What are out-of-pocket costs?

Out-of-pocket costs refer to the portion of your medical expenses that you pay yourself, as opposed to the costs that are paid by your health plan.

The ACA imposed a cap on how high out-of-pocket costs can be, for covered in-network care that's considered an essential health benefit.1 Out-of-pocket caps are only required to apply to essential health benefits. And there are no regulations in place to cap how much people spend on out-of-network care (except for Medicare Advantage PPO plans, which do have a cap on out-of-pocket costs for out-of-network care).2

What expenses are included in out-of-pocket costs?

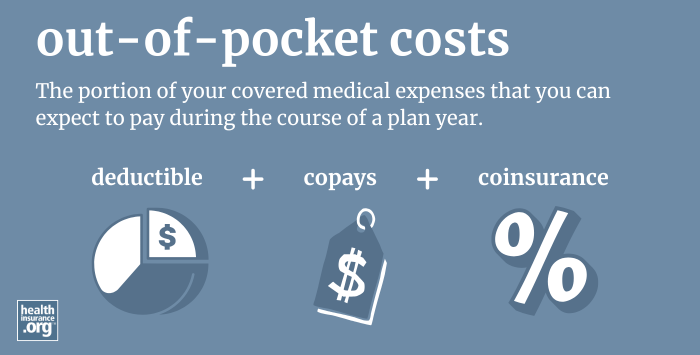

Your out-of-pocket costs can include a combination of your health plan's deductible, copays, and coinsurance, for any covered, in-network services.

The monthly premiums you pay to have coverage are not included in out-of-pocket costs.3 Out-of-pocket costs are only incurred if and when you need medical care, whereas premiums must be paid every month, regardless of whether you need medical care or not.

If you receive medical care that's not covered by your health plan, you'll have to pay the full cost of the treatment, but it won't count towards your policy's out-of-pocket limit (an example would be the cost of dental care, assuming your plan does not include dental coverage).

Are out-of-pocket costs capped?

Yes, there's an upper limit on how high a plan's out-of-pocket exposure can be. For 2026, the maximum out-of-pocket for an individual is $10,600, and for a family, it's $21,200. These limits will increase to $12,000 and $24,000, respectively, in 2027.4 And a proposed rule calls for even higher allowable out-of-pocket caps for Catastrophic plans (and some Bronze plans) starting in 2027.5

Health plans can cap out-of-pocket spending below the maximum allowable limits, so the limits vary from one plan to another. And the ACA's cost-sharing subsidies also result in lower out-of-pocket limits for eligible enrollees who select Silver-level Marketplace plans.

Under the ACA, family plans can have total out-of-pocket limits that are double the individual out-of-pocket limit, but no individual can be expected to pay more in out-of-pocket costs than the individual limit, even if he or she is covered under a family plan. (This rule was implemented in 2016.)

The ACA's out-of-pocket limits apply to all individual market health plans with effective dates of 2014 or later. They also apply to employer-sponsored plans with effective dates of 2014 or later, including both fully-insured and self-insured plans.6

The ACA's out-of-pocket limits do not apply to grandmothered plans or grandfathered plans. They also don't apply to plans that aren't regulated at all by the ACA, such as short-term health insurance, fixed indemnity plans, non-insurance Farm Bureau plans, and non-insurance health care sharing ministry plans.7

Is there a limit on out-of-pocket costs if you don't stay in-network?

The ACA's out-of-pocket limits do not apply to out-of-network care.3 So if you use out-of-network providers, your out-of-pocket costs can be considerably higher than the limits stated above. On some plans, they're double the in-network limits, but on other plans, out-of-pocket costs can potentially be unlimited if patients receive care from doctors or hospitals that aren't in the health plan's network.8

And it's increasingly common to see plans that simply don't cover out-of-network care at all, unless it's an emergency situation. HMOs and EPOs use that model, and they are quite common, especially in the individual/family health insurance market.

The federal No Surprises Act, which took effect in 2022, protects consumers from surprise out-of-network billing in emergencies and in situations where the patient receives care from an out-of-network provider while at an in-network facility.

Footnotes

- "FAQS About Affordable Care Act Implementation, Part 46" U.S. Department of Labor. June 4, 2021 ⤶

- "Final Contract Year (CY) 2026 Standards for Part C Benefits, Bid Review and Evaluation" Centers for Medicare & Medicaid Services. Apr. 16, 2025 ⤶

- "Out-of-pocket maximum/limit" HealthCare.gov. Accessed Sep. 27, 2025 ⤶ ⤶

- "Premium Adjustment Percentage, Maximum Annual Limitation on Cost Sharing, Reduced Maximum Annual Limitation on Cost Sharing, and Required Contribution Percentage for the 2027 Benefit Year" Centers for Medicare & Medicaid Services. Jan. 29, 2026 ⤶

- "Patient Protection and Affordable Care Act, HHS Notice of Benefit and Payment Parameters for 2027; and Basic Health Program" Centers for Medicare & Medicaid Services. Feb. 11, 2026 ⤶

- "Affordable Care Act Implementation FAQs - Set 18" Centers for Medicare & Medicaid Services. Accessed Sep. 27, 2025 ⤶

- "Private Health Coverage: Information on Farm Bureau Health Plans, Health Care Sharing Ministries, and Fixed Indemnity Plans" Government Accountability Office. July 26, 2023 ⤶

- "2016 PPO Plans Remove Out-Of-Network Cost Limits, A Costly Trap For Consumers" KFF Health News. Dec. 3, 2015 ⤶