What is an out-of-pocket maximum?

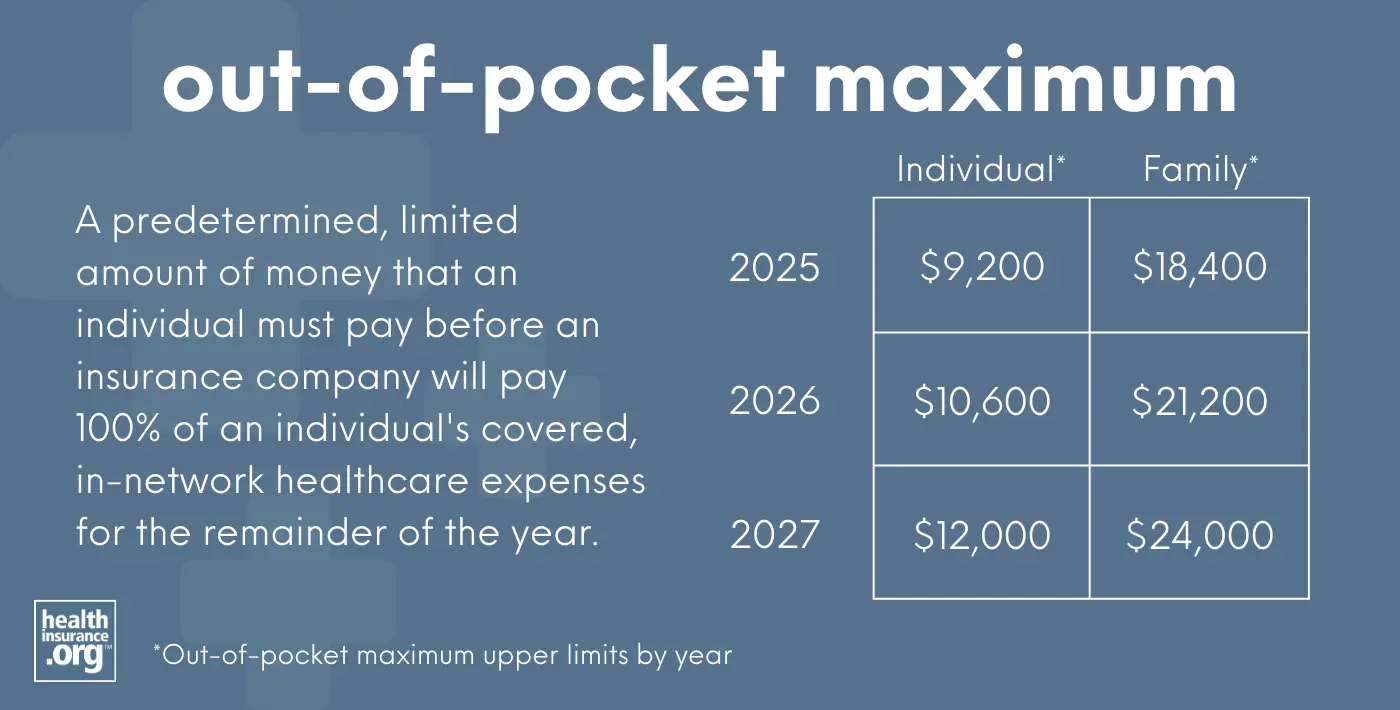

An out-of-pocket maximum is a predetermined, limited amount of money that an individual must pay before an insurance company or self-insured health plan will pay 100% of an individual's covered, in-network health care expenses for the remainder of the year.

Health insurance plans can set their own out-of-pocket maximums, but they're constrained by federal regulations that impose an upper limit on how high out-of-pocket costs can be. This limit is adjusted each year by the Department of Health & Human Services.1

Out-of-pocket caps apply to in-network care that's considered an essential health benefit, and only to plans that are not grandfathered or grandmothered or exempt from ACA regulations (such as short-term health insurance), as those plans do not have restrictions on their out-of-pocket exposure.

The out-of-pocket limit applies to all other types of private (non-Medicare/Medicaid) health insurance, including individual, small group, large group, and self-insured health plans.

What is the maximum out-of-pocket limit for 2026?

In 2026, the upper limits on maximum out-of-pocket are:2

- $10,600 for an individual

- $21,200 for multiple family members on the same policy.

