decline from the ratio we saw in the previous few years.

For perspective, about 19% of the total amount that was rebated to consumers in 2018 was for individual market coverage, but the continued sharp increases in premiums in 2018 pushed profitability considerably higher and has resulted in a much larger total MLR rebate amount for individual market consumers since 2019.

Including the rebates issued in the fall of 2022, total rebates issued from 2012 through 2022 amount to about $10.8 billion. The rebates issued in the fall of 2022 were based on insurers’ MLR performance across 2019, 2020, and 2021. Premiums in the individual market spiked in 2017 and again in 2018, and based on the MLR data, it appears they were set too high by 2018. They have been much more stable for 2019, 2020, 2021, 2022, and 2023, but the MLR rebates continue to be very large due to the three-year rolling average calculation and the fact that rates are still mostly in the same ballpark region as 2018.

To clarify, the goal is to have insurers spending the majority of your premium dollars on medical claims so that rebates aren’t necessary —and that’s obviously working, as the vast majority of consumers do not receive MLR rebates in any given year. But given that insurers set premiums a year in advance, it’s not always possible to accurately project membership (and thus revenue) and claims costs. So the rebates serve as a backstop, ensuring that even if premiums are ultimately set too high in a given year, the MLR rules still apply.

Rebates vary by state and by insurer

Although total rebates were far larger in the fall of 2020 than they had ever been, and were at their second-highest level in the fall of 2021 and fifth-highest in the fall of 2022, most people didn’t receive a rebate check at all, since most insurers tend to be in compliance with the MLR requirements. Every year, there are some states where no rebates are issued (ie, all of the insurers in that state hit the MLR targets; this was the case in seven states in 2019, but only four in 2020 and 2021, and five in 2022), and even in states where MLR rebates are issued, they’re usually only sent out by a few insurers.

In 2018, almost 6 million people received rebates (including the individual, small group, and large group markets). The largest average rebates were in Minnesota that year, where more than 41,000 consumers received average rebates of $479 each. Nationwide, the average rebate check was $119.

But in 2019, nearly 9 million people received rebates, and the average rebate check was $154 (it averaged $208 for the 3.7 million people who received an MLR rebate based on individual market coverage). The largest average rebate checks were sent in Kansas, where about 25,000 people received rebates that averaged $1,081.

And in 2020, the average rebate check grew to $219. The largest average rebate checks were again sent in Kansas, where more than 40,000 people received rebates that averaged $611.

In 2021, the average rebate check dropped to $205. Oregon had the largest average rebate checks, at 647. But only 311 consumers in Oregon received rebate checks, all in the large group market. Virginia had the highest total rebates, amounting to more than $234 million, spread across more than half a million consumers. And Florida had the highest number of consumers receiving rebates, at more than one million.

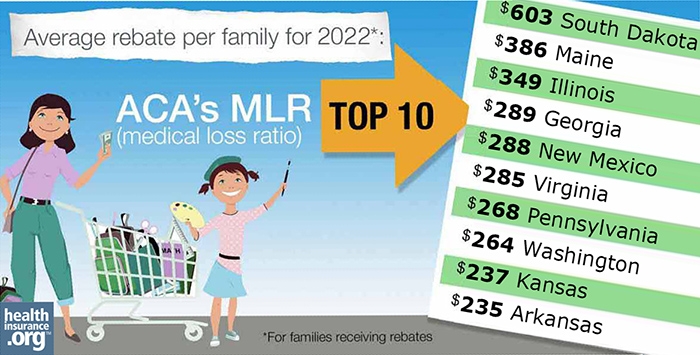

In 2022, the average rebate check dropped again, to $167. Average checks were the largest in South Dakota that year, averaging $603. But fewer than 1,800 people in South Dakota received rebate checks in 2022.

For subsidized enrollees, rebate amounts can exceed net premiums

MLR rebates are paid to policyholders. In the case of employer-sponsored plans, the rebates are sent to the employer (who can pass them on to employees or use the money to reduce employees’ future premiums or provide enhanced benefits). And in the case of individual market plans, the rebate is sent to the individual who purchased the plan. And the rebate amount is based on the full cost of the plan, regardless of how much of that cost was offset by a premium subsidy.

Premium subsidies became disproportionately large in 2018, due to the way insurers handled the cost of cost-sharing reductions (CSR). That resulted in a sharp uptick in the number of individual market enrollees who paid very low premiums, or no premiums at all, for bronze plans, and even gold plans in some areas. And that has increased even more since 2021 (and through at least 2025), due to the temporary enhancement of premium subsidies under the American Rescue Plan and Inflation Reduction Act.

But if a plan has to send out MLR rebate checks, the checks are based on a percentage of the full cost of the plan. And the full amount of the rebate is sent to the enrollee — it’s not sent to the US treasury, even though that might have been who paid the bulk of the premiums via premium subsidies. Dave Anderson and Charles Gaba both have excellent explanations of this.

