In this article

If you’re shopping for health insurance in the Marketplace/exchange (in other words, an Obamacare health plan), you might be eligible for income-based premium subsidies that may cover a significant portion of your monthly premiums.

But as of early 2026, Congress has not extended the subsidy enhancements that had been in place since 2021. The issue was still actively under consideration in Congress as of early 2026, so we could still see a change to the subsidy structure. But for now, since the subsidy enhancements expired at the end of 2025:

- The “subsidy cliff” has returned in 2026, meaning federal subsidies are no longer available to anyone with a household income above 400% of the 2025 federal poverty level.

- For applicants with household income that doesn’t exceed 400% of FPL, subsidies no longer cover as much of the premiums as they did in 2025. This is because households are expected to pay a larger share of their own premiums.

Who’s eligible for ACA premium subsidies?

Subsidy eligibility is based on household income, as explained in more detail in our overview of Marketplace premium subsidies.

Of the nearly 23.4 million people who were enrolled in private plans through the exchanges as of early 2025, 93% were receiving premium subsidies.1 But in early 2021, before the subsidy enhancements had been put in place, 86% of Marketplace enrollees were receiving premium subsidies and total enrollment was less than half of the 2025 enrollment, with only 11.3 million people enrolled in early 2021.2

As noted above, the issue of a subsidy enhancement extension was still under consideration in Congress in early 2026. But because the subsidy enhancements expired at the end of 2025, enrollment for 2026 was trending lower than the year before,3 due to the higher net premiums for 2026 coverage

- Learn how pre-tax retirement account contributions and health savings account (HSA) contributions can reduce your ACA-specific modified adjusted gross income that’s used for subsidy eligibility calculations.

- And learn about how HSA access has been expanded for 2026.

How have the income limits for ACA premium subsidies changed?

Prior to 2021, Marketplace buyers were eligible for premium subsidies if their projected household income didn’t exceed 400% of the prior year’s federal poverty level. From 2021 through 2025, this income limit did not apply, due to the American Rescue Plan and the Inflation Reduction Act.

For 2026, the pre-2021 rules are once again in place, and will remain in place unless changed by Congress. This means subsidy eligibility extends from 100% of FPL to 400% of FPL (the lower threshold is an income of more than 138% of FPL in states that have expanded Medicaid).

For subsidy-eligible enrollees, the subsidy amount is based on their ACA-specific modified adjusted gross income (MAGI) and the cost of the benchmark plan – the second-lowest-cost Silver plan available in the Marketplace.4

Note that the cost of the benchmark plan differs from one person to another. Each applicant’s subsidy calculation is unique, based on their household MAGI versus the benchmark plan’s premium for that particular applicant.

Learn how ACA-specific MAGI is calculated.

On the lower end of the income spectrum, buyers are eligible for subsidies in most states that have implemented the ACA’s Medicaid expansion if their income is above 138% of the federal poverty level.5 In those states, applicants below that threshold are eligible for Medicaid.

In the states that haven’t yet expanded Medicaid eligibility (Alabama, Florida, Georgia, Kansas, Mississippi, South Carolina, Tennessee, Texas, Wisconsin, and Wyoming), buyers are eligible for premium subsidies if their income is at least equal to the federal poverty level. Because Medicaid expansion hasn’t yet been implemented in these states, eligibility for Medicaid is based on strict pre-ACA eligibility guidelines. (In nine states that have rejected Medicaid expansion, low-income residents continue to face a coverage gap.)

Since 2023, premium subsidies have been newly available to some people who were impacted by the family glitch in previous years. Before 2023, families were ineligible for subsidies in the Marketplace if they had access to employer-sponsored coverage that was considered affordable for just the employee – regardless of how much it cost to add the family to the employer’s plan.

The IRS finalized new regulations to fix the family glitch in October 2022, allowing some employees’ family members to become newly eligible for subsidies in the Marketplace if the cost to cover them under an employer-sponsored plan is not considered affordable. The family glitch fix affects some families more than others.

How can I calculate my health insurance subsidy?