These limits are a significant increase from 2025, when they were $9,200 and $18,400, respectively.3

(The Biden administration had initially finalized 2026 caps of $10,150 and $20,300,4 but the Trump administration subsequently finalized a rule change that resulted in a higher out-of-pocket cap. This is described in more detail below.)

What is the maximum out-of-pocket limit for 2027?

For 2027, the upper limit on maximum out-of-pocket costs will again grow significantly under the methodology finalized by the Trump administration. They will be:5

- $12,000 for an individual

- $24,000 for multiple family members on the same policy

However, CMS has proposed a rule change for 2027 and future years that would, if finalized, allow higher maximum out-of-pocket limits for Bronze and Catastrophic plans.6

What is the maximum out-of-pocket limit for an HSA-eligible plan?

The allowable out-of-pocket limits for HSA-qualified high-deductible health plans (HDHPs) are lower, at $8,500 for an individual and $17,000 for a family in 2026.7 But these caps don't apply to Marketplace Bronze and Catastrophic plans, which are all considered HDHPs as of 2026 (those plans must comply with the regular upper limit on maximum out-of-pocket, described above).

How have out-of-pocket limits changed over the years?

The highest allowable out-of-pocket maximum changes annually. In 2014, it was just $6,350 for an individual, but by 2027, it will have increased by 89%. Many health plans, however, have out-of-pocket maximums that are well below the highest allowable amounts. Here are the federally allowed maximum out-of-pocket amounts since they debuted in 2014:

- 2014: $6,350 for an individual; $12,700 for a family

- 2015: $6,600 for an individual; $13,200 for a family.

- 2016: $6,850 for an individual; $13,700 for a family (there was also a requirement starting in 2016 that individual maximum out-of-pocket limits be embedded in family plans).

- 2017: $7,150 for an individual; $14,300 for a family.

- 2018: $7,350 for an individual; $14,700 for a family.

- 2019: $7,900 for an individual; $15,800 for a family

- 2020: $8,150 for an individual; $16,300 for a family.

- 2021: 8,550 for an individual; $17,100 for a family.

- 2022: $8,700 for an individual; $17,400 for a family (note that these are lower than initially proposed; CMS explains the details here)

- 2023: $9,100 for an individual; $18,200 for a family.

- 2024: $9,450 for an individual; $18,900 for a family.

- 2025: $9,200 for an individual; $18,400 for a family.

- 2026: $10,600 for an individual; $21,200 for a family (higher than initially finalized, as explained by CMS).

- 2027: $12,000 for an individual; $24,000 for a family (continuing to use the new methodology that results in a higher limit, and with potentially higher limits for Bronze and Catastrophic plans)6

How does HHS determine the out-of-pocket maximum?

The out-of-pocket maximum is set each year by HHS. In most years, HHS has used a formula that calculates how much the average premium for employer-sponsored health insurance in the preceding year exceeds the average 2013 premium for employer-sponsored health insurance. The out-of-pocket maximum is then based on adjusting the 2014 out-of-pocket maximum by that same percentage growth.

But 2020 and 2021,8 and starting again in 2026, HHS changed the formula to also include the growth of individual market health insurance premiums since 2013.9 This approach results in higher out-of-pocket limits, meaning consumers can pay more in out-of-pocket costs.

The math behind how out-of-pocket limits are calculated

We can get a better understanding for how the out-of-pocket limits are calculated by looking at examples from some recent years. For 2025, HHS looked at how much average employer-sponsored premiums in 2024 ($7,110) exceeded average employer-sponsored premiums in 2013 ($4,897). The growth amounted to 45.2%. So that meant the maximum out-of-pocket for 2025 was 45.2% higher than the maximum out-of-pocket in 2014. That worked out to $9,220, and they round down to the nearest $50, for a 2025 maximum out-of-pocket of $9,200.10

For 2026, the out-of-pocket cap was initially calculated in the fall of 2024 by the Biden administration, using the formula that only considered premium growth for employer-sponsored plans. That amounted to 60% growth from 2013 to 2025, because the projected premium for 2025 had grown to $7,833. This pushed the out-of-pocket cap to $10,150 for a single individual — 60% higher than it had been in 2014.4

But the Trump administration proposed and finalized a change in the methodology, reverting to the process that had briefly been used during the first Trump administration. When they considered both employer-sponsored and individual market premium growth since 2013, it amounted to a 67% increase. This meant the out-of-pocket cap for 2026 would be 67% higher than it had been in 2014, instead of the previously announced 60%. As a result, the highest-allowable out-of-pocket limit for 2026 is $10,600 for an individual and $21,200 for multiple family members covered on the same policy.9

This methodology is continuing to be used for 2027, resulting in another $1,400 increase in the maximum out-of-pocket limit. Individual market premiums increased significantly for 2026, and since individual market premiums are taken into consideration with the current methodology, this had the effect of further increasing the maximum out-of-pocket limit for 2027.5

Are there out-of-pocket caps for Medicare?