The short story is that the rebate amounts might not seem “fair” at all. A person who paid very little in after-subsidy premiums might receive a significant rebate check, while their neighbor might receive no rebate check at all — even if they weren’t eligible for a subsidy and had to pay what seemed an exorbitant monthly premium — because they were enrolled in a plan that met the MLR requirements. To reiterate, most Americans do not receive a rebate check (keep in mind that even with the record-setting rebates that were sent out in 2020, only about 11.2 million people received rebates, which is still a very small chunk of the U.S. population). And the relative affordability of a person’s premiums has little to no bearing on whether they’ll end up receiving a rebate check.

Rebates? What rebates? How do they work?

The rebates are tied to the medical loss ratio: the percentage of insurance premium dollars spent on actual health care – as opposed to marketing, profits, CEO salaries, and other administrative expenses. If an insurer spends less than 80 percent of individual and small-group plan premiums (85 percent for large-group plans) on providing medical care, they must rebate the excess dollars back to plan members and employers via checks that are sent to consumers each fall.

MLR rebates are calculated at the insurer level for each of the three market segments (individual, small group, and large group), and on a state-by-state basis. An insurer’s aggregate numbers in each of those markets are considered to determine whether rebates are necessary. If they are, they apply to everyone who had coverage under that insurer’s plans in that market segment in that state — it’s not broken down on a plan-by-plan basis beyond that. However, the exact amount of each policyholder’s rebate is based on the (pre-subsidy) premiums for the plan that person had.

So if an insurer offers several different plans in the individual market and the aggregate MLR across all of those plans is under 80%, the insurer is going to owe rebates to everyone enrolled in those plans. But people with higher-priced plans (including older people, people who selected richer-benefit coverage, and people in higher-priced areas of the state) are going to get larger rebates than people with lower-priced plans, since the rebate is calculated as a percentage of the premium.

The majority of very large employers self-insure their employees’ health coverage, and MLR rules do not apply to self-insured plans. There were also initially exemptions for non-profit insurers, although they had to begin complying with the MLR requirements in 2014. Some states received CMS approval to modify MLR requirements within the state in the early years, but there are no longer any states with MLR requirements that are lower than the federal rules (Massachusetts has a much higher MLR requirement, at 88% for individual and small group plans; New York’s is 82%).

Although the MLR rules are an important regulatory tool, the majority of insureds do not receive a rebate check, as most insurers’ administrative costs are less than the allowable amount. About 11.2 million people received rebates in 2020, which is only a little more than 3% of the population. Fewer than 10 million people received rebates in 2021, and only about 6 million received them in 2022 (in all cases, this includes consumers with individual and employer-sponsored plans; for the employer-sponsored plans, the rebates are sent to the employer).

Rebates are based on a 3-year average MLR

The rebates that are sent out each fall are based on the average MLR for the prior three years. The rebates that were sent out in 2022 were based on each carrier’s average MLR for 2019 – 2021.

The total rebates sent out in 2021, 2020, and 2019 were the second-highest, highest, and third-highest (respectively) in the program’s ten-year history. Prior to 2019, the largest total rebates had been sent in 2012, as that was the first year that rebates were sent to consumers and insurers were still fine-tuning their revenues and expenses to comply with the ACA’s new rules. But the total rebates sent out in 2019 were higher than they had ever been, and then the rebates that were sent in 2020 dwarfed the 2019 amount, exceeding it by more than a billion dollars. Although the total rebate amount dropped to just over $2 billion in 2021, that was still far higher than the 2019 rebate total had been. Total rebates dropped to just over $1 billion in 2022, amounting to the fifth-highest total in program history.

And while the number of states where no rebates are necessary at all had been steadily rising for the last few years, reaching 11 in 2017 (an indication that more insurers were right-sizing their premiums), it dropped to seven in 2018 and 2019, and then dropped to just four (Rhode Island, North Dakota, West Virginia, and Wyoming) in 2020. It remained at four in 2021, including three of the same states where no rebates were issued in 2020 (the states without any rebates in 2021 were North Dakota, Rhode Island, Vermont, and West Virginia). In 2022, there were five states where no rebates were issued: Alaska, North Dakota, Oregon, Rhode Island, and Vermont.

Although the individual market was the primary driver for the spike in total rebates in 2019, 2020, and again in 2021, there were 15 states where no rebates were sent to individual market enrollees in 2019, and there were no individual market MLR rebates sent in 2020 in eight states plus DC. In 2021, there were no individual market rebates sent to consumers in nine states and DC. And in 2022, no individual market rebates were owed in 14 states and DC.