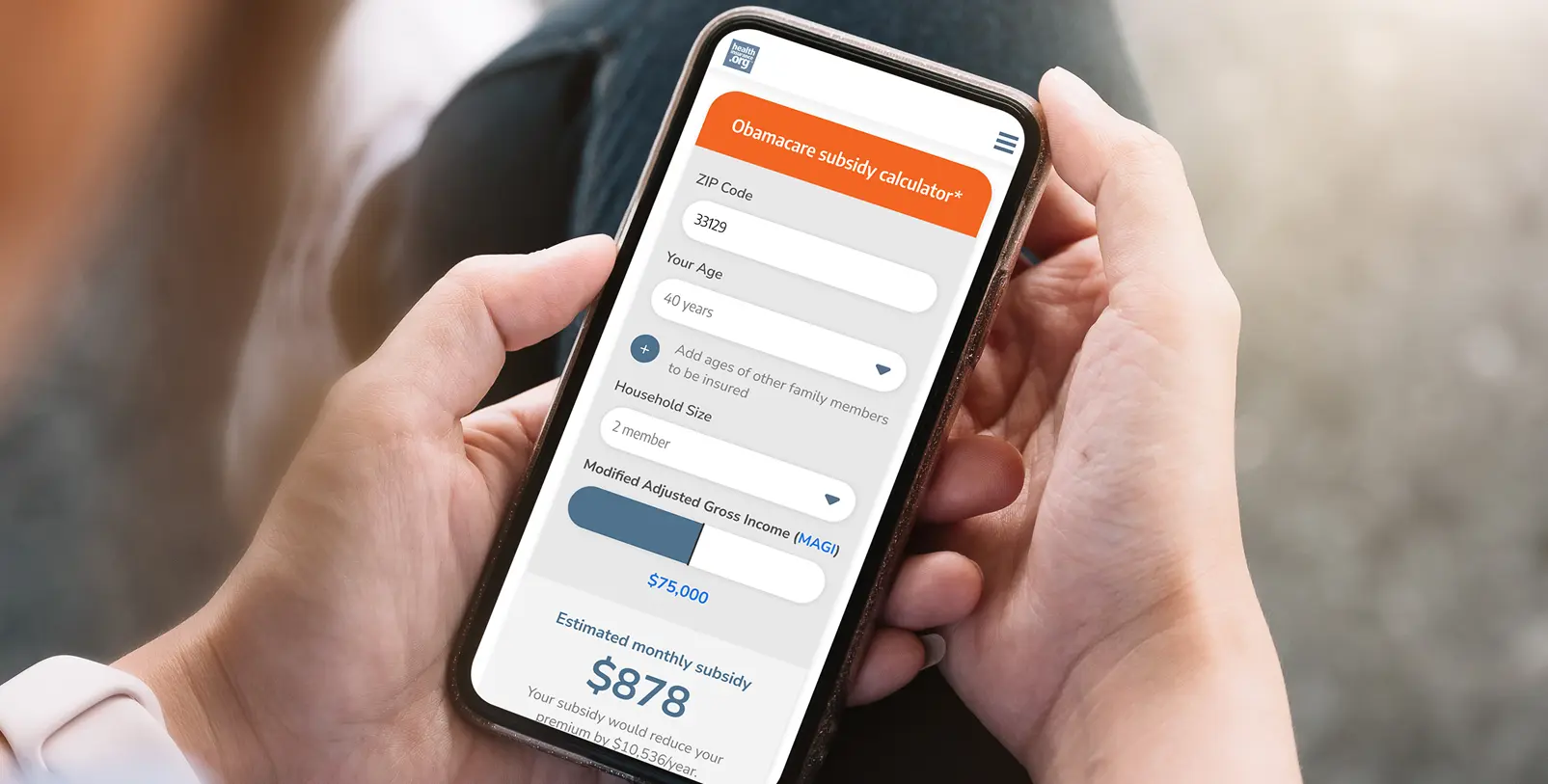

You can use the subsidy calculator on this page to see whether you’re eligible for a subsidy and to see your subsidy estimate. There's still some uncertainty around 2026 subsidy amounts, even after the start of the year. Although Congress allowed the subsidy enhancements to expire at the end of 2025, the issue is still under consideration as of early 2026.

The subsidy enhancements may ultimately be reinstated with modifications, their expiration could be left in place, or Congress could come up with another solution. The calculator on this page will be updated if there are any changes to the subsidy structure.

Do premium subsidy amounts change each year?

Premium subsidy amounts fluctuate from one year to another, based on changes in the cost of the benchmark plan (second-lowest-cost Silver plan6) in each area.