There is no out-of-pocket maximum for Original Medicare, which is why most enrollees have supplemental coverage (from an employer-sponsored plan, Medigap, or Medicaid).

Medicare Advantage plans must cap out-of-pocket costs at no more than $9,250 in 2026.11 But that only applies to services that would otherwise be covered under Medicare Part A and Part B. It does not include out-of-pocket costs for prescription drugs covered by the Part D coverage that's integrated with most Advantage plans, nor does it include out-of-pocket costs for extra benefits like dental and vision.

Medicare Part D coverage historically did not have a cap on out-of-pocket costs. However, that changed as of 2024, under the Inflation Reduction Act. Medicare Part D now has an annual out-of-pocket limit for covered drugs, which is indexed annually. For 2026, it's $2,100.12 This is true regardless of whether the Part D coverage is included in a Medicare Advantage plan or obtained as a stand-alone plan.

Footnotes

- Through 2022, the maximum out-of-pocket limit was published in the annual benefit and payment parameter notice; for 2023 and future years, it's published in guidance that HHS issues no later than January of the prior year; the guidance for 2025 was issued in November 2023, and the guidance for 2026 was issued in October 2024, although the guidance for 2027 was issued in late January 2026. As described below, the 2026 guidance was replaced as part of a subsequent rule issued by HHS in 2025. This rule changed the methodology for calculating out-of-pocket limits, resulting in higher out-of-pocket limit caps for 2026 and future years. ⤶

- "Patient Protection and Affordable Care Act; Marketplace Integrity and Affordability" (Page 442). Centers for Medicare & Medicaid Services; Department of Health and Human Services. June 20, 2025 ⤶

- Premium Adjustment Percentage, Maximum Annual Limitation on Cost Sharing, Reduced Maximum Annual Limitation on Cost Sharing, and Required Contribution Percentage for the 2025 Benefit Year. Centers for Medicare and Medicaid Services. Nov. 15, 2023 ⤶

- Premium Adjustment Percentage, Maximum Annual Limitation on Cost Sharing, Reduced Maximum Annual Limitation on Cost Sharing, and Required Contribution Percentage for the 2026 Benefit Year. Centers for Medicare and Medicaid Services. Oct. 8, 2024 ⤶ ⤶

- "Premium Adjustment Percentage, Maximum Annual Limitation on Cost Sharing, Reduced Maximum Annual Limitation on Cost Sharing, and Required Contribution Percentage for the 2027 Benefit Year" Centers for Medicare & Medicaid Services. Jan. 29, 2026 ⤶ ⤶

- "Patient Protection and Affordable Care Act, HHS Notice of Benefit and Payment Parameters for 2027; and Basic Health Program" Centers for Medicare & Medicaid Services. Feb. 11, 2026 ⤶ ⤶

- "Revenue Procedure 2025-19" Internal Revenue Service. Accessed June 23, 2025 ⤶

- Patient Protection and Affordable Care Act; HHS Notice of Benefit and Payment Parameters for 2022 and Pharmacy Benefit Manager Standards. U.S. Department of Health and Human Services. May 2021. ⤶

- "Patient Protection and Affordable Care Act; Marketplace Integrity and Affordability" (Page 319 and 442). Centers for Medicare & Medicaid Services; Department of Health and Human Services. June 20, 2025 ⤶ ⤶

- Premium Adjustment Percentage, Maximum Annual Limitation on Cost Sharing, Reduced Maximum Annual Limitation on Cost Sharing, and Required Contribution Percentage for the 2025 Benefit Year. Centers for Medicare and Medicaid Services. November 2023. ⤶

- “Final Contract Year (CY) 2026 Standards for Part C Benefits, Bid Review and Evaluation” Centers for Medicare & Medicaid Services. Apr. 16, 2025 ⤶

- "How much does Medicare drug coverage cost?" Medicare.gov. Accessed Jan. 14, 2026 ⤶