Most people don’t get a rebate check, because most insurers are spending the majority of premiums on medical costs

Across all market segments, the majority of insurers have been meeting or exceeding the MLR rules, which is why most people don’t receive MLR rebate checks (this continues to be the case, even with the record-high rebates in 2020 and 2021, but an increasing number of individual market enrollees were in plans that didn’t hit the MLR targets in recent years, as we’ll discuss in a moment). According to the data that was calculated in 2017 (for plan years 2014-2016), the average individual market MLR was 92.9% and the average small group MLR was 86.1% (both well above the 80% minimum requirement).

In the large-group market, the average MLR was 90.3%, also well above the 85% minimum requirement for that market segment. For all three market segments, the average MLR reported for 2017 was the highest it had ever been.

HHS also reported at that point that the vast majority of insureds were enrolled in plans that were meeting the MLR requirements. For the MLR reporting in 2017 (based on 2014-2016 MLR numbers), 95% of individual market enrollees were in plans that met the MLR rules – so only 5% of individual market enrollees ended up getting rebate checks in 2017 (this was an improvement from 2011, when about 83% of individual market enrollees were in plans that met the MLR requirements).

But that changed quite a bit in the last few years. There were 3.7 million individual market enrollees who received MLR rebates in 2019, which amounted to about 30% of the roughly 12 million people enrolled in ACA-compliant individual market plans. And in 2020, for rebates based on the 2017-2019 plan years, almost 5.2 million individual market enrollees received MLR rebates, amounting to well over four out of every ten individual market enrollees. The number of individual market enrollees receiving rebate checks dropped a little in 2021, but still amounted to almost 4.8 million people. It dropped again in 2022, but there were still nearly 2.4 million individual market enrollees who received rebates that year.

Premiums in the individual market only increased slightly for 2019, despite some significant upheaval in the market (elimination of the individual mandate penalty, along with the expansion of short-term plans and association health plans). They barely changed at all for 2020, changed very little for 2021, and generally decreased for 2022 when new plans were taken into consideration. That’s an indication that premiums were certainly adequate in 2018, and possibly too high in some cases (the expectation is that without the aforementioned market upheaval, average rates would have decreased for 2019). For 2023, premiums in the individual market increased modestly in most states, for the first time in a few years.

Loss ratios dropped as insurers regained profitability in the individual market (thanks to large rate increases in 2017 and 2018), and this was the driving factor behind the much larger MLR rebates in 2019, 2020, and 2021. But the majority of individual market enrollees are still in plans that are hitting the MLR targets, despite the sharp rate increases in 2017 and 2018.

Total rebate amounts so far have been:

- $1.1 billion in 2012 (based on 2011 MLR, as the rule became effective that year)

- $504 million in 2013

- $332 million in 2014

- $469 million in 2015

- $397 million in 2016

- $447 million in 2017

- $707 million in 2018

- $1.37 billion in 2019

- $2.46 billion in 2020

- $2.01 billion in 2021

- $1.03 billion in 2022

In 2022, more than 6 million consumers received rebates that averaged $167. (The average was $205 in the individual market, $169 in the small-group market, and $110 in the large-group market; rebates in the group market are sent to employers, who then have options for how to use the money.)

In five states — Alaska, North Dakota, Oregon, Rhode Island, and Vermont — there were no MLR rebates necessary in 2022, because all of the individual, small group, and large group insurers met the MLR requirements.

Wyoming had no MLR rebates for five years in a row (2016, 2017, 2018, 2019, and 2020), because all insurers offering coverage in the state have met the MLR requirements each year, although Blue Cross Blue Shield of Wyoming had to pay out $3.8 million in MLR rebates to nearly 27,000 individual market enrollees in 2021 (BCBSWY had the state’s entire individual market share until the end of 2020; an additional insurer joined the market as of 2021). But it’s worth noting that Wyoming had the highest average MLR rebates in 2015, and Hawaii, which had no rebates in 2017, had the highest average rebates in 2016 and the second-highest average rebates in 2018. In small markets like Wyoming and Hawaii, a few expensive claims can have a very significant impact on MLR numbers.

So although nobody received a rebate check in five states in 2022, that’s a good thing — it means that all of the insurers in those states spent at least 80% (at least 85% for large group plans) of premiums on medical claims and quality improvements, as opposed to administrative costs. (You can think of this as similar to a tax refund: People certainly like receiving a tax refund, but the ideal scenario is to not overpay your taxes during the year, since that just gives the IRS an interest-free loan.)