Premium subsidies continue to be larger in most of the country than they were in 2017 and previous years, due to the way the cost of cost-sharing reductions (CSR) has been added to Silver plan premiums in most states. But the temporary increase in subsidy amounts due to the American Rescue Plan and Inflation Reduction Act expired at the end of 2025.

Premium subsidy amounts are also linked to changes in benchmark premiums from one year to the next. In general, if average benchmark premiums decrease (as they did in 2019,7 2020,8 2021,9 and 2022), average premium subsidy amounts will also decrease.

When benchmark premiums increase, as they did each year prior to 2019, and also for 2023, 2024,10 and again for 2025,11 average premium subsidy amounts will also increase.

For 2026, average benchmark premiums increased significantly,12 which generally has the effect of increasing subsidy amounts. But at the same time, the expiration of the subsidy enhancements had the effect of driving subsidy amounts down, and the average enrollee is seeing a significant increase in after-subsidy premiums for 2026.12

In any year, it’s important to understand that averages only describe the big picture. Each enrollee’s subsidy amount will change based on their own specific circumstances, including income changes and how the benchmark premium is changing for them in particular.

Are premium subsidies available for any health plan?

Premium subsidies can be used with any metal-level plan (Bronze, Silver, Gold, or Platinum) available in the Marketplace. But they can’t be used to pay for plans purchased outside the Marketplace, even if the same plan is sold in the Marketplace. So it’s important to make sure you’re shopping on the Marketplace if you want to take advantage of any available financial assistance.

Subsidies can’t be used to pay for pediatric dental/vision plans that are sold in the Marketplace as a stand-alone plan – as opposed to being embedded in the medical plan – unless the available medical plans do not include embedded pediatric dental/vision.

Subsidies also can’t be used to pay for short-term health insurance (which is not ACA-compliant) or supplemental insurance coverage, including accident supplements, adult dental/vision plans, critical illness insurance plans, or stand-alone prescription drug insurance. Except for adult dental and vision plans, these types of coverage are not available for purchased in the Marketplace.

And although catastrophic health plans – which are ACA-compliant – are available via the Marketplace/exchange, subsidies cannot be used with catastrophic plans. So catastrophic plans are generally only a good choice for an applicant who isn’t eligible for subsidies.

Are there other types of ACA subsidies?

Yes. The ACA also provides cost-sharing reductions (CSR, also known as cost-sharing subsidies), which can reduce your out-of-pocket costs – as long as you enroll in a Silver plan. More than half of all the people who enrolled in Marketplace plans during the open enrollment period for 2025 coverage selected a plan that included cost-sharing subsidies.13

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written hundreds of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- “Effectuated Enrollment: Early 2025 Snapshot and Full Year 2024 Average” CMS.gov, July 24, 2025 ⤶

- “Effectuated Enrollment: Early 2021 Snapshot and Full Year 2020 Average” Centers for Medicare & Medicaid Services. June 5, 2021 ⤶

- “Marketplace 2026 Open Enrollment Period Report: National Snapshot” (22.8 million enrollees as of late December 2025/early January 2026) and “Marketplace 2025 Open Enrollment Period Report: National Snapshot” (23.6 million enrollees as of late December 2024/early January 2025) CMS Newsroom ⤶

- “Second Lowest Cost Silver Plan Technical FAQs” CMS.gov, December 16, 2016. ⤶

- “Medicaid and CHIP overview” CMS.gov, August 2023 ⤶

- “Second lowest cost Silver plan (SLCSP)” Healthcare.gov. Accessed November 2024 ⤶

- “2019 Rate Hikes” ACASignups.net. ⤶

- “2020 Rate Changes” ACASignups.net. ⤶

- “2021 Rate Changes” ACASignups.net. ⤶

- “Plan Year 2024 Qualified Health Plan Choice and Premiums in HealthCare.gov Marketplaces” Centers for Medicare & Medicaid Services. Oct. 25, 2023 ⤶

- “Plan Year 2025 Qualified Health Plan Choice and Premiums in HealthCare.gov Marketplaces” Centers for Medicare & Medicaid Services. Oct. 25, 2024 ⤶

- “ACA Insurers Are Raising Premiums by an Estimated 26%, but Most Enrollees Could See Sharper Increases in What They Pay” KFF.org. Oct. 28, 2025 ⤶ ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, Accessed Oct. 29, 2025 ⤶