But in most states, at least some consumers received rebate checks in 2022, as had been the case in prior years. Here are the data for the rebates that insurers sent out in the fall of 2022:

| State | Total Rebates (including individual, small group, and large group markets) | Number of consumers who received a rebate

|

Average rebate amount

|

| USA | $1,030,920,844 | 6,164,906 | $167 |

| Alaska | $0 | 0 | $0 |

| Alabama | $29,675 | 361 | $82 |

| Arkansas | $32,964,016 | 140,276 | $235 |

| Arizona | $43,209,556 | 200,851 | $215 |

| California | $105,195,477 | 866,863 | $121 |

| Colorado | $18,360,442 | 121,721 | $151 |

| Connecticut | $1,851,125 | 29,615 | $63 |

| District of Columbia | $29,491,123 | 233,110 | $127 |

| Delaware | $1,350,545 | 21,959 | $62 |

| Florida | $21,034,568 | 191,259 | $110 |

| Georgia | $5,747,961 | 19,856 | $289 |

| Hawaii | $1,725,862 | 13,184 | $131 |

| Iowa | $1,137,964 | 8,121 | $140 |

| Idaho | $2,132,681 | 38,139 | $56 |

| Illinois | $2,748,070 | 7,864 | $349 |

| Indiana | $679,042 | 55,425 | $12 |

| Kansas | $8,863,405 | 37,462 | $237 |

| Kentucky | $9,882,629 | 75,966 | $130 |

| Louisiana | $3,385,308 | 61,869 | $55 |

| Massachusetts | $47,386,629 | 452,005 | $105 |

| Maryland | $53,446,981 | 228,568 | $234 |

| Maine | $20,058,766 | 51,953 | $386 |

| Michigan | $25,596,877 | 117,630 | $218 |

| Minnesota | $3,365,804 | 33,324 | $101 |

| Missouri | $40,371,558 | 183,506 | $220 |

| Mississippi | $11,940,572 | 93,468 | $128 |

| Montana | $4,907,748 | 27,197 | $180 |

| North Carolina | $1,578,202 | 25,607 | $62 |

| North Dakota | $0 | 0 | $0 |

| Nebraska | $3,886,750 | 23,011 | $169 |

| New Hampshire | $26,004,242 | 113,486 | $229 |

| New Jersey | $15,750,008 | 121,177 | $130 |

| New Mexico | $8,328,400 | 28,903 | $288 |

| Nevada | $2,951,144 | 14,327 | $206 |

| New York | $11,105,650 | 240,207 | $46 |

| Ohio | $13,380,339 | 203,354 | $66 |

| Oklahoma | $1,454,384 | 11,622 | $125 |

| Oregon | $0 | 0 | $0 |

| Pennsylvania | $175,696,171 | 655,133 | $268 |

| Rhode Island | $0 | 0 | $0 |

| South Carolina | $17,131,186 | 104,011 | $165 |

| South Dakota | $1,046,947 | 1,738 | $603 |

| Tennessee | $6,576,183 | 48,250 | $136 |

| Texas | $68,935,441 | 602,705 | $114 |

| Utah | $2,044,513 | 12,100 | $169 |

| Virginia | $146,646,508 | 514,217 | $285 |

| Vermont | $0 | 0 | $0 |

| Washington | $18,891,044 | 71,569 | $264 |

| Wisconsin | $12,420,452 | 59,573 | $208 |

| West Virginia | $76,044 | 648 | $117 |

| Wyoming | $152,851 | 1,717 | $89 |

CMS has a further breakdown by individual, small group, and large group markets.

GOP tried unsuccessfully to repeal the federal MLR rules in 2017, but MLR requirements appear to be here to stay

While the MLR provision has obvious appeal to consumers, it isn’t universally loved – and was among the ACA provisions in Republicans’ crosshairs as they attempted to repeal the ACA in 2017. The Senate’s 2017 Better Care Reconciliation Act (BCRA) would have eliminated the federal requirement that insurers spend the majority of premiums on health care. (That measure did not pass the Senate when it was introduced as a substitute for H.R. 1628 in July 2017.)

Under the BCRA, states would have become responsible for the regulation of insurers’ administrative costs. This is similar to the approach that the Trump administration took with regard to insurers’ network adequacy (although the Biden administration is working to reverse that, and return to federal oversight of network adequacy), and it’s in keeping with the GOP belief that regulatory authority should be concentrated at the state – rather than federal – level.

The Congressional Budget Office estimated that about half the U.S. population lives in states where the current federal MLR rules would have been maintained if the BCRA had been implemented, and the other half live in states where the rules would have been relaxed. “Relaxed” rules would have led to increased premiums (and of course, smaller MLR rebates), particularly for people who don’t qualify for premium subsidies in the exchange. As noted above, individual market rebates are sent to the policyholders, even if the bulk of their premiums were paid by the federal government via subsidies. But without an MLR requirement, insurers would be able to charge higher prices without having to worry about future rebates, and consumers who don’t qualify for subsidies would be hardest hit.

GOP efforts to repeal the ACA in 2017 were not successful, though, so insurers in every state still have to spend the majority of your premium dollars on medical costs and quality improvements, rather than administrative expenses. And the Supreme Court upheld the ACA in 2021, for the third time in a decade.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.